Are you trying to find a suitable model that will allow utmost flexibility and reliability for your financial startup or service? Traditional financial services like payments, lending, and borrowing were once only accessible through established banks and financial institutions.

However, this changed with the rise of blockchain technology. As cryptocurrencies gained popularity, the conversation expanded beyond digital money to include two new financial systems: Decentralized finance (DeFi) and centralized finance (CeFi).

The global Decentralized finance market was worth USD 20.48 billion in 2024 and is expected to rise 53.7% from 2025 to 2030.

In this blog, we’ll explore what DeFi and CeFi are, their features, examples, and more. Let’s get started!

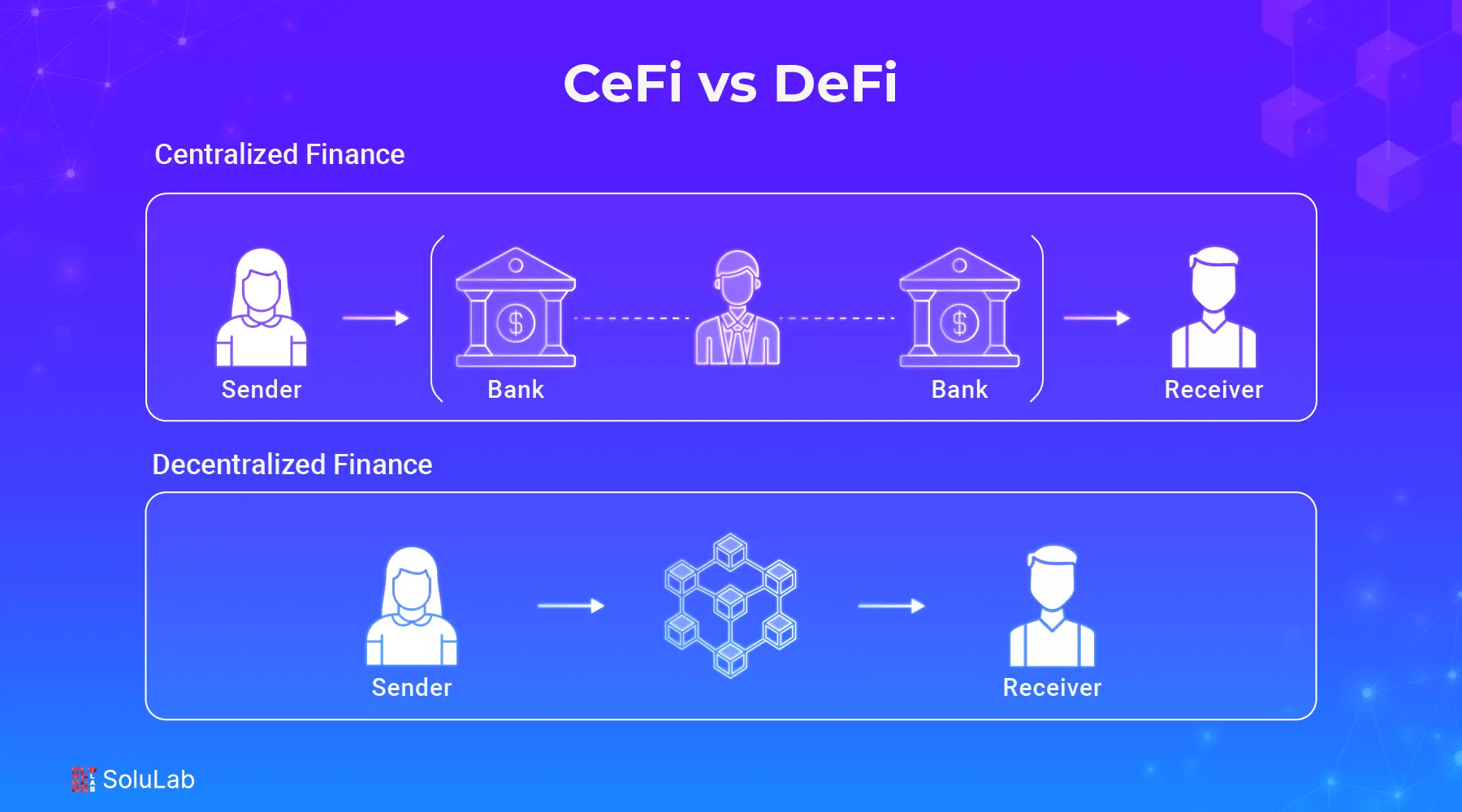

The conventional financial system that most people are used to is represented by centralized exchange finance, or CeFi. It contains financial institutions that depend on middlemen to handle services and enable transactions, such as banks, brokerage houses, and payment processors. These middlemen are essential to CeFi’s operation because they sustain user and system confidence. However, a small number of corporations hold a disproportionate amount of control due to this centralization.

CeFi provides accessibility, user-friendliness, and a variety of services, including investment products, savings accounts, and loans, despite its conventional structure. Many trust CeFi because of its reputation, regulatory compliance, and fund security. However, with the rise of blockchain, many users are also turning to options provided by a Decentralized finance development company to explore more transparent and automated financial solutions.

