2026 is becoming a major turning point for digital money and enterprise blockchain. Big businesses, banks, global payment networks, and even governments are no longer testing blockchain. They are now using it for real financial operations, tokenized assets, and on-chain finance. The change is fast and happening across every major industry.

The global blockchain market size is estimated at $33 billion in 2026 and expected to grow at a compound annual growth rate (CAGR) of over 43% to reach nearly $393 billion by 2030. Meanwhile, over 137 countries are exploring CBDC, with 49 currently in pilot or launch stages.

If you are a founder, investor, or decision-maker, these trends matter. They tell you where the market is moving, what customers will expect, and how companies will use blockchain solutions to cut costs, move money faster, and unlock new business models. This guide gives you a clear view of the biggest Blockchain Trends for 2026 and shows how they will impact global finance, technology, and business growth.

How the Blockchain World Will Change from 2026 to 2030?

Before we talk about specific blockchain technology trends, it helps to zoom out and understand the size and direction of the market you are building for.

Analyst reports place the global blockchain market in the mid-tens of billions of dollars. By 2030, many expect it to reach hundreds of billions, or even low trillions, depending on what is counted, like crypto assets, tokenization, DeFi, and core infrastructure, but a few signals matter more than the big headline number:

- Institutional finance is moving fast. Tokenized Treasuries, tokenized funds, and regulated institutional DeFi pilots are no longer small tests. They are becoming part of real financial systems.

- The number of countries testing or exploring CBDCs has now crossed into triple digits. These pilots are also shifting from small local tests to real cross-border payment corridors.

