You’re sitting in a boardroom. Your CFO just asked the question everyone’s thinking – Should we actually move into blockchain, or is this just hype? That’s exactly where most enterprises get stuck. Not because blockchain isn’t valuable, it is.

But because they’re terrified of the unknown. They’ve heard stories about years-long blockchain development and implementations, massive budgets disappearing, and projects that never delivered real value, so nothing happens. Their competitors take action while you wait for perfect clarity that never comes. But you don’t need perfect clarity, you just need proof.

And the reason is that building a blockchain PoC in just 4 weeks forces focus. It strips away the noise, the unnecessary features, the what-ifs. So you’re not building the final product, you’re answering one critical question- Does this actually work for our business? And frankly, that answer changes everything.

A blockchain proof of concept gets thrown around a lot in enterprise tech discussions. But most people, even smart CTOs and product leaders, get it wrong.

It’s not a minimum viable product, or pilot, or a production system. It’s something much more specific. Think of it this way: A blockchain PoC is the shortest path between a business problem and technical validation, nothing more, nothing less.

Here’s what that means practically. You’re building just enough of a blockchain application development to answer these questions:

That’s it. You’re not optimizing, scaling, or hardening security for millions of transactions. You’re validating the fundamental premise.

The confusion usually comes from comparing it to alternatives:

When you’re building a blockchain application, this clarity matters. So let’s learn more about their differences-

| Dimension | PoC (Proof of Concept) | MVP (Minimum Viable Product) | Pilot |

| Primary Objective | Validate core technical feasibility | Validate real user demand and usability | Validate production-readiness in real conditions |

| Key Question Answered | Does this work? | Do users want this? | Can this run reliably at scale? |

| Typical Duration | 4–8 weeks | 3–6 months | 6–12 months |

| Typical Budget Range | $150K–$400K | $400K–$2M | Six-figure+ (often $1M+) |

| Team Size | 6–12 specialists | 12–20 cross-functional team | Dedicated long-term team |

| Scope of Features | Minimal, assumption-driven | Core product functionality | Near-production feature set |

| Blockchain Focus | Protocol viability, smart contract logic, integrations | User flows, performance, incentives, security | Stability, scalability, compliance, monitoring |

| Deployment Environment | Dev / Testnet | Staging or limited Mainnet | Production (limited real-world rollout) |

| Risk Level | Low financial, high learning | Medium financial, medium learning | High financial, low learning |

| Typical Enterprise Mistake | Skipping it entirely | Overbuilding before validation | Treating it as “testing” instead of operations |

| Failure Cost | Minimal | Expensive | Very expensive |

| Success Output | Clear go / no-go decision | Product with real user feedback | Evidence of operational readiness |

If you need more clarity on POC vs Prototype vs MVP, click here.

Most enterprises skip straight to MVP or pilot, thinking they’ll save time; they don’t. What usually happens is they’ve already spent 6 months and a million dollars validating something that doesn’t actually work for their use case. By then, the business has lost patience.

The 4-week PoC prevents that entirely!

Four weeks sounds impossible until you realize something – you’re not building a product, rather you’re making a binary decision. And binary decisions don’t need perfect information; they need sufficient information. Here’s what makes the timeline actually work:

When you have unlimited time, you optimize everything. When do you have 4 weeks? You optimize for one thing: validation. That forces ruthless prioritization. The team stops debating whether to support 15 use cases and picks the three that matter most.

Deloitte’s enterprise blockchain study found that teams operating under 4-week constraints delivered 3.2x faster than open-ended timelines, not because they worked harder, but because they made faster decisions.

This isn’t 2017 anymore. You’re not building blockchain infrastructure from scratch. Ethereum, Hyperledger Fabric, Solana, Polygon, these all exist. They work, and you’re not inventing. You’re assembling.

That changes everything about timeline feasibility. You’re picking proven components, integrating them, and validating fit. That’s inherently faster than building novel infrastructure.

Five years ago, every blockchain use case was unique; now they cluster. Supply chain tracking? Thousands of companies have done it. Fintech settlement? Proven at scale. Healthcare records? Multiple production examples exist.

Enterprise blockchain POC patterns are becoming standardized, which means your 4-week team can build on playbooks rather than inventing methodologies.

