The global crypto market now serves over 560 million users, and that number is growing fast. With more institutions and enterprises exploring digital assets, one key decision stands out: should you build on a centralized exchange (CEX) or a decentralized exchange (DEX)?

Choosing between CEX vs DEX isn’t just a technical decision. It affects how you manage compliance, user experience, custody of assets, liquidity, and scalability. For businesses building crypto platforms, understanding the real-world pros and cons of each model is critical.

Whether you’re launching a DeFi project, a fintech app, or an enterprise-grade crypto solution, this guide breaks down DEX vs CEX from a business-focused angle. You’ll get clarity on features, use cases, costs, and long-term strategies.

Centralized Exchange (CEX) development gives your business full control over security, user experience, and regulatory compliance. This type of crypto exchange is ideal for enterprises looking for fast transactions, strong liquidity, and smooth onboarding for users, especially when dealing with fiat currencies.

A CEX is often the preferred choice for enterprises that want to launch quickly, integrate with banks, or offer a wide range of crypto-fiat services. However, it’s important to have strong security and compliance frameworks in place.

A Decentralized Exchange (DEX) is a type of crypto exchange that allows users to trade digital assets directly, without any middlemen like banks or centralized companies. These exchanges are built on blockchain technology and powered by smart contracts, which means trades happen automatically, securely, and transparently.

Popular examples include Uniswap, PancakeSwap, and Curve. Users can swap tokens instantly through liquidity pools, with no sign-up, approval, or central control. This makes DEXs open, fast, and permissionless.

For enterprises, launching a DEX platform means giving users complete control over their assets, enhancing privacy, and minimizing regulatory dependencies. Partnering with a reliable Decentralized Exchange development company ensures your DEX is secure, scalable, and tailored to long-term business goals.

If your focus is user privacy, global access, and decentralized control, building a DEX can set your platform apart. A leading Blockchain development company helps you create a secure and scalable DEX tailored to your enterprise needs.

Choosing between a CEX vs DEX is more than just a tech decision; it’s a strategic move that affects compliance, user trust, scalability, and revenue.

