With a substantial increase in recent times, the cryptocurrency market has reached a valuation of trillions of dollars. A significant portion of this success can be attributed to the potential applications of the underlying blockchain technology. Given that blockchain emerged alongside digital currencies, it comes as no surprise that its applications in the financial sector hold great promise.

In essence, blockchain in financial services can be understood as a decentralized ledger that records transactions. For financial service providers, this technology has the potential to facilitate faster and more cost-effective transactions, automate contracts, and enhance security. While blockchain technology has yet to achieve widespread adoption, several financial institutions are already leveraging its capabilities.

The Ethereum blockchain transforms business networks, shared operating models, and processes in banking and finance, resulting in increased openness, inclusivity, security, efficiency, reduced costs, and novel products and services. It facilitates the issuance of digital securities within shorter timeframes and at lower unit costs, enabling greater customization. This customization aligns digital financial instruments with investor demands, expanding the investor market, minimizing costs for issuers, and mitigating counterparty risk. Over the past five years, the technology’s maturation for enterprise-grade applications has showcased these advantages:

A new report from Jupiter Research predicts that blockchain in finance deployments will allow banks to achieve significant cost savings in cross-border settlement transactions. The report suggests that banks could save up to $27 billion by 2030, representing a reduction in costs of over 11%. Ethereum, in particular, has already proven its potential to disrupt the industry, delivering cost advantages of over 10 times compared to traditional technologies. Financial institutions recognize that distributed ledger technology has the potential to save billions of dollars for banks and major financial institutions over the next decade.

The digitization of financial instruments, including digital assets, smart contracts, and programmable money, propels the advantages of blockchain to new heights. It enables unparalleled levels of connectivity and programmability among products, services, assets, and holdings. These digitized instruments will revolutionize the operations of commercial and financial markets, establishing a paradigm shift where value is generated at every touchpoint. Digital financial instruments provide businesses with the following benefits:

1. Authenticity and Scarcity: Digitization ensures data integrity, establishing a single source of truth for asset provenance and full transaction history.

2. Programmable Capabilities: Governance, compliance, data privacy, identity (KYC/AML attributes), system incentives, and stakeholder participation features can be integrated within the digital assets.

3. Streamlined Processes: Enhanced automation increases operational efficiency, enabling real-time settlement, audit, and reporting, and reducing processing times, errors, and delays.

4. Economic Benefits: Automated and efficient processes lead to decreased infrastructure, operation, and transaction costs.

5. Market Reactivity: Digital securities offer greater customization than standardized securities and can be issued quickly, allowing issuers to create tailored financial instruments that meet investor demand.

6. New Products and Markets: Digital asset tokenization enables secure, scalable, and rapid asset transfers, fractionalized ownership of real-world assets, tokenized micro-economies, and more.

By combining these benefits, governance systems become more transparent and accountable, business models become more efficient, incentive alignment among stakeholders improves, liquidity increases, the cost of capital decreases, counterparty risk is reduced, access to a broader investor and capital base is granted, and the door is opened to all other digital financial instruments.

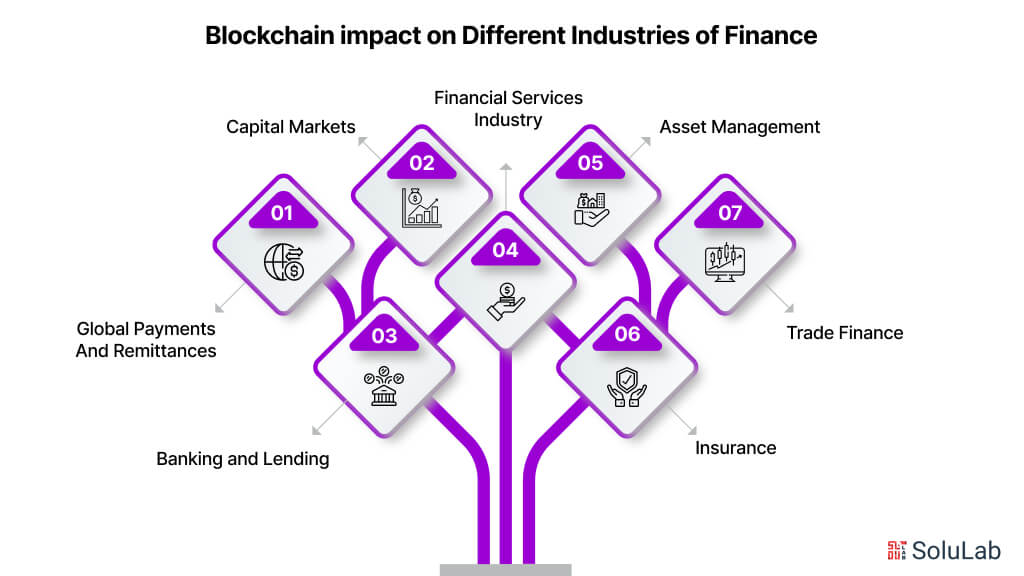

Of the numerous applications of blockchain in finance, a few key uses include:

Let’s delve deeper into how financial institutions could integrate blockchain technology to address the aforementioned scenarios and explore the potential motivations driving their adoption.