Here are some examples of CeFi platforms:

Blockchain technology is what lies behind the relatively new financial concept known as Decentralized finance, or DeFi. Through smart contracts, customers can access financial services directly, eliminating the need for centralized middlemen. Smart contracts are self-executing programs that guarantee transactions take place as planned without requiring outside intervention.

DeFi’s Decentralized structure provides a greater level of accessibility and transparency. Anyone with an internet connection can use it, which lowers the obstacles that traditional banking institutions frequently impose. Decentralized finance companies are leading this shift by offering open financial services that eliminate the need for intermediaries, making financial systems more inclusive and efficient.

Here are some examples of DeFi platforms:

Read More: How to Build DeFi Apps from Scratch?

The question is whether users should trust people or technology, even though DeFi and CeFi differ significantly.

Users of Decentralized finance (DeFi) have faith that the technology will operate as intended to carry out the services that are being provided. With CeFi, however, customers have faith in a company’s employees to handle money and provide services.

DeFi and CeFi both provide a variety of financial services linked to cryptocurrencies. Let’s talk about some of the characteristics and capabilities that set the two ecosystems apart.

| Attributes | DeFi | CeFi |

| Funds Custody | The user has complete authority over funds custody. | Outside of the user’s custody |

| Services available | Borrowing, Lending, Payments, Trading | Trading, Borrowing, Fiat-to-crypto, Payments and Lending |

| Personal Information | Proof of Work | Pluggable Framework |

| Security | Not accountable for funds. | Vulnerable in case of security bridges on the exchange. |

| Market Cap | $16 billion | $324 billion |

| Customer Service | NA | Provided by major changes. |

| Risk Factor | Security relies on the technology you are using. | Centralized exchanges are responsible for security. |

In DeFi, transactions are atomic, meaning they either happen completely or not at all. This is enforced by smart contracts, reducing the chances of incomplete or failed processes. In CeFi, transaction finality may take time and often involves multiple intermediaries, which can delay or split processes.

DeFi gives users full control of their assets through non-custodial wallets—no middlemen involved. In contrast, CeFi platforms are custodial, meaning they hold and manage your funds for you. While this can be convenient, it also means trusting a third party with your assets.

DeFi transactions often involve gas fees, which can spike during network congestion (especially on Ethereum). CeFi platforms usually charge fixed fees, which can be more predictable, but sometimes higher, depending on the service.

DeFi security depends on the smart contract code—if there’s a vulnerability, funds can be at risk. CeFi relies on traditional security systems, but is also vulnerable to hacks, insider fraud, or data breaches.

Read Also: Key Green Finance Trends

The future of CeFi (Centralized Finance) and DeFi (Decentralized Finance) is likely to be a hybrid one, where both systems coexist and complement each other. CeFi platforms offer a user-friendly experience, customer support, and regulatory compliance, making them more appealing to traditional investors.

DeFi helps users with complete control over their assets, enabling permissionless trading, lending, and earning opportunities without intermediaries. Decentralized finance platforms are at the core of this movement, offering transparent and accessible financial services. As regulations become clearer and blockchain technology matures, we might see greater collaboration between CeFi and DeFi platforms.

CeFi institutions could integrate DeFi protocols to offer users more flexibility and better yields. This blend of security and innovation could reshape the global financial system, offering more inclusive and transparent services.

Both centralized (CeFi) and Decentralized finance (DeFi) share a common goal: to make crypto trading more accessible and boost trading volume. However, they take very different approaches to achieve this.

CeFi focuses on security and fairness by operating through trusted intermediaries and regulated platforms. On the other hand, DeFi aims to eliminate middlemen, relying on peer-to-peer networks and smart contracts. For instance, DeFi protocols often allow flexible transaction ordering, which can increase the potential for market manipulation, but it also opens the door for innovation and new trading strategies in the crypto space.

SoluLab, a DeFi Development Company, can help you pick the right one as per your requirements. Contact us today to discuss further!

CeFi is generally considered more secure due to regulatory oversight and insured deposits. However, DeFi offers higher transparency and security through blockchain technology but is more susceptible to smart contract vulnerabilities.

DeFi transaction costs are reduced due to the lack of intermediaries, however, they vary across networks. Due to intermediaries, CeFi transactions average higher fees. In contrast to centralized crypto exchanges, Decentralized platforms often charge lower fees but may have fluctuating charges based on network congestion.

Yes, both systems are accessible worldwide, but DeFi can provide more borderless access, while CeFi may have geographical restrictions and regulatory requirements.

CeFi is typically more accessible for beginners due to its regulated environment, easy-to-use platforms, and customer service. DeFi may require more knowledge of blockchain and cryptocurrency.

In CeFi, intermediaries like banks, credit institutions, and payment processors are responsible for managing transactions, maintaining records, and ensuring compliance. On the other hand, a Decentralized Finance (DeFi) development company helps build systems that eliminate the need for such intermediaries by using blockchain and smart contracts.