Saudi Arabia is not experimenting with real estate tokenization. It is operationalizing it at a national level. Not only SA, but also tokenization in Australia, the USA, the EU, and Asia are walking in the innovation path.

However, Saudi Arabia launched a national blockchain-backed infrastructure for real estate registration, digital ownership transfer, and fractionalization. This initiative, led by the Real Estate Registry (RER) under the supervision of the Real Estate General Authority (REGA), directly aligns with Vision 2030 and signals a clear shift toward digital, transparent, and globally investable real estate markets.

Unlike pilot projects seen in other countries, Saudi Arabia’s real estate tokenization approach is structural. The registry itself is being modernized to support tokenized ownership, regulated marketplaces, and enterprise-grade integrations. For banks, developers, asset managers, and PropTech firms, this is no longer a future concept. It is a live opportunity.

This guide explains why the market is accelerating, how the infrastructure works, and how enterprises can participate safely and profitably.

Key Takeaways

- Tokenization in Saudi Arabia has moved from pilots to real, regulated market activity.

- Banks and regulators are actively supporting real-world asset tokenization initiatives

- Tokenization platforms can reduce settlement time by 60–90%.

- First movers in Saudi Arabia can capture liquidity pools 2–3x faster than market standards and licensing frameworks.

Why Saudi Arabia’s Real Estate Tokenization Is Growing Faster in 2026?

Saudi Arabia’s tokenization growth is not driven by speculation. It is driven by policy, regulation, and institutional demand.

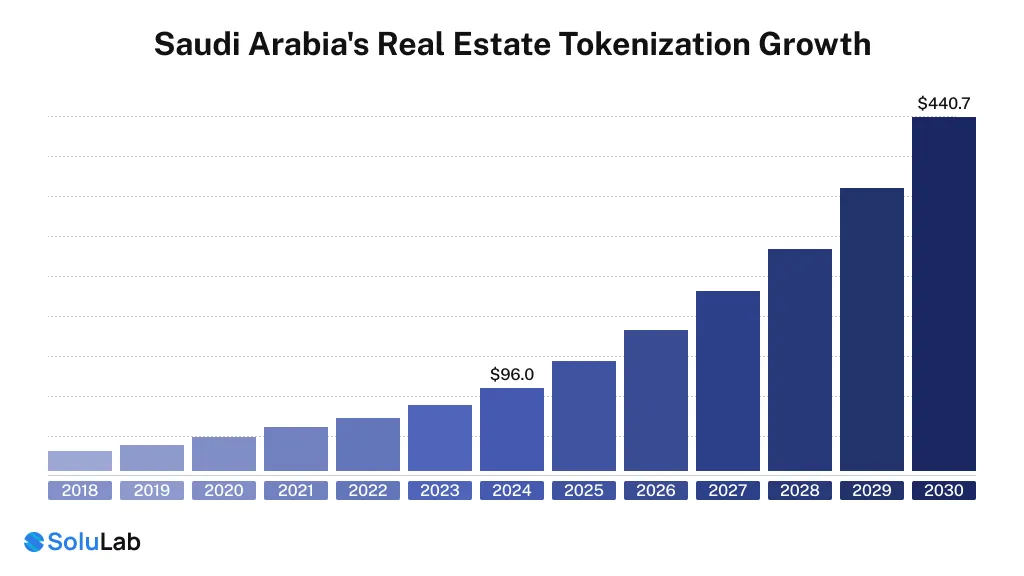

Grand View Research says that the Saudi Arabia tokenization market has already created USD 96 million in 2024 and is expected to reach USD 440.7 million by 2030, with a 24.1 percent CAGR. This development is pegged on tangible assets, particularly real estate.

What is driving this acceleration?

1. Vision 2030 and capital market modernization

The concept of tokenization aligns well with the strategy of the Saudi Arabian economy to diversify, ensure an inflow of foreign direct investments, and modernize the capital markets. The real estate will be a logical initial point since it is already regulated, valuable, and globally appealing.

2. National registry-led infrastructure

Unlike private tokenization platforms, Saudi Arabia’s model is built around the registry as the legal source of truth. This eliminates ownership disputes, reduces fraud, and provides confidence to institutional investors.

