The traditional financial system, despite its long-standing dominance, has shown glaring limitations that have prompted the search for a more inclusive, efficient, and transparent alternative. This archaic system, characterized by intermediaries, lengthy processing times, and restricted access, has left many individuals and businesses underserved, particularly in emerging economies. As technological innovation continues to reshape industries, the financial sector is no exception, giving rise to the phenomenon of Decentralized Finance (DeFi).

One of the primary limitations lies in the presence of intermediaries, which often result in cumbersome processes, increased transaction costs, and extended processing times. This not only contributes to inefficiencies but also excludes a significant portion of the global population from accessing financial services due to stringent requirements and geographical barriers. Furthermore, the lack of transparency within the traditional financial system has led to issues of hidden fees, unfair lending practices, and a general lack of accountability.

Read Also: Building Trust in a Digital World: The Power of Blockchain Development

At its core, DeFi represents a departure from the traditional financial system’s centralized control and intermediaries, replacing them with transparent, autonomous, and secure transactions enabled by blockchain. The crucial role played by Blockchain Development in shaping DeFi cannot be overstated, as it is the vehicle through which the principles of decentralization, automation, and security are realized.

Decentralized Finance (DeFi) is a revolutionary concept that seeks to reshape the traditional financial landscape by leveraging blockchain technology and smart contracts to create an open, transparent, and permissionless financial ecosystem. At its core, DeFi envisions a world where financial services are accessible to anyone with an internet connection, eliminating the need for intermediaries and centralized authorities. This democratization of finance is underpinned by a set of core principles:

DeFi operates on decentralized networks like Ethereum, where transactions are validated by a distributed network of nodes rather than a central authority. This eliminates single points of failure and promotes censorship resistance.

DeFi aims to create a seamless environment where various applications and protocols can interact and complement each other, fostering a rich ecosystem of interconnected services.

All transactions, agreements, and data on DeFi platforms are recorded on public blockchains, making them transparent and auditable by anyone. This transparency helps build trust among participants.

DeFi is designed to be accessible to a global audience, allowing individuals from all walks of life to engage in financial activities without the need for traditional banking infrastructure.

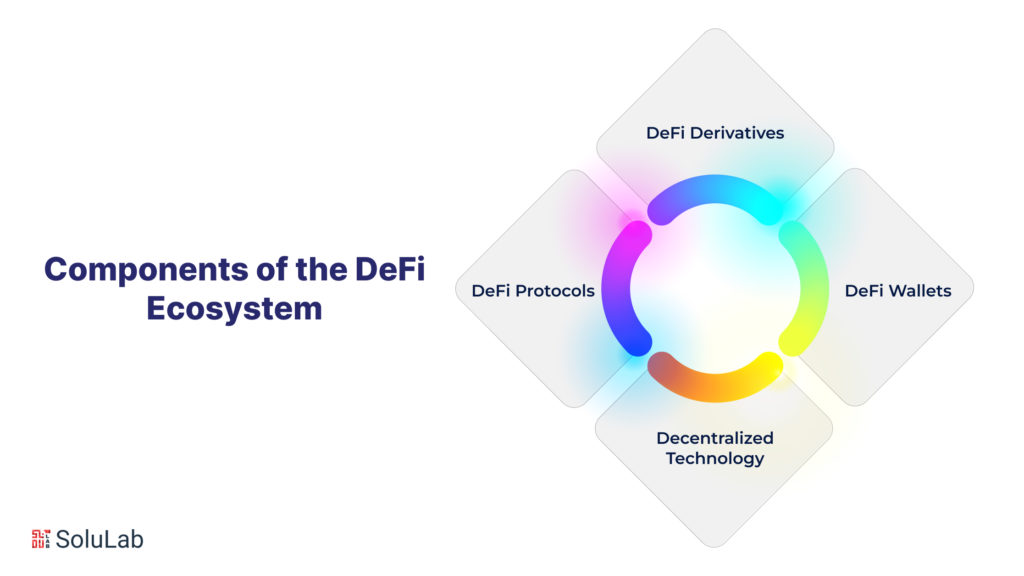

DeFi protocols are the building blocks of the ecosystem, governing various financial activities through automated smart contracts. These protocols enable a wide range of functionalities, including decentralized exchanges (DEXs), lending and borrowing platforms, yield farming, and more.

