The global asset-backed securities (ABS) market has been experiencing significant growth. As per the recent report in 2023, the market size was valued at approximately $2510.83 billion and is projected to reach $3757.14 billion by 2030, with a compound annual growth rate (CAGR) of 5.7%

As the market grows, new indices concerning the operation and rate of change of assets are produced. Asset-backed securities (ABS), a type of debt product, are supported by a pool of assets.

Support might take the form of student loans or credit card receivables. Mortgage-backed securities (MBS) are a type of asset-backed investment that is secured by a portfolio of mortgages. In this blog, we will look at the differences between asset-backed securities vs mortgage-backed securities.

Asset-backed securities (ABS) are financial investments that are secured by a foundational pool of assets, often those that provide cash flow from debt, including loans, leases, credit card balances, or receivables. It may take the shape of a bond or note that pays interest at a predetermined rate for a specified period of time, until maturity. Asset-backed securities can be a better option for income investors than other debt products such as corporate bonds or bond funds.

Asset-backed securities permit issuers to raise funds for lending or other investments. The underlying assets of an ABS security are frequently illiquid and cannot be sold individually. So, by pooling assets and constructing a financial instrument from them—a process known as securitization—the issuer may make illiquid assets valuable to investors. It also allows companies to remove shakier assets from their books, reducing their credit risk.

For investors, purchasing an ABS provides the prospect of a revenue stream. The ABS lets customers invest in a wide range of income-generating assets, some of which are exotic and not accessible in any other investment.

The U.S. market has shown strong performance, with a 45% year-over-year increase in issuance, totaling $202.5 billion as of June 2024. Globally, the ABS market is anticipated to grow from $2276.03 billion in 2023 to $3112.45 billion by 2028, at a CAGR of 6.3%.

There are several types of ABS, with all having unique features, cash flows, and values. The following are some of the most frequent kinds.

Home equity loans are quite comparable to mortgages, hence home equity ABS is similar to mortgage-backed securities. The main distinction between home equity loans and mortgages is that customers with a home equity loan often do not have strong credit, which is because they were unable to obtain a mortgage. When examining home equity loan-backed ABS, investors should consider the credit ratings of the borrowers.

Auto loans are depreciating assets, therefore their cash flows include monthly interest, principal payment, and prepayment. An auto loan ABS has a substantially lower prepayment risk than a home equity loan ABS or MBS. Prepayment occurs only when the borrower has sufficient means to repay the loan.

Refinancing is uncommon when interest rates decrease since autos degrade faster than the loan debt, leaving the collateral value of the car lower than the outstanding sum. The balances of these loans are often small, and borrowers will not be able to save large sums by refinancing at a reduced interest rate, offering little motivation to refinance.

Credit card receivables are an example of a non-amortizing asset ABS. They have no regular payment amounts, but new loans and adjustments can be introduced to the pool’s composition. Credit card receivables’ cash flows comprise interest, principal payments, and yearly fees.

Credit card receivables are frequently locked up for a time during which no principal is paid. If the main is paid during the lock-up period, fresh loans will be put to the ABS with the principal payment, resulting in an unchanging pool of credit card receivables. Following the lock-up period, the main payment is transferred to ABS investors.

Student Loan ABS are collections of loans given out to cover the cost of higher education. These loans could come from private lenders or be guaranteed by the government. The borrowers’ repayment of their student loans upon graduation provides the cash flows. Keep in mind that the loans can be available to students who graduate at various times or with different degrees.

Pools of leases on machinery or equipment are connected to ABS through equipment leasing. These assets are leased by businesses, and the lease payments go toward the cash flows that sustain the ABS. The value of the leased equipment, which might include large office furniture, heavy machinery, and manufacturing equipment, serves as the collateral.

Small business loan ABS consists of loan pools created especially for small firms. Since these loans are secured by the expected cash flows from the small firms taking out the loans, they can carry a greater risk. Since the performance and profitability of ABS is dependent on the small businesses’ capacity to fulfill their repayment commitments, the state of the economy and the financial stability of these companies are important variables that influence the risk associated with ABS.

Similar to bonds, mortgage-backed securities (MBS) are investments. Every MBS is a portion of a group of mortgages and other real estate debt that investors purchase from banks or government agencies that provided the original loans. Similar to bond coupon payments, investors in mortgage-backed securities get monthly payments.

Purchasing mortgage-backed securities amounts to an investor providing money to homebuyers. A broker is able to buy and sell MBSs. The minimum investment is not the same for every issuer. An MBS has to be given to a GSE or a private financial business along with receiving one of the top two ratings from an approved credit rating agency in order to be traded on the market today. Non-agency MBS are issued by private financial organizations and do not come with any guarantees. Securities are classified by seniority and marketed to investors with varying risk tolerances.

Mortgage-backed securities (MBS) are financial instruments secured by a pool of mortgages. They are created when banks bundle mortgages and sell them to investors. MBS can be classified into various types based on their structure and the underlying mortgages. Understanding the different types of MBS is crucial for investors to make informed decisions and assess mortgage-backed securities rates effectively.

