Traditional smart contracts are based on fixed rules. They do what they’re told, nothing more. But modern businesses need more than that. They need smart systems that can adapt, predict, and respond automatically. So, businesses are combining AI and smart contracts to build faster, smarter, and more flexible systems.

These new-age contracts bring together the power of blockchain and artificial intelligence. You gain self-operating agreements that can think, learn, and make decisions based on live data, giving your business a competitive edge in speed, efficiency, and accuracy.

82% of businesses using AI-powered automation report a reduction in operational costs of at least 25% within a year.

If you’re a growing business looking for smarter, scalable systems, AI-based smart contract automation might be exactly what you need. Let’s begin!

A smart contract is like a digital agreement that runs automatically on a blockchain. It follows set rules and executes actions like sending payments, without needing human input once it’s live.

An AI smart contract is a smart contract enhanced with AI algorithms. This means it can learn from data, understand patterns, and make decisions on its own, just like a human would, but faster and without errors.

Unlike basic smart contracts that can only do what they’re told in advance, AI-powered smart contracts can adapt in real time. They process live data, make sense of changing conditions, and respond automatically.

Example: Citi used AI-powered smart contracts in 2023 to automate trade finance with Maersk and the Panama Canal Authority. Payments were auto-triggered on shipping milestones, cutting manual work and saving hundreds of thousands in fees.

Most businesses today use traditional smart contracts, which are rule-based programs on a blockchain. They only follow pre-written instructions. Once deployed, they can’t adapt or change unless someone updates the code manually. This makes them reliable, but not flexible.

Now, compare that with AI smart contracts; they are smarter, more adaptive, and data-driven. By combining machine learning, natural language processing (NLP), and real-time analytics, AI contracts can learn from data, make predictions, and even adjust themselves based on new inputs. Here’s a simple table to show the key differences:

| Feature | Traditional Smart Contracts | AI Smart Contracts |

| Logic Type | Predefined, rule-based | Dynamic, learning-based |

| Ability to Adapt | No | Yes (automated decision-making) |

| Use of Real-Time Data | No | Yes |

| Intelligence Level | Basic, fixed | Advanced (can interpret & learn) |

| Example Use Case | Fixed rental payments | Dynamic pricing or insurance claim automation |

With AI smart contracts, your business can benefit from automation that thinks. These contracts can read data, understand behavior patterns, and act accordingly, saving time, reducing errors, and increasing efficiency.

If you’re considering adding this level of intelligence to your blockchain systems, it’s smart to partner with an experienced AI development company that understands both AI and blockchain infrastructure.

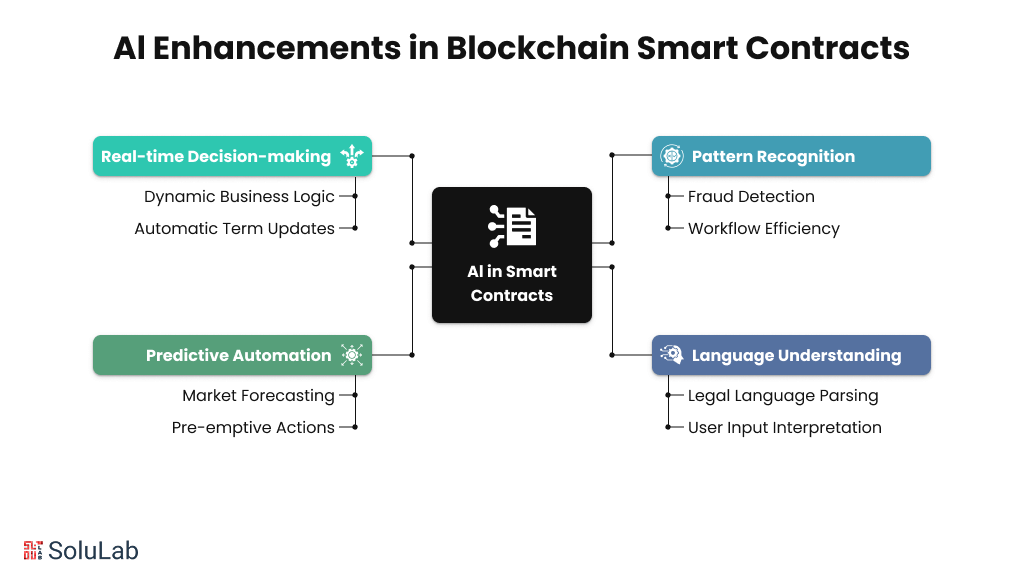

AI is more than just a trend; it makes smart contracts smarter and more useful for businesses. Here’s how AI smart contract development services can enhance blockchain solutions:

This combination is especially powerful in AI in DeFi smart contract management, where fast market changes need flexible contracts. If you’re wondering how to integrate AI with smart contracts, our experienced AI smart contract development company is here to guide you step-by-step.