1. Money Transfers: Blockchain financial services, beginning with Bitcoin, was created to facilitate fund transfers between two parties (point A to point B) without the need for a central authority. As blockchains have developed, they’ve enabled faster and more cost-effective transactions. A notable example is Ripple, a company that utilizes blockchain for financial services for RippleNet, a global payments network. RippleNet processes transactions within five seconds, with a minimal cost of a fraction of a cent. Financial institutions leveraging blockchain technology can offer more efficient money transfer services. International money transfers that could take hours or days using traditional methods can now be completed in seconds at a fraction of the cost.

2. Enhanced Transaction Security: Financial institutions are frequently targeted by fraudulent activities. Digital payments, in particular, pose the risk of information theft during the transaction process as they pass through payment processors and banks. blockchain in the financial industry leverages cryptographic algorithms to process and record transaction blocks. This cryptography offers a potential solution for financial companies to mitigate risks associated with transaction processing.

3. Automated Smart Contracts: The introduction of Ethereum in 2015 marked a significant milestone in blockchain in the financial industry. It was the first blockchain to incorporate smart contracts, which are self-executing contracts triggered when predefined conditions are met. Contracts play a crucial role in the financial services industry, and companies allocate substantial resources to their management. Self-executing smart contracts have the potential to streamline this process significantly. For instance, an insurance company could utilize smart contracts to expedite the claims process. Upon a client’s claim submission, it would be automatically reviewed by the codes programmed into the blockchain for financial services. If the claim is deemed valid, the smart contract will execute and initiate payment to the client.

4. Customer Data Storage: To prevent fraud and money laundering, most financial organizations must conduct identity verification processes with their clients. While this process is vital for business integrity, it can be time-consuming and costly. An alternative solution is to leverage blockchain technology with AML monitoring software to store customer data securely and transparently. When a company completes the Know-Your-Customer (KYC) process with a new client, it can add the client’s data to the financial services blockchain. Subsequently, other financial institutions can utilize this KYC data rather than repeating the process independently. This approach not only streamlines the process for financial companies but also reduces the burden on clients, eliminating the need for multiple KYC processes for different financial accounts.

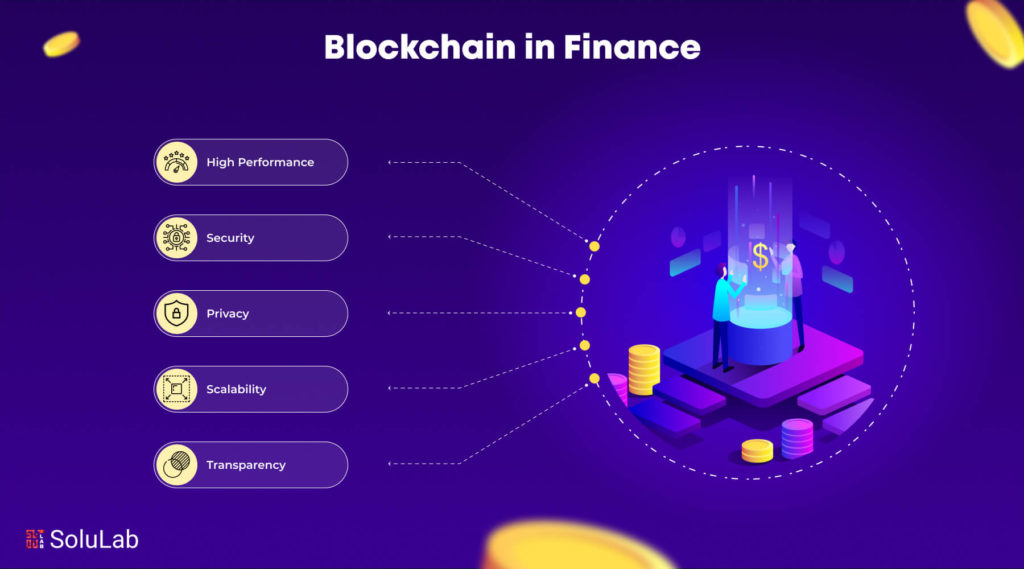

Before delving into the specific industries that can benefit from blockchain technology, let’s briefly explore the foundational concepts and benefits of blockchain.

