Tokenization on Solana has quietly moved from a developer experiment to a serious business strategy. Today, companies are not just launching meme coins or NFTs. They are creating platform tokens, loyalty assets, in-app currencies, governance tokens, and digital financial products that need speed, low costs, and reliability.

Solana offers that foundation.

With fast transaction finality, near-zero fees, and a growing ecosystem of wallets, exchanges, and developer tools, Solana blockchain development has become a practical choice for businesses, without the friction seen on older networks.

This blog breaks down:

Let’s get in to see how tokenization on Solana is shaping 2026.

When businesses evaluate blockchain platforms, the question is rarely “Which chain is popular?” It is usually, “Which chain works at scale without burning budget?”

That is where Solana stands out!

Solana processes thousands of transactions per second with near-instant confirmation. For businesses running user-facing apps, marketplaces, or financial platforms, speed directly impacts user trust and retention.

On Solana, transaction fees are typically fractions of a cent. This matters when you:

Cost predictability is a major reason enterprises prefer Solana over congested networks.

Solana’s SPL Tokens are well-supported across wallets, exchanges, and developer tools. This reduces friction when:

To design a well-versed token infrastructure, you need an experienced tokenization development company that can offer multiple services- this we will discuss in further sections.

While Real World Assets on Solana use advanced compliance tooling, standard Solana tokenization remains flexible and fast. Businesses can build crypto-native assets without regulatory overhead unless their model requires it.

For most platforms, this balance is exactly what they need.

Australia’s Treasury and ASIC released updated token mapping guidelines in 2024, clarifying:

Solana tokenization for Australian users must align with these classifications.

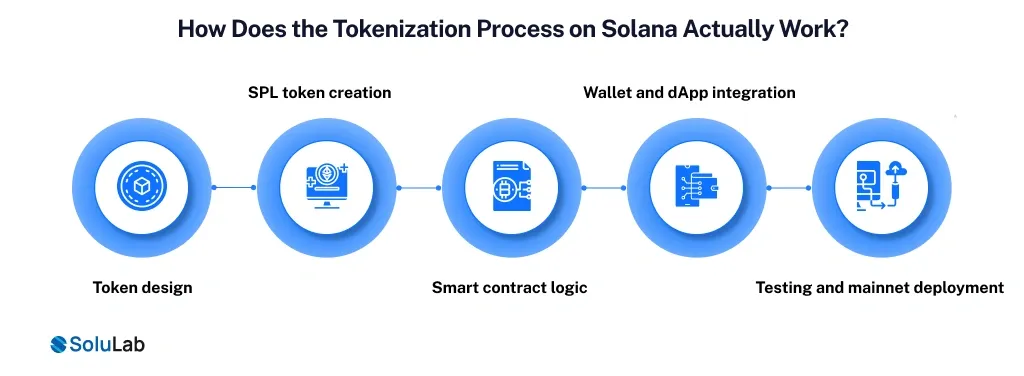

Building tokens on Solana follows a structured lifecycle. Below is how enterprises typically move from idea to launch.

Everything starts with clarity.

Before you create a Solana token, you define:

Strong token design avoids future rework and builds long-term value.

Most tokens on Solana are created using SPL Tokens, the native token standard.

At this stage, you’ll need Solana developers to:

This step officially brings your token into existence on the Solana blockchain.

For simple tokens, SPL standards are enough. As of advanced use cases, custom smart contract logic is added to:

This is where Solana token development services add real value by translating business logic into secure on-chain programs.

Once the token exists, it must be usable. This phase includes:

A good crypto token development solution ensures smooth user onboarding.

Before launch, everything is tested on Solana’s testnet:

After validation, the token is deployed to the mainnet and becomes fully live. This is the moment you officially

