Have you ever wondered why some cryptocurrencies’ prices are volatile, while others seem more stable? That’s where asset-backed cryptocurrencies come in. Unlike regular cryptos like Bitcoin that rely on market demand, these are tied to real-world things, like gold, real estate, or fiat money.

Most people hesitate to invest in crypto because it feels risky and unpredictable. Asset-backed cryptocurrencies help fix that by giving each token a real value behind it, making them more trustworthy and steady. These coins bring the benefits of crypto speed, transparency, and global access, without the crazy ups and downs.

In this blog, we’ll break down what they are, how they work, and why they might just be the future of safer crypto investments.

Asset-backed cryptocurrencies are digital tokens that are backed by real-world assets like gold, real estate, fiat currency, or commodities. Each token represents a claim on the underlying asset, giving it more stability compared to traditional cryptocurrencies like Bitcoin, which are highly volatile.

For example, Tether (USDT) is backed by U.S. dollar reserves, and PAXG (Paxos Gold) is backed by physical gold. These assets are either held in reserves or managed through smart contracts to maintain trust and transparency. Similarly, Monex offers 1 oz gold bars that are commonly used to back digital tokens like these, making it easier to link physical assets with blockchain systems.

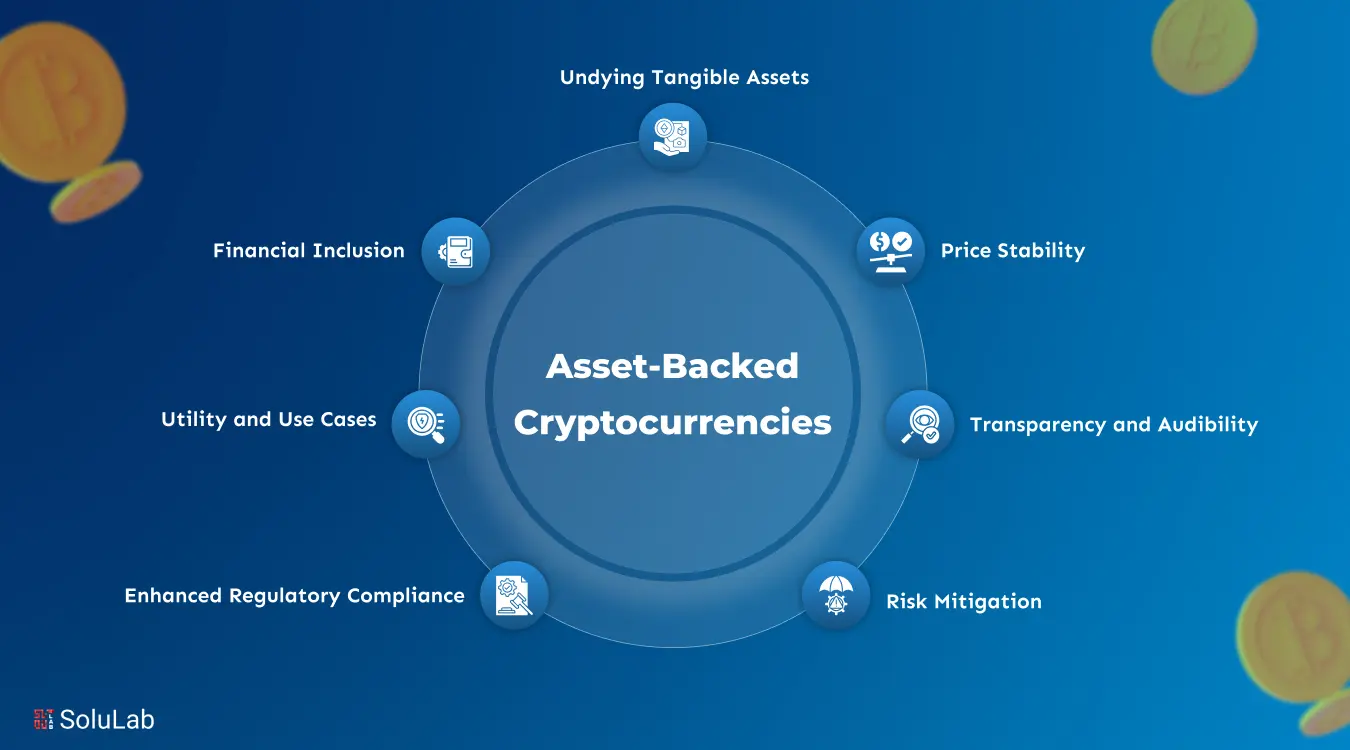

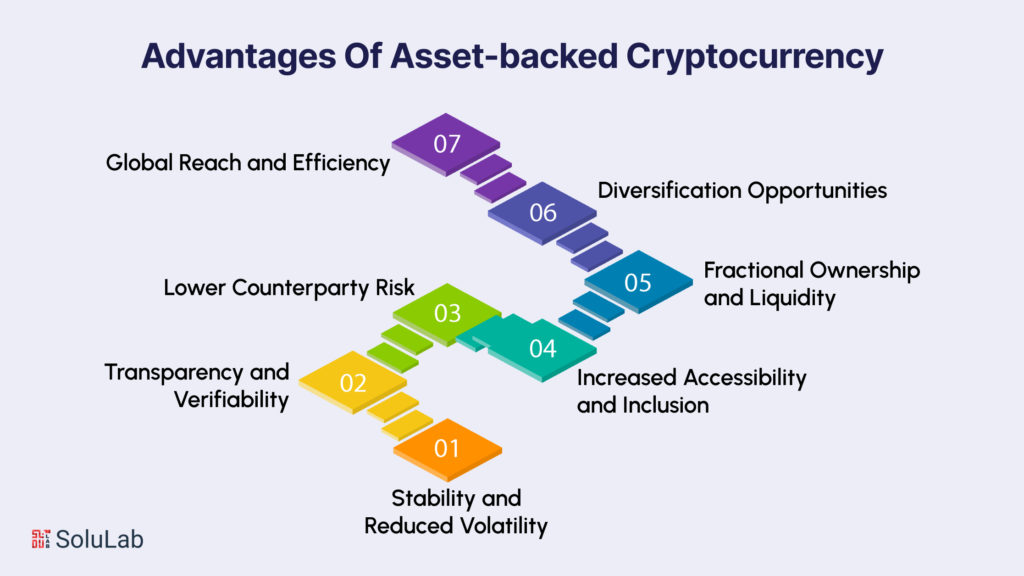

ABCs combine blockchain technology with tangible assets to change digital banking, giving consumers and investors worldwide advantages. These innovative tokens appeal to both beginners and experts. Here are some advantages of asset-backed cryptocurrency

One of the most prominent advantages of asset-backed cryptocurrencies is their inherent stability compared to conventional cryptocurrencies. By anchoring their value to tangible assets like precious metals, real estate, or fiat currencies, ABCs mitigate the extreme price fluctuations often associated with purely speculative tokens. This stability inspires confidence among investors and creates an attractive haven for risk-averse individuals seeking a reliable store of value in the digital realm.

Asset-backed cryptocurrency enhances transparency and verifiability within the financial ecosystem. The underlying assets that back these tokens are held in reserve and can be publicly audited, ensuring that the value of the cryptocurrency is directly tied to the real-world assets it represents. This level of transparency fosters trust and accountability, crucial factors in driving widespread adoption and acceptance of these digital assets.

Traditional financial systems involve several intermediaries, adding layers of counterparty risk to transactions. In contrast, asset-backed cryptocurrencies leverage blockchain technology, enabling peer-to-peer transactions with minimized counterparty risk. Smart contracts play a pivotal role in automating processes and ensuring that all parties fulfill their obligations, thereby reducing the potential for default or fraud.

