Web3 founders today can’t afford slow launches as the market is racing ahead, and the global blockchain industry is expected to hit $67B+ by 2026. However, traditional monolithic blockchains often hinder teams with lengthy development cycles, scaling limitations, and rigid systems.

This is where the shift toward modular blockchain architecture is happening, and it’s changing how fast teams can build. Modular blockchains break the system into flexible parts. Each layer can be upgraded, scaled, and improved independently. This means faster blockchain app development, better performance, and more room to customize without being held back by a single chain’s limitations.

So, if you want speed, control, and scalability, modular blockchain design is now the smarter path. It helps you launch quicker, build solutions that match your exact business needs, and future-proof your Web3 product in a market where competition grows every day. This blog shows how modular design helps you launch Web3 products faster, lower your costs, and build systems that fit your exact business needs.

Key Takeaways

- Modular blockchains boost speed by up to 100× by separating execution, consensus, and data availability.

- 65% of new smart contracts are being deployed on modular L2s, showing a massive industry shift.

- Enterprise adoption jumped 45% this year.

- Modular tools like rollups, appchains, shared DA layers, and permissioned L2s now let startups ship MVPs in weeks instead of months.

What Is Modular Blockchain Architecture?

Most companies today want to build fast, scale fast, and avoid high costs. But traditional monolithic blockchains slow everything down because they try to do everything on one layer. This creates bottlenecks, higher fees, and long development cycles.

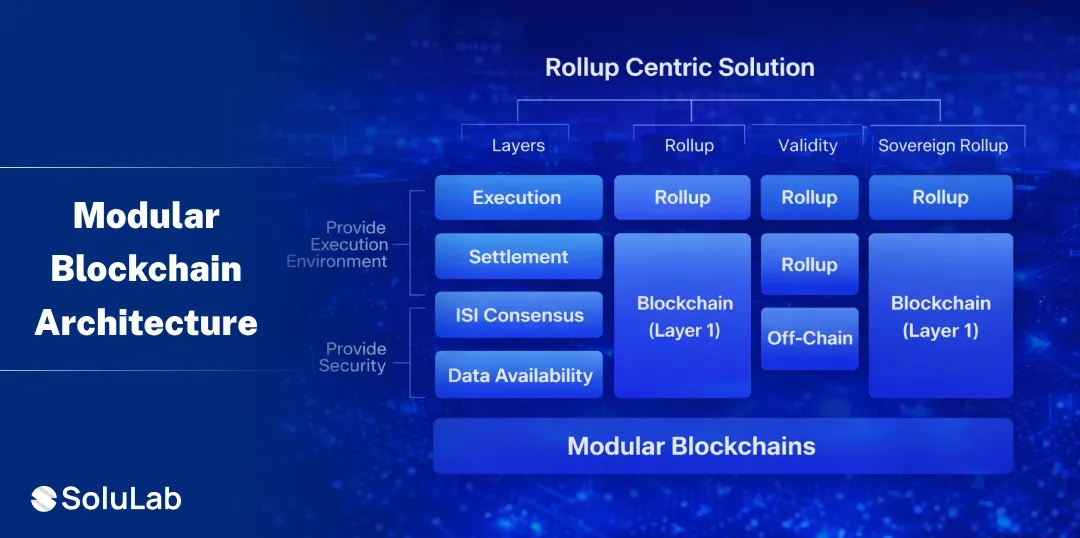

Modular blockchain architecture fixes this by breaking the system into smaller, specialized parts. Each layer focuses on one job, making the whole network faster and easier to build on.

- Consensus Layer: Keeps the network secure and verifies transactions.

- Data Availability (DA) Layer: Stores and publishes data so nodes can check state without downloading everything.

- Execution Layer: Runs smart contracts and processes transactions, with freedom to choose custom VMs or runtimes.

- Settlement Layer: Handles finality, dispute resolution, and state proofs for rollups and connected chains.

Because each layer is independent, developers can swap, upgrade, or optimize specific components without disrupting the entire system. This reduces engineering overhead, improves flexibility, and enables far faster scaling compared to monolithic chains. The result is a blockchain ecosystem that works more like a modular tech stack, similar to combining specialized microservices, rather than relying on one rigid, all-in-one system.