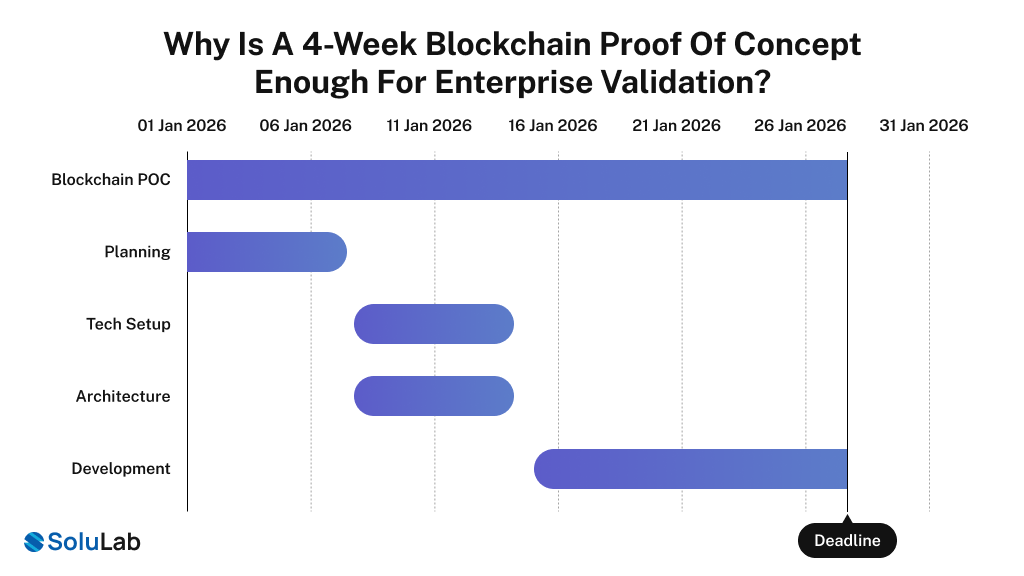

Here’s the truth from running actual blockchain poc development projects: the first week is planning, the second week is tech setup and architecture, weeks 3-4 are development. If you have experienced people and a clear scope, this timeline works.

If you don’t have experienced people, then 4 weeks becomes 12 weeks. But that’s not a timeline problem. That’s a resourcing problem.

This is the most important week, and not for the reasons you’d think. Most teams want to skip here and jump to cool tech. Don’t do that!

Week 1 is about answering – Why are we actually doing this? If you can’t answer that clearly, the next three weeks are a waste.

On Day 1, Start by getting the right people in a room. You need:

Your agenda for day one is simple. Walk through the current process that blockchain is supposed to improve. Not the happy path. The messy, real path.

Document everything. Be specific. We spend 4 days reconciling invoices between three parties, beats invoicing is slow. By the end of day one, you should have identified 3-5 specific pain points that blockchain could address.

Day 2, you define success. Not in vague terms like faster and cheaper. In actual metrics.

Get numbers, write them down, and Stakeholders will reference these constantly. By mid-week, your technical team starts evaluating which blockchain technology could even work for this.

This isn’t picking between Ethereum vs. Solana yet. It’s more basic:

You’re not deep-diving into architecture, but you’re just eliminating obviously wrong answers.

A supply chain tracking use case probably doesn’t need Ethereum’s full security model. A financial settlement use case absolutely does. That one question alone narrows your technology options dramatically.

Now you define the MVP of your blockchain proof of concept. What’s the absolutely minimum you need to prove this works?

If this is about supply chain transparency, you’re not building a full enterprise system. You’re building: Can product A move from point B to point C with transparent, tamper-proof tracking?

That’s it.

One use case. One happy path. No edge cases. No error handling optimization. Just: Does the core premise work?

By Friday afternoon, you should have:

If you don’t have these five things by Friday? Your week 1 failed, and you need to repeat it. Everything else depends on this foundation being solid.

This is where the technical team takes the foundation from Week 1 and builds a blueprint. The goal is to have a clear technical path forward with zero ambiguity.

This week, start with platform selection. Here’s the most important thing about choosing a blockchain technology: stop looking for perfect, and start looking for fit. You have three main categories to choose from:

Choose public when you need truly decentralized validation, high security standards, or want to tap into existing token ecosystems, but it has less privacy, higher transaction costs, and public verification.

Use these chains when you control who participates, need privacy controls, want simpler consensus models, but it has less truly decentralized and require more operational overhead.

Use these when your specific use case needs specialized features like cross-chain compatibility or different consensus mechanisms.

For most enterprise blockchain POC projects, you’re choosing between public (Ethereum/Polygon for wider trust) or permissioned (Hyperledger for privacy), but

None of these is wrong, but they solve different problems. Pick based on your Week 1 requirements, not based on what’s trendy. Now, your technical team designs the simplest architecture that proves your point.