3. Demand for fractional access to premium assets

High-value commercial and residential assets are now accessible through regulated fractional ownership models. This expands the investor base without compromising compliance.

4. Enterprise-ready regulation

Rather than slowing innovation, Saudi regulators have created clear supervisory roles. REGA governs oversight and data standards, while RER operates the registry. This separation allows innovation and control to coexist.

How the National Real Estate Registry Enables Secure, Regulated Property Tokenization?

At the core of Saudi Arabia’s approach is a simple but powerful idea: the registry remains the authority, even in a tokenized system.

1. Registry-as-Truth Model

In this model, tokenized ownership does not replace the registry. Instead, tokens are a digital representation of rights recorded in the RER ledger. This ensures that every transaction remains legally enforceable under Saudi law.

2. Blockchain-backed title management

Property titles are digitized and managed using blockchain technology, ensuring immutability, auditability, and transparency.

3. Smart contract-based ownership transfers

Transfers of ownership, full or fractional, are done via a smart contract, which adheres to established rules of regulations and legal frameworks.

4. Shariah-compliant fractionalization

Saudi Arabia already approves a controlled fractional ownership model. On this basis, tokenization is implemented to comply with Islamic finance principles.

5. Interoperability and identity standards

The infrastructure is aligned to the international standards, including W3C Verifiable Credentials, and it is connected to the national identity and payment systems, like Absher, Nafath, and mada.

In the case of enterprises, this implies that tokenized real estate in Saudi Arabia is not legally grey, offshore, and experimental.

Enterprise Adoption Models: How Banks, Developers, and Funds Can Participate

One of the strongest aspects of Saudi Arabia’s tokenization strategy is that it supports multiple enterprise participation models, not a single marketplace.

1. Banks and Financial Institutions

Banks can use tokenized property data to:

- Offer token-backed mortgage and lending products

- Automate escrow and settlement workflows

- Reduce collateral verification and reconciliation time

Tokenization turns real estate into a programmable financial asset without compromising regulatory compliance.

2. Real Estate Developers

Developers gain new options to:

- Raise capital through regulated fractional sales

- Improve liquidity for large-scale projects

- Reach international investors without complex cross-border structures

This shortens funding cycles and improves capital efficiency.

3. Asset Managers and Funds

Tokenized real estate enables:

- Portfolio diversification with smaller ticket sizes

- Faster onboarding of investors

- Transparent reporting and automated distributions

For funds, this reduces operational overhead while improving investor experience.

How to Build a Tokenized Real Estate Platform in Saudi Arabia?

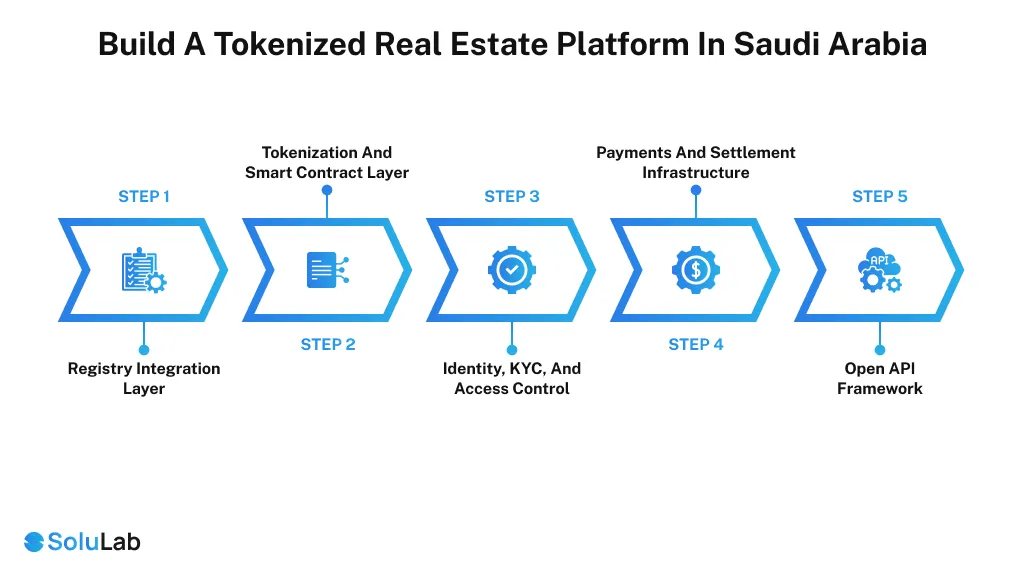

Building a compliant tokenized real estate platform in Saudi Arabia is not about launching a generic blockchain app. It requires deep integration with national systems and regulatory frameworks.

