Building an Ethereum MVP development project sounds straightforward enough. You’ve got the idea, the team, maybe some investor backing, then reality hits. You start building, fees spike, security reviews come back with red flags, and suddenly you’re six months behind schedule, watching competitors launch while yours is still in limbo.

Here’s what most teams don’t realize: blockchain development isn’t just about writing good code, it’s about understanding a completely different ecosystem where gas economics, token design, and security layers are the architectural decisions that determine whether your MVP ships in three months or eighteen.

| And the numbers are sobering. According to Startuptalky, approximately 95% of blockchain and cryptocurrency startups fail, not because the idea was bad, but because teams repeat the same preventable mistakes. Another 90% of global startups fail in their lifecycle, but blockchain projects face even steeper odds. |

When you combine execution risk with market risk, you’re playing with fire if you haven’t thought through your roadmap carefully. This is what separates the 5% that ship, scale, and survive from everyone else – they avoided these seven critical mistakes.

Key Takeaways

- Ethereum MVP development teams waste 60-80% of their budget on features that don’t matter.

- Gas optimization on Ethereum isn’t optional; it’s your product’s competitive moat.

- Tokenomics failures kill projects faster than bad code.

- Architecture without upgrade paths means bugs become permanent.

- Market validation takes 12 weeks.

Why Does Ethereum MVP Break When Teams Try to Scale to Real Users?

Let’s be direct about this: 95% of blockchain startups fail, but the failure mode isn’t usually that the blockchain technology wasn’t ready. It’s what was built– that was the wrong thing.

When you look at what causes these failures, according to research from multiple sources tracking 2026 blockchain projects, it’s remarkably consistent:

1. Overfunding early-stage teams without clear PMF signals.

Investors throw $2M at a talented founding team with a whitepaper, and suddenly they’re burning $200K/month before they’ve talked to a single user. Runway extends the failure timeline, but it doesn’t prevent the crash.

2. Treating Ethereum like a Web2 platform.

Web2 developers who jump into blockchain often miss the fundamental difference – every operation has a cost attached to it. You can’t just spin up unlimited infrastructure. Gas matters. It matters before day one.

3. Poor security discipline baked in from day one.

According to Halborn data, 34.6% of direct contract exploits come from a lack of input validation alone. Then you add reentrancy attacks, unchecked external calls, and access control failures, and you’re looking at a security surface that demands professional audits, not code reviews between friends.

4. Tokenomics as an afterthought.

Teams decide to build a product first, then figure out the token later. By then, the market has moved on, or the economics don’t align with the actual usage patterns. Research shows that tokens launched without clear day-one utility fail 80% of the time.

5. Spreading resources across too many chains too fast.

The pitch sounds good – We’ll deploy on Ethereum, Polygon, Arbitrum, and Solana. But in Reality, you’ve now tripled your audit costs, multiplied your bug surface, and fragmented your liquidity so thin that no single chain has enough depth to create network effects.

The common thread? These aren’t technical failures. They’re execution failures. Teams know the best practices, but they skip the discipline it takes to follow them.

