Banks, asset managers, and fintech companies are now exploring stablecoins for real settlement problems. This includes cross-border payments, fragmented liquidity, and high operational costs. But as usage grows, so does regulatory attention. Large-scale financial systems cannot rely on assets that lack clear reserve backing, redemption guarantees, or oversight.

This is where Singapore enters the conversation.

Singapore has consistently taken a structured approach to digital assets. Instead of banning innovation or allowing unchecked growth, it has focused on building rules first and scaling later. Its latest move is trialing tokenized treasury bills settled using wholesale central bank digital currency (CBDC) and introducing formal laws for stablecoin development solutions.

“Tokenisation has lifted off the ground. But have asset-backed tokens achieved escape velocity? Not yet,” said Chia Der Jiun, Managing Director of the Monetary Authority of Singapore (MAS). This signals a new phase for blockchain finance in Singapore and beyond. Let’s see how this partnership and the latest Singapore stablecoin bills will affect the global markets.

Key Takeaways

- Singapore is moving tokenization from pilots to real financial infrastructure using regulated settlement and wholesale CBDC.

- Regulated settlement can reduce settlement risk by up to 90% compared to multi-day, intermediary-heavy processes.

- Faster settlement improves capital efficiency, freeing 20–30% more liquidity for institutions during trading cycles.

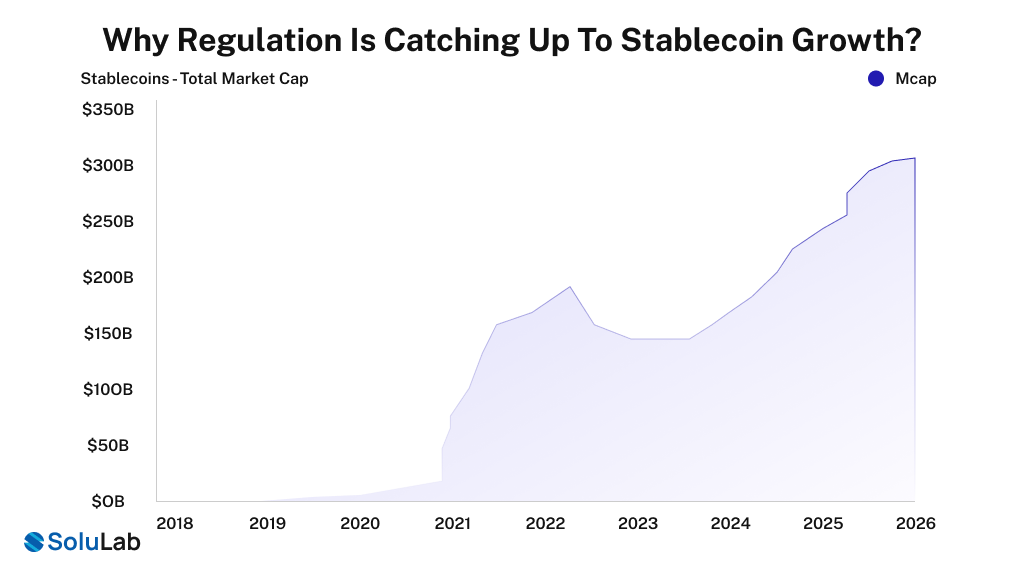

Why Regulation Is Catching Up to Stablecoin Growth?

Stablecoin adoption has grown faster than regulation. Initially, most stablecoins were used inside crypto exchanges and DeFi platforms. Today, they are increasingly being discussed for institutional settlement, trade finance, and capital markets. You can see the growth (Stablecoin Market Cap: $307.758b).

This shift creates new risks:

- What happens if a stablecoin issuer cannot redeem at scale?

- How are reserves verified?

- Can large transactions settle without liquidity stress?

To address these questions, the Monetary Authority of Singapore has announced plans to trial tokenized government securities, including tokenized treasury bills, that Singapore can settle using a wholesale CBDC.

What is being tested and why it matters?

Singapore’s approach combines three elements:

- Tokenized government securities, such as tokenized MAS bills

- Wholesale CBDC, used only by financial institutions

- Blockchain-based settlement, reducing intermediaries

A wholesale CBDC is different from a retail CBDC. It is not meant for public use. Instead, it acts as a trusted settlement layer for banks and regulated institutions handling large-value transactions.

