Payments across borders still take days. Banks and treasury teams still have problems like settlements that take too long, partners that aren’t all in one place, and money that is stuck in transit. Margins are still hurt by reconciliation. At the same time, customers and employees expect payments to be sent quickly, safely, and across continents.

Stablecoin development solutions have already shown that they can fix these problems on a large scale. Stablecoins move trillions of dollars every year. Banks, payment networks, and fintechs are using them in real settlement flows. Governments are putting in place rules to help them.

But it’s not easy to issue and manage a stablecoin inside the company. It needs blockchain infrastructure, reserve management, compliance controls, audits, and security for operations.

This is where Stablecoin as a Service (SCaaS) comes in. SCaaS allows enterprises to use stablecoins as a payment and settlement layer without building everything from scratch. It turns stablecoins into usable financial infrastructure, not a crypto experiment. Let’s see how this works and why companies like Coinbase integrated SCaaS into their platforms.

What Is a Stablecoin-as-a-Service (SCaaS) Platform?

Stablecoin as a Service (SCaaS) is an enterprise-ready infrastructure model. This architecture allows businesses to issue, manage, and integrate stablecoins through a compliant, secure backend.

Instead of becoming a blockchain development company or a regulated financial institution overnight, enterprises use a Stablecoin as a Service platform that already supports:

- Token issuance and redemption

- Fiat or asset-backed reserves

- Compliance and transaction monitoring

- APIs for payments, wallets, and treasury systems

In simple terms, SCaaS is the operating system behind enterprise stablecoins.

It is often described as the “AWS for stablecoins” because companies plug into existing infrastructure instead of building everything themselves. For B2B use cases, this approach is becoming the preferred path.

Why Enterprises Are Turning to Stablecoin-as-a-Service Platform Development?

Enterprises are not adopting stablecoins because they are trendy. They are doing it because traditional payment rails are increasingly misaligned with global business needs.

1. Banking rails were not built for real-time global commerce

Mostly, cross-border payments are dependent on the banking network for secure transactions. This method is slow and costly, as taxes are involved, and opaque, as you can’t see the transfer progress. You will be wrong if you think this only happens at a low level. Even fro well established companies, face this. That’s where stablecoins for b2b payments are gaining traction today.

2. Regulatory clarity is improving worldwide

Between 2024 and 2026, major regions introduced or finalized stablecoin frameworks:

- The EU activated MiCA

- Hong Kong passed a dedicated Stablecoin Ordinance

- Singapore, Japan, Canada, and the UAE clarified rules for fiat-backed stablecoins

This shift has made regulated stablecoin platforms viable for enterprise use.

3. Enterprises want control without operational burden

Using public stablecoins alone limits branding, governance, and integration flexibility. Building in-house is slow and risky.

SCaaS offers a middle ground:

- Enterprise control

- Compliance-first design

- Faster time to market

The Real Business Benefits of Stablecoin-as-a-Service You Must Know in 2026

This is where SCaaS becomes practical. The top companies, like Coinbase, and startups like Agora and Bastin, use stablecoins for cross-border payments and give customers a seamless experience with transactions. Not only have Mastercard and Visa partnered with companies like Circle for international transactions. Let’s see more use cases below.

1. Faster settlement and liquidity efficiency

Stablecoin transactions settle in minutes, not days. For enterprises, this means:

- Reduced working capital lock-up

- Better cash flow visibility

- Faster vendor and partner payouts

In high-volume stablecoin payments, even small time savings translate into meaningful financial impact. This is not just applicable to some banking companies, but also to high-end real estate requirements.

Read Also: Stablecoin Development Transforming Real Estate Transactions

2. Lower operational and reconciliation costs

Traditional payment systems require:

- Multiple banking partners

- Manual reconciliation

- Region-specific workflows

A Stablecoin payments solution simplifies this into a single, programmable settlement layer, reducing back-office overhead.

3. Built-in compliance without rebuilding systems

A regulated stablecoin platform includes:

- KYC and AML workflows

- Transaction monitoring

- Audit-ready reporting

This removes the need for enterprises to design compliance frameworks from scratch while still meeting regulatory expectations.

4. Branded and controlled money flow

With enterprise stablecoin services, companies can issue branded stablecoins for their ecosystem:

- Vendor settlements

- Marketplace payments

- Intercompany transfers

Liquidity stays within the system, improving efficiency and trust.

5. Programmable financial operations

Stablecoins are programmable money. Through smart contracts, enterprises can:

- Automate payouts

- Trigger settlements based on conditions

- Simplify revenue sharing and reconciliation

This is especially powerful for platforms handling recurring B2B transactions.