This is why modular architectures are now powering advanced DeFi protocols, high-throughput appchains, and enterprise-grade networks that require speed, compliance, and predictable performance.

Why Is Monolithic Better Than Modular Blockchain?

In some cases, yes, as a monolithic blockchain like Ethereum keeps everything from execution, consensus, data availability, and security inside one single system. Because all parts live in the same layer, the chain is easier to reason about, very secure, and trusted by a huge developer community.

For many teams, this all-in-one model feels stable and simple, but this same design also creates technical limits:

- Slow upgrades: One small update affects the entire network, so changes need long testing, hard forks, and global coordination.

- Low scalability: All transactions compete for the same block space because execution + DA + consensus run together.

- Higher gas fees: When one area gets congested, the whole system slows down.

- Longer launch timelines: Building new features or Layer-2 solutions takes more time due to the tight coupling of components.

This is why more companies now study modular vs monolithic blockchains before choosing a direction. A modular blockchain architecture separates key functions like execution, settlement, and data availability into specialized layers. This leads to:

- Faster deployment in a few weeks

- Flexible scaling through rollups, appchains, shared DA layers

- Lower costs for both users and builders

- Better performance for real-world apps

For startups and enterprises that want speed, scale, and lower cost, modular blockchain setups often create a stronger business advantage while still connecting to secure ecosystems like Ethereum.

13 Modular Blockchain Solutions Your Business Can Implement

For businesses looking to build, deploy, and sell blockchain development solutions, modular architectures offer scalability, flexibility, and speed. Here are 13 modular blockchain solutions that you can build and implement:

#1. Rollups

Rollups bundle multiple off-chain transactions and submit compressed data to the base chain. Optimistic Rollups assume transactions are valid unless disputed, while ZK-Rollups use zero-knowledge proofs for instant verification. This dramatically increases throughput, reduces gas fees, and accelerates DeFi and NFT applications. Platforms like Arbitrum use rollups to process 40% of Ethereum L2 activity, enabling low-cost trading and secure fraud proofs.

Most people who’ve used Ethereum for years already know the basics but sometimes it helps to step back and look at how things actually work.@arbitrum doesn’t try to change Ethereum itself. It simply gives it more breathing room.

— Alucard (@xCryptoAlucard) November 25, 2025

Ethereum is incredibly powerful but with low… pic.twitter.com/n2Z5dD0PpG

#2. Appchains

Appchains are application-specific blockchains built on modular frameworks, providing isolated execution for higher performance and faster deployment. This is particularly valuable for gaming, marketplaces, and specialized enterprise apps. Projects like Dymension launch custom appchains with 1-second block times, supporting interoperable gaming ecosystems with smooth scalability.

The internet of RollApps meets the internet of Blockchains ⚛️@dymension standardizes rollups with #IBC and enables easy deployment of app-specific rollups (RollApps).

— Cosmos – The Interchain ⚛️ (@cosmos) December 20, 2023

With Dymension mainnet approaching, a new wave of modular blockchains is coming to the #interchain pic.twitter.com/C60KzLHEuU

#3. Sidechains

Sidechains operate independently while being linked to main networks, allowing custom rules, faster blocks, and flexible execution environments. They are widely adopted for NFT marketplace development and high-traffic DApps. For instance, Polygon hosts over 2M daily users, enabling faster and cheaper transactions without congesting Ethereum’s mainnet.

🔧 Polygon’s infrastructure layer is quietly maturing into one of the most versatile environments in Web3.

— 🟣 𝐏𝐨𝐥𝐲𝐠𝐨𝐧 𝐒𝐩𝐚𝐜𝐞 🟣 (@Polygon_Space1) June 5, 2025

With a diverse set of protocols powering data, connectivity, oracles, and cross-chain communication, the foundation is being set for scalable and reliable deployment at… pic.twitter.com/LE7pSPVOpH

#4. Shared Data Availability (DA) Layers

DA layers focus on publishing transaction data without handling execution, reducing storage overhead while improving scalability. Chains like Celestia secure over 1B+ data blobs for rollups, lowering storage costs by 100x for high-volume blockchain applications. This makes them ideal for DeFi platforms and large-scale DApps.

That’s ~2TB of blockspace per day.

