In an era marked by growing environmental consciousness, innovative solutions are emerging to combat climate change. One such innovation is the Carbon Credit NFT Marketplace, a cutting-edge platform that combines the power of Non-Fungible Tokens (NFTs) with the vital mission of carbon credit trading.

In this comprehensive guide, we will explore the world of carbon credits, delve into the exciting realm of NFTs, and unveil the potential of Carbon Credit NFT Marketplaces.

The Kyoto Protocol, established in 1997, and the subsequent Paris Agreement of 2015, represented global agreements that outlined targets for international CO2 emissions reduction. Having garnered ratification from all but six nations, these agreements have led to the establishment of national emission targets and the corresponding regulatory frameworks.

As these new regulations come into effect, there is an escalating demand for businesses to seek strategies for diminishing their carbon emissions. Presently, most interim solutions involve engagement in carbon markets.

Read Our Blog: Top 10 Carbon Crypto Companies to Watch Out in 2025

Carbon credits are a vital component of our battle against climate change. They represent a measurable reduction in greenhouse gas emissions and are a key tool in encouraging individuals and organizations to reduce their carbon footprint. These credits are traditionally traded as certificates or permits, often within complex markets.

However, the traditional approach to carbon credit trading has its limitations, such as a lack of transparency and accessibility. This is why Carbon Credit NFTs come forward as a perfect new-age solution to reduce the carbon footprint and also gain financial benefits in the process.

Carbon credits enable enterprises to diminish their environmental impact by securing financial backing for conservation initiatives worldwide. They also offer the possibility of secondary trading, allowing a company to sell any excess credits to others for financial gain.

An exemplary illustration of this phenomenon is embodied by Elon Musk’s Tesla. Surprisingly, Tesla generated an impressive $518 million in revenue during the initial quarter of 2021 by selling carbon credits to traditional automakers.

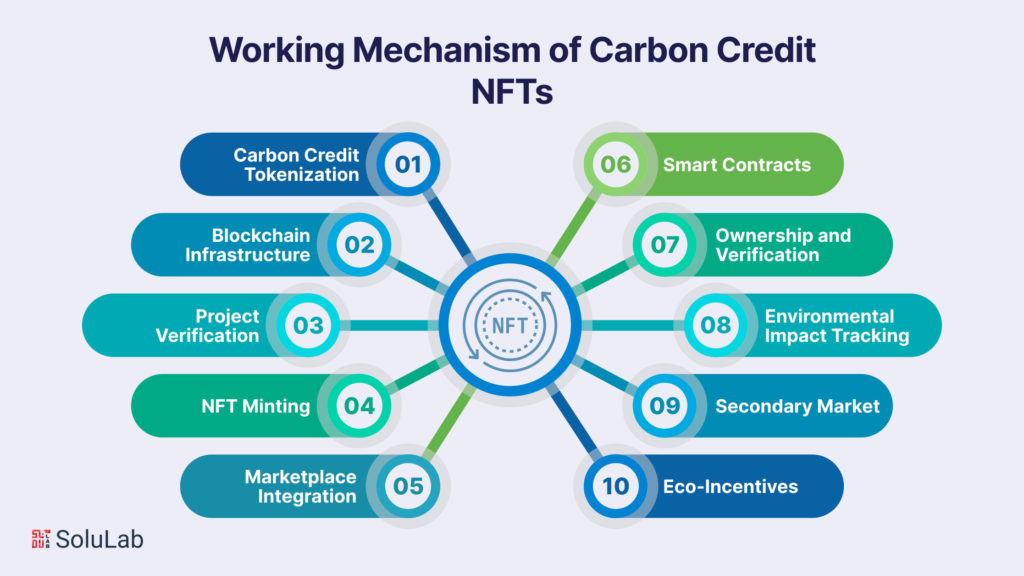

Carbon Credit NFTs representing carbon credits, operate on a unique and innovative system that combines blockchain technology, environmental conservation, and the principles of tokenization. This mechanism serves as the backbone of this emerging solution for tackling climate change. Let’s delve into the working mechanism of Carbon Credit NFTs:

Check Out the Blog: Best Tron NFT Marketplace Platforms of 2025

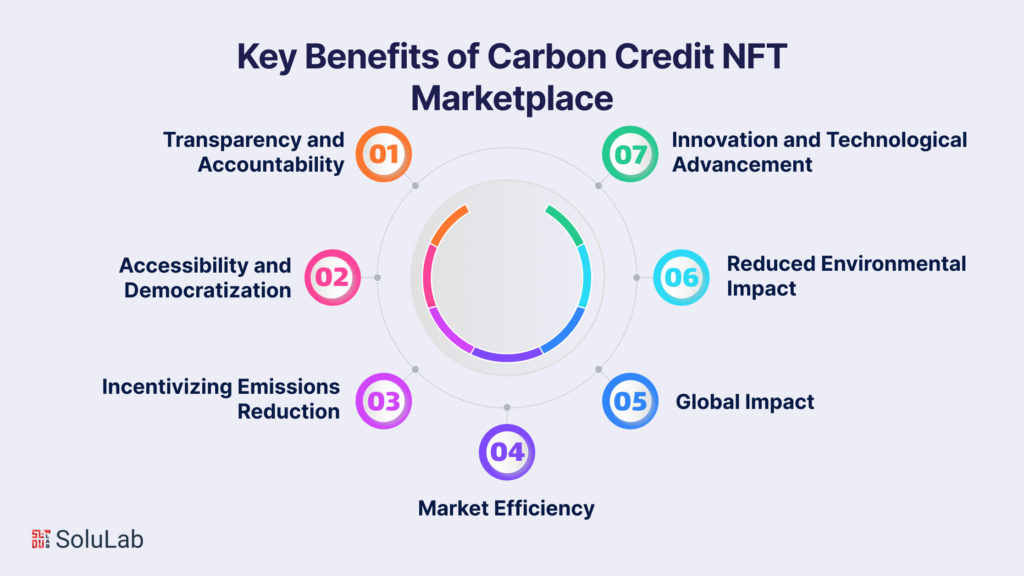

The emergence of Carbon Credit NFT Marketplaces has brought forth a range of benefits that are both environmentally impactful and financially lucrative. Let’s delve into some key benefits, supported by relevant facts and figures:

Fact: According to a report by EY (formerly Ernst & Young), blockchain technology, often employed in NFTs and carbon credit marketplaces, enhances transparency and traceability, reducing fraud and errors in carbon credit trading by up to 99%.

Benefit: Carbon Credit NFT Marketplaces provide an immutable ledger that tracks the entire lifecycle of carbon credits, ensuring transparency and accountability. This instills confidence in carbon credit buyers and investors. Moreover, the core motive of moving towards digital solutions is to offer a transparent system and framework to the beneficiaries.

Fact: The World Bank reports that carbon pricing initiatives, including carbon credit markets, are currently implemented or scheduled for implementation in over 60 jurisdictions globally.

Benefit: Carbon Credit NFT Marketplaces democratize access to carbon credits. Individuals and smaller organizations can now participate in emissions reduction efforts, helping to spread the burden of sustainability more widely.

Fact: The International Emissions Trading Association (IETA) estimates that carbon pricing mechanisms, including carbon credits, can potentially reduce global greenhouse gas emissions by up to 19 GtCO2e per year by 2030.

Benefit: The main motive of Carbon Credit NFTs is to provide modern solutions that can incorporate incentives for carbon reduction, motivating companies and individuals to actively engage in sustainable practices and accelerate emissions reductions.

Fact: A study by the Environmental Defense Fund found that carbon pricing, which includes carbon credit markets, has the potential to drive over $200 billion in clean energy investments annually.

Benefit: Carbon Credit NFT Marketplaces create a more efficient market for carbon credits, facilitating investment in clean energy and sustainable projects while spurring economic growth.

Check Our Press Release: SoluLab Empowers Companies with Carbon Credit Marketplace to Foster Environmental Responsibility

Fact: The United Nations Framework Convention on Climate Change (UNFCCC) states that the sale of carbon credits generated by the Clean Development Mechanism (CDM) reached a cumulative $400 billion by 2020.

Benefit: Carbon Credit NFT Marketplaces contribute to the global effort to combat climate change by mobilizing substantial investments in environmental projects, helping nations meet their emission reduction targets.

Fact: A report by McKinsey & Company indicates that carbon offsetting programs, which carbon credits support, have the potential to reduce emissions by 11 to 20 gigatons per year by 2030.

Benefit: Carbon Credit NFTs enable individuals and companies to take direct action in reducing their carbon footprint, thus aiding in achieving substantial emissions reductions.

Fact: The adoption of blockchain technology in carbon credit markets is rising. According to MarketsandMarkets, the global blockchain market size is projected to reach $39.7 billion by 2025, indicating rapid technological advancement.

