For many individuals, the thought of being able to sell their valued assets at a reasonable price was irresistible. The NFT marketplace is currently the preferred method of trading digital goods for people, companies, artists, and just about everyone else. The ease with which ownership and rights may be obtained during NFT trade is one of the reasons for the growing popularity of NFT markets. As an added convenience, NFT provides a comprehensive history of each asset for its users.

Why not benefit from the billions of dollars that individuals spend on these lavish digital goods without giving them a second thought? If you’re planning to build an NFT marketplace on Ethereum, you may check out this blog to learn more about the process.

The NFT marketplace is a stage where consumers can store, display, trade, or produce NFTs (Non-Fungible Tokens). A Non-Fungible Token is a digital asset that is mainly built on Ethereum Blockchain technology and reflects real-world things. NFT marketplaces enable creators to reach a big audience with their NFT work. You can purchase or sell NFT artworks at a fixed price using these services. However, in order to access and operate on these marketplaces, you will require the following:

The Non-Fungible Token marketplace features an extensive variety of NFT artworks from diverse sectors such as images, arts, movies, and other digital collectibles. Typically, niche marketplaces are in higher demand than ordinary ones since they offer what a client necessitates, concentrate on marketing specialized artwork, and aim at a detailed set of people.

Read Our Blog: Solana Marketplace NFT: How to build your own NFT Marketplace

The Ethereum blockchain enables efficient coordination of data by providing a decentralized platform where multiple parties can store, access, and update information in a transparent and secure manner. This allows for real-time data synchronization and eliminates the need for intermediaries, enhancing trust and reducing the chances of data manipulation or fraud.

Ethereum enables rapid mobilization of resources by allowing smart contracts to automate and streamline various processes. With programmable logic, tasks such as fundraising, supply chain management, and decentralized applications (dApps) can be executed quickly and efficiently, saving time and resources while promoting scalability.

Ethereum facilitates networks that require authorization, allowing permission access to specific participants. This feature is beneficial in industries where privacy and confidentiality are paramount, such as finance, healthcare, and supply chain management. It ensures that only authorized individuals or entities can participate and interact within the network.

The Ethereum network is designed to be highly scalable and adaptable to different use cases. It offers various solutions to address scalability challenges, such as layer 2 solutions like sidechains and state channels, allowing for increased throughput and improved performance. This flexibility enables the Ethereum blockchain to support a wide range of applications and accommodate a growing number of users.

Ethereum enables secure and direct transactions between individuals without the need for intermediaries, such as banks or payment processors. By utilizing the native cryptocurrency, Ether (ETH), individuals can transact peer-to-peer globally, with lower transaction fees and faster settlement times compared to traditional financial systems. This empowers individuals by giving them greater control over their financial interactions.

Ethereum offers finality in transactions and smart contract execution. Once a transaction or smart contract is included in a block and added to the blockchain, it becomes immutable and tamper-proof. This ensures that transactions are irreversible, providing certainty and trust in the integrity of the network’s operations.

Ethereum incorporates a layer of incentive through its native cryptocurrency, Ether (ETH), and its consensus mechanism known as proof-of-stake (PoS). Participants who validate and secure the network by staking their ETH are rewarded with additional tokens. This incentivizes network security, participation, and decentralization, creating a self-sustaining ecosystem that fosters innovation and growth.

Read Also: Everything You Need to Know About Metaverse NFT Marketplace Development

Ethereum serves as a forerunner in the blockchain network by ensuring its trustworthiness, consistency, security, and stability. Apart from the Ethereum network’s security, protocol developers always consider the types of apps and tools that users and developers prefer. Businesses should seek advice from a reputable blockchain development service provider when selecting an appropriate blockchain.

An NFT marketplace must have a common user interface (UI) to facilitate interaction. It should have a search bar, filters, and a large number of categories, a community section, a dashboard, and an administration panel. All of these distinct categories and search bar filters are critical to providing an exceptional user experience since they lower the user’s search time.

Cross-chain interoperability is required for the integrated crypto-wallets, which must be utilized to acquire or use the cryptos stored in the wallet. To construct an Ethereum-based NFT, you must first create an Ethereum wallet, Metamask.

Front-end development is a component of the NFT trading platform that is used to communicate with the user. It has an intuitive UI, increased productivity, and security precautions.