Pass-through securities are the simplest form of MBS. In this type, the principal and interest payments from the underlying pool of mortgages are passed directly to investors, minus servicing and guarantor fees. Pass-through securities are typically issued by government-sponsored enterprises (GSEs) like Fannie Mae, Freddie Mac, or Ginnie Mae. The mortgage-backed securities rates for pass-through securities are influenced by the interest rates on the underlying mortgages, as well as the credit quality of the borrowers.

CMOs are more complex than pass-through securities. They are divided into tranches, or slices, each with different maturities, risk levels, and interest payments. Investors can choose tranches that match their risk tolerance and investment horizon. The mortgage-backed securities rates for CMOs vary by tranche, with higher-risk tranches offering higher potential returns to compensate for the increased risk.

Strip securities are a type of MBS that separates the interest and principal payments of the underlying mortgages into two distinct securities: Interest-Only (IO) strips and Principal-Only (PO) strips. IO strips pay interest income only, while PO strips pay the principal repayments. These securities cater to investors with specific income or risk preferences. The mortgage-backed securities rates for IO and PO strips are influenced by prepayment rates and the interest rate environment.

Unlike residential MBS, CMBS are backed by commercial real estate loans, such as office buildings, shopping centers, and apartment complexes. CMBS tend to have higher mortgage-backed securities rates compared to residential MBS due to the larger and more complex nature of the underlying properties. These securities are also typically structured with tranches, offering varying levels of risk and return.

Agency MBS are issued by GSEs like Fannie Mae, Freddie Mac, and Ginnie Mae, and they come with an implied government guarantee, making them less risky. Non-agency MBS, on the other hand, are issued by private institutions and do not carry a government guarantee, which can result in higher mortgage-backed securities rates due to the increased credit risk.

Key segments within the ABS market include residential mortgage-backed securities (RMBS), auto loan ABS, and credit card ABS. RMBS alone account for about 25% of all ABS issuances. Additionally, collateralized loan obligations (CLOs) represent a significant portion, making up 40% of the global structured finance market.

Asset-Backed Securities market offer several advantages to investors, issuers, and the financial market as a whole. Here are some of the key benefits:

ABS provides investors with the opportunity to diversify their portfolios. By investing in a pool of various underlying assets, such as loans, leases, or receivables, investors can spread their risk across multiple asset types and issuers. This diversification can reduce the impact of any single asset’s poor performance on the overall investment.

The securitization process transforms illiquid assets into tradable securities. This increased liquidity allows investors to buy and sell ABS more easily in the secondary market, enhancing their ability to manage their portfolios and respond to changing market conditions.

ABS often offers higher yields compared to other fixed-income securities of similar credit quality. This yield premium compensates investors for the additional complexities and risks associated with the underlying asset pools and the securitization process.

ABS can be structured to meet the specific needs and risk appetites of different investors. By creating tranches with varying levels of risk and return, securitizers can tailor ABS to appeal to a wide range of investors, from those seeking high returns to those prioritizing safety and stability.

Related: A Guide to Asset Tokenization

For issuers, securitization distributes the risk associated with the underlying assets across a broad investor base. This can improve the issuer’s balance sheet, free up capital, and reduce the concentration of risk, making the issuer more financially stable and able to extend further credit or finance additional projects.

ABS provide issuers with access to capital markets, allowing them to raise funds more efficiently than through traditional financing methods. This access can be especially beneficial for financial institutions, enabling them to originate new loans and support economic growth.

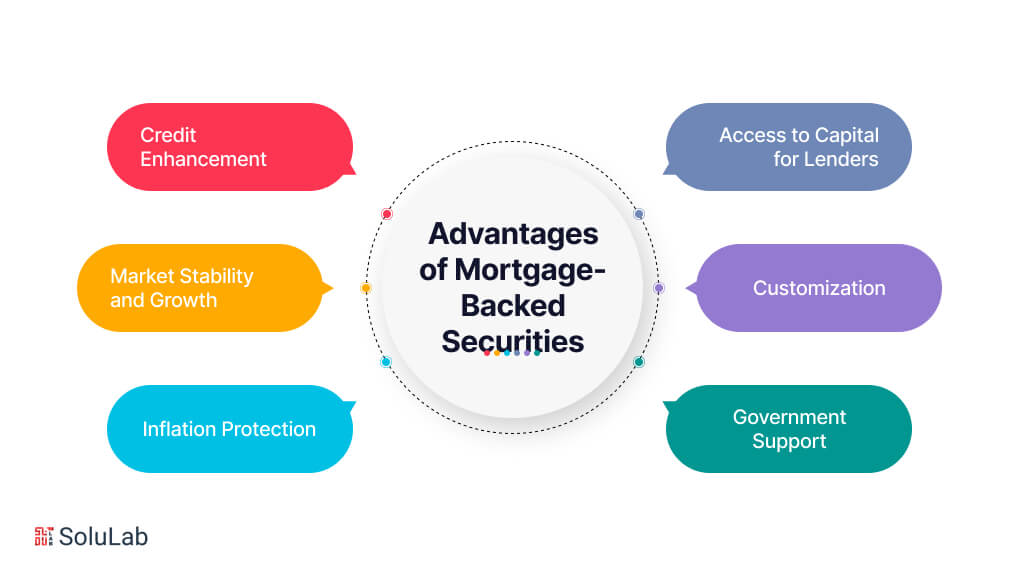

Mortgage-Backed Securities (MBS) offer numerous benefits to investors, issuers, and the broader financial market. Here are some key advantages:

Many MBS come with credit enhancements, such as guarantees from government-sponsored entities (GSEs) like Fannie Mae, Freddie Mac, or Ginnie Mae. These enhancements improve the credit quality of the securities, making them more attractive to investors and potentially lowering borrowing costs for issuers.

Issuing MBS allows financial institutions and mortgage originators to access capital markets efficiently. By selling mortgage loans to be securitized, lenders can free up capital to originate new loans, supporting housing market growth and economic development.

MBS plays a crucial role in promoting market stability and growth by providing a steady flow of capital to the housing market. This continuous flow of funds helps maintain liquidity in the mortgage market, enabling borrowers to secure loans more easily and fostering overall economic stability.

MBS can be structured to meet the specific needs and risk appetites of various investors. By creating different tranches with varying levels of risk and return, securitizers can tailor MBS to appeal to a wide range of investors, from conservative to high-yield seeking.

Certain types of MBS, such as those backed by adjustable-rate mortgages (ARMs), can offer some protection against inflation. As interest rates rise, the interest payments on ARMs adjust upward, potentially increasing the income for investors and providing a hedge against inflation.

MBS backed by GSEs benefit from an implicit or explicit government guarantee, which can enhance investor confidence and provide a level of security. This government backing can make MBS a more attractive and stable investment option compared to other types of securities.

Asset-Backed Securities (ABS) and Mortgage-Backed Securities (MBS) are both types of structured financial instruments, but they have distinct characteristics and serve different purposes. Here are the key differences between them:

While both ABS security and MBS are forms of asset-backed securities, they differ significantly in terms of the underlying assets, market participants, credit enhancements, risk factors, payment structures, and market size. Understanding these differences is crucial for investors when considering ABS vs MBS as part of their investment strategies.

In summary, while Asset-Backed Securities (ABS) and Mortgage-Backed Securities (MBS) share the common feature of being backed by pools of assets, their differences are pronounced. ABS is backed by a diverse range of financial assets such as auto loans, credit card receivables, and student loans, offering investors exposure to various sectors of the economy. In contrast, MBS are exclusively backed by mortgage loans, providing a direct link to the real estate market. Both types of securities offer benefits such as enhanced liquidity, diversification, and attractive yields, yet they come with distinct risk profiles and market dynamics. Understanding these differences is essential for investors looking to optimize their portfolios with structured finance products.

However, the process of securitization and managing ABS and MBS presents significant challenges, including complex structuring, regulatory compliance, and the need for transparent and secure asset tracking. This is where SoluLab comes in as a leading tokenization development company. SoluLab leverages blockchain technology to enhance the securitization process, providing robust solutions for asset tokenization that ensure transparency, security, and efficiency. By tokenizing assets, SoluLab can streamline asset management, reduce costs, and improve accessibility for investors. To learn more about how SoluLab can help overcome the challenges in the ABS and MBS markets, contact us today.

ABS are backed by a variety of financial assets such as auto loans, credit card receivables, and student loans. MBS, on the other hand, are exclusively backed by mortgage loans, either residential or commercial. While both offer benefits like diversification and liquidity, they differ in the type of underlying assets, risk profiles, and market dynamics.

Examples of assets that can be securitized into ABS security include auto loans, credit card debt, home equity loans, student loans, and equipment leases. These diverse asset types provide investors with exposure to different segments of the economy.

Both ABS security and MBS come with risks such as credit risk (borrower defaults), prepayment risk (early loan repayments), and interest rate risk. However, MBS are more directly tied to the real estate market, making them sensitive to housing market fluctuations and economic conditions affecting homeowners.

Credit enhancements like over-collateralization, reserve accounts, subordination, and third-party guarantees improve the credit quality of ABS and MBS. For MBS, government-sponsored entities (GSEs) like Fannie Mae, Freddie Mac, and Ginnie Mae often provide additional guarantees, making these securities more attractive to investors by reducing default risk.

SoluLab, as a tokenization development company, uses blockchain technology to address challenges in the securitization process, such as complex structuring, regulatory compliance, and asset tracking. By tokenizing assets, SoluLab enhances transparency, security, and efficiency, streamlining asset management and improving accessibility for investors. To find out how SoluLab can assist with your securitization needs, contact us today.