Tokenized real estate is growing from just an idea to an innovative investment model. XRPL plays a major role in this shift due to its speed, low fees, ecosystem growth, and compliance-ready design. For businesses exploring tokenization, XRPL lowers operational barriers and supports scalable, regulated property markets.

As global adoption rises, from the UAE’s government-backed initiatives to institutional pilots. XRPL blockchain development gives companies a practical path to launch secure and accessible real estate tokenization platforms.

Key Takeaways

|

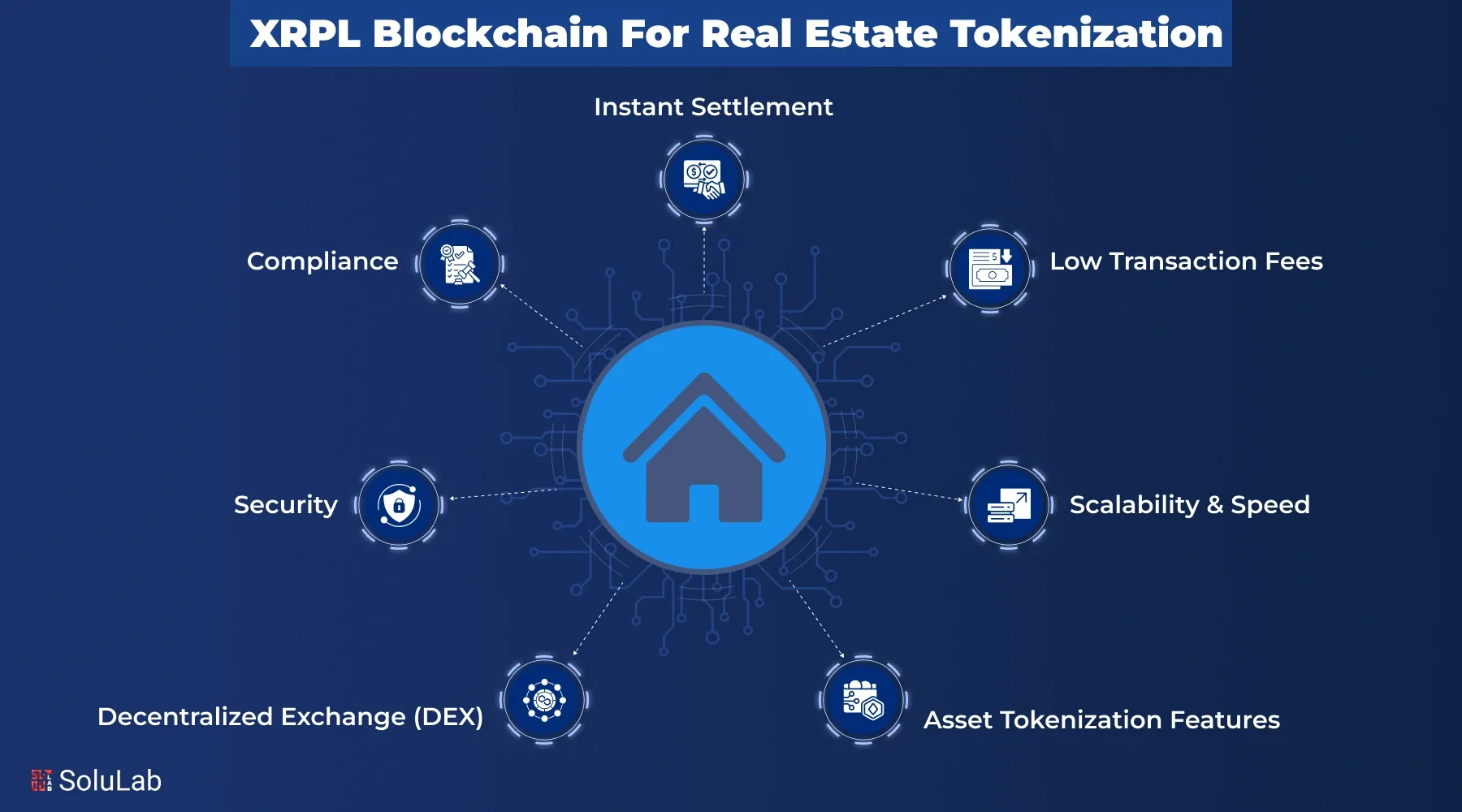

XRPL delivers features that align with real-world property needs. These features help businesses reduce friction, improve liquidity, and scale across markets. XRPL services also simplify asset issuance and compliance, which is crucial when dealing with high-value assets like real estate.