— Celestia (@celestia) November 24, 2025

𝗘𝗻𝗼𝘂𝗴𝗵 𝘁𝗼 𝗳𝗶𝘁 𝗮𝗹𝗹 𝗯𝗹𝗼𝗯𝘀 𝗲𝘃𝗲𝗿 𝗽𝗼𝘀𝘁𝗲𝗱 𝗼𝗻 𝗘𝘁𝗵𝗲𝗿𝗲𝘂𝗺 𝗶𝗻𝘁𝗼 𝗮 𝘀𝗶𝗻𝗴𝗹𝗲 𝗱𝗮𝘆, 𝗖𝗲𝗹𝗲𝘀𝘁𝗶𝗮 𝘀𝗰𝗮𝗹𝗲𝘀 𝗿𝗼𝗹𝗹𝘂𝗽𝘀 𝘁𝗼 𝘁𝗵𝗲𝗶𝗿 𝗲𝘅𝘁𝗿𝗲𝗺𝗲.

#5. Custom Permissioned Rollups

Permissioned rollups provide private, compliance-ready environments for enterprises, integrating KYC and governance controls. They are critical for regulated financial applications. Arbitrum Orbit, used by JP Morgan Onyx, allows regulated asset transfers, combining rollup efficiency with enterprise-grade compliance.

#6. Modular Execution Layers

Execution layers provide high-performance computation for applications that require heavy processing, such as trading platforms, DeFi protocols, and gaming engines. Fuel is a strong example, achieving 10k+ TPS through parallel execution while ensuring deterministic outcomes for complex blockchain operations.

What if rollups could think for themselves?@syndicateio just introduced a new rollup architecture, designed not just to scale but to coordinate.

— PARSA (@Parsats_eth) November 5, 2025

➤ Smart Rollups with embedded Sequencer Contracts

➤ Modular nodes: Fees, Permissions, Staking, Sequencing

➤ A built-in Atomic… pic.twitter.com/cSJCLX7FTg

#7. Settlement Layers

Settlement layers ensure cross-chain finality and reconciliation, supporting multi-chain asset transfers and trustless interactions. Hyperlane, for example, bridges over 50 chains, enabling atomic swaps in multi-chain DeFi applications without relying on intermediaries.

CHAIN COVERAGE: 180+ chains

— Hyperlane ⏩ (@hyperlane) November 21, 2025

VM SUPPORT: EVM, Solana VM, Cosmos SDK, CosmWasm, Starknet VM, ZKsync VM, Radix VM, and more.

SYSTEM STATUS: Expanding… pic.twitter.com/smYJS3mD4d

#8. Modular Consensus Layers

Consensus layers provide tunable configurations like PoS, BFT, or hybrid models for enterprise needs. They allow custom validator sets, slashing rules, and finality times, balancing security with performance. Berachain, built on Cosmos, demonstrates this with custom slashing for DeFi applications, ensuring fast yet secure liquidity operations.

Introducing the Crypto Performance Race Check

— Bored Shamrocks (@ArtificialSham1) February 10, 2025

Let's have a look how the $BERA Token performed since the Mainnet launched on Feb 6.

🪙 About $BERA: A standout Layer-1 blockchain token from $Berachain, using a unique Proof of Liquidity consensus model, Full EVM compatibility for… pic.twitter.com/wKDzhv4Jh4

#9. Interoperability Modules

Interoperability modules enable secure cross-chain communication for assets and data. Protocols such as IBC (Cosmos) connect over 100 chains, facilitating shared liquidity and composable DeFi ecosystems, making multi-chain development more seamless.

Join the Find Your Cosmonaut quest!

— Cosmos – The Interchain ⚛️ (@cosmos) April 16, 2025

Cosmos is home to 120+ IBC-connected chains, each with its own culture, vibe, and frontier to explore. To celebrate IBC Eureka, we are exploring our universe!

100 Winners will share a $10,000 USDC Prize Pool 🏆

⚛️ How to participate 👇 pic.twitter.com/XcaALhN9sd

#10. Modular Identity Systems

On-chain identity systems provide privacy-preserving KYC and AML verification, enabling secure user onboarding. Lens Protocol, for example, powers over 1M decentralized social profiles, allowing verifiable and composable digital identities suitable for regulated platforms.