By anchoring tokenized government securities to wholesale CBDC, Singapore is testing a model where private blockchain-based assets settle using central bank-backed money. This reduces counterparty risk and strengthens trust across the system.

This is a clear signal that regulation is no longer reactive. It is being designed alongside real-world deployment.

Stablecoin Regulation: What MAS Is Signaling to the Market

Alongside tokenized bills, Singapore is preparing a formal stablecoin regulatory regime. This is not just about licensing exchanges or issuing warnings. It is about defining how stablecoins can function safely within the financial system.

Key signals from Singapore’s stablecoin regulation

The proposed Stablecoin Regulatory Framework in Singapore focuses on:

- Reserve quality and transparency

- Redemption reliability

- Clear governance and accountability

- Risk management for systemic stablecoins

The message is simple. If a stablecoin becomes widely used, it must behave like a financial utility, not an experiment.

This approach directly impacts:

- Singapore dollar stablecoin designs

- Cross-border settlement models

- Integration with regulated crypto exchanges in Singapore

For businesses exploring stablecoins, this reduces uncertainty. Instead of guessing future rules, builders can now design products aligned with regulatory expectations from day one.

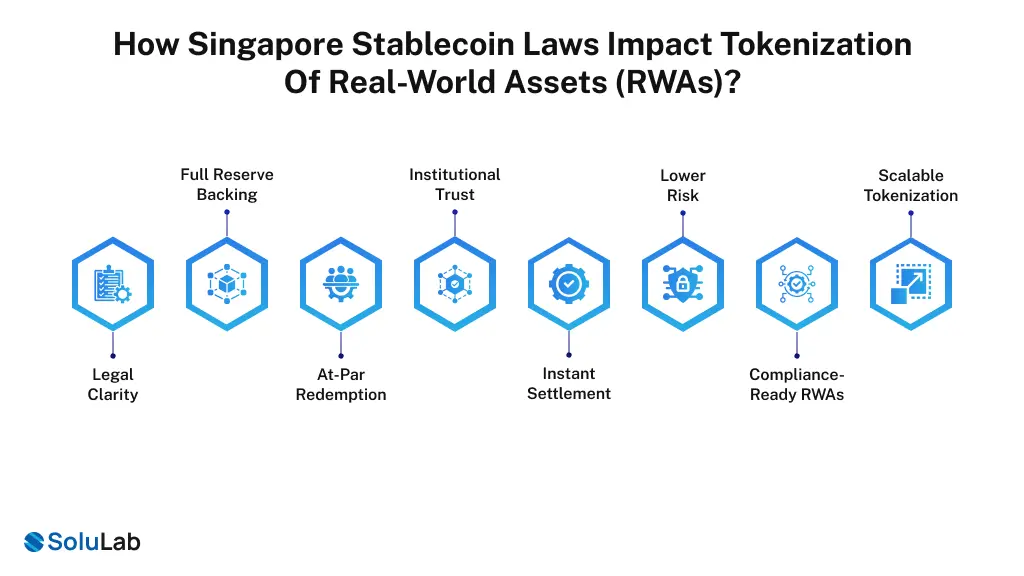

How Singapore Stablecoin Laws Impact Tokenization of Real-World Assets (RWAs)?

RWA Tokenization only works at scale if settlement is reliable.

Many tokenization pilots failed not because of poor technology, but because settlement assets lacked trust. When real money is involved, institutions care deeply about finality, liquidity, and compliance.

1. Why settlement is the missing piece

Singapore is testing tokenized bonds, tokenized treasury bills, and other blockchain-based assets that are needed:

- Predictable settlement

- Regulated counterparties

- Minimal operational risk

By linking tokenized government securities to wholesale CBDC, Singapore addresses these issues directly.

2. Impact on tokenization in Singapore

Singapore’s stablecoin laws and CBDC development trials improve:

- Confidence in tokenized MAS bills and Singapore tokenized bonds.

- Adoption of blockchain finance by Singapore institutions can be trusted.

- Institutional participation in the tokenization of Singapore ecosystems

3. Transactions:

With wholesale CBDC-backed settlement, transactions can move closer to same-day or near-instant settlement. This reduces delays typically caused by multiple intermediaries and manual confirmations. For institutions, faster settlement means less capital locked during the transaction window.

