Today, cryptocurrency trading is no longer a niche activity but a global financial force. While decentralized platforms are gaining traction, centralized cryptocurrency exchanges (CEXs) remain the backbone of digital asset trading, offering liquidity, user-friendly interfaces, and faster transactions that attract both beginners and professional traders.

However, building a centralized exchange isn’t as simple as deploying trading software. With evolving regulations, growing security threats, and rising user expectations, launching a successful CEX requires careful planning, robust technology, and a compliance-first approach.

In this guide, we’ll break down the step-by-step process of building a centralized crypto exchange, explore the essential features, and highlight how expert development partners like SoluLab can help you turn your vision into a secure, scalable, and profitable reality.

A Centralized Cryptocurrency Exchange (CEX) is a digital platform where users can buy, sell, and trade cryptocurrencies through an intermediary — the exchange itself. Unlike decentralized exchanges, where transactions occur directly between users, a CEX acts as the middleman, managing order books, holding funds, and ensuring trades are executed quickly and securely.

Popular examples include Binance, Coinbase, and Kraken, all of which rely on a centralized structure to provide high liquidity, customer support, and advanced trading tools.

In the crypto ecosystem, Centralized Exchanges (CEXs) function much like traditional banks — acting as trusted intermediaries that safeguard user assets, process trades efficiently, and ensure liquidity is always available. While decentralized exchanges (DEXs) have been gaining attention, the majority of retail and institutional traders still gravitate toward centralized platforms for one simple reason: trust backed by performance.

For newcomers aiming to compete, launching a CEX today means blending security, compliance, and innovation into one seamless trading platform — the very formula top blockchain developers like SoluLab specialize in delivering.

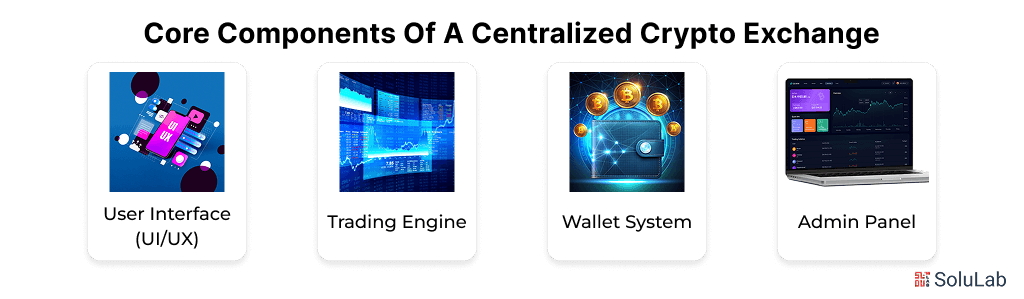

A successful CEX isn’t just about connecting buyers and sellers — it’s about building a robust, secure, and intuitive ecosystem. Every high-performing exchange is built on four essential pillars:

Your interface is your first impression — your digital handshake. A well-designed UI must deliver:

Think of this as the brain of your exchange — the powerhouse that keeps everything running smoothly. An effective trading engine must:

Your wallet system is more than just a balance display — it’s the digital vault protecting your users’ assets. A secure setup includes:

A smart fund management system automates transfers between hot and cold wallets, keeping exposure low while ensuring liquidity.

The admin panel is your team’s mission control. A strong back-end panel should enable you to:

A CEX is only as strong as its foundation — and these components form the framework that determines its security, speed, and user trust.