For instance, Uniswap and SushiSwap are popular DEX protocols that allow users to trade tokens directly without relying on centralized exchanges. Aave and Compound, on the other hand, facilitate lending and borrowing by allowing users to lend their assets and earn interest or borrow assets against collateral.

DeFi derivatives represent a realm of innovation within the ecosystem, offering ways to manage risk and speculate on various assets. Synthetic assets, for instance, allow users to gain exposure to traditional financial instruments like stocks, commodities, or indices without actually owning them.

These assets are created through the use of smart contracts, which track the value of the underlying asset and replicate its price movements. This opens up new avenues for diversification and investment strategies within the DeFi ecosystem.

Read Our Blog: Top 10 Defi Lending Platforms in 2023

DeFi wallets play a pivotal role in the ecosystem, serving as the gateway for users to interact with various DeFi protocols and applications. These wallets are often non-custodial, meaning users retain control over their private keys and funds.

They enable users to seamlessly manage their assets, participate in liquidity provision, stake tokens for rewards, and execute transactions on DeFi platforms. By integrating with different protocols, DeFi wallets provide a unified and user-friendly interface for engaging with the ecosystem.

Decentralized technology, primarily blockchain, forms the bedrock upon which the entire DeFi ecosystem is built. The immutability and transparency of blockchain enable secure and trustless transactions, while smart contracts automate the execution of agreements without the need for intermediaries.

The adoption of decentralized technology allows DeFi to function seamlessly across borders, providing users with a level of control, security, and accessibility that traditional financial systems struggle to offer.

In the subsequent sections of this exploration, we will delve deeper into the evolution of DeFi protocols, the disruptive potential of DeFi derivatives, the role of DeFi wallets in enhancing user experience, and the challenges and prospects presented by decentralized technology within the DeFi landscape. As we unravel the intricate layers of the DeFi ecosystem, the transformative potential of blockchain technology becomes increasingly evident in reshaping the future of finance.

At the heart of the DeFi revolution lies the groundbreaking capabilities of blockchain technology. Blockchain serves as the foundational technology that underpins the entire DeFi ecosystem, providing the tools necessary to reshape traditional financial systems. One of the most significant contributions of blockchain to DeFi is its ability to eliminate intermediaries, promoting transparency, security, and efficiency in financial transactions.

By leveraging blockchain’s decentralized architecture, DeFi platforms can ensure that transactions are verified and recorded on a distributed ledger. This approach eliminates the need for traditional financial intermediaries, reducing costs and potential points of failure. Additionally, the immutability of blockchain ensures that once a transaction is recorded, it cannot be altered or tampered with, adding a layer of security and trust.