The future of social is looking ✨ bright ✨ today as the Lens API surpassed one million gasless transactions! What an incredible moment for the ecosystem 🌍🌿 pic.twitter.com/Ge88rpoZ6k

— Lens (@LC) July 19, 2022

#11. Decentralized Storage Layers

These layers integrate distributed storage networks with execution and settlement layers, offering redundant, secure, and scalable data management. Arweave provides permanent storage for over 10M NFTs, ensuring integrity without central servers, ideal for enterprise and NFT-heavy applications.

📣 Major announcement: @Meta is now using Arweave to permanently store digital collectables from @Instagram.

— 🐘🔗 sam.arweave.dev (@samecwilliams) November 2, 2022

Instagram users are now able to issue digital collectables for their posts, stored on Arweave.

Some thoughts 👇 pic.twitter.com/Y0xjhDwHid

#12. Enterprise Consortia Chains

Consortia chains allow multiple organizations to collaborate while maintaining security and governance, ideal for supply chain, finance, or utility networks. Energy Web Chain tracks assets across 100+ utilities, enabling transparent, auditable energy tracking while supporting industry collaboration.

#13. Tokenization Layers

Tokenization layers enable regulated real-world asset (RWA) solution, compliant payments, and automated yield generation. Centrifuge has tokenized over $500M in invoices, allowing secure, compliant financial instruments for institutional clients.

⚡ Live: Centrifuge launches SPXA, the first-ever tokenized S&P 500 Index Fund licensed by @SPDJIndices.

— Centrifuge (@centrifuge) September 25, 2025

Exclusively on @base, with multichain expansion to be powered exclusively by @wormhole.

Managed by @anemoycapital, @JHIAdvisors, with @FalconXGlobal as the anchor investor. pic.twitter.com/g8ZRr6xp5T

Real-World Case Studies

Modular blockchain systems are now delivering measurable, real-world business results across Web3, DeFi, gaming, and enterprise finance. With data availability (DA) outsourcing, custom rollups, and modular execution layers, companies are reducing costs, launching faster, and scaling to enterprise levels. Below are real examples utilizing modular blockchain systems

1. Celestia-Based Rollups

Celestia’s modular DA layer is helping teams launch sovereign rollups faster and cheaper by separating execution from data storage. Here are the Key metrics:

- Launch time reduced to 3–4 weeks, instead of 12–16 weeks on monolithic chains (75% faster).

- DA costs 5–1,000x cheaper, with blob fees around $0.00002 per transaction.

- Up to 1,300 TPS in production with 99.9% uptime.

- Supports 1GB block sizes, enabling Visa-level throughput (40,000+ TPS equivalent).

- Over 20 rollups launched, including Berachain and Eclipse, Celestia handles 680K+ tx/month at just 10% network usage.

Utilizing this, Teams cut infrastructure costs by 35–50% and launched scalable Web3 apps without L1 limits.

2. Arbitrum OP Stack & Orbit Appchains

Arbitrum’s modular architecture allows developers to deploy customized L2/L3 chains with shared security and built-in optimistic rollup features. Here are the Performance numbers:

- Appchain deployments in under 2 weeks (including the 7-day challenge period).

- 99.95% uptime, backed by decentralized sequencing with BoLD.

- 25–40% lower infra costs using AnyTrust DA.

- 250ms block times for gaming and high-volume applications.

- Ecosystem: $13B+ TVL, fastest-growing optimistic framework in 2025.

Using Arbitrum OP Stack, Companies can launch fast, low-cost chains for gaming, DeFi, and consumer apps using existing Ethereum trust.

3. Permissioned Financial Rollups (Banks & Enterprises)

Banks are now using permissioned rollups with built-in KYC/AML and role-based access, allowing them to join DeFi without regulatory risks. Here are the numbers that you can’t overlook:

- 1,500+ TPS with deterministic finality.

- <30-second settlement times for large-volume transactions.

- 97% faster compliance cycles using perpetual KYC.

- 1M+ transactions/day on enterprise chains (e.g., JPMorgan’s JPMD).

- 60% reconciliation efficiency and 25% FX cost reduction reported by major institutions.

Using Rollups, Financial institutions finally get both blockchain scalability and regulatory safety, enabling tokenization and cross-border finance.

