Managing finances isn’t always smooth. Many Australians still face long loan approval times, bulky banking interfaces, and limited access to personalized financial advice. On the other hand, fintech companies face rising compliance costs and pressure to deliver faster, safer services.

From automating tedious processes to detecting fraud in real-time, AI solutions are transforming the way the fintech industry operates in Australia. With the rise of AI applications in fintech, startups and banks alike are delivering smarter, more personalized financial experiences.

At the same time, AI agents in financial services are helping businesses stay compliant and agile in the face of strict regulations. In this blog, we’ll explore how AI is in fintech, use cases, and look at what the future holds. Let’s get started!

AI in the Australian finance industry has over 800 fintech companies operating across the country, and it’s one of the fastest-growing tech sectors in the region. Sydney and Melbourne have become major hubs, attracting both local startups and global players.

Supportive regulations, like open banking and the Consumer Data Right (CDR), have made innovation easier and safer. In fact, Australia’s fintech adoption rate hit 58%, one of the highest in the world.

Within the financial services and insurance industries, 39% of businesses have adopted AI, utilizing it for various applications, including customer service chatbots and automation of routine tasks.

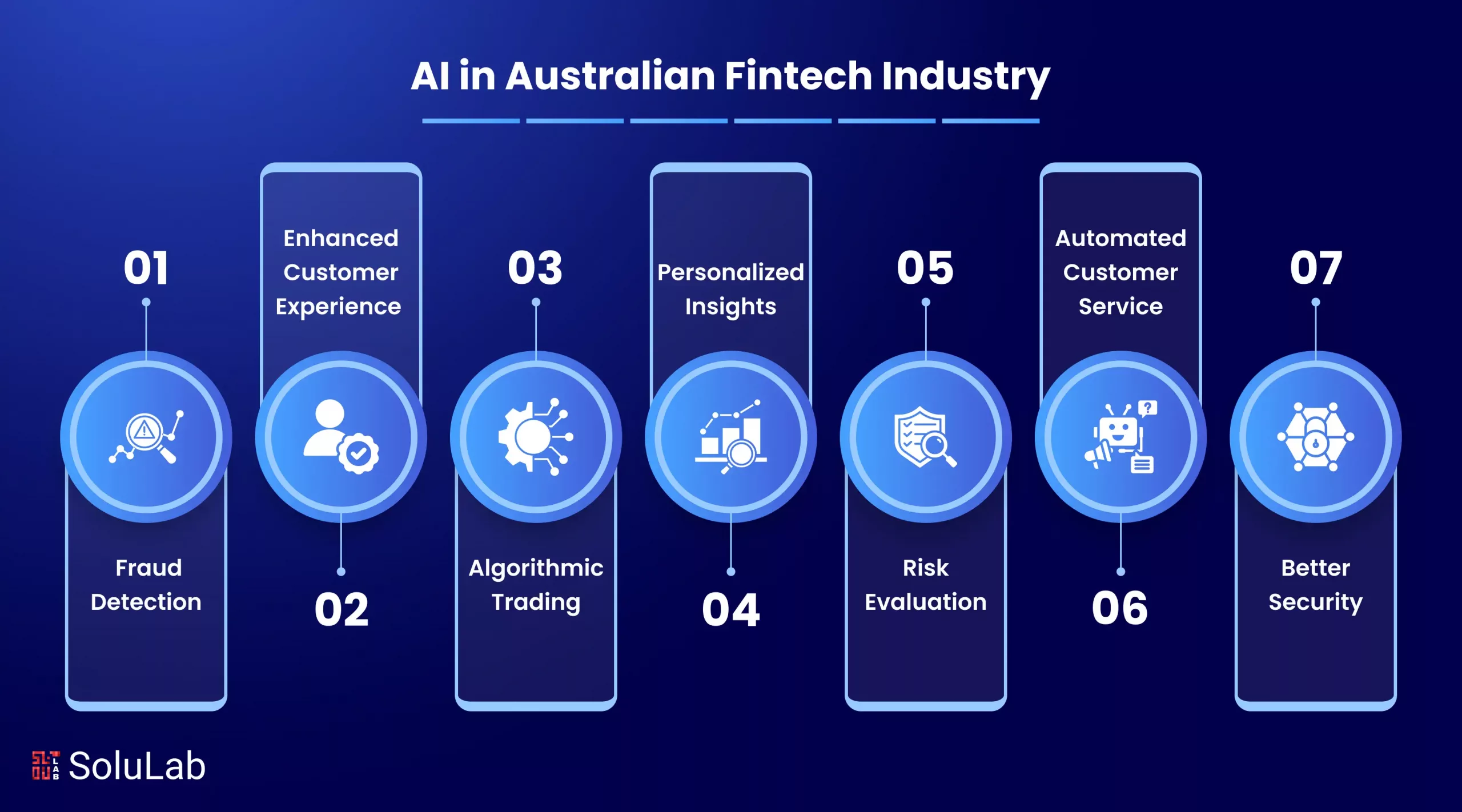

AI in the financial industry is improving the financial geography in Australia, offering consumers smarter, faster, and more secure services. Here are some of the benefits:

By analyzing vast amounts of transaction data, AI systems can identify unusual patterns and flag potential fraudulent activities before they arise. For example, the Commonwealth Bank of Australia (CBA) has implemented AI-driven systems to detect and investigate financial crimes more efficiently and protect customers’ assets.

