In today’s rapidly evolving digital landscape, two revolutionary concepts have emerged to redefine the way we perceive ownership, value, and participation: Non-Fungible Tokens (NFTs) and Decentralized Finance (DeFi). While NFTs have sparked a craze in the art world by transforming unique digital assets into tradable commodities, DeFi has been disrupting traditional finance by ushering in decentralized financial systems. But what happens when these two powerful forces intersect?

This blog delves into the exciting convergence of NFTs and DeFi, exploring how they are reshaping the new era of gaming economics and the broader digital economy. So, let’s get started!

The intersection of NFTs (Non-Fungible Tokens) and DeFi (Decentralized Finance) represents a groundbreaking fusion of technologies that promise to revolutionize how we perceive, trade, and utilize digital assets. Let’s delve deeper into this fascinating convergence:

The fusion of NFTs and DeFi isn’t just a technological novelty; it’s altering the very fabric of digital economies, particularly in gaming. It’s paving the way for new economic models that allow gamers to monetize their skills and investments in virtual worlds, developers to fund projects in innovative ways, and investors to explore new horizons in asset ownership and trading. As we delve further into this blog, we’ll see how this intersection is catalyzing the “play-to-earn” phenomenon and redefining the gaming landscape in profound ways.

Gaming has ascended from a form of entertainment to a colossal industry that now plays a central role in the digital economy. With a market value surpassing $200 billion, it has outgrown traditional entertainment sectors and is becoming a dominant cultural force. Beyond its financial prowess, gaming is a wellspring of innovation, influencing technological advancements, from cutting-edge graphics and processing power to the development of virtual and augmented reality. These innovations often find applications in fields far beyond gaming, making it an essential driver of broader technological evolution.

Furthermore, gaming’s impact extends into the realms of education, social connection, and entrepreneurship. Gamification and serious games are transforming the way we learn and develop skills, while gaming’s capacity to foster social communities, friendships, and support networks is strengthening its social significance. The rise of content creators and streamers, drawing vast audiences on platforms like Twitch and YouTube, showcases how gaming has created new economic opportunities, leading to digital entrepreneurship. As the concept of the metaverse gains ground, gaming stands at the forefront, providing the infrastructure and user base for this connected digital universe. In essence, gaming is no longer confined to a screen; it is a driving force shaping the very fabric of the digital economy.

NFTs, or Non-Fungible Tokens, have taken the digital world by storm, and the gaming industry is no exception. To understand their impact, it’s crucial to grasp the concept of NFTs.

NFTs are fundamentally digital assets that indicate ownership of a one-of-a-kind object or piece of information. The non-fungibility of NFTs distinguishes them from regular cryptocurrencies such as Bitcoin or Ethereum. In other words, each NFT is one-of-a-kind, making it impossible to interchange with other tokens on a one-to-one basis. This uniqueness is made possible through blockchain technology, which records and verifies the authenticity of these digital assets.

The gaming industry has seamlessly integrated NFTs into its ecosystem, offering players unprecedented opportunities and experiences. Here are some key ways in which NFTs are transforming the gaming landscape:

Overall, NFT in gaming has evolved from being a mere novelty to a fundamental component of the industry. They grant players greater control over their gaming experiences and open up a world of possibilities for virtual economies and creativity.

Decentralized Finance (DeFi) has emerged as a game-changing force in the financial sector. It’s a system that aims to decentralize traditional financial services, enabling peer-to-peer transactions, removing intermediaries, and promoting transparency. DeFi operates on blockchain technology, similar to cryptocurrencies like Bitcoin and Ethereum. However, it goes beyond digital currencies to offer a wide range of financial services, including lending, borrowing, staking, yield farming, and more.

In recent years, the gaming industry has begun to realize the potential of integrating DeFi into its ecosystem. This convergence of DeFi and gaming is creating exciting new opportunities for players and developers alike. Here’s how these two worlds are coming together:

The integration of DeFi with gaming brings several benefits to players:

The integration of DeFi and gaming holds immense promise for the gaming industry. As DeFi lending platforms and DeFi NFT games continue to evolve, gamers can expect more opportunities to participate in decentralized finance while enjoying their favorite virtual worlds.