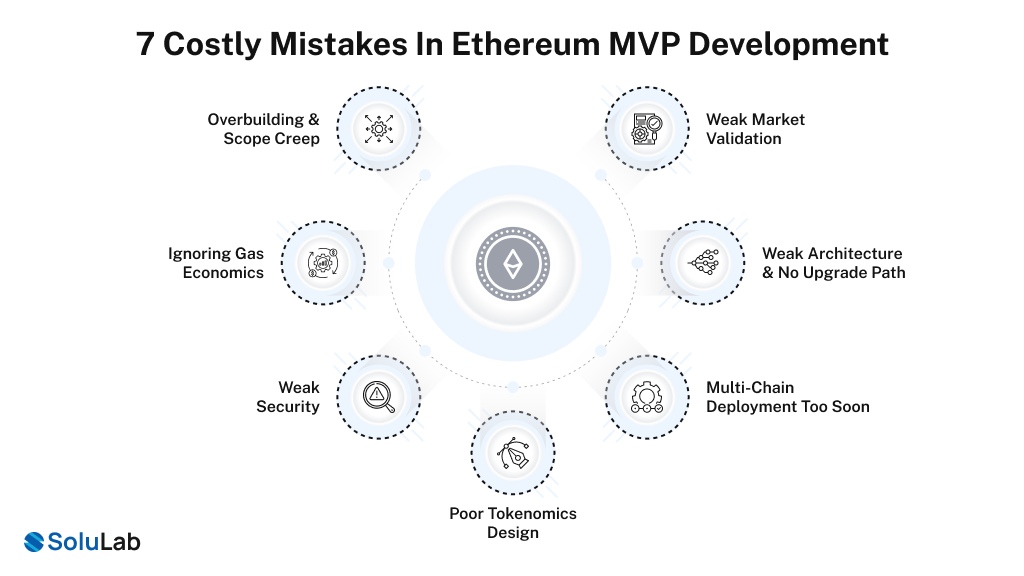

7 Costly Mistakes in Ethereum MVP Development

Here are the 7 mistakes that you should avoid when you build an MVP on Ethereum, as these mistakes can cause you more harm than good.

Mistake #1: Overbuilding & Scope Creep

This is the silent killer. You have an MVP timeline – let’s say six months. By month two, someone says, What if we added staking? By month four, we should have governance built in from day one. By month six, you’ve added 15 features, your original launch date has slipped to month 10, and your team is burned out.

Here’s what happens – build Ethereum MVP projects almost always start with ambition, but somewhere around week 8, founders realize they can do just a little more before launch. That little bit compounds. Six months becomes fourteen months. Your burn rate stays constant, but your runway tightens. Meanwhile, competitors who shipped a simpler version have real users and real feedback to iterate from.

The data backs this up. Teams that ship Ethereum MVP security with 3-5 core features in 3-4 months have a 68% success rate in reaching product-market fit. Teams that try to build 15+ features before launch? Their success rate drops to 8%. That’s not a coincidence, it’s a pattern.

What does overbuilding look like in practice?

- Day 30: We need DEX functionality. Added to scope.

- Day 60: Users will want cross-chain bridging. Added to scope.

- Day 90: We should have admin dashboards for management. Added to scope.

- Day 120: Governance should be decentralized from day one. Added to scope.

By day 180, your original feature set has been buried under layers of nice-to-haves. And here’s the killer part – Ethereum product development teams often don’t realize they’ve lost focus until they’re looking at a four-month delay.

The Fix we suggest to builders is to use ruthless prioritization. Not these features are important – brutal prioritization. What’s the one thing users absolutely need to get value from your protocol? Build that. Everything else is version 2.0, 3.0, or maybe never.

Set hard launch dates and hold them. If you’re not shipped by month six, you’ve already lost momentum. The market moves fast, but delays compound.

Create a core product first. Staking, governance, multi-chain support, advanced analytics – these belong on a roadmap, not in your MVP. Your MVP should solve one problem really well, not five problems adequately.

Mistake #2: Ignoring Gas Economics

Here’s a conversation that happens in every blockchain startup, usually around month three:

Users are saying transactions cost $40. That’s crazy.

Well, we could optimize, but that would push back the launch schedule…

Never mind, let’s just ship it. We’ll optimize after launch.

(Narrator: They never optimize after launch.)

Gas optimization, Ethereum isn’t some nice-to-have performance tweak. It’s not like shaving milliseconds off a Web2 API response. Gas economics are your product’s competitive moat. If your transaction costs $50 on Ethereum mainnet and a competitor’s costs $1 on Arbitrum, you’ve already lost.

Let’s talk numbers. Average gas fees on Ethereum in 2025 were $3.78 per transaction – down from $5.90 in March 2024, thanks to Layer 2 scaling improvements like EIP-4844, which reduced rollup gas fees by over 50%. But here’s the key insight: Layer 2s made that optimization, and your smart contract probably didn’t.

When you deploy to mainnet without optimizing for gas, your typical user transaction costs somewhere between $5-$20, depending on network congestion. Compare that to Arbitrum or Optimism, where the same transaction costs $0.20-$0.50. Which would you choose?

Teams that ignore this early make a critical error: they assume they can optimize later. Then later comes, and optimization would require redesigning the contract architecture. By then, users have switched to competitors on L2s. By then, your TVL is fractional.