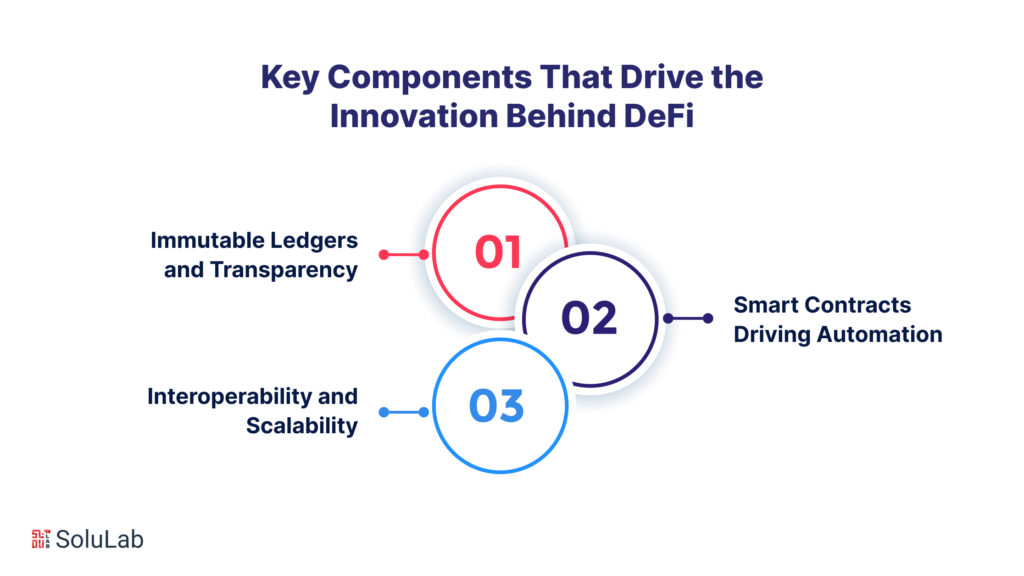

At the core of blockchain’s value proposition is its ability to create immutable ledgers. Transactions are grouped into blocks, linked sequentially, and cryptographically sealed. This chain of blocks, or blockchain, forms a transparent and tamper-proof record of all transactions. In the context of DeFi, this transparency is crucial as it allows participants to independently verify transactions and activities, fostering trust within the ecosystem.

Smart contracts are self-executing contracts with code that automatically enforces the terms of an agreement. These contracts eliminate the need for intermediaries, as they execute actions based on predefined conditions being met. In DeFi, smart contracts enable various financial activities such as lending, borrowing, trading, and yield farming. This automation not only increases efficiency but also reduces the potential for human error and manipulation.

Read Also: 10 Best Defi Exchanges 2023

Blockchain’s interoperability and scalability are essential for the expansion of DeFi. Interoperability allows different blockchain networks to communicate and share data, enabling users to access a wider range of services. Scalability, on the other hand, ensures that blockchain networks can handle a large number of transactions without congestion. As DeFi applications gain popularity, blockchain development focuses on enhancing these aspects to support the growing demand for efficient and seamless financial services.

In the subsequent sections of this exploration, we will delve deeper into the evolution of specific DeFi protocols, the innovative realm of DeFi derivatives, the significance of DeFi wallets, and the challenges and opportunities posed by decentralized blockchain technology. As we uncover the intricate layers of this transformative landscape, the indispensable role of blockchain development in shaping the future of finance becomes abundantly clear

Uniswap stands as a trailblazer in the realm of decentralized exchanges (DEXs). By introducing an automated market maker (AMM) model, Uniswap enables users to trade tokens without relying on traditional order books. Instead, liquidity providers lock up assets in smart contracts, facilitating trading through algorithmic price adjustments. This innovation enhances liquidity and accessibility, paving the way for a new era of peer-to-peer token trading.

Read Our Blog Post: List of Top 10 Defi Savings Accounts

Compound has redefined the way individuals lend and borrow digital assets within the DeFi ecosystem. It introduced the concept of algorithmic interest rates, where lending and borrowing rates are dynamically determined based on supply and demand. This dynamic model ensures efficient capital allocation and has become a cornerstone of the DeFi lending landscape.

MakerDAO has revolutionized stablecoins through its creation of DAI, a decentralized stablecoin pegged to the US Dollar. MakerDAO’s decentralized autonomous organization (DAO) governance model empowers users to participate in decision-making, ensuring the stability of DAI’s value. This fusion of stablecoins and governance exemplifies the democratic potential of blockchain technology in financial systems.

Yield farming and liquidity mining represent groundbreaking mechanisms that incentivize users to contribute liquidity to DeFi platforms. Users can lock up their assets in liquidity pools, earning rewards in the form of additional tokens. These rewards act as a yield on their deposited assets, creating an ecosystem where users actively participate in protocol governance and growth while earning returns on their investments.

Flash loans have introduced a new dimension to DeFi by allowing users to borrow assets without collateral as long as the loan is repaid within a single transaction block. This innovation has enabled complex financial operations, such as arbitrage and collateral swapping, within the DeFi ecosystem. Composability, the ability of DeFi protocols to seamlessly interact with each other, further enhances the possibilities for creating intricate and efficient financial strategies.

Read Also: Top 10 Defi NFT Games to Look for in 2023

As we delve deeper into the innovative landscape of DeFi, it becomes evident that these protocols are not only redefining traditional financial paradigms but also pushing the boundaries of what is achievable in the digital realm. The subsequent sections will continue to explore the dynamic facets of DeFi, including the transformative potential of DeFi derivatives, the significance of DeFi wallets, and the role of decentralized technology in fostering this evolution.