Gone are the days of long wait times for customer support. Due to AI integration in financial solutions, AI-powered chatbots and virtual assistants now provide instant, 24/7 assistance. They handle routine inquiries and offer personalized financial advice. CBA’s virtual assistant, “Ceba,” is a prime example, assisting customers with various banking needs and improving overall satisfaction.

For investors, AI enables algorithmic trading by analyzing market trends, historical data, and even social media sentiment to execute trades. This technology enables faster, more efficient trading decisions, potentially maximizing returns and minimizing risks.

AI analyzes individual spending habits and financial goals to offer tailored advice. Robo-advisors, powered by AI, provide personalized investment strategies, making financial planning more accessible and affordable for a broader audience. This personalization enhances customer engagement and satisfaction.

Assessing creditworthiness has become more accurate with AI. By evaluating a wide range of data points, including transaction history and employment records, AI models can predict potential risks. This leads to more informed lending decisions and better risk management for financial institutions.

AI improves customer service by automating routine tasks such as account inquiries and transaction processing. This reduces operational cost, plus allows human agents to focus on more complex issues, overall efficiency, and the responsiveness of financial services.

Beyond fraud detection, AI enhances cybersecurity by monitoring for potential threats. It can detect anomalies in user behavior, flagging suspicious activities that may indicate security breaches.