Gas optimization for Ethereum comes down to understanding what’s expensive:

- Storage writes: 20,000 gas. This is your enemy. Every mapping update, every state change, is expensive.

- Storage reads: 200 gas. Basically free comparatively.

- Memory operations: Cheap during execution, but you pay gas for operations, not storage.

Real optimization means designing backwards from a cost target. Maybe you want users to pay $0.50 per transaction max. On the Ethereum mainnet, that’s roughly 250,000 gas (with $3.78 fees). That’s your constraint. Design the contract to fit that budget.

The Fix we suggest you:

- Use mappings instead of arrays for lookups. Direct access is 200 gas; iterating arrays is N*2000+ gas.

- Batch operations. Instead of 10 separate transfers, bundle them into one transaction.

- Minimize storage writes. Cache values in memory during execution, write once.

- Consider launching on Layer 2 first. Ethereum mainnet for security, L2 for UX. zkSync, Arbitrum, Optimism, and Base combined handle over $43.3 billion in TVL as of 2025.

You’re not choosing between gas optimization and features. You’re choosing between building on L2 and becoming irrelevant on mainnet.

Mistake #3: Weak Security

2025 was the year blockchain teams learned that security isn’t optional. According to 2026 security research from BlockEden, crypto thefts soared to $3.4 billion in 2025 alone, and DeFi assets lost to smart contract security vulnerabilities totaled $3.1 billion in just the first half of 2025.

The most exploited vulnerabilities were reentrancy attacks ($300M+ losses since January 2024), unchecked external calls, and lack of input validation (34.6% of direct exploits in 2025).

But here’s the scary part – most of these vulnerabilities are preventable. They’re not sophisticated attacks; they’re mistakes that proper audit processes catch immediately.

Yet teams skip smart contract audits because they cost $150K-$300K and push back launch timelines. They figure, we’ll ship it, monitor it closely, and audit once we have users. Then they get hacked, lose user funds, and the project never recovers.

Ethereum has become a target for sophisticated attackers precisely because money moves through it. The larger your TVL, the bigger the target on your back. And if your security posture is weak, you’re not a target, you’re a fish in a barrel.

According to OWASP 2025 Smart Contract Top 10 data, the most critical vulnerabilities include:

- Reentrancy attacks – Exploiting function callbacks before state updates complete

- Input validation failures – 34.6% of direct contract exploits

- Unchecked external calls – Proceeding after calls fail

- Access control vulnerabilities – Missing permission checks

- Flash loan attacks – Borrowing massive amounts within a single transaction

Here’s the brutal reality – professional auditors catch these in 40 hours of review. If you haven’t had external eyes on your code, you’re gambling with user funds.

The Fix we suggest you:

Build security into architecture, not as an afterthought.

- Internal review: 5% of the budget. Week 1-2 of development, continuously.

- Automated testing: Hardhat, Foundry, Slither. Run these constantly. They catch 40% of issues.

- Property-based testing: Use Echidna to find edge cases your unit tests missed.

- External audit: 8-10% of the budget. Select firms with strong track records. Trail of Bits, Cyfrin, and OpenZeppelin are industry standards. This is non-negotiable for anything handling user funds.

- Bug bounties: 2-3% ongoing. Immunefi and HackerOne let ethical hackers find what you missed.

- Post-launch monitoring: Tenderly and OpenZeppelin Defender provide real-time alerts on suspicious contract activity.

Security is the cost of doing business in Ethereum. Treat it as such.

Mistake #4: Poor Tokenomics Design

The moment you decide your project needs a token, you’ve entered a completely different game. Token design isn’t marketing, it’s economic design.

And according to Syndika’s 2025 research, 70% of tokens launched between 2021-2023 lost 90%+ of their value within a year. That’s not because of bear markets, but because teams built tokenomics that don’t work.

Here’s the core problem: tokens launched without a clear day-one utility become speculative instruments. They’re not products; they’re gambling chips. The team tells a story that you’ll need this token for governance in Q3, investors buy on the promise, and when Q3 arrives, and governance isn’t ready, or it’s ready, but nobody actually uses it, the price collapses.

Forbes research on tokenomics failures consistently shows that the top reasons tokens fail are:

- Token utility is promised for later: You’ll need it for staking in Q2. It’s now 2026 and staking is still planned for Q3.