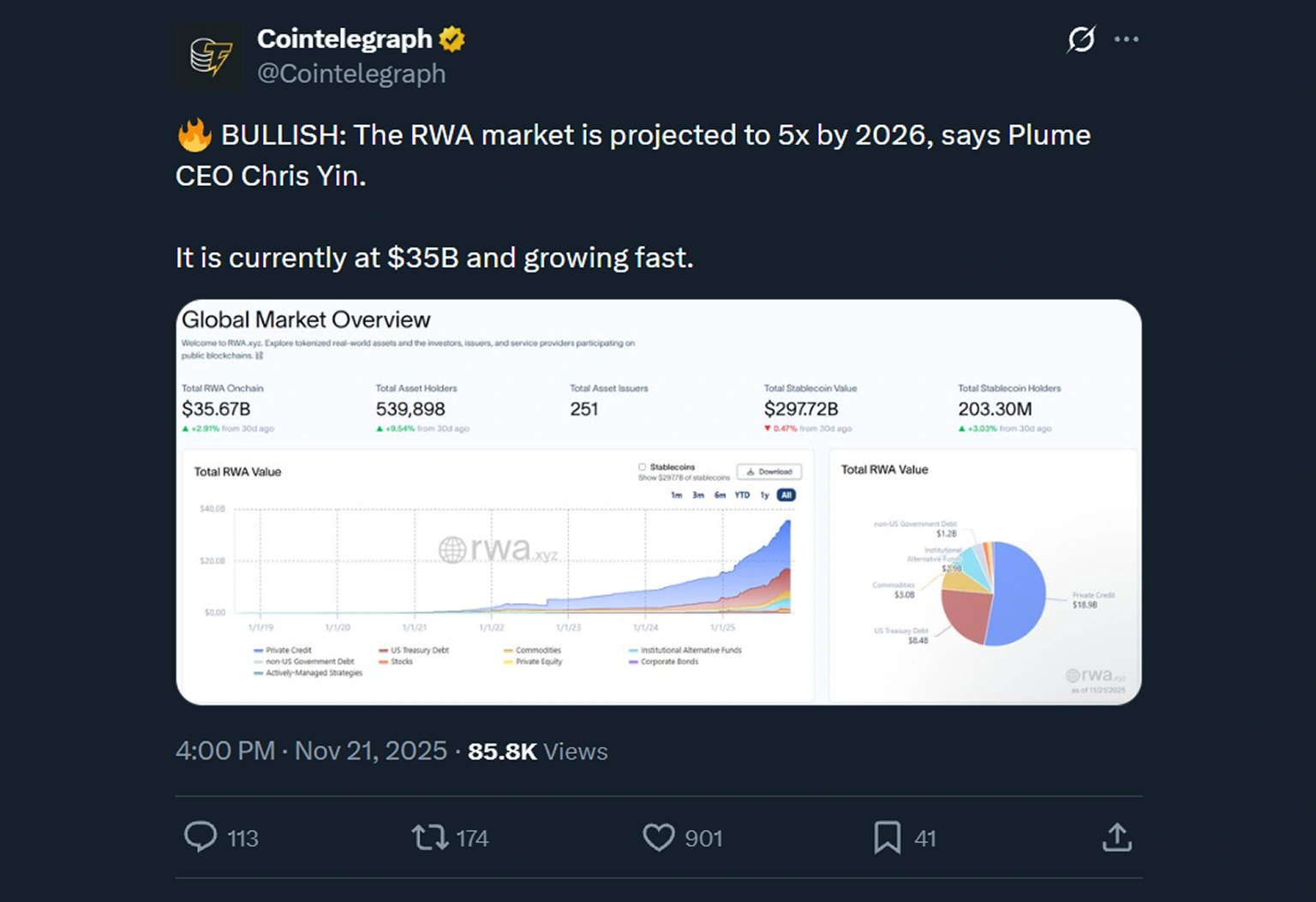

- Real-world asset tokenization (RWA) has grown from an idea into a multi-billion-dollar segment. Many now project it to reach double-digit trillions by 2030.

For you, this means the blockchain projects you build in 2026 are not side projects. They should be connected to where global liquidity, regulation, and infrastructure are heading over the next 5–10 years.

11 Big Blockchain Trends That Will Change 2026

Here are the 11 most important blockchain trends you should watch in 2026. These trends matter if you are building real products, raising money, or upgrading your tech systems. In all, these blockchain future trends will shape how money, data, and digital ownership move in 2026 and the years ahead.

1. Real-World Asset (RWA) Tokenization

If you follow only one blockchain trend in 2026, let it be this one. Real-world asset tokenization is already moving tens of billions of dollars of real estate, private credit, Treasuries, and other assets on-chain. RWA platforms let you break a building, a fund, or invoices into digital units that trade 24/7 with instant settlement and built-in compliance. Here is why you should care:

- You can unlock liquidity from assets that were stuck in files and manual paperwork.

- You can offer smaller ticket sizes to more investors without changing your whole system.

- You can test new revenue ideas like streaming yields or auto-rebalancing that old banking systems can’t support.

From a business point of view, if something on your balance sheet is big, slow, and hard to move, tokenization will enter that market in the next 3–5 years. For example

- By late 2025, BlackRock’s BUIDL alone crossed $500M in tokenized Treasuries, becoming the world’s largest on-chain fund.

- Franklin Templeton and Ondo Finance together manage billions in tokenized real estate and private credit. Even JPMorgan is running tokenized private credit pilots on-chain.

This is one of the clearest blockchain predictions for 2026, and it’s already live in real products.

2. AI x Blockchain Convergence

From 2023 to 2025, everyone was busy with AI, but in 2026, founders finally started asking, that How do I make my AI safer, more transparent, and easier to monetize. That is where AI with blockchain becomes one of the biggest blockchain trends for real businesses. Blockchain for AI helps with:

- data provenance (proving where training data came from)

- on-chain audit logs for AI models

- clear royalty and attribution flows

AI for blockchain helps with smarter risk engines, better fraud detection, automated governance, and dynamic settings for on-chain systems.

For example, Projects like SingularityNET, Fetch.ai, and Ocean Protocol have already proven working AI × Blockchain models. Enterprises now integrate these systems for regulated AI deployments where audits and traceability are required.