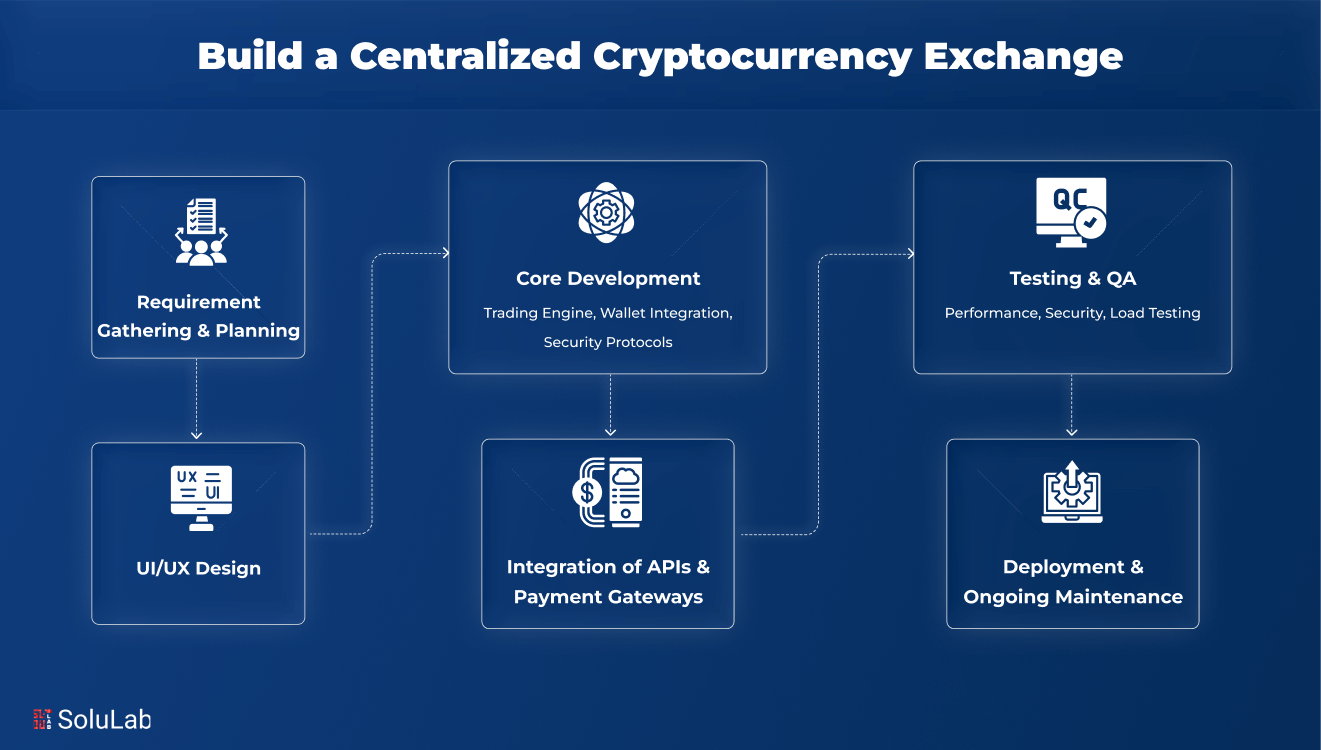

The development of a centralized cryptocurrency exchange has many components. Each stage requires careful attention. Let’s check the following details to know all the steps needed.

Every successful exchange starts with planning. Teams define business goals, user profiles, and core functionalities. Will it support fiat deposits, margin trading, or just crypto-to-crypto? Understanding regulations for each target region is crucial.

The roadmap is laid out with timelines, cost estimates, legal support, and milestones to align business goals with development execution from the very beginning.

Complying with financial laws is non-negotiable. Countries have different crypto rules, so identifying licensing needs, registration processes, and anti-money laundering (AML) frameworks early is vital.

Planning includes integrating identity verification (KYC), transaction monitoring, and AML checks that satisfy global regulations.

Legal advisors and compliance consultants are involved even before development begins to avoid risks later.

Developers work with stakeholders to finalize the exchange’s core features. This includes spot trading, order types, fiat on-ramp support, liquidity solutions, and token listing processes.

Teams also choose between custom-built platforms and white-label options. A clear product specification document is created, outlining every expected function and integration, from APIs to user account management.

The tech stack forms the foundation of the exchange. Languages like Go, Node.js, or Rust are chosen for backend performance. Frontends use React or Vue.js to ensure responsive design.

Databases like PostgreSQL or Redis handle user sessions and trading data. The right tech ensures the platform is fast, scalable, secure, and easy to maintain long-term.

Exchanges need to support multiple tokens and chains. Integration is done using blockchain APIs and SDKs for Ethereum, Solana, BNB Chain, and more. Developers set up wallet modules to accept ERC-20, BEP-20, and native tokens.

These integrations enable smooth deposits, withdrawals, and balance management with blockchain confirmations and gas fee optimization for efficiency.

Read Our Blog Post: How to Launch a Crypto Exchange in Switzerland?

User interface design focuses on clarity, accessibility, and speed. Designers create wireframes for trading views, wallets, and dashboards. The goal is to help both beginners and experienced traders navigate effortlessly.

Tools like Figma or Adobe XD are used to build and test responsive designs for web and mobile, ensuring a seamless user experience across all devices.

The trading engine is the system’s core. It matches buy and sell orders using algorithms that ensure high-speed execution. It must support different order types like market, limit, and stop-limit.

Latency optimization and load balancing are added to handle massive concurrent trades. The engine also manages real-time order book updates and price discovery mechanisms.

Hot wallets manage live user transactions, while cold wallets offer offline storage for security. Wallet infrastructure includes private key encryption, transaction broadcasting, and auto-syncing of balances. Systems must prevent double-spending and provide instant wallet-to-exchange fund transfers.