- Vesting cliffs overwhelm market liquidity: 40% of the founders’ tokens unlock in month 12. The market can’t absorb that supply. Price drops 60%. Nobody’s surprised.

- Launch timing into bear markets: Launching a token when the market is contracting is like opening a restaurant during a recession. Possible? Sure. Wise? No.

- Unfair distribution: Founders, investors, and early backers have 80% of the supply. The community has 20%. The incentives are misaligned.

- No stress-testing: What happens if ETH crashes 30%? Does your token’s utility still matter? If users only hold it for price appreciation, you’re in trouble.

- Confusing listings with liquidity: Getting listed on Binance isn’t the same as having market depth. Thin order books mean price volatility and slippage that makes your token unusable.

The fix isn’t complex, but it requires discipline:

The Fix we suggest you:

- Token utility is day-1 necessity, not a roadmap promise: If you’re launching a governance token, governance must work on day one. If it’s a fee-bearing token, fees must be collected on day one. No exceptions.

- Stagger vesting: Instead of a one-year cliff, unlock over 24-36 months. This gives the market time to absorb supply without catastrophic price pressure.

- Stress-test your tokenomics: Model what happens if the price drops 30%, 50%, 70%. Does your system still work? Are there incentive misalignments?

- Launch during market strength: If you have the choice between Q4 2025 (strong market) and Q1 2026 (uncertain), pick Q4, as momentum matters.

- Validate token demand before TGE: Talk to 100 potential users. Would you actually use this token? Not Would you buy it, but Would you use it? Big difference.

Remember, the token market is efficient at pricing in reality. If your token doesn’t provide real value, the market will price that in immediately. There’s no hiding from it.

Mistake #5: Multi-Chain Deployment Too Soon

Here’s the pitch every investor loves to hear – Our MVP will launch on Ethereum, Polygon, Arbitrum, Optimism, and Solana. That way, we capture all the user bases.

But the reality is that you’ve now created five different smart contract codebases, tripled your audit costs ($150K × 3 = $450K), multiplied your bug surface area (each chain has unique quirks), and fragmented your liquidity so thin that none of your chains has enough depth to create network effects.

But in 2025, approximately 87% of Ethereum ecosystem liquidity stays on Ethereum and its Layer 2s (Arbitrum, Optimism, Base), but only 13% is fragmented across other chains. When projects deploy to five chains simultaneously, they discover too late that users don’t follow, but liquidity does, and liquidity congregates where critical mass already exists.

The timeline impact is brutal: teams planning six months for a single-chain MVP turn that into 14 months for multi-chain. That’s not anecdotal; that’s the pattern across 2025-2026 blockchain projects.

Here’s why multi-chain gets complicated:

- Each chain requires its own audit: Not just a review of shared code; each chain has its own risk profile. Solana’s program model is completely different from EVM chains. Different auditors might be needed.

- Cross-chain state sync is its own headache: How do you ensure state consistency across chains? Bridge contracts introduce additional security risks.

- Fragmented liquidity doesn’t add up: If you have $1M liquidity across five chains, each chain has $200K. That’s not enough depth for traders to execute large orders without massive slippage.

- User experience becomes a nightmare: Which chain should I use? How do I move my assets between chains? Why is this transaction 10x more expensive on Solana?

Smart sequencing is the opposite of simultaneous deployment: The Fix we suggest you:

- Phase 1 (Months 1-3): Ship on a single Layer 2 (Arbitrum, Base, or Optimism). These are EVM-compatible, have massive liquidity already, and offer 100x lower gas than mainnet.

- Phase 2 (Months 4-6): If you’ve achieved real product-market fit (10K+ active users, 30%+ retention), add Ethereum mainnet for the security-maximalist crowd.

- Phase 3 (Months 9-12): Only after you’ve proven the model on Ethereum/L2 should you consider Solana or other L1s. By then, your team understands multi-chain operations.

This sequencing also buys you time. You’re not trying to build and audit five implementations simultaneously. You’re proving the model, then expanding. This is how successful multi-chain projects actually work.

Mistake #6: Weak Architecture & No Upgrade Path

Here’s a fact that should scare you: Smart contracts are immutable. Once deployed, you can’t edit them. You can’t patch them or fix bugs post-launch.