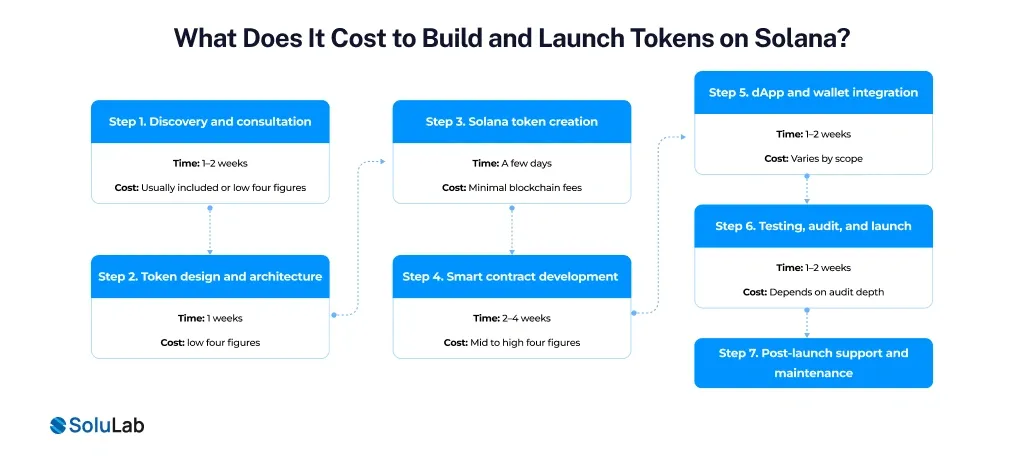

When businesses ask how much does it cost to create a Solana token, the real answer depends on how structured and scalable the project needs to be. Below is how most Solana token development services move from idea to launch, along with realistic cost and time expectations.

This phase defines the token’s purpose, supply, use cases, and technical scope. It helps avoid costly redesigns later.

Time: 1–2 weeks

Cost: Usually included or low four figures

Here, teams finalize tokenomics, permissions, and whether standard SPL Tokens are enough or custom logic is needed.

Time: 1 week

Cost: Low four figures

Developers create the Solana (SOL) token, configure minting rules, and deploy it on the testnet.

Time: A few days

Cost: Minimal blockchain fees

Custom logic is added for transfers, rewards, or governance if required.

Time: 2–4 weeks

Cost: Mid to high four figures

This step enables users to interact with the token inside apps and wallets.

Time: 1–2 weeks

Cost: Varies by scope

Before you launch a token on Solana, everything is tested and secured.

Time: 1–2 weeks

Cost: Depends on audit depth

Ongoing updates, monitoring, and 24/7 support keep the token stable and scalable.

Overall, the Solana Token Creation Cost remains highly competitive, making it an efficient choice for businesses looking to build tokens on Solana without long-term cost pressure.

Tokenization on Solana is not theoretical. It is already live across multiple industries.

Startups and SaaS platforms use Solana tokens for:

These tokens power real user activity at scale.

Game studios build in-game currencies and assets on Solana because of:

A notable example is xStocks.

xStocks offers tokenized equities, crypto tokens that mirror real stocks or ETFs. Each token acts like a “claim ticket” that tracks the price of a real share, similar to how a gift card balance represents money in a bank account.

This shows how Solana fits into serious financial infrastructure without sacrificing speed or usability.

While Solana real-world assets use specialized compliance tooling, some businesses explore hybrid models, starting with standard tokenization before evolving into regulated structures.

From the above information, you can see how tokenization on Solana is no longer just for crypto-native teams. It has become a practical option for businesses that want to:

Whether you plan to build tokens on Solana for utility, governance, or digital economies, we at SoluLab, an asset tokenization development company, offer clear consultation, integrations, and solutions.

With our 250+ experts’ support, you can even have the latest features: AI-enabled tokenization, compliance-friendly tokenization, and automated KYC/AML.

For more details, contact us today and build the future with present tokenization solutions.

The total Solana token creation cost usually ranges from $10,000 for basic SPL tokens to higher budgets for advanced. Especially for smart contracts, integrations, audits, and long-term Solana token development support.

Most businesses can build and launch a token on Solana in 4 to 8 weeks. This depends on token complexity, smart contract logic, wallet integration, testing, and compliance or security review requirements.

You can contact SoluLab directly through their website to discuss Solana token development solutions. Including consultation, cost estimates, timelines, and end-to-end support for launching tokens on Solana at enterprise scale.

SPL Tokens are used for crypto-native assets like utility tokens and rewards, while real-world assets on Solana require advanced compliance tools, permissioned transfers, and specialized infrastructure for regulated asset tokenization.

Yes. With low fees, high speed, and growing adoption for tokenization use cases like payments, gaming, and tokenized equities. Solana is increasingly chosen by enterprises building scalable blockchain products.