Best Tech Stack to Launch Scalable Rollups, Appchains, and Web3 Apps

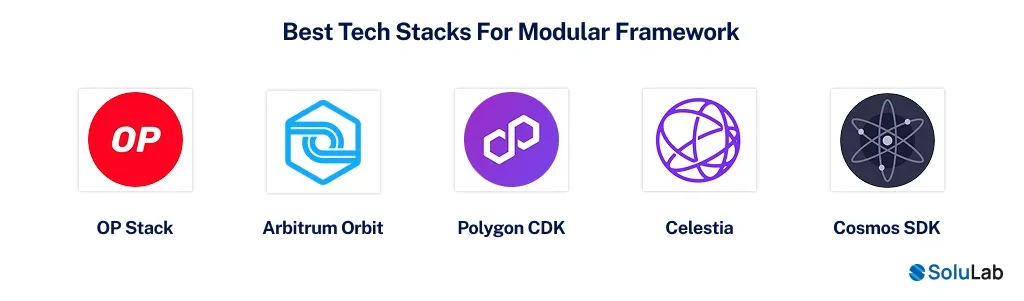

If you want to build scalable, secure, and fast-to-market Web3 products, choosing the right modular framework is key. These frameworks help agencies like ours ship high-performance Web3 apps, L2 rollups, and custom appchains with lower cost and faster deployment. Here are the best options for 2026:

1. OP Stack

A strong choice for EVM rollups and custom appchains. It supports high speed, easy developer tools, and a large ecosystem. Perfect if you want to launch L2 networks, DeFi apps, or enterprise-grade chains quickly.

2. Arbitrum Orbit

A powerful framework for building advanced rollups. It offers better throughput, cheaper transactions, and strong security. With a fast-growing ecosystem, Orbit is ideal for scalable Web3 platforms, gaming, or prediction markets.

3. Polygon CDK

Built for Zero-Knowledge (ZK) chains with full EVM compatibility. CDK is great for projects that need strong privacy, faster finality, and enterprise-level performance. Perfect for DeFi, RWA tokenization, and large user bases.

4. Celestia

The top player in modular data availability (DA). Celestia helps you scale faster because you don’t need to build your own DA layer. Works great for rollups, sidechains, and high-volume transactions.

5. Cosmos SDK

A popular toolkit to build modular chains, business blockchains, and consortium networks. Cosmos SDK offers strong control, custom modules, and fast communication across blockchains through IBC.

Conclusion

Adopting modular blockchains is a smart move for founders and enterprises who want to build and launch Web3 products faster. A modular blockchain architecture breaks complex systems into clear layers, making development simpler, upgrades easier, and overall performance more secure and scalable. This setup lets your team use the latest blockchain technology without dealing with the high cost and time of rebuilding everything from scratch.

For businesses aiming to stay ahead, working with trusted modular blockchain frameworks helps you launch high-performance, low-cost, and future-ready Web3 solutions. If your company wants expert support in building or scaling products on modular blockchains, SoluLab, a leading blockchain development company, can guide you end-to-end and help you ship faster with confidence.

FAQs

Modular blockchains split core functions like execution, consensus, and data availability into separate layers. This avoids congestion on a single chain and allows horizontal scaling. Because each layer handles its own job, projects get higher throughput, lower costs, and more flexibility than monolithic chains.

Look at how well the framework fits your use case, like DeFi, NFTs, gaming, and enterprise. Review the developer ecosystem, interoperability, security of each layer, and upgrade support. Tools like OP Stack, Arbitrum Orbit, and Celestia offer strong modular setups but differ in execution models and data availability, so alignment with your product matters.

A professional Web3 development company handles everything from architecture design and module selection to smart contracts, audits, and deployment. Agencies also manage cross-layer integrations, optimize costs, ensure compliance, and cut development time by using proven modular frameworks.

They act as specialized execution layers that offload transactions from the base chain. This boosts performance, lowers gas fees, and makes it easier for founders to launch scalable Web3 products without building the entire chain from scratch.

Instead of waiting 6–12 months, modular frameworks allow startups to go live in 4–8 weeks, thanks to reusable modules, prebuilt infrastructure, and independent scaling of each layer.

Yes. Modular systems allow custom permissioned rollups, private execution layers, and identity modules that support KYC/AML needs while still keeping the benefits of decentralization and strong security.