Asset-backed cryptocurrency opens up new avenues of financial participation, especially for individuals who face barriers to traditional financial services. With a smartphone and internet access, anyone can access and invest in these digital assets, empowering the unbanked and underbanked populations worldwide. This democratization of finance can lead to greater financial inclusion and economic empowerment for millions.

Tokenization of assets enables fractional ownership, breaking down large assets like real estate or artwork into smaller tradable units. This innovation democratizes investments, allowing individuals to own a fraction of high-value assets that were previously beyond their reach. Moreover, it enhances asset liquidity, as these fractional tokens can be easily traded on blockchain-based exchanges, providing investors with more flexible and accessible ways to buy or sell their holdings.

Asset-backed cryptocurrency expands the investment landscape, providing access to a diverse range of asset classes. Investors can now diversify their portfolios with exposure to multiple traditional assets, cryptocurrencies, or commodities, thereby potentially reducing risk and maximizing returns.

Blockchain technology underpinning ABCs enables instant, borderless transactions, eliminating the need for intermediaries and reducing transaction fees and processing times. This global reach and efficiency make asset-backed cryptocurrency particularly appealing for cross-border transactions and remittances, facilitating a seamless and cost-effective transfer of value across international borders.

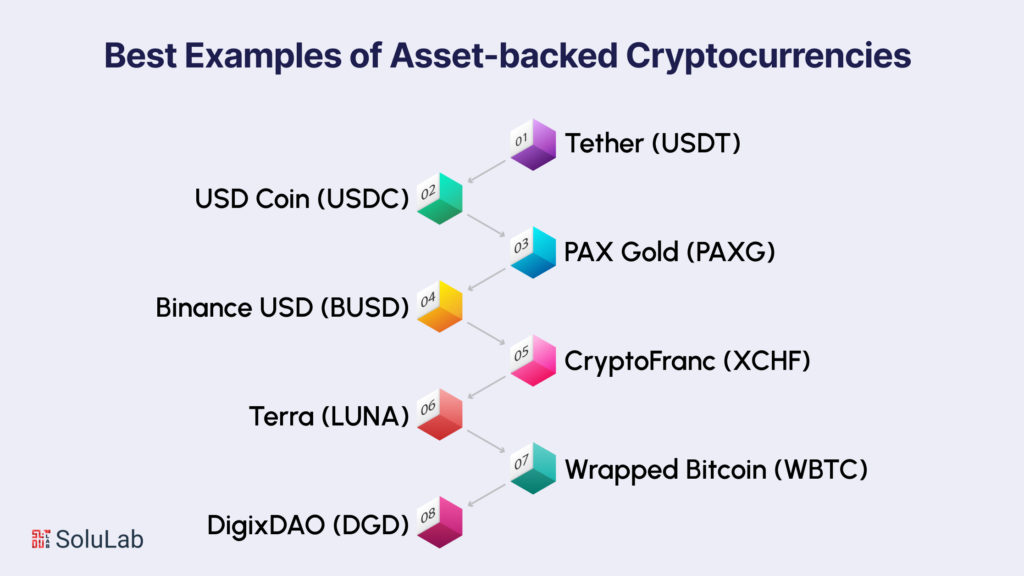

Looking for stable and reliable crypto options? Asset-backed cryptocurrencies are tied to real-world assets like gold or dollars, offering less volatility and more trust. Here are the best ones:

Tether is one of the most well-known examples of a stablecoin backed by fiat currency. Each USDT token is pegged to the value of one US dollar, and the reserves backing the stablecoin are regularly audited to ensure transparency and confidence among users.

Similar to Tether, USD Coin is a stable coin backed by the US dollar on a one-to-one basis. It has gained popularity due to its compliance with regulatory standards and its use in various decentralized finance (DeFi) applications.