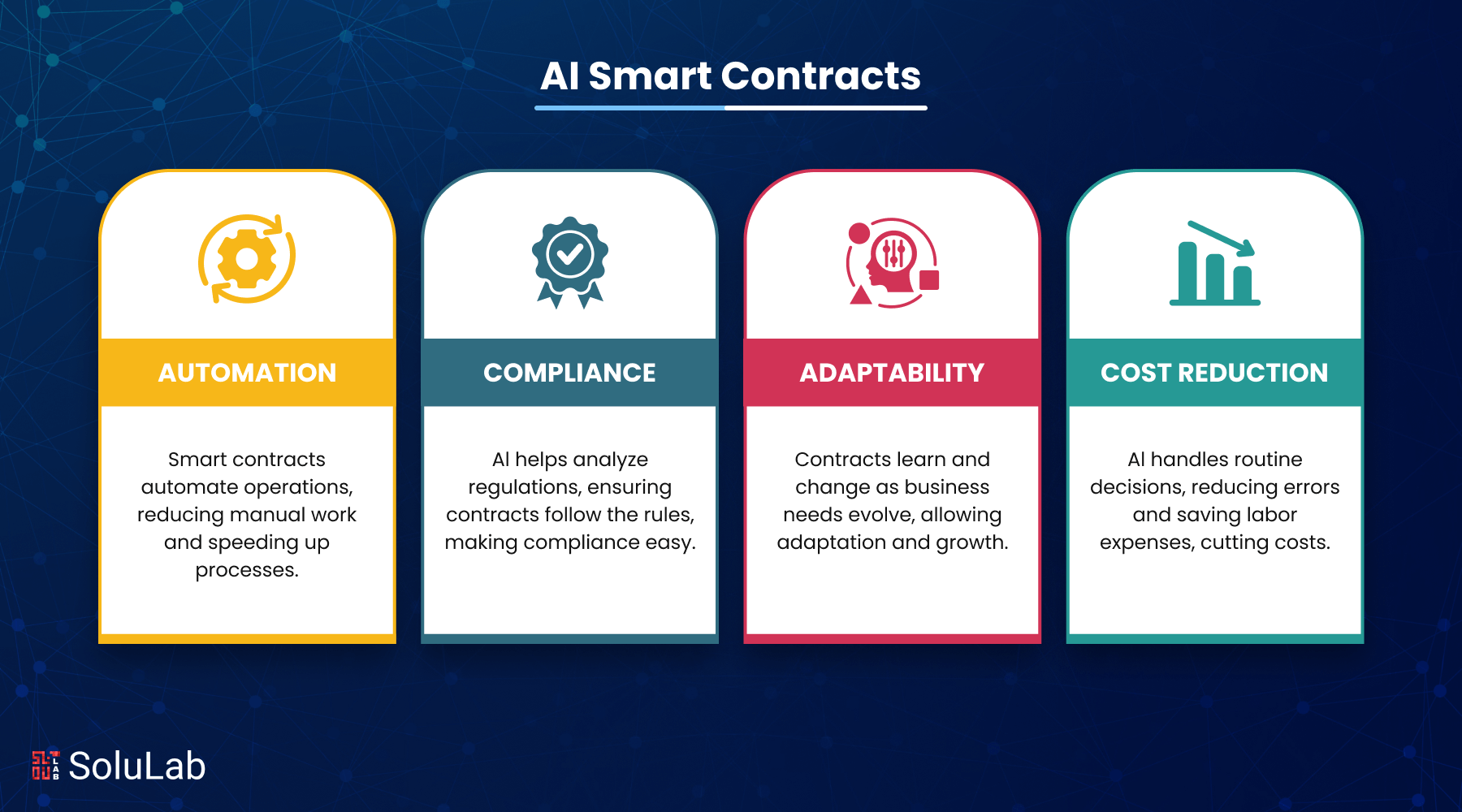

With AI smart contracts, companies gain more control, better decision-making, and smarter automation, all without needing to constantly rewrite the code. There are multiple benefits of AI-powered smart contracts for businesses:

This is how smart businesses stay competitive in today’s fast-moving digital world.

