The biggest change in global banking in the last 50 years is happening quietly and most businesses still have no idea how big it is. By November 2025, the real-world asset (RWA) tokenization market had already hit $35.9B, and it’s now racing toward a massive $9.43T by 2030.This is regulated, institutional money moving on-chain and it’s about to rewrite how companies handle payments, liquidity, and cross-border transactions.

At the center of this shift is tokenization platform development for deposits – simple, safe digital versions of the money already sitting inside banks. Unlike volatile crypto, these deposits are backed 1:1 by regulated accounts and give businesses in the U.S. and UAE something they have never had before like instant payments, real-time liquidity, 24/7 settlement, and fully automated financial workflows on trusted banking rails.

And now comes the biggest signal yet. HSBC, one of the world’s top banking giants, will launch tokenized deposit services for corporate clients in early 2026 across both markets. This is production-grade infrastructure for some of the most powerful financial systems in the world. For any company looking to modernize payments, build on-chain products, or upgrade treasury operations, this move changes everything.

The world of banking is changing, and HSBC is ready to lead. With the RWA tokenization market projected to reach $30 trillion by 2034, larger than the combined GDP of the U.S., China, Japan, and Germany, tokenized deposits are no longer a futuristic idea. HSBC’s tokenized deposits aim to capture this massive opportunity, offering businesses and banks a modern way to manage money.

So why launch in the U.S. and UAE first. This is because In April 2025, U.S. regulators removed restrictions on banks engaging with digital assets, opening the door for blockchain-based deposits. Corporate interest is growing fast as 25% of North American CFOs plan to use digital currencies within the next two years.

Meanwhile, the UAE is already a global hub for digital finance. The CBUAE’s FIT Programme is nearly complete, the digital banking market is projected to hit $3.61 billion by 2029, and regulatory support from VARA makes adoption easier. The country’s growing wealthy population as 10,000 new millionaires in 2025 alone, adds a strong business case.

HSBC’s journey to this point has been deliberate. From Hong Kong’s TDS launch for HKD and USD to Singapore’s cross-border integrations, and proof-of-concepts in the UK and Luxembourg, every step refined their blockchain infrastructure, compliance, and operations.

By 2026, HSBC will offer a fully tested, mature tokenized deposit system, enabling faster payments, better liquidity, and on-chain settlement. It’s a new era in banking, giving businesses and banks a chance to operate smarter, faster, and more efficiently with secure blockchain-ready solutions.

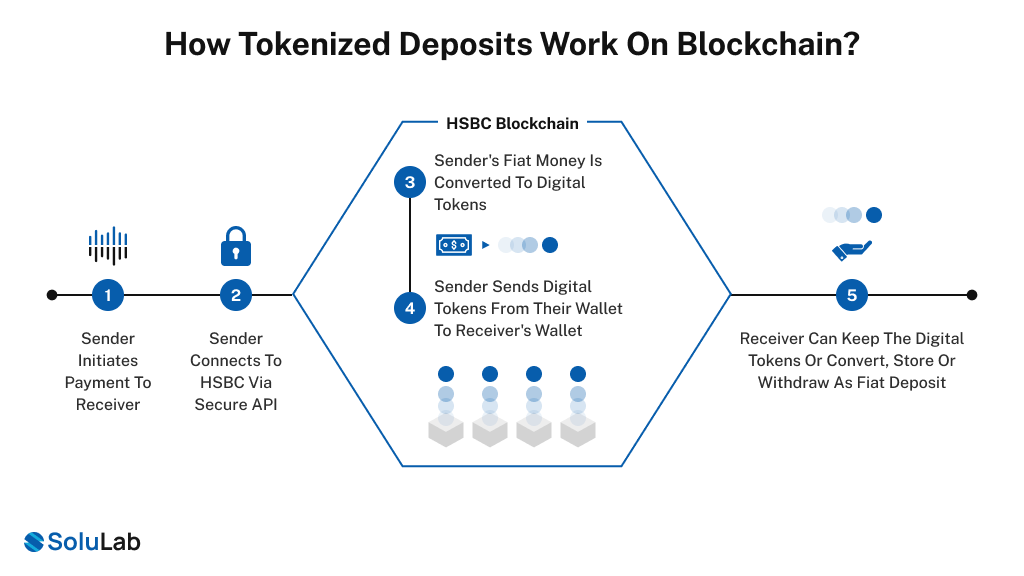

HSBC’s tokenized deposits are digital versions of traditional bank deposits. Unlike cryptocurrency or stablecoins, they are fully regulated, FDIC-insured (in the U.S.), and earn interest but they come with the speed, transparency, and automation of blockchain.