Well, technically, you can use proxy patterns to upgrade the logic contract while preserving state. But teams that don’t plan for this from day one end up in an impossible situation: they have bugs, no way to fix them, and users have lost money.

This happened in 2025 and 2024 with several DeFi projects. Contracts deployed without upgrade paths experienced permanent vulnerabilities. The team’s only option was to deploy v2, migrate users, and hope nobody noticed the security issue.

Ethereum MVP development without considering upgrade paths is like building a house without a foundation plan. You might build it, but the second the ground shifts, it’s gone.

Here’s what proper architecture looks like:

Proxy Pattern:

Instead of deploying a logic contract directly, deploy a proxy contract that delegates calls to the logic contract. This way, you can upgrade the logic contract while preserving user funds in the proxy.

There are different flavors:

- Transparent Proxy: Admin can upgrade; external users can’t. OpenZeppelin’s standard.

- UUPS Proxy: Upgrade authority is on the logic contract, not the proxy. More gas-efficient; more decentralization-friendly.

Modular Design:

Don’t cram everything into one 5,000-line contract. Break functionality into separate, focused contracts:

- Core protocol logic

- Token mechanics

- Governance

- Integration layer

Each contract has a single responsibility, fewer lines of code, smaller audit surface.

Role-Based Access Control:

Use OpenZeppelin’s AccessControl module (or similar) for permission management. Don’t hardcode admin addresses. Use roles, and make role changes explicit.

| // Good: Role-basedbytes32 public constant ADMIN_ROLE = keccak256(“ADMIN_ROLE”);require(hasRole(ADMIN_ROLE, msg.sender), “Not admin”); // Bad: Hardcodedrequire(msg.sender == 0x123…abc, “Not admin”);The hardcoded approach means if you need to change the admin, you’re stuck. Roles let you update permissions without redeploying. |

The Fix we suggest you:

- Plan for upgradability from day one, but use proxy patterns.

- Design modular contracts. Separated concerns, which are easier to audit and fix.

- Implement role-based access control properly.

- Document your architecture. Future maintainers (including future-you) need to understand why you made these decisions.

- Test upgrade scenarios. Not just the initial deployment, but also test that upgrades work correctly.

Architecture decisions in the first two weeks of development save months of pain later.

Mistake #7: Weak Market Validation

Let’s talk about the elephant in the room: you might be solving the wrong problem.

This is the hardest mistake to admit because it typically happens after you’ve built the MVP. You’ve shipped, you’ve deployed, you’ve got the code working, and nobody’s using it.

It happened to Civil (a blockchain-based journalism platform that shut down in 2019). It happened to Provenance (supply chain tracking on blockchain). It happened to dozens of projects in 2024-2025. Great technology, poor product-market fit. They built for crypto insiders, not for the problem they claimed to solve.

According to Growth List research, 90% of early-stage crypto startups fail to secure follow-on funding. That’s not because they ran out of money technically; it’s because they couldn’t prove they were solving a real problem for real users.

Here’s what weak market validation looks like:

- Your beta users are all other crypto developers, not actual end-users.

- You can describe your product in crypto terms, but you can’t explain what problem it solves in plain English.

- You don’t have competitors. Instead, our approach is better than XYZ; nobody else is doing this. That’s a red flag. It might mean the problem doesn’t exist.

- You built for transaction costs, not for user needs. Your pitch is that we’re cheaper than the competitor. That’s not a moat; that’s a feature.

Ethereum MVP development that skips validation is being built in a vacuum. The Fix we suggest you:

Spend the first 12 weeks validating before you code anything:

| Phase | Timeline | Primary Objective | Key Actions | Output / Success Signal |

| Problem Validation | Weeks 1–2 | Confirm the problem is real and urgent | Interview 10+ actual users (not investors or developers); document the problem in users’ own words; validate whether they are actively trying to solve it today | Clear, user-validated problem statement with urgency |

| Competitive Landscape | Week 3 | Understand why others failed or succeeded | Analyze on-chain and off-chain competitors; identify gaps, failed assumptions, and winning differentiators | Defined market gap and positioning hypothesis |

| UX Prototyping | Weeks 4–5 | Test usability before writing code | Build Figma mockups (no code); test user flows with 5 target users; iterate rapidly based on friction points | Validated user flow and MVP feature shortlist |