Multisig setups and hardware wallet integrations ensure maximum protection for both platform and customer assets.

KYC and AML systems are integrated using services like Sumsub, Shufti Pro, or Jumio. Users upload identity documents, take live selfies, and pass region-specific compliance checks. Real-time verifications ensure fast onboarding.

AML tools monitor user behavior and flag suspicious activities. These tools run continuously in the background and adapt based on evolving regulatory requirements.

Admin panels allow exchange staff to manage users, approve KYC, suspend accounts, set trading limits, and monitor system health. Activity logs, fraud alerts, and trade flow analytics are part of this panel.

Developers also integrate dashboards for real-time performance stats, allowing quick responses to anomalies or spikes in user activity.

REST and WebSocket APIs are built for external traders, bots, and partners. These APIs allow market data access, trading, and account operations. Rate limiting, permissions, and key rotation are implemented for security.

Developers run unit, integration, and performance tests. Load testing simulates thousands of users to ensure stable performance during high traffic.

After developing the platform is deployed on ie, AWS or GCP cloud services using Docker and Kubernetes. This test is mainly to test the scalability of the system. Monitoring tools like Grafana and Prometheus are used to track the time, errors, and latency os the platform.

The support team handles the user challenges, and developers work based on the feedback received. At last, new features such as staking, referral bonus, offers, and margin trading are added.

Read Also: Why White-Label Crypto Exchange Development Makes Sense for UAE Banks?

Your users expect more than just a basic trading window. To compete with established players and deliver real value, your Centralized Crypto Exchange should offer a full suite of modern, secure, and high-performance features.

Let’s break down the essentials:

The user onboarding process sets the tone for your entire platform. A good experience should:

Tools like Sumsub, Shufti Pro, or Jumio can automate this while keeping friction low. Remember: compliance isn’t optional. But the experience shouldn’t feel like applying for a loan.

Your users need to make smart trading decisions and they need tools to do that.

Include:

Integrating tools like TradingView or custom chart engines helps here. This is where pro traders spend most of their time, make it powerful, fast, and customizable.

If users can’t move money in or out easily, they won’t use your platform. It’s that simple.

You’ll need:

Also, show pending and completed transactions clearly in user dashboards. Transparency builds trust.

Professional and institutional traders need API access to automate strategies.

You should offer:

APIs aren’t just a bonus, they’re a revenue opportunity. You can offer tiered access, analytics, and even white-labeled trading bots as add-ons.

Security should feel invisible but strong.

These tools do just that:

These features dramatically reduce the risk of account takeovers. They’re essential if you want to be taken seriously.

Security isn’t a feature you tack on at the end it’s the foundation your entire exchange stands on. Without it, you’re handing hackers and bad actors an open invitation.

Here’s what it takes to secure a Centralized Crypto Exchange the right way:

Crypto might be borderless, but regulation isn’t. Every region has its own framework, and ignoring it isn’t an option, it’s a fast track to shutdown.

A well-built exchange isn’t just a tech product; it’s a business. Here’s how a leading centralized crypto exchange development company turns traffic into revenue:

The key is balance. Diversify your revenue streams without making users feel nickel-and-dimed. A transparent, scalable model builds trust and long-term sustainability.

Centralized Cryptocurrency Exchange Development isn’t just about building software. It’s about building trust, utility, and long-term value. Whether you’re targeting day traders, institutions, or the next billion crypto users, you need to nail the execution.

At SoluLab, we specialize in Centralized Crypto Exchange Development, from building secure trading engines to deploying compliant, scalable infrastructures. Whether you’re starting fresh or looking to upgrade an existing platform, we bring technical expertise and blockchain know-how to every step of the journey.

Our team has worked with leading fintechs and crypto startups across the globe. Let’s build something that actually lasts. Want to launch your own crypto exchange? Let’s talk.

Generally, to build a featured centralized crypto exchange takes 4 to 6 months. However, this depends on your business requirements (fully custom takes more time compared to using white-labeled tools) and your budget.

Yes, it’s legal in many countries, but only if you meet local law, register with regulators, and maintain licenses like MSB, VASP, or their equivalents based on your operational region.

White-label exchanges are plug-and-play and faster to launch, but offer limited control. Custom platforms take more time but give you full freedom to design features and scale your way.

Security isn’t optional, it’s the basic requirement of every user. So, using encrypted data storage, multi-signature wallets, anti-DDoS layers, and real-time monitoring keeps the privacy of the customer safe. Also, running regular audits to keep hackers out.

The right tech stack depends on your goals, but go for scalable, secure tools, like Node.js or Go for backend, React for frontend, and PostgreSQL or Redis for robust data handling.