If you run any AI product today, adding even a small on-chain layer for provenance or billing can move you closer to the latest blockchain development trends, instead of looking like another black-box AI tool with a Stripe payment link.

3. Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are no longer ideas on paper. In 2026, many countries will have strong pilots or small-scale launches, and some will run CBDCs at a large scale. CBDCs matter for businesses because they change how you:

- Settle cross-border payments

- Handle compliance and reporting

- Build your wallet, treasury, or payment systems

CBDCs sit at the middle of blockchain technology trends, digital identity, and regulated finance. For example –

- China’s e-CNY surpassed $986B in transactions, making it the largest CBDC pilot in the world.

- Countries like the Bahamas, Jamaica, and Nigeria have already launched retail CBDCs.

- The EU Digital Euro pilot is underway with a 2027 launch window.

If you ignore CBDCs while building any payment, banking, or treasury product for 2026, it will be like ignoring mobile apps in 2010.

4. Institutional DeFi

Institutional DeFi didn’t die after the early hype; it simply grew up. Now, large banks, asset managers, and regulated companies are testing on-chain finance with KYC, verified identities, and permissioned pools. They are running pilots in tokenized repo, tokenized collateral, on-chain FX, and even digital syndicated loans.

For a founder, institutional DeFi is not about yield farms anymore. It is about:

- Cutting back-office costs with faster, automated systems

- Building new on-chain product lines with transparent and programmable rules

- Opening access to new markets, new users, and new capital flows

This is where enterprise blockchain trends start to matter. For example –

- JPMorgan’s Onyx and MAS’s Project Guardian have run institutional pools with verified identities since 2023.

- Aave Arc and Syndicate Protocol provide institutional lending rails.

- BlackRock and Securitize are issuing tokenized funds accessible through DeFi.

If your industry begins settling transactions on public blockchains with permissioned layers, then the tech stack, vendors, and architecture you choose in 2026 will shape your business for years.