Read Also: Top 10 Smart Contract Development Companies in 2025

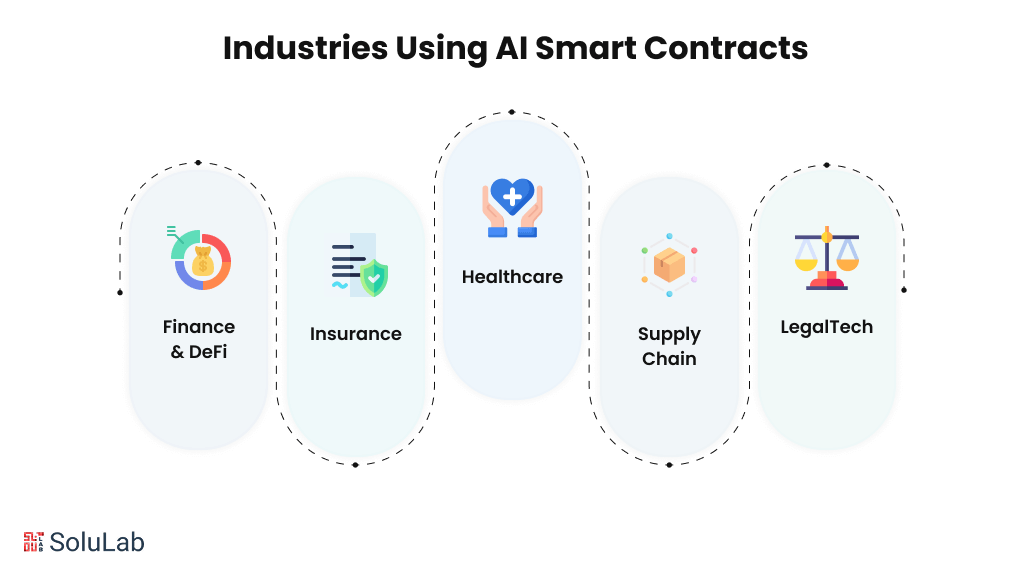

Many industries are quickly adopting AI smart contracts to automate tasks, cut costs, and improve accuracy. Here are some real-world examples showing where these technologies make a big difference:

In finance, especially in DeFi smart contract management, AI smart contracts are used for things like automatic loan approvals, credit scoring, and fraud detection.

Example: Celsius Network uses AI combined with smart contracts to offer personalized loan rates and automate loan handling. This reduces risks and speeds up transactions.

The insurance industry benefits from AI-based smart contract automation by automatically approving claims once AI verifies the documents.

Example: Etherisc uses AI-powered blockchain smart contracts to quickly process claims, reducing manual work and errors.

Healthcare providers use blockchain smart contracts with AI to manage patient consent and control data access safely, while following privacy rules.

Example: Medicalchain blends AI and smart contracts to let patients control who sees their medical records, improving security and transparency.

In supply chains, AI smart contracts help with smart routing and demand forecasting to make deliveries faster and reduce waste.

Example: IBM Food Trust uses AI and blockchain smart contracts to track food supplies in real time, making sure products are safe and high quality.

Legal technology companies use AI smart contract automation to create contracts that can adjust to new data and help understand complex agreements.

Example: Hyperstart offers AI-powered smart contract templates that update automatically, speeding up contract management and reducing errors.

Read More: What Problems Do HTLC Smart Contracts Solve in Crypto Payments?

Today’s digital world moves fast, and your business needs tools that keep up. AI smart contracts let you:

Working with the right partner, like an AI smart contract development company USA, means your contracts are not just smart, they’re secure, scalable, and built to last. Plus, a thorough AI smart contract audit ensures your system stays safe and reliable as it grows.

AI is not the future anymore; it is the present of blockchain technology. Businesses that use AI-powered smart contract solutions gain a real advantage by automating processes, improving decisions, and moving faster than their competitors. If your business wants to stay ahead, our AI in Web3 Development can help you get started right away.

SoluLab, a leading smart contract development company in USA, can render you the best services for AI integration in your business operations. We have worked with numerous businesses to boost their businesses with automation and AI. One such project is Digital Quest, a travel business that partnered with SoluLab to create an AI-powered chatbot for enhanced engagement and travel recommendations.

AI smart contracts are already changing how industries work. Why wait to be left behind when you can lead the change? Contact us now!

AI smart contracts are blockchain contracts powered by artificial intelligence. They don’t just follow fixed rules; they can learn and adapt automatically to improve automation and decision-making for businesses.

An AI smart contract audit is a thorough check of AI-enabled smart contracts to ensure they are secure, reliable, and error-free. Audits help businesses avoid costly bugs and vulnerabilities before deployment.

Blockchain Smart Contracts typically run on fixed rules that execute predefined tasks. In contrast, AI smart contracts add intelligence by using data to make adaptive, real-time decisions, making them more flexible and powerful.

To hire AI smart contract developers, look for experts skilled in both blockchain coding and AI technologies. Our agency offers vetted developers who can build secure, efficient, and scalable AI smart contracts tailored to your needs.

An AI smart contract development company USA combines local market knowledge with technical expertise, offering reliable and compliant AI blockchain solutions tailored for American enterprises.