Blockchain Development Companies stand at the forefront of driving innovation within the DeFi ecosystem. These companies possess the technical expertise and experience necessary to build, deploy, and enhance the protocols, smart contracts, and platforms that constitute the DeFi landscape. Their role is multifaceted and crucial for the continued growth and success of DeFi.

Blockchain Development Companies contribute their technical prowess to create the protocols that underpin various DeFi functionalities. These protocols, including decentralized exchanges, lending platforms, and yield farming mechanisms, rely on intricate smart contracts and innovative design. These companies ensure that these protocols are not only secure but also efficient, scalable, and user-friendly.

Usability is a critical aspect of DeFi adoption. Blockchain Development Companies design user interfaces that make it easier for individuals, regardless of technical expertise, to interact with DeFi platforms. By offering intuitive and user-friendly interfaces, they lower the entry barriers and encourage broader participation in the DeFi ecosystem.

Read Our Blog: What are the Benefits of Using Digital Identity with Blockchain in the Future?

The DeFi space demands a robust security framework due to the potential financial risks associated with smart contracts and protocol vulnerabilities. Blockchain Development Companies perform security audits to identify and rectify vulnerabilities in smart contracts, enhancing the overall safety of DeFi platforms and protecting users from potential risks.

Collaborations and partnerships within the DeFi ecosystem are instrumental in driving innovation, expanding services, and fostering a more interconnected financial landscape.

Blockchain Development Companies collaborate with other projects and protocols to create seamless integrations. These integrations enable protocols to interact and share data, creating a more holistic and interconnected DeFi ecosystem. For instance, a lending platform might collaborate with a decentralized exchange to provide users with convenient access to liquidity.

Blockchain Development Companies play a pivotal role in developing solutions to address the scalability challenges faced by DeFi platforms. By working on layer 2 scaling solutions or cross-chain interoperability frameworks, these companies enable DeFi to accommodate a growing user base and diverse set of assets.

Read Also: DeFi Development – Use Cases, Challenges & Future

Collaboration within the DeFi ecosystem allows for the cross-pollination of ideas and expertise. This collaborative approach fosters industry-wide innovation, where projects learn from each other’s successes and failures, ultimately driving the evolution of DeFi to new heights.

As we explore the intersection of Blockchain Development Companies and the DeFi ecosystem, it becomes evident that these companies are not only the architects of DeFi’s infrastructure but also the catalysts for its growth and expansion. The subsequent sections will delve into the dynamic realm of DeFi derivatives, the innovative features of DeFi wallets, and the broader challenges and opportunities that lie ahead for this transformative financial landscape.

The rapid rise of Decentralized Finance (DeFi) has ignited a paradigm shift in the financial landscape, offering a decentralized and borderless alternative to traditional financial systems. However, as the DeFi ecosystem continues to expand, it encounters a complex web of regulatory challenges that have the potential to significantly influence its growth and adoption.

One of the key challenges faced by DeFi is the lack of clarity in existing regulatory frameworks. DeFi operates in a decentralized and cross-border manner, making it challenging for regulatory authorities to define the jurisdiction and establish rules that apply uniformly. The absence of clear guidelines leaves DeFi participants uncertain about the legality of their activities and exposes them to potential legal risks.

DeFi’s decentralized nature contradicts the traditional regulatory approach that relies on intermediaries for oversight. Concepts like pseudonymous transactions and smart contract automation, while central to DeFi’s innovation, may clash with traditional anti-money laundering (AML) and know-your-customer (KYC) regulations. This conflict between the DeFi ethos and traditional regulations can hinder adoption, particularly by institutions and risk-averse users.

The decentralized nature of DeFi platforms can make it challenging to enforce consumer protection measures and address investor risks. Scams, hacks, and vulnerabilities can lead to significant financial losses for users. The absence of intermediaries means that users may have limited recourse in case of disputes or fraudulent activities.

Read Our Blog: 7 Best Defi Trading Platforms in 2023

Overly stringent regulations could stifle the innovative spirit of DeFi and deter developers from exploring new possibilities. Regulatory hurdles might lead to a fragmented ecosystem with projects either avoiding compliance or relocating to jurisdictions with more favorable regulatory environments. This could potentially limit the growth of the DeFi ecosystem and curtail the benefits it offers.