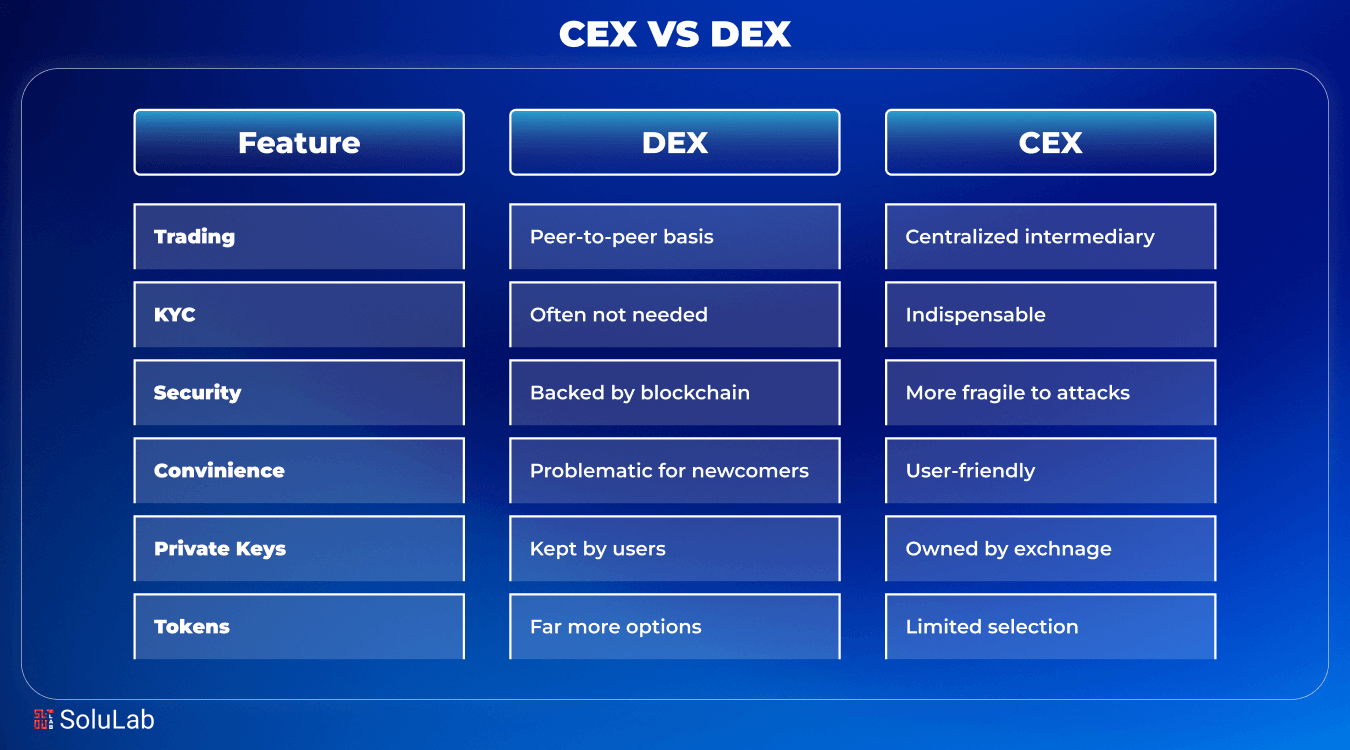

| Feature | Business Impact |

| Custody of Assets | CEXs hold user funds (centralized custody), while DEXs give users full control (non-custodial). |

| Liquidity | Generally higher on centralized exchanges, making them better for high-volume trading. |

| KYC & AML | CEXs fully support compliance, making them ideal for regulated industries. |

| Privacy | DEXs offer better user privacy due to fewer onboarding requirements. |

| Speed & Fees | CEXs are faster with lower latency. Some DEXs may charge higher gas fees depending on the network. |

| Development Complexity | Easier to build and manage on a CEX. Decentralized exchange development may require complex smart contracts. |

| Smart Contract Risk | Present mostly in DEXs due to their on-chain nature. Smart contract audits are critical. |

For any enterprise, the decision between centralized vs. decentralized crypto exchanges should depend on:

Check Out Our Blog Post: How to Build Your Own DEX Like Aster

The market in 2025 is split but growing fast. Most of the daily crypto trading volume (over 72%) still happens on centralized exchanges (CEXs). They’re easier to use, offer higher liquidity, and are trusted in regulated markets. But decentralized exchanges (DEXs) are catching up, especially in DeFi, Web3, and privacy-focused sectors.

As per Chainalysis, DEX trading volumes rose by 23% year-over-year in 2024, and 35% of that came from institutional wallets. This shows strong demand for decentralized platforms, especially in regions where users value control and transparency.

Today, many DeFi development companies are building hybrid exchanges or cross-chain DEXs. These platforms let users enjoy decentralization while still offering the liquidity and speed of CEXs. This mix is becoming the preferred approach for enterprises and startups launching in global markets.

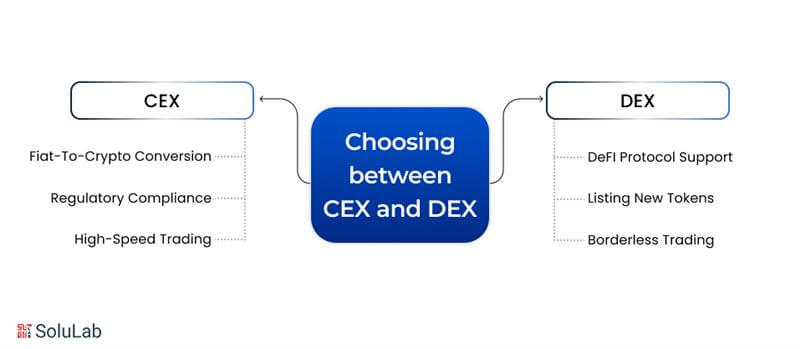

Choosing between a centralized or decentralized exchange depends on your business goals and target audience. Here’s a quick guide:

A Blockchain development company can help you evaluate these options and design the right exchange architecture for your business goals. If you are interested in building your exchange?

Yes, and many businesses are doing exactly that. A hybrid crypto exchange brings together the best of both worlds: the speed and easy user experience of a Centralized Exchange (CEX) and the security and transparency of a Decentralized Exchange (DEX).

These platforms often use smart contracts to handle settlements while keeping order books centralized. This setup improves liquidity, speeds up trading, and still maintains a level of trustless execution.