PAX Gold is an asset-backed cryptocurrency that represents ownership of physical gold. Each PAXG token is backed by one troy ounce of a London Good Delivery gold bar, providing investors with exposure to the precious metal in a digital form.

Read Our Blog: Best Crypto Wallets

Binance USD is a stablecoin issued by the cryptocurrency exchange Binance. It is backed by the US dollar and has been widely adopted for trading purposes due to its association with a reputable exchange.

CryptoFranc is a stablecoin pegged to the Swiss Franc (CHF). It operates on the Ethereum blockchain and is audited regularly to ensure the required reserves back the total number of issued tokens.

Terra is a top blockchain platform that issues stablecoins pegged to various fiat currencies, such as the TerraSDR (SDR- Special Drawing Rights), which is a basket of international reserve currencies.

Wrapped Bitcoin is an ERC-20 token that represents Bitcoin (BTC) on the Ethereum blockchain. Each WBTC is backed by an equivalent amount of BTC, allowing users to access DeFi applications with their Bitcoin holdings.

DigixDAO is a project that aims to tokenize physical gold on the Ethereum blockchain. Each token, such as Digix Gold (DGX), represents a specific weight of gold, allowing users to own and transfer the precious metal digitally.

Asset-backed cryptocurrencies (ABCs) represent a revolutionary departure from conventional cryptocurrencies like Bitcoin and Ethereum, fundamentally altering the way we perceive and interact with digital assets. While both ABCs and traditional cryptocurrencies operate on blockchain technology, the key differentiator lies in the intrinsic value and tangible backing that ABCs possess. Let’s explore the distinct characteristics that set asset-backed cryptocurrencies apart from their non-backed counterparts:

The most significant difference between ABCs and traditional cryptocurrencies is the presence of underlying tangible assets. Unlike Bitcoin and other purely digital tokens, ABCs derive their value from real-world assets, such as precious metals, fiat currencies, commodities, or even physical properties like real estate. These tangible reserves instill a level of trust and stability in ABCs, as their value is tied directly to the performance of the assets they represent.

One of the primary challenges faced by conventional cryptocurrencies is their notorious price volatility. The value of non-backed tokens is subject to wild swings due to market speculation, investor sentiment, and external factors. In contrast, ABCs offer enhanced stability due to their underlying asset reserves. The price fluctuations of ABCs are more closely tied to the performance of the backing assets, resulting in a relatively more stable valuation.

Asset-backed cryptocurrency often provides greater transparency compared to traditional cryptocurrencies. The presence of tangible assets means that these tokens can be audited and verified independently. This transparency fosters trust among users and investors, as they can be assured that the value of their ABC holdings is backed by real, tangible assets.

Read Also: Top 10 Decentralized Crypto Exchanges

The presence of underlying assets in ABCs mitigates certain risks associated with traditional cryptocurrencies. While non-backed cryptocurrencies are susceptible to market sentiment and speculative bubbles, ABCs’ value is anchored to tangible assets, providing a level of risk hedging against market downturns.

Asset-backed cryptocurrency often finds favor with regulators and authorities due to their intrinsic ties to real-world assets. The backing of tangible reserves offers an added layer of legitimacy and accountability, which can facilitate smoother integration into existing regulatory frameworks.

Asset-backed cryptocurrency can offer unique utility and use cases beyond mere speculation and investment. For instance, certain ABCs may enable streamlined cross-border transactions, and remittances, or facilitate fractional ownership of high-value assets. These use cases enhance the real-world applicability and utility of ABCs, making them more than just speculative instruments.

By combining the benefits of blockchain technology with tangible backing, ABCs have the potential to foster financial inclusion. They can provide a gateway for individuals without access to traditional banking services to participate in the global financial ecosystem, opening up opportunities for investment and economic empowerment.