Benefit: Carbon Credit NFT Marketplaces drive innovation by merging blockchain technology with environmental conservation, fostering new solutions for a sustainable future.

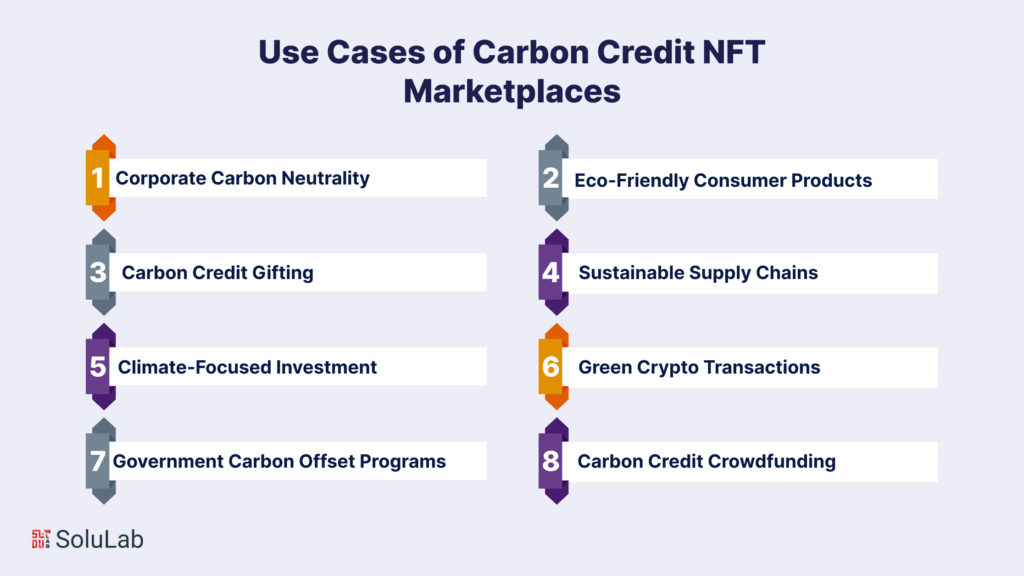

Carbon Credit NFT Marketplaces are poised to revolutionize the way carbon credits are traded and utilized. Here are some use cases of how these innovative platforms are making a difference in the fight against climate change and for better understanding, we will accompany these with real-world examples.

Large corporations seeking to achieve carbon neutrality can utilize Carbon Credit NFT Marketplaces to purchase verified carbon credits, thereby offsetting their emissions.

Example: A tech giant purchases Carbon Credit NFTs equivalent to the emissions generated by its data centers, ensuring it meets its sustainability commitments.

Have A Look at Our Blog: What are the Benefits of Using Digital Identity with Blockchain in the Future?

Companies producing eco-friendly products can showcase their commitment to sustainability by including Carbon Credit NFTs with their merchandise like customized clothing, allowing customers to offset the carbon footprint of their purchases.

Example: A clothing brand includes Carbon Credit NFTs in the purchase of each organic cotton custom t-shirt, enabling customers to contribute to reforestation projects.

Individuals can gift Carbon Credit NFTs to friends and family, promoting environmental awareness and encouraging carbon offsetting as a thoughtful gesture.

Example: A person gifts Carbon Credit NFTs to commemorate a loved one’s birthday, symbolizing their commitment to a greener future.

Companies can ensure their supply chains are sustainable by collaborating with suppliers who use Carbon Credit NFTs to offset emissions associated with production and transportation.

Example: An automobile manufacturer partners with suppliers who utilize Carbon Credit NFTs to offset emissions from raw material extraction to vehicle assembly.

Read Also: How To Launch Your Own NFT Marketplace Website in Less Than 2 Days?

Investors can diversify their portfolios by acquiring Carbon Credit NFTs, supporting carbon reduction projects while potentially benefiting from the appreciation of NFT values.

Example: An environmentally conscious investor purchases Carbon Credit NFTs representing emissions reductions from renewable energy projects, aligning their investments with their values.

Cryptocurrency exchanges and platforms can integrate Carbon Credit NFTs into their transaction processes, allowing users to offset the carbon emissions generated by crypto transactions.

Example: A crypto exchange offers users the option to purchase Carbon Credit NFTs along with Bitcoin, reducing the carbon footprint associated with cryptocurrency mining.