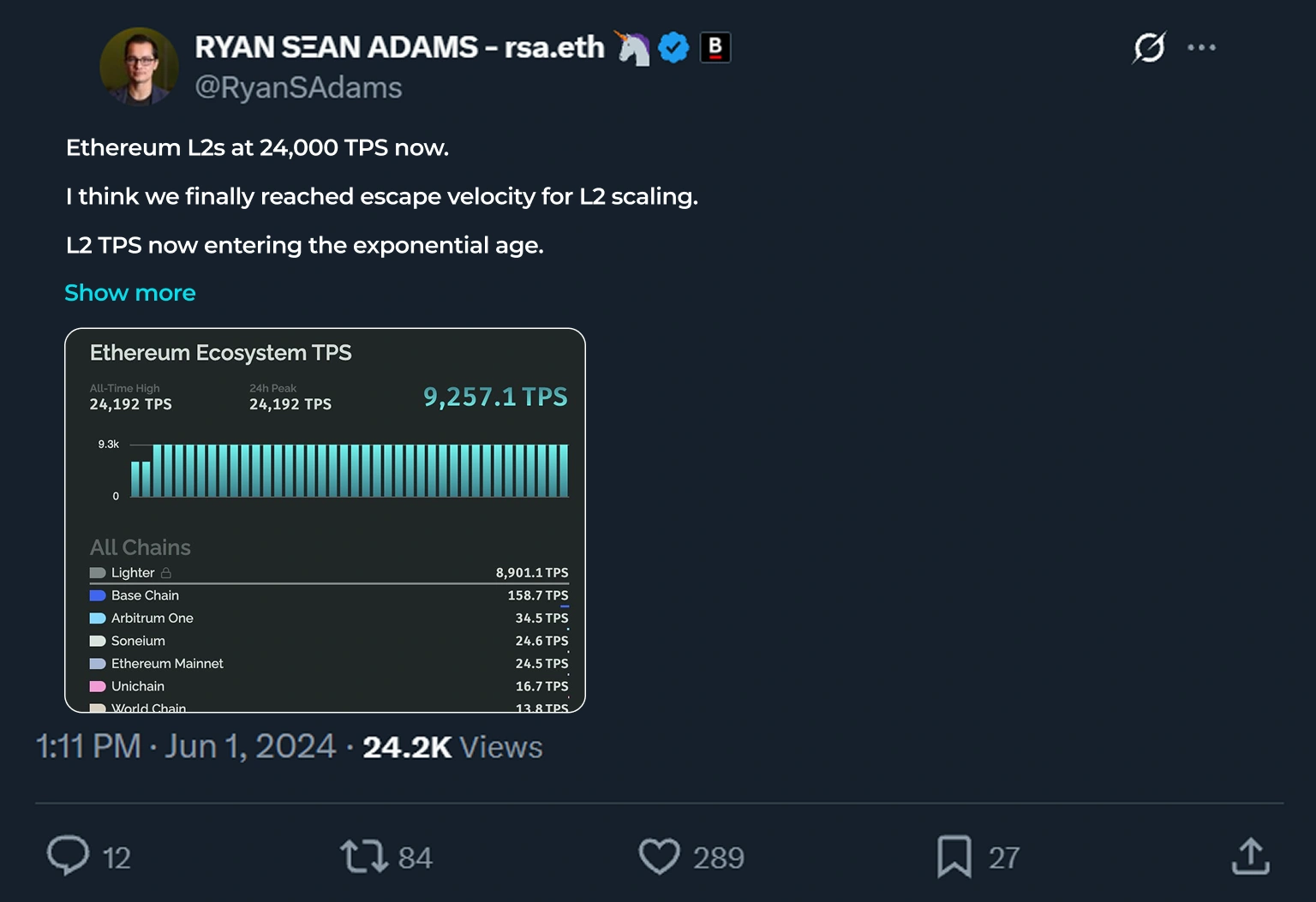

5. Layer-2 Scaling Solutions

You can’t talk about blockchain future trends without talking about scaling. Layer-2 networks (L2s) on Ethereum and Bitcoin are now handling most real transactions. These include rollups, optimistic systems, zero-knowledge L2s, and payment channels.

- Fees drop from dollars to a few cents

- Speed goes from a few transactions per second to thousands

- You still keep the security of a major Layer-1 chain

If you are building in payments, gaming apps, micro-transactions, IoT systems, or AI-powered agents space, you will almost always use an L2 instead of an L1. Here are the Real adoption numbers:

- Arbitrum: $15B+ TVL, largest L2 ecosystem

- Optimism: Backed by Coinbase integrations

- Base: Fastest-growing consumer L2

- StarkNet: Enterprise-trusted zkRollup

This is one of the most important blockchain development trends for founders, architects, and CTOs today.

6. Blockchain-as-a-Service (BaaS)

Most teams today don’t want to run their own nodes, build custom explorers, or manage security systems. They want simple tools, managed hosting, and ready-made blockchain infrastructure.

That’s why Blockchain-as-a-Service (BaaS) is becoming one of the most important blockchain industry trends. Big cloud companies and Web3 infra providers now offer hosted nodes, fast indexers, strong APIs, monitoring dashboards, testing tools, and full turnkey setups.

With BaaS, businesses can build blockchain apps without worrying about servers, uptime, or heavy DevOps work. Here are a few enterprises like AWS, Azure, IBM, and Oracle that now dominate BaaS, and over 90% of enterprise blockchain deployments use BaaS to reduce cost and ship faster.

BaaS also helps with scaling, multi-chain support, security audits, RPC load balancing, and easy upgrades. Teams can focus on their product while the BaaS platform handles all the hard technical work in the background. For many companies, this means faster launches, fewer risks, better performance, and lower long-term costs.