1. Registry integration layer

Direct or approved integration with RER systems to synchronize legal ownership records with tokenized representations.

2. Tokenization and smart contract layer

This layer defines:

- Ownership rules

- Fractional limits

- Transfer restrictions

- Compliance logic

Smart contracts must reflect Saudi real estate laws and regulatory requirements.

3. Identity, KYC, and access control

Enterprise-grade identity verification using national systems ensures only eligible participants can transact.

4. Payments and settlement infrastructure

Escrow-linked payment verification, fiat integration, and compliant settlement workflows are essential for trust.

5. Open API framework

APIs allow banks, PropTechs, and third-party platforms to build services such as valuation tools, lending products, and secondary markets.

This architecture ensures scalability, security, and regulatory alignment from day one.

Real-World Use Cases Already Emerging in Saudi Arabia’s Tokenized Property Market

Saudi Arabia’s tokenization initiative is already enabling practical, revenue-generating use cases.

1. Fractional real estate investment

It allows investors to possess the regulated portions of high-valued assets, which exposes more people to the market, but the legal environment is subject to uncertainty.

2. Tokenized lending and financing

Banks can issue loans backed by tokenized property interests, improving collateral management and reducing risk.

3. Digital escrow and automated settlement

Smart contracts automate payment verification and ownership transfer, cutting weeks from transaction timelines.

4. Cross-border property investment

Global investors have easy access to Saudi real estate without the country’s intricate legal system, boosting FDI flows.

5. Secondary market liquidity

Tokenized ownership makes it easier to trade property interests under supervised frameworks, improving market liquidity.

These use cases show that tokenization in Saudi Arabia is not theoretical. It is operational and expanding. Also, it’s not just SA, but also the USA, the EU, Asia, and Australia are expanding tokenization rules and making it public-friendly.

Conclusion

The market is growing fast, regulators are actively involved, and institutions are investing in infrastructure that will shape how value moves over the next decade. For businesses, the opportunity is no longer theoretical. It is executable.

The question is not whether tokenization will become part of Saudi Arabia’s financial and real estate ecosystem. The real question is who builds early, aligns with regulation, and captures the long-term upside.

For organizations evaluating tokenization companies in Saudi Arabia or planning to work with a tokenization development company, SoluLab experts are here to support you from step one.

We at SoluLab offer a wide range of asset tokenization development services, including:

- Asset Tokenization Platform Development

- Crypto and Digital Tokenization Platforms

- Tokenization as a Service (TaaS)

- Multi-Chain Tokenization Platform Architecture

- White Label Tokenization Platform Solutions

- AI-Enabled Tokenization Intelligence

If you need a customized tokenization platform tailored to Saudi regulatory and business requirements, our experts are ready to help.

Contact us today to discuss your idea and gain insights from our 10+ years of hands-on industry experience.

FAQs

The cost depends on platform scope, compliance needs, integrations, and customization. Enterprise-grade tokenization platforms typically start from mid five figures and scale based on complexity, security, and regulatory requirements.

A basic compliant tokenization platform can take 4–12 weeks. Fully integrated, enterprise-ready platforms with registry, banking, and API layers usually require 3–6 months, depending on customization and approval workflows.

You can contact SoluLab through the website contact form, schedule a consultation call, or speak directly with our experts to discuss requirements, timelines, and compliance considerations for your tokenization initiative.

Yes. Tokenization initiatives must align with Saudi regulatory frameworks. Early engagement with compliance requirements and registry-led models is critical to avoid rework and ensure your platform is legally and operationally viable.

Yes. Most enterprises begin with a pilot or limited-scope platform, then scale into multi-asset, multi-chain, or marketplace models once compliance, integrations, and user adoption are validated.