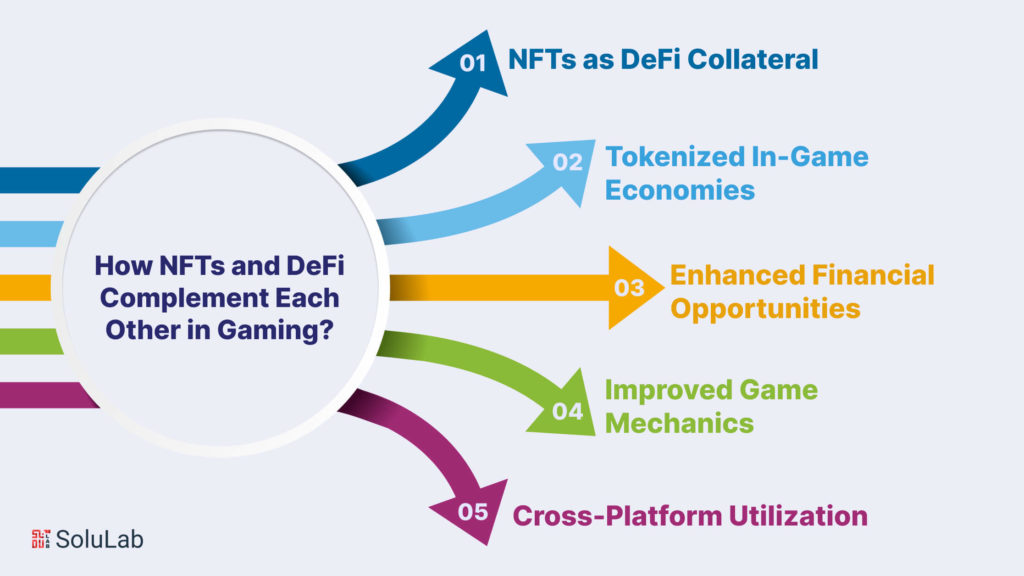

The synergy between Non-Fungible Tokens (NFTs) and Decentralized Finance (DeFi) in the gaming sphere is proving to be a game-changer. Their combination creates a potent force, unlocking a new dimension of possibilities for both players and developers.

The seamless integration of NFTs and DeFi in gaming illustrates their mutual enhancement. As NFTs bring unique ownership and authenticity, DeFi amplifies these assets’ utility, turning them into active components of a decentralized financial ecosystem within the gaming world. This combination not only expands financial possibilities for players but also enriches the gaming experience as a whole.

Gamers are at the forefront of the NFTs and DeFi revolution within the gaming industry. The convergence of these technologies offers a plethora of benefits that empower players in exciting and innovative ways.

One of the most notable advantages for gamers is the newfound ownership of in-game assets. Traditionally, players merely had a license to use digital items within a game. With NFTs, they gain true ownership of these assets. Whether it’s a rare sword, a unique character skin, or a parcel of virtual land, gamers can securely claim their digital possessions. NFTs serve as irrefutable proof of ownership, are recorded on the blockchain, and can be bought, sold, or traded like physical collectibles. This empowers players with a sense of agency over their in-game assets, which can be appreciated in value over time.

NFTs and DeFi provide gamers with unprecedented earning opportunities. Here’s how these technologies enrich the gaming experience:

As NFTs and DeFi continue to gain traction, a burgeoning ecosystem of NFT game development companies is emerging. Gamers can benefit from this trend in various ways. They can collaborate with these companies to create and monetize their game assets or explore new gaming experiences crafted by these developers.

In essence, the combination of NFTs and DeFi not only enhances the gaming experience but also transforms it into a realm of financial opportunities and ownership rights. Gamers are no longer mere participants; they are now empowered creators and investors in the evolving world of NFT-based games and decentralized finance.