Read Also: Tokenization Platform Development Checklist for Enterprises

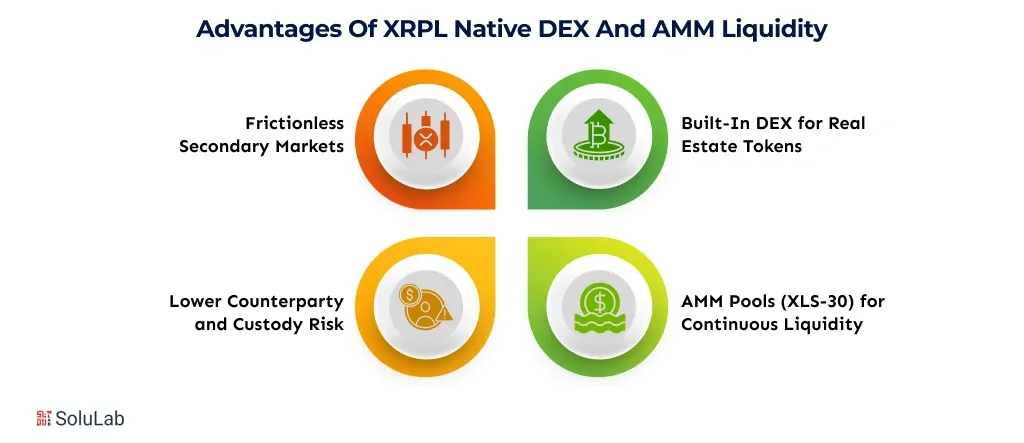

Liquidity is often the biggest challenge in tokenized real estate. XRPL solves this at the protocol level, not through external tooling. This gives platforms stronger liquidity flow and predictable performance.

The XRPL DEX enables direct trading of XRPL tokens on the ledger. There is no off-chain engine, no external orderbook dependency, and no custody gap. This approach improves transparency, which matters for regulated asset markets. Businesses benefit from predictable execution, auditable pricing, and lower operational effort.

XRPL AMM liquidity real estate pools allow property tokens to pair with XRP or stablecoins. These pools support continuous buy-sell activity. AMMs reduce slippage and maintain active pricing even when trading volumes fluctuate. Liquidity providers earn a share of fees, which encourages long-term pool participation.

Real estate has always struggled with resale liquidity. Using a DEX on XRPL solves this problem by making token transfers instant and trustless. Buyers and sellers interact directly on-chain. This creates a real secondary market where tokens no longer sit idle.

Since all trades settle on the ledger, custody risks shrink. Transfers become transparent and verifiable. This is helpful for enterprises building regulated marketplaces and for investors who want clear audit trails.

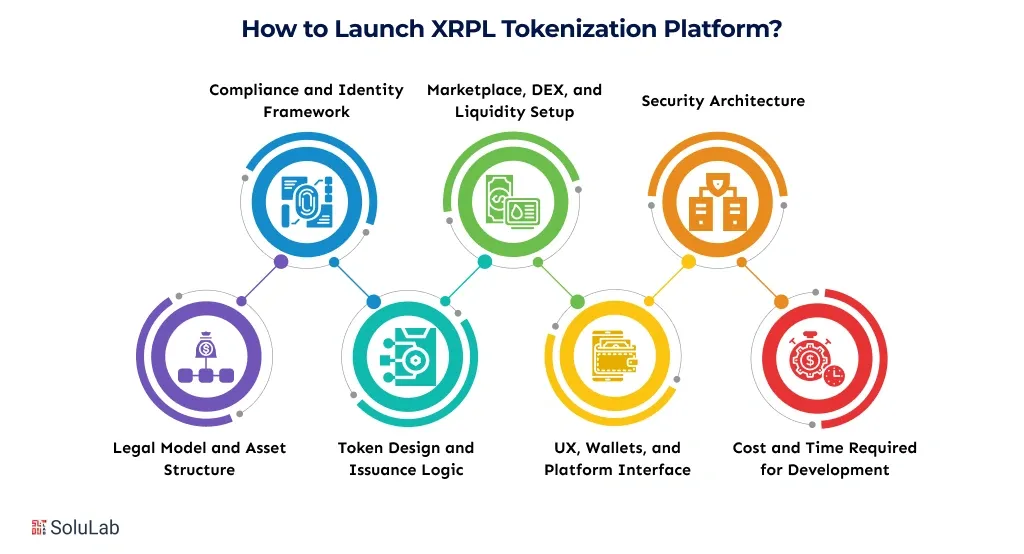

Building a real estate tokenization platform requires legal clarity, technical execution, and smooth onboarding for users. Below is a step-by-step structure that businesses can follow.