Projects like Serum and Injective follow this hybrid model. If you’re planning to build a hybrid platform, it’s also possible to integrate a Crypto Trading Bot that can operate across both CEX vs DEX models to maximize trading efficiency.

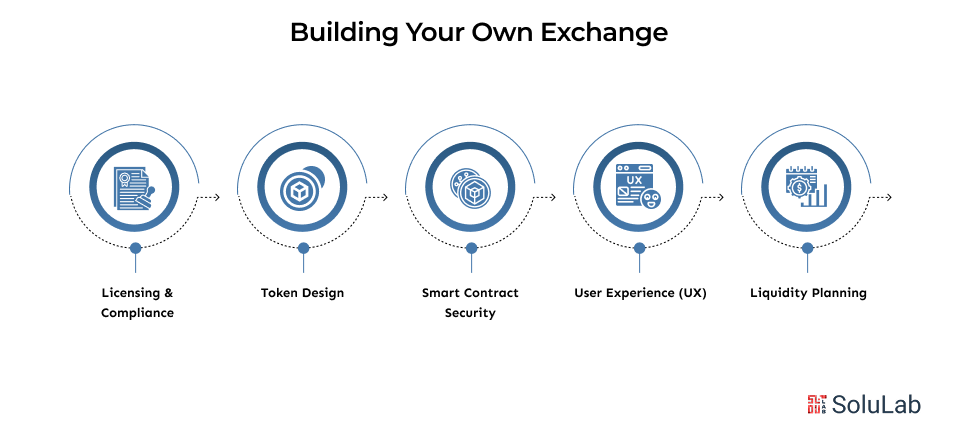

Before you build a crypto exchange, here are key things every business should consider:

Partnering with a trusted Cryptocurrency Development Company ensures your platform is secure, compliant, and ready to scale.

The cost of building a crypto exchange depends on the type, Centralized (CEX) or Decentralized (DEX), and the features you need.

| Exchange Type | Estimated Cost Range | Key Cost Factors |

| Centralized Exchange (CEX) | $120,000 – $350,000 | Margin trading, KYC/AML compliance, fiat ramps, backend infrastructure |

| Decentralized Exchange (DEX) | $80,000 – $250,000 | Smart contract development, UI/UX for on-chain trading, security audits, tokenomics |

Working with an experienced white label exchange development company helps reduce risk, manage costs better, and ensure your platform is compliant and scalable from day one.

At SoluLab, we build both Centralized Exchanges (CEX) and Decentralized Exchanges (DEX) tailored to enterprise needs.

As a leading cryptocurrency exchange development company in the USA, we combine our experience in DeFi, smart contracts, and AI integration to help enterprises launch faster, scale securely, and stay future-ready.

There’s no one-size-fits-all answer in the CEX vs DEX crypto conversation. The best choice depends on your business goals, customer expectations, regulatory requirements, and long-term growth plans.

Whether you want full control with a Centralized Exchange, or transparency and self-custody with a Decentralized Exchange, success comes down to building the right foundation. With a trusted Decentralized Exchange development Partner, your company can confidently launch in the competitive world of Crypto Exchanges and stay ahead.

Let’s help you build it right. Contact us to get started!

For businesses, CEXs provide smoother onboarding, regulatory compliance, and deep liquidity. But DEXs offer security, transparency, and lower counterparty risk, making them ideal for DeFi-native firms.

CEX platforms need user KYC, support, and backend management. DEX platforms rely more on smart contracts, wallet integration, and on-chain liquidity. Your platform’s vision should guide this decision.

Some of the leading DEXs include Uniswap, PancakeSwap, dYdX, and Curve. These platforms are open-source and serve as benchmarks for enterprises planning to build similar infrastructure.

They form the core infrastructure of the crypto economy, enabling token liquidity, fundraising (through IEOs/IDOs), and user onboarding. A reliable exchange boosts brand trust and transaction volume.

It depends on your audience and market. If you’re targeting retail users and require regulatory ease, go with a CEX. If you’re DeFi-focused, looking for transparency and low-cost operations, a DEX may be better.

Look for a team with proven experience in exchange architecture, smart contract development, security audits, and regulatory readiness. SoluLab builds both CEX and DEX platforms from scratch with custom features for enterprises.