A reputable NFT development business will provide assistance in establishing smart contracts. All logic for the NFT platform will be implemented at the back end. As previously stated, the NFT marketplace operates as a decentralized system, and smart contracts aid in the management of large data flows and their validation on the Blockchain. Ethereum is used to make the trading features of the NFT market work. A variety of smart contracts are used to make this happen.

It also helps set up a number of marketplace and business logic services that use Blockchain, digital wallets, auction processes, and so on to help people buy and sell things.

Numerous test cycles will be used to determine the functioning of the created product. The QA team will guarantee that no defects or faults are left in order to ensure that the product is secure, useful, dependable, and productive. Throughout the testing process, the product must adhere to the project’s objectives and aims.

After completing the testing phase, it’s time to deploy your NFT platform to a cloud server. However, do not become complacent because this is not the final stage; you must continue to maintain and upgrade the program on a regular basis. Ascertain that the NFT platform you develop adheres to all market trends and meets the needs of your users.

When we hunt for an Ethereum NFT marketplace, we may select one of the two processes:

Scratch-based NFT Marketplace solutions require time to build all the features that satisfy the user’s expectations, and safety is deemed better in this category. Here, we may incorporate new features and upgrade an existing platform at any moment. It is a hard one, yet it delivers an apparent profit.

White label NFT Marketplace solutions are already developed, tested, and ready for implementation. It is an efficient and hassle-free approach that enables you to start your company sooner. This is useful for those who wish to launch their platform at a minimal cost. The key benefit is that there is no requirement for a huge development team as compared to producing new ones.

Ethereum has the most mature and widely adopted blockchain ecosystem for NFTs. It has a strong developer community, extensive tooling support, and a wide range of existing decentralized applications (dApps) and wallets that support NFTs. This established ecosystem provides a solid foundation for building and integrating NFT marketplaces.

Ethereum has defined and popularized key NFT standards, such as ERC-721 and ERC-1155, which have become industry standards for creating and exchanging NFTs. These standards ensure interoperability between different NFT projects, allowing seamless integration and transfer of assets between various platforms.

Ethereum’s network effects contribute to its dominance in the NFT space. It has a large user base and a substantial number of active wallets, which enhances the visibility and discoverability of NFTs listed on Ethereum-based marketplaces. This widespread adoption helps attract buyers, sellers, and collectors to your marketplace.

Ethereum is built on a secure and decentralized blockchain, providing robust security and immutability for NFT transactions. The distributed nature of the network ensures that NFT ownership records are resistant to censorship and tampering, instilling trust and confidence in users.

Read Our Blog: How To Launch Your Own NFT Marketplace Website in Less Than 2 Days?

Ethereum’s smart contract functionality is a powerful tool for developing advanced features and functionalities within an NFT marketplace. Smart contracts enable the automation of various processes, such as royalties, licensing, and secondary sales. They can also facilitate escrow services, auctions, and other complex transactions, enhancing the functionality and user experience of your marketplace.

Ethereum offers extensive integration possibilities with other decentralized finance (DeFi) protocols and services. This integration allows for seamless liquidity pools, decentralized exchanges, lending platforms, and more, expanding the utility and potential use cases of NFTs within your marketplace.

Ethereum is constantly evolving, with several improvements and upgrades planned. One of the significant upgrades is Ethereum 2.0, which aims to enhance scalability, reduce transaction costs, and improve overall network efficiency. Building on Ethereum ensures that your NFT marketplace can benefit from these upcoming improvements.