Start by selecting a legal wrapper. SPVs, trusts, or REIT-style structures work well. Map investor rights, dividend rules, liquidation logic, and governance. Match the wrapper with the chosen token type: fungible tokens for fractional units or NFTs for whole-property structures.

Set up workflows for KYC and AML. Use authorized trust lines to limit access only to verified investors. Build jurisdiction-based restrictions according to markets like the US (SEC), EU (MiCA), UAE (VARA), or Singapore (MAS). Protect investors with clear legal terms that align with token logic.

Use XRPL Issued Currencies to mint real estate tokens. Apply freeze or clawback controls if required by regulations. Write token distribution flows for dividends, rental income, and voting. Align tokenomics with business goals such as buy-back programs or liquidity incentives.

Enable listing on the XRPL Dex. Activate AMM pools for deeper liquidity. Form partnerships with fintech apps, RWA platforms, and exchanges. Add LP rewards that encourage long-term liquidity. Balance incentives across retail and institutional investors.

Investors should use a simple interface. Support wallets like Xumm or institutional custodial wallets. Build investor dashboards that show holdings, yield, and property documents. Add multilingual support and a clean UI to reduce onboarding friction.

Use multi-sig wallets for issuer accounts. Secure private keys through hardware-based storage. Conduct audits for every core module. Add monitoring modules for suspicious transfers and failed access attempts.

A basic real estate tokenization platform on XRPL usually takes 4 to 5 weeks. This includes legal coordination, token issuance, basic dashboards, and compliance setup. And costs $15k.

A full-scale XRPL Tokenization Platform with multi-country compliance, custody integration, and liquidity engineering can take 3 to 5 months.

Costs vary by scope. Advanced builds with institutional security, cross-chain support, and AMM engineering require more budget. The best thing to do is to contact a tokenization development company that has expertise and is low-cost.

Compliance is a major barrier in tokenization. XRPL helps businesses reduce complexity through native tools that enforce rules at the token level.

Authorized trust lines ensure tokens only reach approved investors. Freeze and clawback features support legal action and dispute settlements. These tools allow platforms to stay aligned with the SEC, MiCA, VARA, and MAS frameworks.

Integration with identity providers allows KYC data to connect with trust lines. Transactions remain transparent, and on-chain activity becomes auditable. This simplifies cross-border investor onboarding. Typical fees can be as low as $0.0002 per transaction. These metrics make high-volume trading and microdividend payouts economical and auditable.

Using Hooks or sidechains, businesses can apply geographic limits or enforce rule sets depending on investor location. This is useful when dealing with the US (strict securities rules), the EU (MiCA), or the UAE (real estate licensing via DLD and VARA).

There are some on going adoption news that prove XRPL supports regulated global markets:

Read Also: 9 Key Features of Next‑Gen Tokenization Platforms for 2030

XRPL enables practical business models and product features that will shape the market:

Technology is evolving fast, and XRPL is shaping a new era of secure, scalable, and compliant tokenized real estate. To keep pace with market shifts, you need a development partner who understands XRPL blockchain, regulatory needs, and real estate workflows. That is where SoluLab helps you.

At SoluLab, the leading real estate tokenization development company, we help you build reliable marketplaces, automate compliance, and unlock global liquidity. Whether you plan to tokenize property on XRPL or launch a full XRPL Tokenization Platform, our experts guide you through every step.

If you are ready to turn your vision into a live platform, connect with SoluLab today.

Real estate developers, property managers, REITs, brokers, fintech platforms, and investment firms benefit most. XRPL reduces settlement delays, lowers transaction costs, and supports fractional ownership for global investors.

XRPL uses trust lines, freeze controls, clawback, and automated KYC checks to meet regional rules. This makes it easier to follow US, EU, UAE, and Singapore regulations without complex customs systems.

SoluLab brings strong Web3 expertise, clear compliance support, and reliable engineering. The team delivers secure XRPL platforms, scalable architectures, and smooth user experiences tailored for property and investment businesses.

A basic build starts in the lower six figures. Complex platforms with multiple jurisdictions, automated compliance, dashboards, liquidity pools, and advanced security move toward the mid-to-high six-figure range.

Companies can tokenize rental income streams, launch global property marketplaces, create ESG investment products, offer fractional pre-sale tokens, or use AMM-based rewards to attract long-term investors.