Smart contracts play a pivotal role in asset-backed cryptocurrency, revolutionizing the way traditional assets are tokenized and transferred on the blockchain. These self-executing contracts, written as lines of code, facilitate the seamless exchange of value and ownership, ensuring transparency, security, and automation within the asset-backed crypto ecosystem. The integration of smart contracts has paved the way for the emergence of a new era in finance, where real-world assets and digital tokens can coexist harmoniously.

Smart contracts enable the automatic management of asset-backed cryptocurrency. Once the terms and conditions of the contract are coded into the blockchain, the contract will execute itself based on predefined triggers and actions. This automation reduces the need for intermediaries and minimizes human intervention, leading to greater efficiency and cost-effectiveness.

The immutability of blockchain technology ensures that smart contracts operate with complete transparency. All contract terms and asset information are recorded on the blockchain, accessible to all participants in real-time. This transparency fosters trust among stakeholders as they can independently verify the details of the contract and the underlying assets.

Smart contracts operate on decentralized blockchain networks, removing the need for a central authority or intermediary. This decentralized nature eliminates the single point of failure, making it highly secure and resistant to hacks and fraud. Additionally, since smart contracts are tamper-proof, the risk of manipulation or unauthorized alterations is significantly reduced.

Read Our Blog: Top 10 Asset Tokenization Platforms

Traditional asset transfers can be time-consuming and involve multiple intermediaries, causing delays and increasing transaction costs. With smart contracts, asset-backed cryptocurrency enables near-instantaneous settlement as code executes automatically when the predefined conditions are met. This speed and efficiency open up new possibilities for real-time trading and liquidity.

Smart contracts facilitate fractional ownership of assets. Through tokenization, valuable assets like real estate, precious metals, or artwork can be divided into smaller, tradable units. This fractionalization democratizes access to high-value assets, allowing a broader range of investors to participate in previously exclusive markets.

The borderless nature of blockchain technology combined with smart contracts allows asset-backed cryptocurrency to be transacted across geographical boundaries without the complexities of traditional cross-border transactions. This capability fosters financial inclusion and access to global markets.

For income-generating assets, such as real estate or revenue-sharing businesses, smart contracts can automate the distribution of dividends or payouts to token holders. This streamlines the distribution process, making it more efficient and accurate.

Smart contracts can incorporate governance rules and compliance requirements, ensuring that all stakeholders adhere to the predefined protocols. This feature is especially crucial in regulated industries, where adherence to specific guidelines is mandatory.

Smart contracts can be designed to interact with other smart contracts and decentralized applications (dApps). This interoperability enhances the functionality and utility of asset-backed cryptocurrencies, enabling them to integrate seamlessly into various blockchain ecosystems.

Asset-backed cryptocurrencies are changing the way people think about asset-backed cryptocurrencies. By linking each token to a real asset like gold, real estate, or fiat currency, they offer more stability and trust than regular cryptocurrencies.

This makes them a great option for investors who want the benefits of crypto without the wild price swings. As more businesses and users look for safer ways to use digital currency, asset-backed tokens could play a big role in the future of finance.

Looking to create your asset-backed cryptocurrency? SoluLab, a trusted asset tokenization development company in the USA, can guide you every step of the way. Contact us today to discuss further.

Yes, many are regulated depending on the country and issuer. For example, USDC and BUSD follow strict U.S. financial regulations and undergo regular audits.

ABCs are created by linking the value of the digital token to the underlying asset using blockchain technology. The value of the cryptocurrency is directly tied to the performance and market value of the asset it represents.

The main purpose of ABCs is to introduce stability and reduce the volatility often associated with traditional cryptocurrencies like Bitcoin. By pegging the value to real-world assets, these tokens aim to provide a more secure and predictable investment option.

The level of centralization can vary depending on the specific ABC. Some may have a more centralized governance model to manage the underlying assets, while others might be decentralized on a public blockchain with a smart contract governing the asset-backing process.

Backed crypto means each token is supported by a real-world asset like gold or fiat currency, helping maintain a stable value and increasing trust among users.