The global nature of DeFi exacerbates regulatory challenges, as different countries have varying approaches to blockchain and digital assets. A lack of harmonization in regulations can lead to confusion for global users and impede cross-border participation.

The regulatory challenges facing DeFi can significantly impact its growth trajectory and user adoption in several ways:

Read Also: 9 Best Defi Staking Platforms in 2023

Traditional financial institutions and institutional investors often prioritize regulatory compliance and legal certainty. Uncertainty surrounding DeFi’s regulatory status might discourage its entry into the ecosystem, limiting the influx of capital and expertise.

Regulatory concerns can discourage retail users from entering the DeFi space, especially those who are risk-averse or less familiar with the intricacies of blockchain technology. A lack of regulatory clarity may make potential users hesitant to engage with DeFi platforms.

Overly restrictive regulations might discourage developers from creating new and innovative DeFi protocols. This could limit the diversity of services offered within the ecosystem and hinder its overall development.

Disparate regulatory approaches across jurisdictions can lead to fragmented services and platforms. Users might have limited access to certain DeFi services based on their geographical location, hampering the vision of a globally accessible financial ecosystem.

In the ever-evolving landscape of finance, the role of blockchain development in shaping the future cannot be overstated. As we’ve journeyed through the intricacies of the DeFi ecosystem and its reliance on blockchain technology, one name that stands out for its potential to drive transformative change is SoluLab.

SoluLab, a leading blockchain development company, showcases its prowess in blockchain development, placing it at the forefront of the DeFi revolution. With a deep understanding of the nuances of blockchain architecture, smart contracts, and decentralized applications, SoluLab, as a dedicated blockchain development company, is poised to shape the DeFi landscape in profound ways.

In a world where innovation and collaboration are paramount, SoluLab’s expertise becomes an invaluable asset. By crafting robust and secure protocols, they empower DeFi platforms to operate seamlessly while ensuring the safety of users’ assets. SoluLab’s contributions extend beyond just code; they are instrumental in creating user-friendly interfaces that break down barriers to entry, making DeFi accessible to a broader audience.

SoluLab, a leading deFi development company, places a strong emphasis on security and audit practices, bolstering the credibility of DeFi projects. In an arena where vulnerabilities carry significant repercussions, their meticulous approach and thorough testing effectively minimize potential hazards, cultivating an atmosphere of assurance and dependability. Furthermore, SoluLab’s commitment to innovation harmonizes seamlessly with the ever-changing realm of DeFi. As the landscape progresses, their proficiency equips them to adeptly craft and implement solutions tackling new obstacles, whether linked to scalability, interoperability, or regulatory adherence. To embark on a secure and forward-looking deFi journey, contact SoluLab today.

Blockchain development plays a pivotal role in the DeFi ecosystem by enabling the creation of secure, transparent, and decentralized financial applications and protocols.

2. How does blockchain technology contribute to the growth of DeFi protocols?

Blockchain technology provides the underlying infrastructure for DeFi protocols, ensuring trustless transactions, immutability, and tamper-proof records, thereby fostering the growth of the DeFi ecosystem.

3. What is the role of a blockchain development company in the DeFi space?

A blockchain development company specializes in creating and optimizing the technology stack required for DeFi applications. They design, build, and maintain the decentralized architecture that powers DeFi protocols.

4. Can you explain the concept of DeFi derivatives and its relationship with blockchain development?

DeFi derivatives are financial contracts whose value is derived from an underlying asset. Blockchain development facilitates the creation and execution of smart contracts that enable the trading, settlement, and management of DeFi derivatives in a transparent and automated manner.

5. What are some of the top DeFi protocols that showcase the impact of blockchain development?

Top deFi protocols like Aave, Compound, Uniswap, and MakerDAO exemplify the influence of blockchain development. These protocols utilize decentralized blockchain technology to offer lending, borrowing, decentralized exchanges, and stablecoin issuance.

6. How do decentralized blockchain technologies contribute to the security of DeFi ecosystems?

Decentralized blockchain technology enhances the security of DeFi ecosystems by eliminating single points of failure, reducing the risk of hacks, and ensuring that transactions and smart contracts are executed without the need for intermediaries.