Payment speed is all matters for users and business partners. But can banking afford the cost to improve the speed? We all know the answer. No. That’s where stablecoin development solutions come into the picture. But one kind of stablecoin can handle long-term value over global volatility. That’s where the new trend of commodity backed stabelcoins gaining serious attention.

Linking digital value to tangible assets (gold, silver, oil, and green tokens), enterprises are conducting sustainable and transparent transactions. Through this business, reduce uncertainty and enhance traditional finance principles.

As more companies explore tokenization, cross-border settlements, and digital asset infrastructure, the interest in launching commodity stablecoin models continues to grow. So, let’s see how to and what things to keep in mind before building a commodity-backed stablecoin platform.

Key Takeaways

- Choosing the right commodity, custody model, and redemption structure defines credibility more than technology alone.

- Transparent reserves and controlled issuance can reduce operational and confidence risks by up to 40% compared to unbacked models.

- For enterprises, the real goal is not launching a token but building a reliable financial infrastructure that works across borders.

Why Commodity-Backed Stablecoins Are Gaining Enterprise Attention?

Enterprise teams don’t go after buzzwords. They want to see real value, behavior that can be predicted, and clear operations. Businesses are increasingly interested in commodity-backed stablecoins because they combine the efficiency of blockchain technology with the value of real assets. The changing stablecoin market reflects this phenomenon.

Sources in the industry say that stablecoins can be linked to fiat money, cryptocurrencies, or real goods. In commodity-backed models, tokens are linked to real assets like gold, silver, oil, or other tradable goods. This gives them intrinsic value exposure without actually owning the asset.

- Tangible value support

Commodity-pegged stablecoins are linked to physical assets, giving holders exposure to real-world value. This stands in contrast to purely digital or volatile crypto collateral.

- Hedge against volatility and inflation

In markets with unstable local currencies or inflation pressures, asset-linked stablecoins provide a reliable store of value. Enterprises often view commodity pegging as a risk management tool, especially in cross-border treasury strategies.

- Enhanced settlement and liquidity mechanics

Stablecoin development generally enables faster, cheaper settlement compared with traditional financial rails. Commodity-backed tokens can also serve as programmable settlement assets in tokenized ecosystems.

Commodity-Backed vs Fiat and Crypto-Backed Stablecoins

A clear comparison with other digital currencies like crypto and fiat models can give you more details on why commodity-pegged stables are on the rise.

| Criteria | Fiat-Backed Stablecoins | Crypto-Backed Stablecoins | Commodity-Backed Stablecoins |

| Backing Asset | Fiat currencies (USD, EUR) | Cryptocurrencies (BTC, ETH) | Physical commodities (gold, oil, metals) |

| Value Stability | Stable to fiat currency | Depends on crypto market volatility | Linked to real commodity market prices |

| Volatility Risk | Low, but tied to fiat inflation | High due to crypto price swings | Moderate, based on commodity pricing |

| Collateral Type | Bank-held cash or equivalents | Over-collateralized digital assets | Physically stored, audited commodities |

| Counterparty Risk | High reliance on banks and issuers | Smart contract and market risk | Custodian and storage risk |

| Transparency | Issuer disclosures and audits | On-chain collateral visibility | Physical audits + on-chain proof |

| Regulatory Exposure | Strong banking regulation | Evolving crypto regulation | Commodity and financial regulations |

| Use Case Fit | Payments and remittances | DeFi and crypto-native use | Treasury, hedging, asset tokenization |

| Enterprise Appeal | Medium | Low to medium | High |

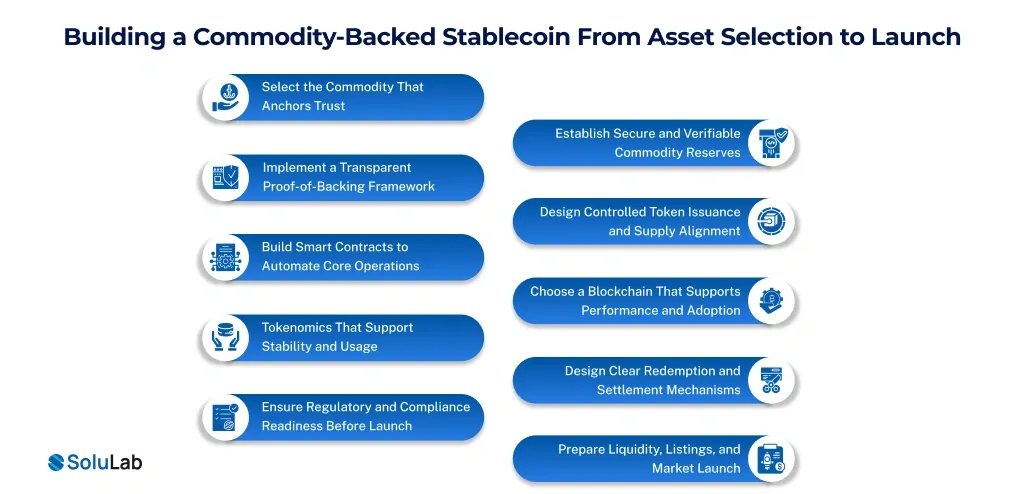

Building a Commodity-Backed Stablecoin From Asset Selection to Launch

Launching a commodity-backed stablecoin is not about technical details. It’s all about your decision-making, from type to infrastructure, market strategy, and partnerships. Let’s see how it’s done through the following steps.