Capital markets are a platform for issuers seeking capital to connect with investors who have the appropriate risk and return profiles. Raising capital can be challenging for issuers, including entrepreneurs, startups, and large organizations. Firms must navigate increasingly stringent regulations, longer time to market, interest rate volatility, and liquidity risk. Emerging markets face additional challenges, such as a lack of rigorous monitoring, comprehensive regulation, and sufficient market infrastructure for issuing, settlement, clearing, and trading.

Blockchain for financial services offers several benefits for capital market use cases, including:

In the face of rising demands for enhanced liability risk management, more agile decision-making frameworks, and navigating the complexities of evolving regulations, venture capital firms, private equity firms, real estate funds, and specialty markets are turning to blockchain in finance industry for innovative solutions. Blockchain’s capabilities can effectively streamline asset and stakeholder management, offering a range of benefits:

In today’s world, global payments and remittances involve numerous intermediaries charging fees for their services. Sending $200 internationally can take 2 to 7 days and cost an average of 6.94%, resulting in a $48 billion reduction in remittances due to fees and intermediaries. Blockchain financial services has the potential to streamline payment and remittance processes, reducing settlement times and significantly lowering costs.

Here are some of the potential benefits of using blockchain for payments and remittances:

Core banking services encompass transactions, loans, mortgages, and payments, many of which depend on traditional execution processes. For example, it takes 30 to 60 days for individuals to secure a mortgage and 60 to 90 days for small and medium enterprises to obtain a business loan due to processes such as information verification, credit scoring, loan processing, and funds distribution.

Blockchain technology can revolutionize banking and lending services by streamlining processes, minimizing counterparty risk, and reducing issuance and settlement times. It offers several key benefits:

Trade finance encompasses the infrastructure, processes, and funding that facilitate international trade supply chains. However, the industry heavily relies on paper-based processes, which are prone to security vulnerabilities and lengthy transaction times, often taking 90-120 days to process letters of credit, verify documents, and establish trust among stakeholders. Blockchain technology has the potential to upgrade trade finance by digitizing the entire trade finance lifecycle, enhancing security, and improving efficiency. It can enable increased transparency in governance, reduced processing times, lower capital requirements, and mitigate risks associated with fraud, human error, and overall counterparty risk.

Specifically, blockchain can facilitate the following advancements in trade finance:

In property and casualty insurance, fraud is a prevalent concern, and claim assessments often take an extended duration. Blockchain technology offers a solution by securely streamlining data verification, claim processing, and disbursement, resulting in significantly reduced processing times. Here are the key benefits:

Blockchain technology has the potential to revolutionize the financial services industry by offering several compelling advantages. Here are the main benefits of blockchain in finance:

Implementing blockchain in the financial industry presents several challenges:

In conclusion, the transformative potential of blockchain in finance is immense. By leveraging blockchain for financial services, the industry can achieve unparalleled levels of transparency, security, and efficiency. The adoption of blockchain in financial services is set to revolutionize traditional banking, insurance, and investment sectors, paving the way for blockchain financial services to become a cornerstone of the modern financial ecosystem. Financial services blockchain solutions offer significant benefits, including reduced fraud, lower costs, and faster transactions. As the blockchain in finance industry continues to evolve, it is clear that blockchain in the financial industry will play a pivotal role in shaping its future.

Companies like SoluLab are at the forefront of this transformation, providing cutting-edge solutions for blockchain and financial services. Their expertise in blockchain technology in finance ensures that businesses can seamlessly integrate blockchain into their operations, enhancing their capabilities and competitiveness. As we look to the future, the collaboration between finance and blockchain will continue to grow, driving innovation and creating new opportunities in the blockchain finance industry. The synergy between blockchain fintech and traditional finance promises a dynamic and resilient financial landscape, underscoring the critical role of blockchain finance in driving progress and prosperity.

Blockchain in finance provides a secure, transparent, and efficient method for recording and verifying transactions, reducing fraud and operational costs.

Blockchain for financial services enhances security by using cryptographic methods to protect transaction data, making it tamper-proof and resistant to unauthorized access.

The benefits of using blockchain in financial services include faster transaction times, reduced costs, improved transparency, and enhanced security.

Blockchain financial services are transforming traditional banking by streamlining processes, reducing the need for intermediaries, and increasing transaction speed and accuracy.

Blockchain technology significantly impacts the financial services blockchain by providing a decentralized ledger that ensures transparency and security, thereby increasing trust in financial transactions.

Blockchain in the finance industry drives innovation by enabling new financial products and services, such as decentralized finance (DeFi), smart contracts, and real-time cross-border payments.

Blockchain fintech is considered a game-changer for the finance sector because it offers innovative solutions that enhance efficiency, reduce costs, and open up new avenues for financial inclusion.