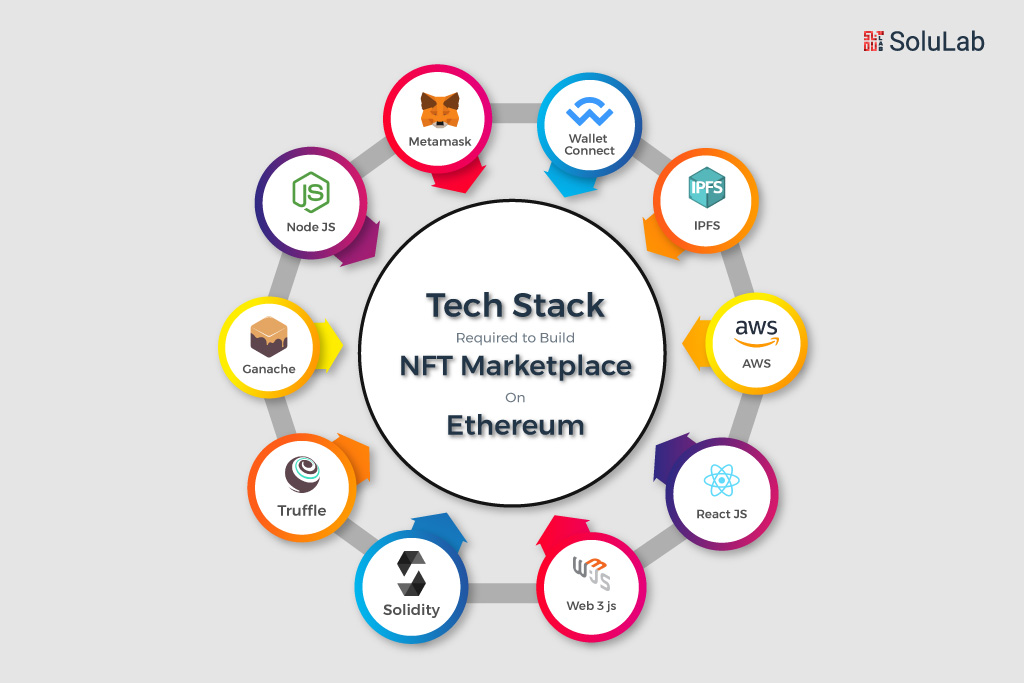

A statically-typed curly-braces programming language, Solidity was created for use with the Ethereum Virtual Machine to develop smart contracts. Tokens of value, ownership, voting, and other types of logic may be implemented using smart contracts since they run on a peer-to-peer network with no central authority.

Use the most recent Solidity version for deploying contracts. This is due to the fact that new features, bug fixes, and breaking changes are released regularly.

Web3.js is a required JavaScript package that is used to establish connections to Ethereum’s blockchain technology. It is a collection of libraries that allow you to communicate with an Ethereum node via HTTP, IPC, or WebSocket.

Truffle was made to help with the testing and deployment of Ethereum smart contracts and custom code. For private and public networks, Ethereum decentralized applications (dApps) are supported.

With Truffle –

Personal blockchains, such as Ganache, allow developers to rapidly build distributed applications on the Ethereum and Corda blockchains. If you’re developing, deploying, and testing your dApps in a deterministic environment, you can utilize Ganache. There are two versions of Ganache: a graphical user interface and a command-line interface.

It is possible to store and access data in IPFS or InterPlanetary File System in a distributed fashion. While it doesn’t have its own incentive program, it may be utilized in conjunction with one or more contracts to ensure long-term success. Working with a pinning service, which “pins” your data for you, is another option for preserving IPFS data. It’s possible to operate your own IPFS node and contribute to the network in order to store your own and/or other people’s files for free.

React.js, which stands for React JavaScript, is a free and open-source front-end framework. JavaScript’s React framework lets you create user interfaces declaratively, efficiently, and with a lot of flexibility. It allows you to build complicated user interfaces out of tiny and separated “components” of code.

Using MetaMask, you may access the Ethereum blockchain using a software wallet that connects to the network. In order to connect with decentralized apps, users may access their Ethereum wallets through a browser extension or mobile app.

Node.js is a JavaScript runtime environment that is open-source and cross-platform. Node.js runs the V8 JavaScript engine, the basis of Google Chrome, outside of the browser. This enables Node.js to be incredibly performant.

Node.js software operates in a single process, without launching a new thread for every request. Node.js includes a set of asynchronous I/O primitives in its standard library that prevent JavaScript code from blocking and typically, libraries in Node.js are designed following non-blocking paradigms, making blocking behavior the exception rather than the rule.

Having gone over the specifics of Ethereum and the NFT Marketplace, anyone interested in understanding how to develop an NFT marketplace will be on the correct track.

SoluLab stands out as the ideal choice for NFT marketplace development and blockchain development. As a leading company in the industry, SoluLab offers comprehensive solutions tailored to the unique requirements of businesses. With their deep expertise in blockchain development, they ensure secure and efficient NFT marketplace platforms. Their services encompass end-to-end development, smart contract integration, and robust security measures. Partner with SoluLab to unlock the full potential of NFTs and blockchain technology, achieving success in the ever-evolving digital landscape, and hire blockchain developers from SoluLab today to get work experience like never before.

