The concept of these sources is to combine the latest, most impactful stories related to the Fintech industry ALL IN ONE to your email.

Personally, it’s convenient and resourceful and always be my top email to open at the beginning of the day

Morning Brew is my first source to read daily. It basically covers all aspects of the Technology/business industry generally: Federal Reserve policy, Tesla’s grand ambitions, IPOs, the memes dominating pop culture, and a whole lot more.

Morning Brew also has the latest podcast channel Business Casual, I followed some.

You can also read: 5 concepts to master If you work in E-commerce.

Marcel News is my favourite source to read about Fintech generally, I followed Marcel since he started the newsletter 3–4 years ago when I was in the Netherlands. The channel started with a lot of helpful information related to EU fintech, and soon, opened to the latest world Fintech updates

The newsletter is focusing on #Payment, #Crypto, #challengerbanks and many more.

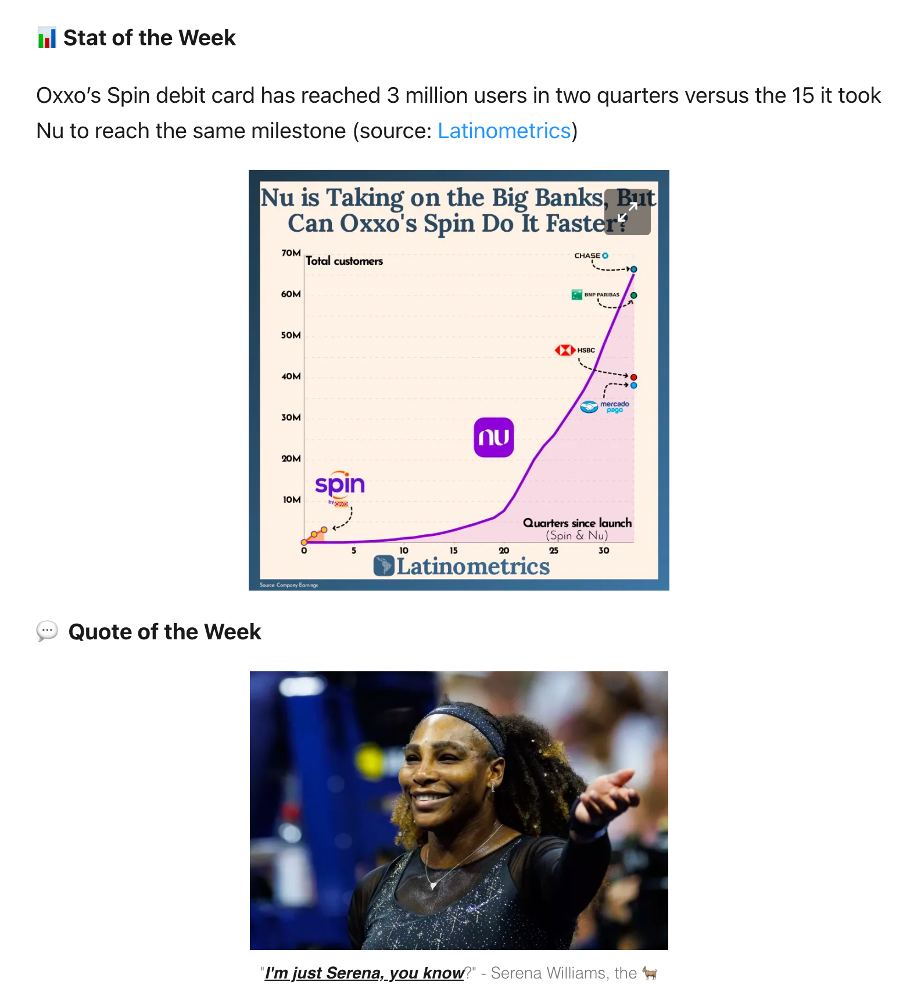

I love the writing in This Week in Fintech. It is the full sense of humour but also very direct to the point. The sum-up is super cool to read, an insightful letter for the beginning of the day!

The newsletter focuses on financing, M&A, Fintech product launch and many more. The great parts of this channel are

You can also read : What is NFT in Gaming? The Blockchain Crypto Game Market

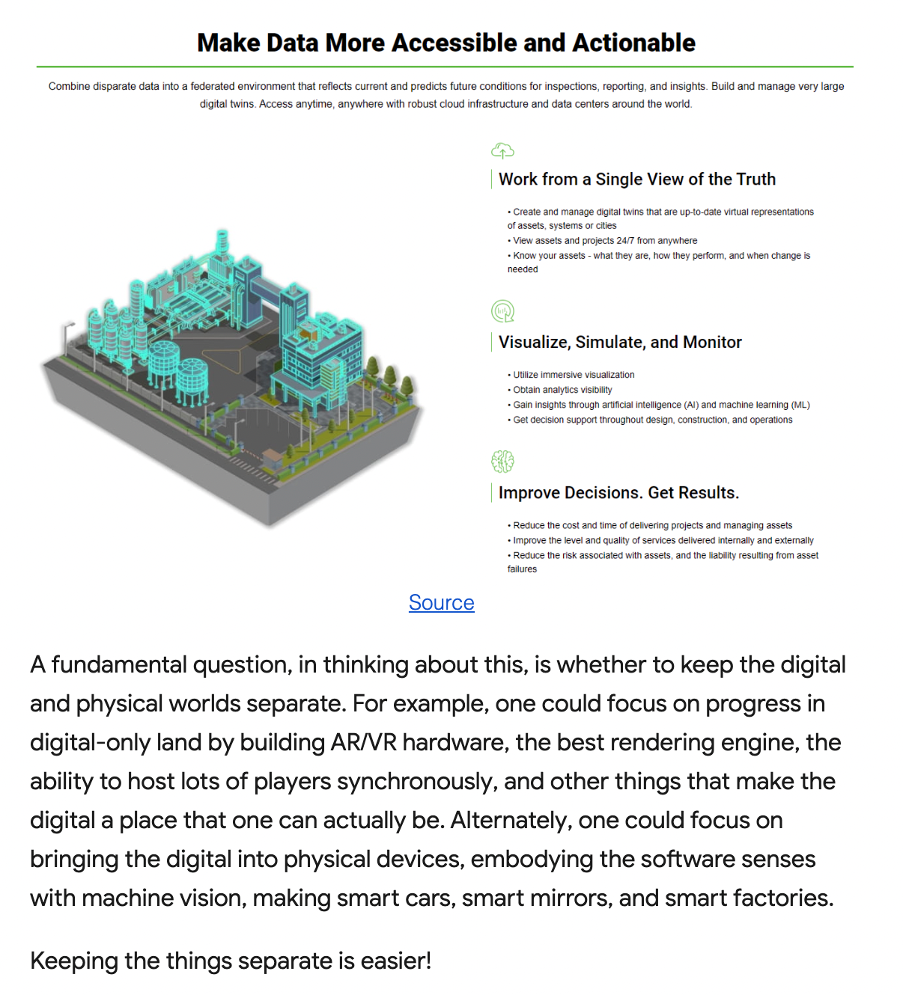

The Fintech Blueprint is curated by Lex Sokolin. Lex has held multiple senior industry positions, including CEO, COO, and CMO at top-tier companies in the Fintech sector. I particularly find the channel information very useful. In my case, I am interested in Fintech and Web3 industries. Also, the article is well written and makes us think deeper about the problem

I followed Lina’s Newsletter a very long time ago (cannot even remember exactly). He opens the quality discussion and updates the latest news on Finance & Technology.

Most importantly, the channel always provides 3 impact stories: Easy to read and concise.