Governments can leverage Carbon Credit NFT Marketplaces to administer and enhance their carbon offset programs, ensuring transparency and efficiency.

Example: A national environmental agency partners with a Carbon Credit NFT Marketplace to facilitate carbon credit trading among local businesses and individuals.

Read Also: Metaverse NFT – Foundation Of Next Blockchain Revolution!

Crowdfunding platforms can enable campaigns that fund carbon reduction projects by selling Carbon Credit NFTs, allowing individuals to collectively support environmental initiatives.

Example: A crowdfunding campaign raises funds to reforest an area by selling Carbon Credit NFTs, providing backers with a tangible environmental impact.

The future of the Carbon Credit NFT Marketplace holds immense promise as it converges two transformative forces: carbon credit trading and blockchain-based Non-Fungible Tokens (NFTs). This innovative fusion is set to redefine how we address climate change and carbon emissions in the years to come.

Firstly, the integration of NFT technology into carbon credit markets is gaining momentum. According to a report by Statista, revenue in the NFT industry is reported to reach US$1,601.00m in 2023. This surge highlights the growing interest in NFTs and their potential applicability to carbon credits. In the future, Carbon Credit NFTs could become a widely accepted and accessible means of trading and offsetting carbon emissions.

Secondly, blockchain technology is revolutionizing the transparency and integrity of carbon credit transactions. Blockchain’s immutable ledger and smart contracts enable real-time tracking, verification, and trading of Carbon Credit NFTs, ensuring the legitimacy and impact of each credit. This transparency is vital for building trust among participants and verifying emissions reductions.

Furthermore, global commitments to carbon neutrality are expected to drive the adoption of Carbon Credit NFTs. The Paris Agreement aims to limit global warming to well below 2 degrees Celsius, and countries are setting ambitious targets to achieve carbon neutrality. To meet these goals, companies and individuals will increasingly turn to Carbon Credit NFT Marketplaces to offset their carbon emissions, further fueling the growth of this innovative ecosystem.

In conclusion, the future of the Carbon Credit NFT Marketplace is marked by technological advancements, increased participation, and a growing demand for sustainable practices. As blockchain and NFT technologies continue to mature, and as the world becomes more committed to addressing climate change, Carbon Credit NFTs are undeniably the need of the hour.

SoluLab, a distinguished leader in carbon credit marketplace development, is your go-to partner for top-tier carbon credit NFT marketplace development services and solutions. Their team of seasoned experts has a proven track record of creating exceptional Carbon NFTs tailored to diverse business models. When you opt for SoluLab to spearhead your Carbon Credit NFT marketplace development, you unlock a world of advantages.

In the ever-evolving landscape of Carbon Credit NFT marketplaces, trust in SoluLab’s expertise to lead the way. With a commitment to excellence and a history of success, SoluLab is your gateway to harnessing the full potential of carbon credit NFTs. Join hands with SoluLab today and embark on a journey toward sustainable and profitable environmental impact through cutting-edge blockchain technology.

A Carbon Credit NFT Marketplace is a digital platform where Non-Fungible Tokens (NFTs) are used to represent and trade carbon credits. It provides a transparent and efficient way to buy, sell, and trade carbon credits, which can help individuals and organizations offset their carbon emissions.

Carbon Credit NFTs are a digital form of carbon credits represented by unique tokens on a blockchain. They offer enhanced transparency, traceability, and accessibility compared to traditional paper or digital certificates. NFTs make it easier to verify the authenticity of carbon credits and facilitate secondary trading.

Carbon Credit NFTs offer several advantages, including transparency, accessibility, and the potential for incentives. They provide a clear record of carbon offsetting efforts, enable wider participation in carbon markets, and can incorporate rewards or benefits for carbon reduction activities.

To participate, you can start by creating an account on a carbon credit NFT marketplace platform. Then, you can browse available Carbon Credit NFTs, purchase them, and track your carbon offsetting contributions.

Carbon credit projects must meet specific environmental standards and verification processes to qualify for tokenization as NFTs. Common projects include renewable energy initiatives, reforestation, methane capture, and energy efficiency projects.

Authenticity is ensured through blockchain technology. Each Carbon Credit NFT is recorded on a blockchain ledger, providing an immutable record of its origin and ownership. Additionally, verification mechanisms validate the legitimacy of the carbon credits.

Like any investment, there are risks, such as market volatility and the potential for fraudulent projects. It’s essential to conduct due diligence, verify project credentials, and choose reputable Carbon Credit NFT Marketplaces.