| Beta Recruitment | Weeks 6–8 | Secure real-world early users | Recruit 50–100 early adopters; clearly position the product as beta; set expectations around instability | Committed beta cohort ready to test |

| Feedback Iteration | Weeks 9–10 | Identify true value-driving features | Track feature usage; observe drop-offs; isolate the single feature delivering core value | Ruthlessly prioritized MVP scope |

| MVP Launch | Weeks 11–12 | Ship only what matters | Launch with beta-validated features; remove unused functionality; focus on reliability over breadth | Lean MVP aligned with real user demand |

This process takes discipline because it’s not shipping code, it’s learning. But it prevents you from spending six months building the wrong thing.

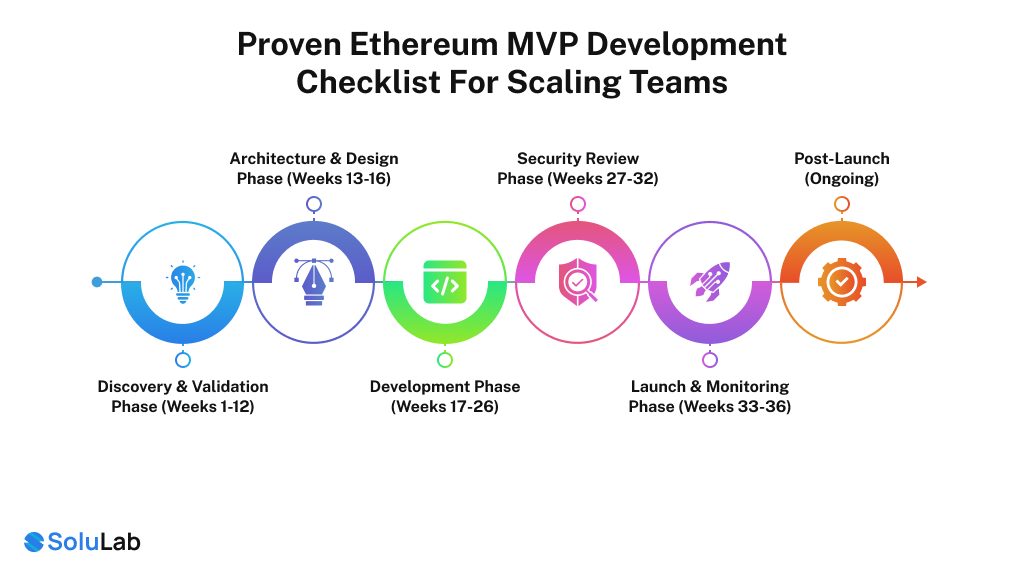

Proven Ethereum MVP Development Checklist for Scaling Teams

Use this checklist as you build your Ethereum MVP security, architecture, and launch plan. Print it. Check items off. Use it as your north star.

- Discovery & Validation Phase (Weeks 1-12)

If you’re serious about building an Ethereum MVP that actually survives, the work starts much earlier than most teams expect. Long before contracts or tooling, it’s about getting uncomfortably close to the problem.

That usually means talking to real users, often non-crypto ones, and learning how they describe the pain in their own words, not how we’d explain it in a pitch deck. Teams that rush past this step often end up solving the wrong thing, just with better code.

- Architecture & Design Phase (Weeks 13-16)

As those conversations take shape, it becomes easier to see what already exists, both on-chain and off-chain, and where your product actually fits. Simple prototypes, tested early, tend to surface issues that no architecture diagram ever will.

By the time MVP development begins, the strongest teams already have early users waiting, some retention signal, and a clear answer to a hard question: does this really need blockchain right now, or are we forcing it? When the answer is yes, starting on an Ethereum L2 usually keeps costs and complexity under control.

- Development Phase (Weeks 17-26)

Once validation is done, architecture choices start to matter a lot more than most founders realize. This is where small decisions quietly lock you into months of future work. Knowing what must live on-chain, what can stay off-chain, and how you’ll upgrade later saves real pain down the line. Access control, upgrade patterns, and gas costs aren’t details– they shape how safe and usable the MVP will be. Writing these decisions down, even informally, helps teams stay aligned when things get messy.