For a supply chain example:

That’s literally it. Don’t design for 10 million transactions per day, but design for the 10,000 transactions you’ll do in your PoC test period. Your validation does X work on blockchain, but can we scale X to enterprise levels?

By Thursday, you should have:

Same-day decision on supporting infrastructure:

Don’t overthink this. You’re not choosing your stack for the next five years; you’re choosing for the next 2 weeks of development. Different parameters entirely.

Here’s where most teams expect chaos. But honestly, it doesn’t have to be. Week 3 is your development sprint. Two weeks of focused building.

Your blockchain developer sets up the local development environment, test networks, and basic CI/CD pipelines. This should take one day maximum; it’s not novel work. It’s a standard blockchain development setup that exists in documentation everywhere. If it’s taking longer, something’s wrong with your environment, or you’ve chosen overly complex infrastructure.

Week 2 is about building your core blockchain application development. But remember, you’re not building production code, you’re building validation code.

Your smart contracts should:

A supply chain tracking smart contract at the PoC stage is probably 200-300 lines of Solidity. Not 10,000. You need developers who’ve written smart contracts before, doesn’t need to be experts. Just people who understand the basics of how blockchain consensus affects code design.

Most blockchain dev shops can produce clean, working smart contracts in 3-4 days for a well-scoped blockchain PoC.

Now you connect your smart contract to the outside world.

This means:

– Creating a simple API that lets your existing system interact with the blockchain

– Writing basic unit tests (they don’t need to be exhaustive)

– Running the whole flow end-to-end a few times

– Identifying what breaks and fixing it

Most integration issues surface immediately once you start running the whole system together. That’s actually good. You want to find surprises during PoC, not during pilot.

By the end of Week 3, you should have:

Parallel to smart contract development, someone’s building the interface. An enterprise needs to see the blockchain working. Not in terminal output, but in a real interface. This doesn’t mean building a beautiful consumer app. It means building something that:

That’s a 2-3 day build for a decent developer. Most enterprises underestimate how much value comes from just seeing the system work visually. The CFO doesn’t care about smart contract code. Show him a dashboard where he can watch transactions settle in real-time, and suddenly, blockchain becomes real to him. Spend the dev time here. It’s not wasted.

Final week, you’re not building anything new. You’re validating that what you built actually answers your Week 1 questions.

Now run your PoC through a realistic load:

Document the numbers and compare against your Week 1 requirements. If you needed 100 transactions per second and you’re getting 50? That’s important data. It doesn’t mean blockchain won’t work, but it means you need a different blockchain for production scale.

But you’re not running a full $50K security audit. You’re doing a basic review:

Hire a security specialist for a day, which would cost around $3-5K. Worth every penny!

Now get the stakeholders from Week 1 in a room. Show them the system working end-to-end. Don’t script this. Let them use it. Watch where they get confused and watch what they immediately see value in. Their reactions tell you more than any metrics can.

But every blockchain proof of concept ends with a decision.

There are only two honest answers: Yes or No. Not maybe, let’s spend another 4 weeks researching. If the answer isn’t clear by Friday, your PoC scope was too broad. Most well-run PoCs result in a Yes. Not because the team is biased, but because good scoping in Week 1 means you only test things likely to work.

The goal isn’t to always say yes. The goal is to make that decision with high confidence, low risk, and minimal wasted investment. If you say No, you’ve saved the company millions by validating this path doesn’t work before betting the farm. That’s worth $300K and 4 weeks of team time. Absolutely.