7. Supply Chain & Provenance Systems

Supply chain and provenance tools were hyped early, but today they are becoming one of the strongest enterprise blockchain use cases. Real value is now clear in:

- Lot-level tracking for food and pharma

- Anti-counterfeit checks for luxury goods and key components

- Carbon and ESG reporting linked to real product movement

It’s no longer about putting everything on a blockchain; it’s about adding just enough cryptographic proof in the right places so regulators, partners, and customers can trust what a company claims. For example –

- Walmart reduced traceability time from 7 DAYS to 2.2 SECONDS using blockchain.

- De Beers tracks diamonds end-to-end to eliminate counterfeiting.

For many mid-market manufacturers, logistics teams, and retailers, this will be their first real step into blockchain development and supply chain blockchain systems in 2026.

8. Tokenized Securities & Treasury Bills

In 2026, tokenized Treasuries quietly crossed several billion dollars in AUM. In 2026, this entire category will grow even more and expand into new asset classes. Today, you already see:

- Tokenized government bonds

- On-chain money market funds

- Tokenized private credit and real estate portfolios

These tokenized assets are now used for yield products, treasury operations, and daily cash-management tools. The biggest shift is how tokenized securities bring faster settlements, better liquidity, transparent audits, and easy global access. Here are a few live examples:

- BlackRock BUIDL & Franklin Templeton Utilize Securities and created $7.3B+ AUM

- Ondo Finance is running corporate repo and credit products

- JPMorgan is testing tokenized money market workflows

Banks, asset managers, and fintechs are now exploring on-chain versions of T-Bills, corporate bonds, repo markets, and credit products because tokenization cuts costs, reduces errors, and speeds up the entire workflow.

9. Zero-Knowledge Proofs (ZK-Tech)

Zero-knowledge proofs are no longer just research. Today, ZK-tech is used in privacy Layer 2s, digital identity tools, and even compliance systems. ZK-tech is important because it lets you:

- Prove something about your data, like age, KYC, or solvency, without sharing the data

- Follow privacy rules while still giving partners or regulators verified proof

- Build safer finance apps, health systems, public tools, and consumer products

As global rules around data get tighter, zero-knowledge proofs are becoming one of the most important blockchain innovations for businesses to understand. zkSync, Polygon ID, and Aztec Network are already used globally by banks, fintechs, and enterprises.

10. Cross-Chain Interoperability

By 2026, no serious company can depend on only one blockchain. The market moves too fast, and users expect smoother, bigger networks. That’s why bridges, messaging layers, and interoperability protocols are becoming core parts of Web3, and Chainlink CCIP, LayerZero, Wormhole, and Cosmos IBCare are now the base layer for real products. For founders and teams, this means:

- Build with multi-chain support from day one

- Make the chain invisible to users

- Plan for future liquidity, rules, and ecosystems, not just today’s trends

11. Green & Sustainable Blockchain

This is one of the key blockchain technology trends that will decide if your app feels stuck on one chain or works smoothly across the full Web3 world. It’s a major factor in long-term product success and user trust.

Today, regulators, investors, and large companies want clear answers about energy use, carbon impact, and sustainability. This is pushing people to think in a more serious way about how blockchain platforms affect the environment.

You will see:

- More chains sharing audited energy reports

- More companies are asking for proof-of-stake or other low-energy systems

- More use of on-chain carbon tracking and digital carbon offset tools

If you sell blockchain solutions to enterprises, staying aligned with these sustainability-focused blockchain trends will help you close deals faster. Big companies now ask clear questions about energy use, carbon footprint, and long-term environmental impact, and they are already using Ethereum, Polygon, Deso, and Solana to publish verified energy usage reports.

They prefer green blockchain systems that run on proof-of-stake, use low-power nodes, and offer real data on how much energy the network uses. You will also see more interest in on-chain carbon tracking, digital carbon credits, and blockchain-based offset tools. These help companies meet ESG targets and report their climate numbers with confidence.