Here’s the difference between Traditional Banking and Tokenized Deposits:

| Process | Traditional Banking | Tokenized Deposits |

| Deposit Handling | Deposit $1 million → Bank holds funds in reserve | Deposit $1 million → Converted into a digital token on blockchain |

| Settlement Time | 2–5 business days | Instant settlement, 24/7/365 access |

| Accessibility | Limited access, mostly during business hours | Funds accessible anytime, globally |

| Automation | Manual approvals and payments | Smart contracts automate payments and workflows |

| Security & Insurance | Standard banking protections | FDIC-insured (U.S.), fully regulated, blockchain-backed |

| Key Takeaway | Traditional, slower, office-hour dependent | Safe, insured, faster, and smarter digital banking experience |

Only approved banks and corporate clients can access the network. This ensures security, compliance, and control, unlike public blockchains like Bitcoin or Ethereum.

Payments and processes are programmed on-chain. For example: Pay the supplier only when the invoice is verified. The blockchain technology executes it automatically, in milliseconds, removing human error and delays.

Transactions settle in seconds, anytime, even outside banking hours. Multinational corporations can manage cross-border cash flow instantly, without waiting for bank openings.

Supports USD, AED, EUR, HKD, SGD, and other major currencies. Cross-border transfers that normally take days now settle in seconds, saving time and cost.

In 2025, the U.S. banking sector took a big step forward. Regulators shifted from warning about digital assets to supporting responsible innovation.

Here’s what changed for banks:

And the result is that U.S. companies are expected to adopt tokenized deposit services faster through 2026-2027. Early adopters gain a competitive edge in corporate banking.

But the UAE takes a proactive approach. Its Central Bank is building infrastructure to attract global institutional capital.

Here’s what happened:

For HSBC, the UAE is a strategic hub to capture regional wealth and build operational dominance in the Middle East.

Tokenized deposits are redefining how money moves in banking and enterprise finance. By combining blockchain efficiency, automation, and real-time visibility, they offer faster payments, lower risks, and smarter treasury management. Here’s how banks, institutions, and enterprises can benefit.

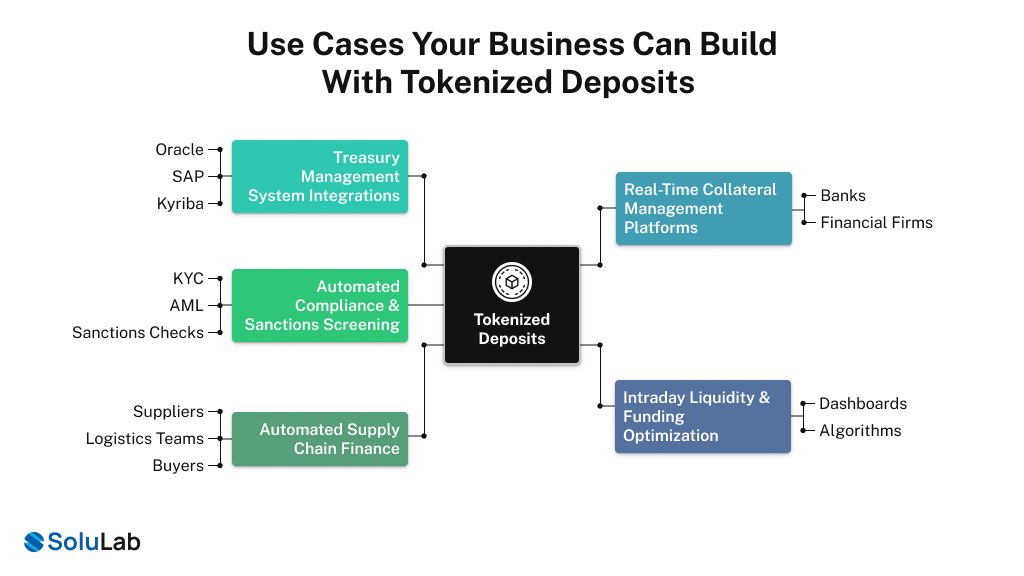

Tokenized deposits are opening a huge new market for development agencies, fintech firms, and enterprises. As banks like HSBC move their money systems on-chain, companies will need new tools, new platforms, and new integrations. This creates a massive opportunity to build products that solve real business problems. Below are the top use cases where your business can win today.

Most large companies use tools like Oracle, SAP, and Kyriba to manage cash and payments. These platforms are the center of a company’s cash flow, but they cannot connect to blockchain on their own. By adding a layer that links these systems to HSBC’s tokenized deposit network, businesses can send and receive on-chain payments directly from the tools they already use. This makes blockchain feel natural and easy for enterprise teams.