An NFT marketplace on the Ethereum blockchain is a platform where users can buy, sell, and trade non-fungible tokens (NFTs). NFTs are unique digital assets that can represent artwork, collectibles, virtual real estate, and more. Ethereum provides the underlying infrastructure for creating, storing, and transacting NFTs, making it a popular choice for building NFT marketplaces.

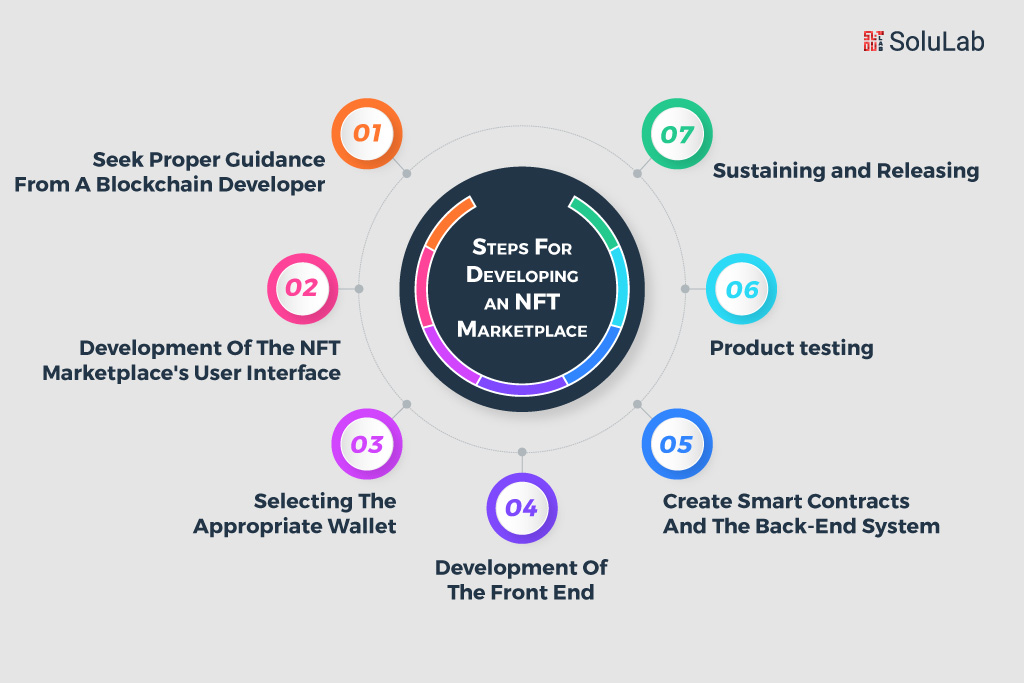

Building an NFT marketplace on the Ethereum blockchain involves several key steps. First, define the scope and features of your marketplace. Then, choose a suitable development framework or partner with a blockchain development team. Next, design the user interface and implement functionalities such as NFT listing, search, bidding, and transaction management. Finally, integrate Ethereum smart contracts to handle NFT ownership and transfers securely.

When building an NFT marketplace on Ethereum, the most commonly used programming language is Solidity, which is used for writing smart contracts. Additionally, web development languages like JavaScript, HTML, and CSS are used for building the front-end user interface. Popular tools and frameworks for Ethereum development include Truffle, OpenZeppelin, Web3.js, and Metamask for wallet integration.

Ensuring the security and integrity of your NFT marketplace is crucial. Employ security best practices such as conducting thorough smart contract audits and testing for vulnerabilities. Implement strong user authentication and authorization mechanisms to protect user accounts and sensitive data. Regularly update and patch your platform’s dependencies to address any security vulnerabilities. Additionally, educate your users about best practices for secure wallet usage and transaction handling.

Handling transactions and payments on your NFT marketplace involves integrating cryptocurrency wallets and implementing secure payment gateways. Users will need to connect their Ethereum wallets (such as Metamask) to your marketplace to interact with the blockchain. Use appropriate libraries and APIs to process transactions, calculate fees, and handle escrow services if necessary. Provide clear instructions and user-friendly interfaces to guide users through the payment process.