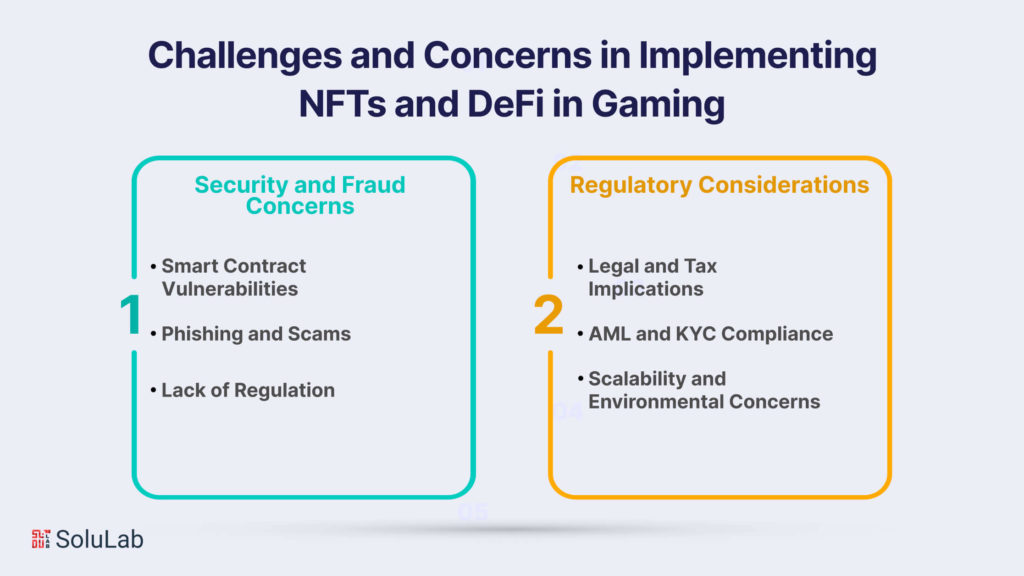

While the integration of NFTs and DeFi in gaming presents a myriad of exciting possibilities, it also comes with its share of challenges and potential risks that both players and developers should be aware of. Here, we delve into some of these concerns:

It’s important for gamers and developers to navigate these challenges with a combination of vigilance and responsible usage. Staying informed, practicing due diligence, and adhering to the best security practices can help mitigate risks and foster a safer and more robust ecosystem for NFTs, DeFi, and gaming. Furthermore, as the regulatory landscape continues to evolve, staying compliant with relevant laws is paramount to ensure a seamless and secure experience.

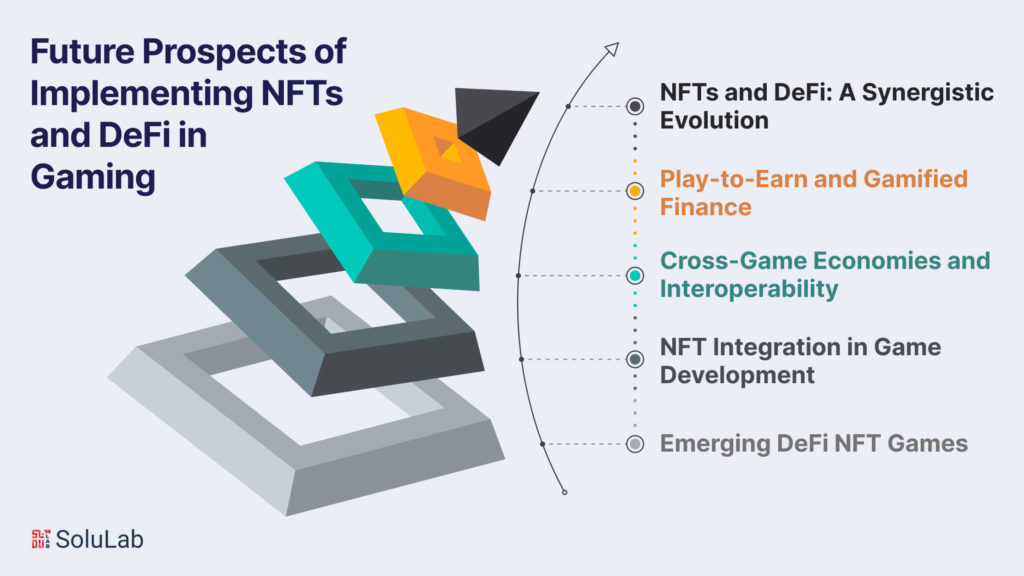

The future of the gaming industry is being dynamically shaped by the convergence of Non-Fungible Tokens (NFTs) and Decentralized Finance (DeFi). As these technologies continue to gain momentum, their impact on gaming is expected to be transformative.