Step 1. Select the Commodity That Anchors Trust

Start with a commodity the market already understands. Gold and silver work well for value storage, and oil and gas fit trade and settlement use cases, while carbon credits or agricultural commodities suit niche or regional markets.

The right asset choice shapes who will trust, use, and hold your stablecoin long term.

Step 2. Establish Secure and Verifiable Commodity Reserves

Physical commodities must be stored in regulated vaults, warehouses, or licensed custodians. This applies whether you’re holding gold bars, oil inventories, or verified carbon units.

Clear ownership records and insurance coverage are non-negotiable for institutional trust.

Step 3. Implement a Transparent Proof-of-Backing Framework

Backed does not mean trusted unless it’s provable. Reserves should be audited by independent firms and matched publicly against circulating tokens.

On-chain proof combined with off-chain audits is what enterprises expect, not marketing claims.

Step 4. Design Controlled Token Issuance and Supply Alignment

Each token should represent a fixed unit, for example, one gram of gold, one barrel equivalent, or one verified carbon credit.

Minting only happens after reserves are secured, and tokens are burned automatically when redeemed. This keeps the supply honest.

Step 5. Build Smart Contracts to Automate Core Operations

Automation of repeating and time-consuming tasks can reduce 40% of manual work. Include smart contract developemnt to manage minting, burning, redemption rules, and compliance logic. Stablecoin development with smart contract integration simplifies transactions and partnerships.

Step 6. Choose a Blockchain That Supports Performance and Adoption

As you can see, Ethereum and Polygon have reduced transaction costs over the years through blockchain support. If you integrate this into the stablecoin platform, user growth, exchange enhancements, and volume expectations increase.

Step 7. Tokenomics That Support Stability and Usage

Maintain sustainability in the storage of records, audits, and insurance through good tokenomics of commodity-based stablecoins. To know about such implementations, do contact a reliable crypto token development company.

Step 8. Design Clear Redemption and Settlement Mechanisms

Holders must know exactly how redemption works. This could mean physical delivery for large holders or cash settlement linked to spot prices.

Clear thresholds and timelines matter more than incentives when trust is tested.

Step 9. Ensure Regulatory and Compliance Readiness Before Launch

Commodity-backed stablecoins touch financial, commodity, and digital asset regulations at the same time.

Licensing, KYC/AML, and jurisdictional rules should be handled upfront, not after launch.

Step 10. Prepare Liquidity, Listings, and Market Launch

Liquidity defines whether a stablecoin is usable. Exchange access, market-making, and a controlled rollout are essential.

Without liquidity, even a well-designed commodity-backed stablecoin stays theoretical.

Scaling the Stablecoin for Institutional and Global Use

After launch, scaling becomes less about technology and more about operational discipline. Institutions expect predictable reporting, defined governance, and systems that perform consistently under volume. Let’s see one of the real-world use cases.

Tether (Tether Gold – XAUT)

Tether extended its stablecoin model into commodities with XAUT, a gold-backed token supported by physical reserves.

Why this matters:

- Built on existing stablecoin infrastructure

- Achieved global liquidity by leveraging exchange integrations

- Shows how commodity-backed models can scale using familiar market rails

XAUT highlights how liquidity and market access accelerate adoption when commodity backing is clearly defined.

From above, all you need to know now is that any commodity-backed stablecoins typically require:

- Standardized reserve reporting aligned with audit and accounting expectations

- Clear governance over smart contract upgrades, redemptions, and disclosures

- Operational processes that hold up during market stress or high redemption demand

Conclusion

Through the right commodity-backed stablecoin and standard, your business can take a new turn. Let’s discuss the details in more depth with a top stablecoin development company like SoluLab. A right partner is also key to success. SoluLab offers effective solutions and services to your stablecoin vision. For example:

- Regulatory Compliance & KYC Integration

- Token Integration & Wallet Development

- Global Token Distribution Platforms

These are just a few services. With 250+ in-house expert developers, your vision takes reality within weeks. Contact us today!

FAQs

Development cost depends on commodity type, compliance scope, blockchain choice, and integrations. Most enterprise-grade commodity-backed stablecoin projects typically range from $10k to high five figures.

On average, development takes 5 to 16 weeks, including smart contracts, compliance setup, integrations, testing, and launch preparation. Timelines may vary based on regulatory and asset complexity.

It’s simple: visit the SoluLab’s website, go to the form below, and fill in your details. The team will contact you in 24 to 72 hours based on region and time.

The most critical integrations include custody providers, proof-of-reserve systems, KYC/AML tools, and price oracles. Also, wallets and exchange connectivity for liquidity and smooth redemption workflows take a little more time based on your requirements.

Commodity-backed stablecoins are well-suited for enterprises, institutions, and conservative investors. Because they link digital assets to real commodities with clear value, transparency, and regulatory alignment.