Today, banks and financial firms hold large amounts of collateral across different markets. When this collateral becomes tokenized, it can move instantly and can be managed on one unified system. Businesses can build platforms that help banks track, update, and use tokenized collateral in real time, making lending and settlements much smoother.

Every international payment needs KYC, AML, and sanctions checks. With tokenized deposits, these checks can run inside smart contracts. RWA tokenization development agencies can build systems where compliance happens automatically as the payment is processed. This removes friction and makes cross-border payments faster and safer for global companies.

Tokenized deposits also make it possible to build intraday liquidity tools that help companies use their capital more efficiently. Since blockchain settlements happen in seconds, businesses no longer need to keep large amounts of idle money waiting for payments to clear. Builders can create dashboards and algorithms that show real-time cash positions and help companies move funds more intelligently throughout the day.

When payments and records live on-chain, companies can create systems where payments are released the moment certain conditions are confirmed like delivery, invoice approval, or quality checks. This reduces delays and simplifies coordination between suppliers, logistics teams, and buyers across different countries.

In the U.S., banks can offer digital assets and tokenized deposits if they follow FDIC and OCC rules that are strong security, AML/CFT checks, and 100% reserve backing. The GENIUS Act (2025) also gives clearer rules for bank-issued digital money, making tokenized deposits safer for institutions.

The UAE is even more supportive. VARA and the Central Bank of the UAE provide clear licensing and payment-token rules, giving businesses a real first-mover advantage when using tokenized deposits.

HSBC operates under both frameworks to keep services compliant and trusted. For cross-border activity, HSBC must follow AML, OFAC, currency, and tax rules in both the U.S. and UAE. Tokenized deposits make this easier with automated checks and reporting. This complex compliance creates a natural moat for big banks, and it opens opportunities for us to help enterprises build secure, compliant tokenized payment systems and APIs without dealing with regulatory headaches.

Traditional treasury systems caused 2-5 day delays for cross-border settlements. Ant needed instant HKD/USD transfers for global operations. So, they integrated HSBC’s tokenized deposit service in Hong Kong (May 2025), enabling real-time wallet-to-wallet transfers on permissioned blockchain.

The Impact:

Cross-bank fund movements required multi-day processing with settlement risk. Both banks needed 24/7 corporate treasury capabilities. So, they executed HK$3.8M (~$488K) tokenized deposit transfer in November 2025 under Project Ensemble, the first real-money interbank test.

The Impact:

Multinational subsidiaries faced fragmented cash visibility across time zones. Siemens required instant intercompany funding. So, they used JPMorgan’s tokenized deposit system (HSBC Hong Kong mirror), shifting funds across entities in seconds via blockchain platforms.

The Impact:

The banking world in 2026 will look very different from today. HSBC’s push toward tokenized deposits in the U.S. and UAE marks the point where blockchain stops being an experiment and becomes real financial infrastructure. This shift will unlock faster payments, better liquidity, and smarter, 24/7 banking for enterprises that choose to adopt early.

And for businesses that want to build on this new wave, SoluLab can help. As a leading Asset Tokenization Development Company, SoluLab supports banks, enterprises, and fintech teams in creating secure, compliant, and scalable tokenized products, whether it’s tokenized deposits, on-chain payments, treasury tools, or end-to-end digital asset systems. The change has already begun and now is the time to build.

Tokenized deposits are digital versions of real bank money backed by regulated banks like HSBC, with FDIC protection and interest-earning ability. Stablecoins are issued by private fintech companies, usually not insured, and carry higher risk. Both use blockchain, but tokenized deposits offer stronger trust and compliance, which matters for businesses.

HSBC plans to launch tokenized deposits in the first half of 2026, with a wider rollout expected around Q2 2026. The initial focus will be on UAE corporate clients and U.S. institutional clients, with more details likely as we get closer to launch.

The first two currencies will be USD and AED, and HSBC is expected to add EUR, GBP, HKD, and SGD soon after. This expansion follows their earlier launches in Hong Kong, Singapore, the UK, and Luxembourg, making multi-currency access more likely within the first year.

Traditional banks rely on intermediaries and work only during business hours, which slows down payments. Blockchain processes transfers directly and runs 24/7, reducing a 2–5 day payment to just a few seconds. This speed is a major advantage for companies managing global payments.

At launch, HSBC will focus on larger companies that handle high transaction volumes. But as adoption grows and infrastructure scales, these services will naturally become accessible to mid-size and smaller businesses. Early awareness gives smaller enterprises a future advantage.

Companies should review their current payment processes, discuss readiness with their banking partners, and understand what systems need upgrades. Working with a Web3 development agency like SoluLab, helps you plan smooth integrations, staff training, and budgeting before the 2026 rollout.