The synergy of NFTs and DeFi in gaming is anticipated to deepen. NFTs offer unique ownership of in-game assets, while DeFi provides a robust financial ecosystem. This combination is set to create even more complex and interactive in-game economies.

The concept of “play-to-earn” is on the rise. Gamers can earn rewards, cryptocurrencies, and valuable NFTs by participating in games and DeFi activities. This gamified approach to finance may blur the lines between traditional gaming and financial services, offering players incentives to be more active within both ecosystems.

Cross-game interoperability will gain further prominence. Gamers will be able to use their NFT assets, such as characters, skins, or in-game items, across multiple games and platforms. This will lead to the development of comprehensive, cross-game economies where assets can be utilized seamlessly.

NFTs are expected to become an integral part of game development. Game studios may incorporate NFTs as core features, enabling players to have true ownership of in-game assets and making the creation of user-generated content more rewarding. NFT-based games are likely to proliferate, offering players new gaming experiences with the potential for financial benefits.

The emergence of DeFi NFT games, which integrate the principles of decentralized finance with NFTs, will continue to expand. These games often feature NFTs representing in-game assets that players can trade, stake, or use as collateral for loans. The synergy between DeFi and NFTs in gaming is expected to provide a growing array of financial opportunities for players.

In the entwined realms of gaming, Non-Fungible Tokens (NFTs) and Decentralized Finance (DeFi) have sparked a revolution. The fusion of these groundbreaking technologies is paving the way for a new era where players are not merely gamers but active participants in dynamic economies. The ownership of in-game assets, the prospect of earning through play, and the amalgamation of finance with gaming experiences are reshaping how we perceive digital entertainment. However, amidst the promises of this synergy, challenges like security concerns and regulatory ambiguities loom, requiring vigilance and adaptation from gamers and developers alike.

The future of NFTs and DeFi in gaming is as promising as it is transformative. As these technologies continue to evolve, the gaming landscape is on the brink of a monumental shift, where the traditional boundaries between gaming and financial ecosystems are blurring. The potential for cross-game economies, player-centric game development, and emerging DeFi NFT games point to a future that’s not just about entertainment but also about financial empowerment within gaming. Yet, in this burgeoning era of possibilities, education, caution, and adaptability are keys to embracing the revolution responsibly.

At SoluLab, as an NFT game development company and a DeFi development company, we stand at the forefront of integrating NFTs and DeFi into gaming experiences. Our expertise lies in delivering innovative solutions that bridge the realms of gaming and these transformative technologies. With tailored NFT game development services, pioneering DeFi integrations, and a commitment to pioneering the future of gaming, we invite you to take the first step toward this groundbreaking journey. Join us in crafting immersive gaming experiences that redefine ownership, finance, and the thrill of gaming. Contact us today and let’s redefine gaming together!

NFTs, or Non-Fungible Tokens, are digital assets that represent unique ownership of items, characters, or in-game content. In gaming, NFTs allow players to truly own their in-game assets, which can be bought, sold, and traded. Each NFT is verifiably unique and is typically recorded on a blockchain, ensuring the authenticity and scarcity of the asset.

Gamers can earn money by participating in play-to-earn games that reward them with cryptocurrencies, NFTs, or other valuable in-game assets. They can also earn by lending their NFTs within DeFi platforms, staking assets, or creating and selling NFT-based game content. The combination of NFTs and DeFi opens up numerous opportunities for players to monetize their gaming activities.

Yes, there are security risks, including smart contract vulnerabilities, phishing scams, and a lack of regulation. It’s essential for players to be cautious and conduct due diligence when interacting with NFTs and DeFi platforms. Using reputable services, keeping software up to date, and staying informed about potential risks are vital precautions.

NFTs are transforming traditional game development by allowing players to own in-game assets and creating a new dimension of player involvement. Game studios are integrating NFTs into their games, incentivizing user-generated content, and making game economies more player-centric. DeFi is also being incorporated into game mechanics, enhancing financial opportunities for players.

SoluLab specializes in NFT game development services and the integration of DeFi in gaming experiences. We work with game developers to create innovative solutions that leverage the power of NFTs and DeFi. If you’re looking to harness the potential of NFTs and DeFi in your gaming projects, SoluLab is your trusted partner for pioneering the future of gaming. Contact us today to start redefining gaming and finance together.