6. Reduced dependency on intermediaries

Stablecoins allow direct value transfer between counterparties. Fewer intermediaries mean:

- Lower fees

- Less operational friction

- More predictable settlement outcomes

For enterprises operating across regions, this is a structural advantage.

How Stablecoin-as-a-Service Works For Your Business?

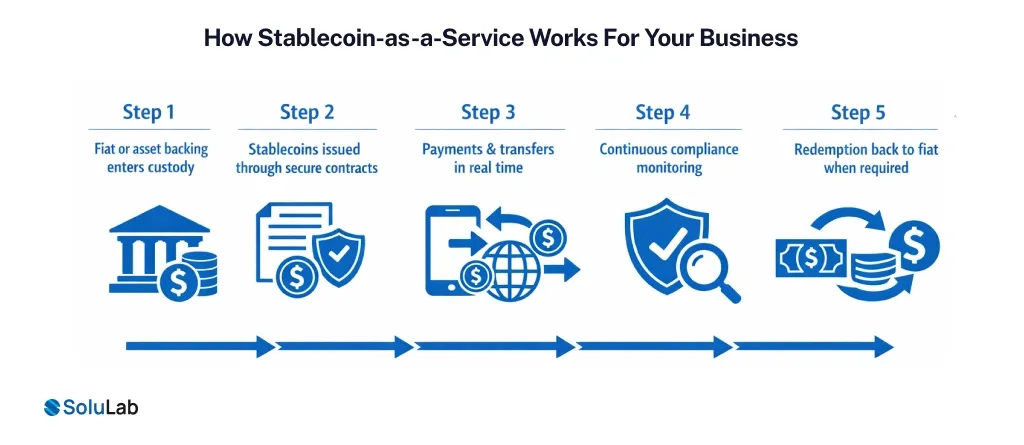

Understanding what stablecoins are and how Stablecoin as a Service works helps decision-makers evaluate adoption realistically. Below is a simplified enterprise flow.

Step 1: Fiat or asset backing enters custody

Funds are deposited with regulated custodians or trust partners. These reserves back the stablecoin 1:1, ensuring stability and trust.

Step 2: Stablecoins are issued through secure contracts

The SCaaS provider mints stablecoins based on deposited reserves. Smart contracts are audited, controlled, and governed under predefined rules.

Step 3: Payments and transfers happen in real time

Stablecoins move across wallets, applications, or platforms instantly. Enterprises can integrate transfers directly into their systems using APIs.

This enables B2B stablecoin payments without banking delays.

Step 4: Compliance runs continuously in the background

Every transaction is monitored for:

- Risk signals

- Jurisdictional rules

- Regulatory thresholds

This ensures compliance without interrupting operations.

Step 5: Redemption back to fiat when required

Stablecoins can be redeemed for fiat on demand, maintaining liquidity and balance sheet clarity. The enterprise never needs to manage blockchain complexity directly.

Launch Your SCaS Platform With SoluLab

Building a stablecoin platform is not just a technical project. It is a financial infrastructure decision that impacts compliance, security, and long-term scalability.

SoluLab is a stablecoin development company designed specifically for enterprise use cases.

How SoluLab support enterprise SCaaS initiatives?

With our 250+ experts’ support, we first analyse your goals, requirements,s and plan the development lifecycle. You can also check our stablecoin development services.

- Stablecoin platform development– From architecture to deployment, a clean process as explained above.

- Compliance-ready designs-KYC, AML, auditability, and jurisdictional platforms will be built based on your region and vision.

- AI and Blockchain integration-With our latest technology stack, we provide AI-powered stablecoins and other integrations that suit your system updates.

- White-label and stablecoins– Full control over your tokens, regulations, and integration flows.

- Wallet development– Simplify your customers’ transactions through the wallet feature in your digital assets platform.

For more details on Stablecoin development services, contact our experts today!

FAQs

Most SCaaS platforms take 8–16 weeks, depending on compliance needs, blockchain choice, integrations, and customization. Using existing frameworks speeds things up significantly.

Costs usually range from $10,000, based on features, compliance scope, regions covered, and integrations like wallets, KYC, and fiat on/off-ramps, and any customizations increase the cost.

You can directly book a call with SoluLab through the form at the end of the service page. Once you fill the form, you will receive a response within 24 to 72 hours based on your region and timings

Yes, when built correctly. SCaaS platforms are designed to support KYC, AML, audits, and regional regulations like MiCA, Hong Kong rules, and other licensed frameworks.

Not at all. SCaaS abstracts blockchain complexity, letting enterprises use stablecoins like any modern payment infrastructure without managing wallets or protocols internally.