4. Trading:

Reliable settlement makes secondary trading more practical. Institutions are more willing to trade tokenized bonds and government securities when they know settlement will be completed as expected. This helps tokenized assets move beyond issuance and into active trading.

5. Liquidity:

Clear settlement timelines improve liquidity planning. Banks and asset managers can manage intraday liquidity more efficiently when redemption and settlement are predictable. This reduces the need to hold excess buffers.

6. Technology:

A central bank-led model encourages standardization. Shared settlement rails and token standards make integration easier across banks, custodians, and platforms.

7. Institutional Confidence:

Most importantly, regulated settlement builds trust. When settlement risk is reduced, institutions can treat tokenization as part of normal operations, not an experiment.

Initiatives like Project Guardian have already shown how tokenized assets can work in areas like foreign exchange and fixed income. The latest announcement moves these experiments closer to production use.

For enterprises, this means asset tokenization is no longer just a proof of concept. It is becoming an operational strategy.

What Compliant Stablecoin and Tokenization Development Looks Like Now?

Under emerging Singapore stablecoin regulation, development priorities are changing.

Building a stablecoin or tokenized asset today is not just about smart contracts. It is about aligning technology with financial rules.

Core principles shaping development

Compliant development focuses on:

- Reserve-backed stablecoin design

- Clear redemption logic

- Audit-ready smart contracts

- Permissioned access where required

- Interoperability with future CBDC rails

This is especially relevant for:

- Singapore dollar stablecoin initiatives

- Regulated crypto exchange integrations

- Institutional settlement platforms

Instead of retrofitting compliance later, teams are embedding it directly into architecture and workflows.

Development Process Aligned With Emerging Stablecoin Rules

A compliant development process under Singapore’s regulatory direction typically follows structured stages.

1. Regulatory and use-case assessment

Before writing code, teams define and discuss your requirement.

- Target users and transaction volumes

- Whether the asset could become systemically important

- Licensing or crypto license in Singapore requirements

This stage prevents costly redesigns later.

2. Asset and token model design

Clear decisions are made on your requirements and current scenarios:

- Asset backing and custody

- Token standards and transfer rules

- On-chain and off-chain responsibilities

For tokenized government securities, legal clarity is essential.

3. Smart contract development

Contracts are built with:

- Redemption controls

- Transfer restrictions were needed

- Transparency for audits and reporting

This ensures alignment with stablecoin regulatory expectations.

4. Settlement and integration

Systems are designed to:

- Settle using regulated stablecoins today

- Integrate with wholesale CBDC settlement in the future

- Work alongside existing banking infrastructure

5. Security, governance, and audits

Ongoing monitoring, audits, and governance structures are put in place to support long-term operations.

Conclusion

Regulated tokenization, supported by strong settlement assets, is becoming a realistic path forward for financial institutions. Stablecoins are no longer competing with regulation, as you can see in the above discussion. Adapting to new changes as fast as possible is now the greatest asset you can ever ask for in the tokenization market. So, if you are looking for regulatory-ready, customized solutions, SoluLab, a tokenization platform development company, is here to support your business in every possible way.

With our 250+ efficient experts are ready to upgrade your stablecoin tokenization platform to a Singapore regulatory-friendly one. Also, the latest adoption of AI reporting, insights, and analysis features is uplifting the business expectations. Contact us today and discuss your ideology and innovative solutions.

FAQs

Costs depend on asset type, compliance scope, smart contract complexity, and integrations. For regulated stablecoins or tokenized securities, pricing usually ranges from a pilot budget to a full-scale enterprise implementation.

Timelines (2 to 8 months) vary by regulatory readiness and use case. A basic compliant setup can take a few months, while production-grade platforms aligned with stablecoin laws and audits typically take longer.

You can directly book a consultation with SoluLab’s experts to discuss your use case, compliance needs, and architecture planning through the website. You can see a form at the end, fill that and SoluLab’s team will reach out to you in 24 to 72 hours.

You need to assess reserve backing, redemption logic, governance, and target users. Early regulatory analysis helps ensure the stablecoin design aligns with Singapore’s stablecoin regulatory framework before development begins.

You can start now by designing a compliance-ready architecture. Singapore’s direction is clear, and early preparation helps avoid rework later while positioning projects to scale as regulations finalize.