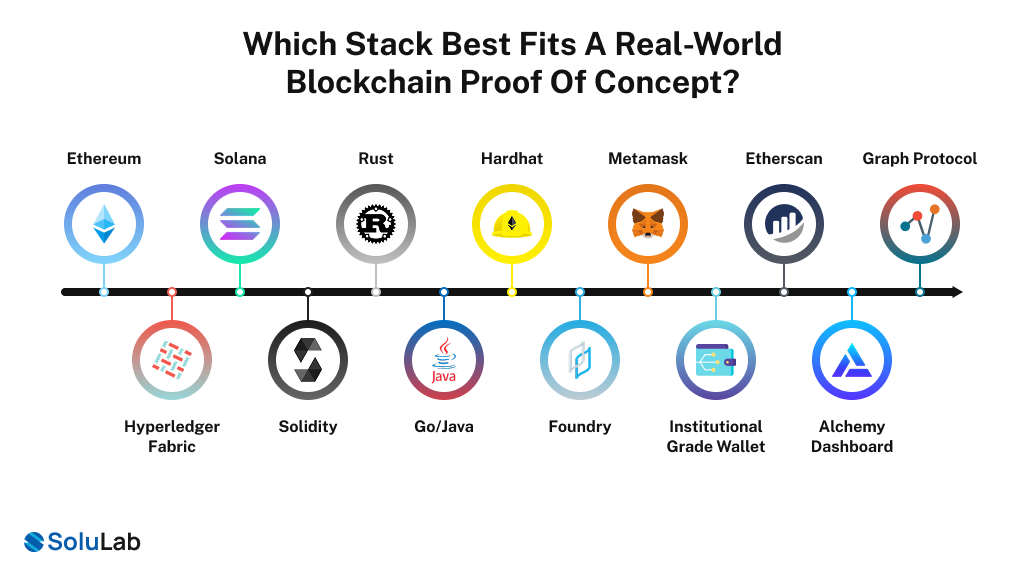

Stop overthinking this. Here’s what actually works in 2026:

Polygon gives you:

Is it perfect? No. But it’s the safest default for enterprise blockchain POC in 2026.

Use this unless you have a specific reason not to.

If your PoC involves data you don’t want publicly visible, Fabric is the play:

The only issue is more operational complexity, as you’re not using public infrastructure.

If your PoC needs thousands of transactions per second from day one, Solana is faster than Ethereum/Polygon. But most blockchain application development doesn’t need that. But if you do, Solana delivers.

Pick Solidity unless you have strong reasons otherwise. It’s where the talent pool is.

Hardhat. Use Hardhat.

For a PoC, you probably need:

Yes, you need real security even for a PoC. You’re proving this works for your company. Can’t cut corners here.

Use free tiers of these. Plenty for PoC scale.

Food safety incidents made it take up to 7 days to trace contaminated products back to the source, and Supply‑chain data was siloed across farmers, distributors, and retailers, slowing recalls and increasing risk.

Solution

Walmart and IBM ran a blockchain proof of concept on Hyperledger Fabric for mango traceability, and key supply‑chain events (farm, packer, distributor, store) were recorded on a shared, tamper‑evident ledger with a simple UI for scanning and querying.

Impact

The Bank of England wanted to test if distributed ledger technology could support RTGS‑style wholesale payments without risking live infrastructure, and they needed evidence on performance, resilience, and operational impact before considering DLT in core settlement systems.

Solution

PwC and the Bank built a blockchain PoC on Ethereum to simulate RTGS‑like gross settlement between multiple participants, and Smart contracts modeled settlement logic in a rapid 6‑week build, focused on feasibility rather than full production readiness.

Impact

At the end of your 4 weeks, you’ll have data. Here’s how to interpret it:

1. Technical Metrics That Matter

Transaction Finality Time: How long until a transaction is guaranteed permanent? For most enterprise blockchain use cases, under 10 minutes is fine. If it’s taking hours, that’s a problem.

Throughput: Transactions per second your system can handle. Scale this to your expected production volume. If you need 100 TPS and you’re getting 50, that shapes your architecture decisions.

Cost per Transaction: What does each transaction cost in gas/fees? Scale to your expected monthly volume. Turns into a real operational cost.

Integration Latency: Time from your existing system triggering a blockchain transaction to that transaction settling. Includes network latency. Should be under 1-5 minutes for most enterprise use cases.

2. Business Metrics That Matter

Time Reduction: How much faster does your process run with blockchain? 3 days to 3 hours? Great. 3 days to 2.8 days? Not enough benefit.

Cost Reduction: Does blockchain actually save money or just move costs around? Calculate real savings, not theoretical.

Risk Reduction: Is the process more trustworthy? Can you prove it? (This is hard to measure but critically important.)

Stakeholder Confidence: Did all participants agree that this is valuable? Or are some skeptical? You need broad buy-in, not narrow technical enthusiasm.

3. The Single Metric That Drives Decisions

(Time/Cost Benefit) ÷ (Implementation Effort for Pilot) = Viability Score

The math drives the decision.