How Enterprises Will Actually Use Web3 in 2026?

2026 is the year Web3 becomes a real enterprise tool, not just a crypto space. Because companies will start using it only where it truly helps their business. Here’s what you’ll see:

- Finance: RWA tokenization, DeFi payment rails, CBDCs, and on-chain KYC

- Supply chain: provenance tracking, real-time compliance, and ESG reporting

- Healthcare: secure data, medical record integrity, and drug tracking

- Media & gaming: digital ownership, loyalty systems, and assets that work across platforms

Most people won’t even call it Web3. They’ll just feel the benefits like faster settlement, better rewards, and smoother digital experiences. But behind the scenes, these are real blockchain future trends finally being used in day-to-day business operations.

How SoluLab Can Build Any of These 11 Use Cases in Just 4 Weeks?

If you want to turn your idea into a real Web3 product, SoluLab can help you build any of these 11 use cases in only 4 weeks. Our team works with blockchain, smart contracts, CBDC solutions, tokenization platforms, DeFi apps, and enterprise blockchain development. We follow a fast, reliable, and transparent system:

1. Week 1 — Plan & Architect

We map your idea, pick the right tech, and prepare the full flow for your crypto, tokenization, or CBDC-based system.

2. Week 2 — Smart Contracts & Backend Development

We develop secure smart contracts, set up all backend logic, and integrate major chains like Ethereum, Polygon, BNB Chain, or a private blockchain.

3. Week 3 — Frontend & Dashboard

We design a clean UI and link your user dashboard to the on-chain with backend logic.

4. Week 4 – 5 — Test & Launch

We run audits, QA, security checks, and prepare your product for launch.

Conclusion

The real value of learning about blockchain development trends is using them to make smarter business decisions. The biggest opportunities now sit in real assets, compliance, and efficiency. As a founder or leader, your edge comes from choosing one or two clear bets and executing well.

Let’s turn your 2026 blockchain vision into a real MVP. Book a discovery call and get feedback in days, not months. A strong blockchain development company like SoluLab, should guide you with solid business outcomes, not noise. 2026 can be the year you watch these trends or the year you build with them.

FAQs

1. How do I decide which blockchain use case is right for my startup or company?

Start by looking at your biggest pain points around data trust, asset liquidity, and operational delays. Then check if tokenization, supply chain tracking, or compliant DeFi systems can solve them. Working with a skilled blockchain development company helps you map your real needs to the right solution, ensuring measurable ROI without guesswork.

2. Why should I consider working with a blockchain development agency instead of building in-house?

Agencies bring deep expertise, faster execution, and tried-and-tested frameworks that prevent costly mistakes. They help you pick the right architecture, meet compliance standards, and scale safely. For founders focused on growth and product-market fit, a blockchain development agency makes adoption smoother without adding extra internal load.

3. What are the typical timelines and costs involved in building blockchain-based solutions like tokenization or DeFi?

Timelines depend on complexity, but an MVP usually takes 4–6 weeks, costing around $75K–$250K. Full enterprise builds for tokenization or institutional DeFi take 6–10 months and can cross $500K. A reliable agency will give clear estimates that match your goals, scope, and compliance needs.

4. How can I ensure compliance and security when integrating blockchain into my product?

You need to align your solution with rules like MiCA, OFAC, and strong KYC/AML checks. Security means smart contract audits, safe key management, and penetration testing. Agencies with regulated-industry experience build these controls into the product from day one, lowering risk and supporting innovation in areas like asset tokenization services or compliant DeFi.

5. What ongoing support do blockchain development agencies provide after product launch?

A good agency offers continuous monitoring, updates, smart contract improvements, and help adjusting to new regulations. They support scaling, infrastructure upgrades, and new feature rollouts. With ongoing partnership, your solution stays secure, compliant, and ready for future trends like RWA tokenization and advanced payment systems.