Blockchain app development itself is rarely the hard part. The real challenge is discipline. Using well-tested libraries, protecting against basic attack vectors, validating inputs, and writing solid tests isn’t glamorous, but it’s what separates projects that limp to audit from those that pass cleanly. Teams that skip this phase often think they’re moving faster, but end up paying for it twice.

- Security Review Phase (Weeks 27-32)

Security, too, isn’t something you bolt on at the end. Fresh eyes on the code, automated tools, and eventually an external audit all catch different kinds of problems. The best teams also assume something will go wrong post-launch and plan for it– clear monitoring, incident response, and a way for researchers to report issues responsibly.

- Launch & Monitoring Phase (Weeks 33-36)

When it’s finally time to launch, things should feel boring. Testnets, small betas, fixing what actually breaks, and only then pushing to mainnet. Monitoring tools go live, communication channels are clear, and token plans, if they exist at all, are pushed far enough out that the product has proven it deserves one.

- Post-Launch (Ongoing)

After launch, the job doesn’t end. Contracts need watching, users will show you where the friction is, and usage patterns will force you to optimize in ways you couldn’t predict earlier. Expanding chains or designing tokenomics too early usually does more harm than good. The teams that last are the ones that let real traction lead the roadmap, not the other way around.

Conclusion

Building on Ethereum in 2026 is harder than it’s ever been, not because the technology is more complex, but because the bar for quality has risen. Users expect professional-grade security. Token holders expect rational tokenomics, while regulators expect KYC/AML integration. The days of shipping fast and breaking things are over. The 5% of projects that succeed aren’t succeeding because they got lucky. They’re succeeding because they applied discipline:

- Ruthless scope discipline (3-5 features, not 20).

- Gas economics are designed into architecture from day one.

- Security was budgeted at 10-15% from the start.

- Tokenomics is designed for actual utility, not speculation.

- Single-chain launch followed by strategic expansion.

- Architecture built for upgradability.

- 12 weeks of market validation before writing code.

These aren’t best practices. They’re table stakes. But the good news is the playbook is clear. The teams that follow it ship, gain traction, raise follow-on funding, and SoluLab, as an Ethereum development company, can help you achieve it. The teams that skip steps learn expensive lessons in production. Your choice is either learn from others’ $2M mistakes or pay that tuition yourself.

FAQs

Layer 2 (Arbitrum, Base, Optimism) 100% of the time. Gas is 100x cheaper, security is equivalent (settlement to Ethereum mainnet), and users already have bridge tooling. Only mainnet if you specifically need maximum decentralization or have regulatory requirements. Otherwise, you’re paying $50 per transaction to launch a product that nobody’s using yet. That’s backwards.

10-15% of your total MVP development budget. That includes internal review (ongoing), automated testing (continuous), and external audit ($150K-$300K depending on contract complexity). Skipping an external audit is like removing airbags from a car. The accident might not happen today, but when it does, it’s catastrophic. Include bug bounty (2-3% ongoing) and post-launch monitoring (2%). The total cost of security isn’t negotiable if you’re handling user funds.

After you have a clear product-market fit: 10,000+ active users, 30%+ week-over-week retention, and obvious token utility. Launching earlier makes you a speculation vehicle, not a product. The market will price that in immediately. If you launch too early, your token becomes a liability. If you launch at the right time, with real demand, your token becomes a tool that actually gets used.

Depends on funds at risk. If you’re handling user assets, an external audit is non-negotiable. If you’re building a governance token with no financial logic, you might skip it. But “might” is the operative word. Insurance costs the same as an audit, minus the prevention benefit. Insurance doesn’t prevent hacks; audits prevent them. The choice is yours, but it’s an explicit risk decision.

4-6 months for a functioning MVP, assuming a 2-3 person team with an external audit. Anything shorter and you’re skipping validation or security. Anything longer and you’ve lost momentum. If you’re hitting month 8 without a shipped product, you’ve slipped scope somewhere. Reset.

3-5 core features maximum. If you can’t explain what your MVP does in two sentences, it’s too complex. Staking, governance, multi-chain support, and NFT integration belong on a roadmap, not in v1.0. Your MVP should be the minimal viable version of your core value prop. Everything else is a distraction.