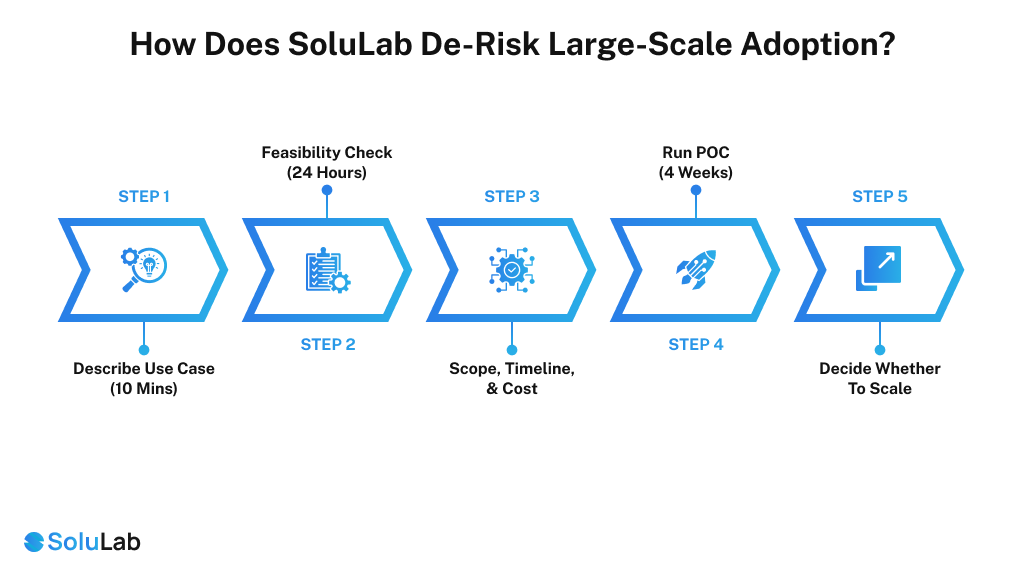

This is where most enterprises get stuck, knowing what to do, but not knowing who to trust with it. And that’s where we come in.

We’ve built blockchain proof of concept applications for fintech companies, supply chain networks, healthcare systems, and enterprise platforms. Most of our PoCs move to production. That’s not luck. That’s experience.

Your 4 weeks should be spent validating your business case, not fighting technology or figuring out how to approach the problem.

We handle the technical complexity, so you can focus on the business decision.

Here’s how it works:

1. You describe your use case in 10 minutes

2. We do a feasibility check (usually 24 hours)

3. We give you a scope, timeline, and cost estimate

4. If it makes sense, we run your PoC

5. You decide whether to scale it

You’re sitting in that boardroom again. The CFO asks: Should we move to blockchain? Now you have a path forward that doesn’t require a year of debate or a massive bet before you know if it works. You run a 4-week blockchain proof of concept with a Blockchain development company.

Like SoluLab, spend around $200K and 4 weeks of team time.

Get a clear answer. If yes? You move to a 4-6 month pilot with realistic budget and timeline expectations. If not? You saved millions by validating a path won’t work before going all-in. Either way, you’ve made a decision based on data, not assumptions.

That’s the value of building a blockchain PoC in just 4 weeks. The companies that succeed with blockchain aren’t the ones with the most advanced technology. They’re the ones who validated quickly, learned fast, and iterated intelligently. You can do that. Four weeks. Clear answer. And Minimal risk.

Yes. Not every use case, but most enterprise use cases fit. The key is a tight scope. If you’re asking, can blockchain help us with X? and X is specific enough to articulate in a sentence, you can probably validate it in 4 weeks. If you’re asking how we use blockchain without a specific problem, you need longer, months longer. That’s not a PoC, that’s strategic exploration. That’s why we focus on the first bucket. Specific problems, under four-week validation.

We expect that most enterprises don’t. That’s exactly why you hire an experienced blockchain development company for the PoC. You should have one person on your team who’s technically competent enough to understand what we’re doing and approve decisions. But you don’t need in-house expertise. That’s what we bring.

Maybe. Depends on the scope. If your PoC is tiny, a single smart contract, no integration, we might do it for $50-80K. But we’d be suspicious of quotes significantly below $100K. Either they’re cutting corners, or they don’t understand enterprise requirements, but quotes significantly above $300K usually mean they’re including more than a PoC.

Typically 4-8 months, as the PoC proves the concept. The pilot (4-6 months) hardens everything like security, performance, and operations, then production. Some companies try to rush pilot phase, don’t. That’s where most blockchain failures happen.

Honestly? That’s a win too. We had one client where the PoC revealed they didn’t actually have a trust problem; they had a speed problem, and Blockchain wasn’t the right answer. It saved them $5M and 12 months of wasted effort. A good blockchain proof of concept gives you the data to make the right decision, whether that’s moving forward or stopping.

It happens as you learn something unexpected and realize your original direction doesn’t make sense. That’s why we build flexibility into the process. Pivoting mid-PoC costs time and money, but it’s manageable if it happens early. By Week 3, pivoting usually means extending the timeline or narrowing the scope. Can’t do everything.