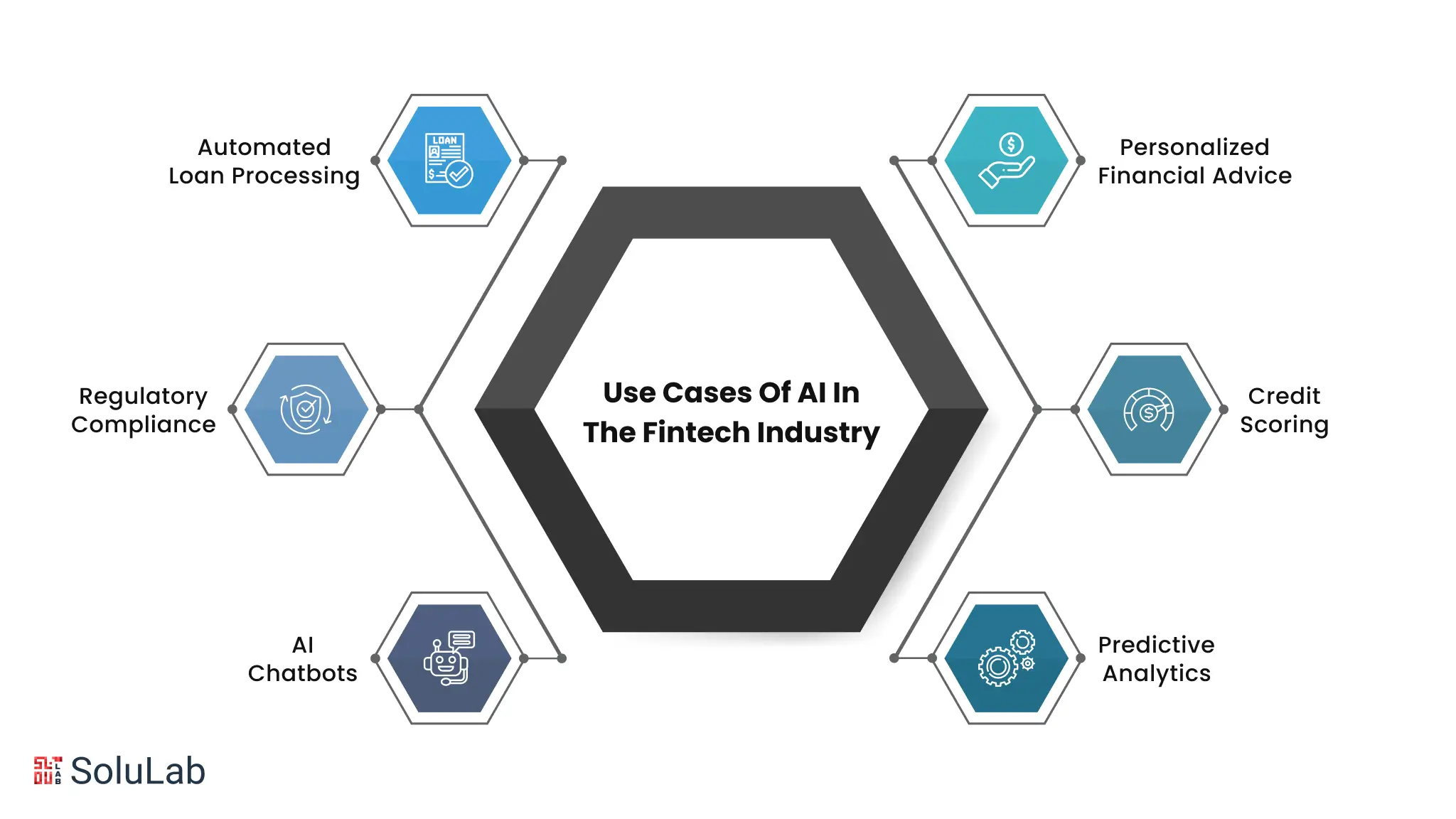

Artificial Intelligence (AI) is rapidly transforming the fintech space, offering innovative solutions across various sectors. From enhancing security to personalizing financial services, AI’s capabilities are vast and continue to expand. Here are some AI use cases in fintech you should know:

The days of universal financial advice are long gone. These days, AI-powered platforms provide personalized suggestions based on user spending patterns, financial objectives, and risk tolerance. Users are empowered to make wise choices regarding saving, investing, and budgeting because of this customisation.

By evaluating enormous statistics, such as credit history, income, and even social media activity, artificial intelligence is changing loan approvals. In addition to speeding up the approval process, this technology improves accuracy and equity, opening out credit to a wider range of people.

It can be difficult to figure out the complex web of financial regulations. By automating compliance checks, tracking transactions in real time, and identifying possible infractions, AI simplifies this process. This ensures prompt adherence to regulatory standards while simultaneously minimizing manual labor.

People without long credit histories are frequently overlooked by traditional credit rating techniques. AI modifies this by analyzing data from other sources, such as energy bills and social media posts, to provide a more thorough and inclusive evaluation of creditworthiness.

AI-powered chatbots have improved customer service in the financial industry. These virtual assistants improve customer experience while lowering operating expenses by answering common questions, responding instantly, and being available 24/7.

AI is used in predictive analytics to foresee consumer behavior, market trends, and possible hazards. Fintech businesses may optimize investment strategies, make proactive judgments, and customize services for each client by evaluating both historical and current data.

Read More: Asset Tokenization Regulations for Australia

The Australian fintech sector is poised for significant disruption and growth fueled by advancements in Artificial Intelligence. Here are some future trends you’ll see in the upcoming years:

Consider AI would know your financial goals, risk tolerance, fears, and personality. This information could develop a flexible financial plan for your changing life.

Generative AI in the fintech industry might change your budget and savings goals. It may advise financial storm techniques if you’re unexpectedly laid off. This hyper-personalization, powered by advanced AI models, would be improving financial planning, making it more adaptive and responsive to individual needs.”

Ignore robot responses! AI chatbots will learn to read your mood and reply accordingly. Stressed about a low bank balance? This AI buddy would offer budgeting advice, encouragement, and income-boosting strategies with empathy.

Suppose a chatbot that can answer financial questions and provide emotional assistance in difficult circumstances. A more holistic and supportive financial experience would result.

Insurance has been one-size-fits-all. AI could tailor an insurance policy to your lifestyle. This AI-powered health insurance plan might evaluate your fitness tracker data and reward healthy habits with lower premiums.

Car insurance may also analyze your driving habits and commute traffic jams to determine your risk profile and change your coverage. Personalized insurance may be cheaper and more suited to your requirements.

Financial goods require frequent upkeep, like autos. In predictive financial product maintenance, AI can spot issues before they happen. AI could analyze your investment portfolio and anticipate its performance in different market scenarios.

It may then suggest portfolio tweaks to reduce risk and maximize profits. AI might also monitor your buying habits and identify cash flow gaps, helping you avoid financial stress. This preventive approach would protect your finances.

AI could help manage debt and achieve financial freedom. Consider a system that analyzes your loans and credit cards and develops a customized payback schedule.

The AI could negotiate reduced interest rates with lenders for you. Automation and support could make debt management easier and less stressful.

To wrap it up, AI in finance is changing the game for Australia. From faster loan approvals to smarter fraud detection, it’s making financial services more efficient, secure, and user-friendly. With Australian startups leading the charge and strong government backing, the country is well on its way to becoming a global fintech hub.

AI-Build partnered with SoluLab to develop a scalable, AI-powered CAD solution using generative models like GANs and CNNs. The result? Automated design generation, real-time error detection, and enhanced customization—reducing manual effort and boosting productivity.

SoluLab, a top AI development company in Australia, can help you automate your business to scale faster and stay competitive through a practical AI solution. Contact us today to discuss further!

AI in fintech refers to using artificial intelligence technologies like machine learning, natural language processing, and predictive analytics to improve financial services.

AI helps fintechs improve operations, reduce human error, deliver faster services, and offer personalized customer experiences—all crucial in a competitive market.

Yes, AI applications must comply with financial regulations, privacy laws, and guidelines under frameworks like the Consumer Data Right (CDR).

AI evaluates non-traditional data like utility payments or social behavior to offer a fairer and more inclusive assessment of creditworthiness.

Not entirely. AI chatbots handle routine queries, but human agents still manage complex or sensitive issues. It’s more about collaboration.