Blockchain technology is a decentralized and immutable digital ledger system that records transactions across a network of computers in a secure and transparent manner. It consists of a chain of blocks, each containing a set of transactions. What sets blockchain apart is its cryptographic security and consensus mechanism, which ensures that once information is recorded, it cannot be altered or deleted without the consensus of the network participants. This technology was originally created as the underlying framework for cryptocurrencies like Bitcoin, but its potential applications have since expanded far beyond digital currencies.

Each block in a blockchain contains a group of transactions, and these blocks are linked together in chronological order, forming a chain. The unique feature of blockchain is its cryptographic validation mechanism, which ensures that once data is added to the chain, it cannot be altered or tampered with without consensus from the majority of network participants. This inherent security makes blockchain technology a trustworthy and tamper-resistant solution for various applications.

Read Our Blog Post: Top Blockchain Technology Companies in 2023

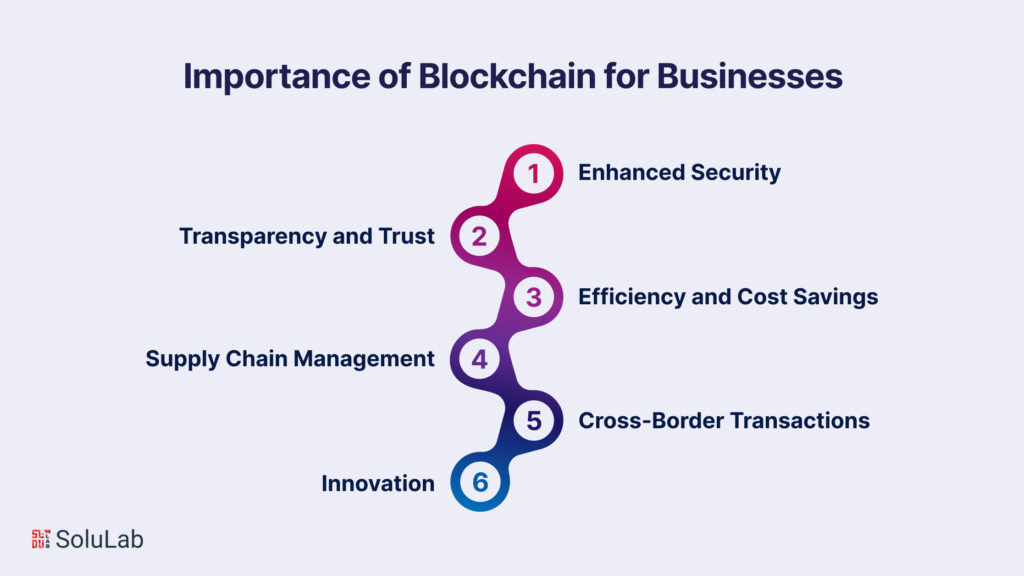

The importance of blockchain for businesses cannot be overstated, as it has the potential to transform traditional business operations, enhance security, and drive efficiency in a multitude of ways. Blockchain technology offers several key advantages:

Blockchain’s cryptographic nature makes it highly secure, reducing the risk of fraud and unauthorized access to data. This is especially critical in industries where data integrity is paramount, such as finance and healthcare.

Blockchain’s transparent and immutable ledger fosters trust among participants. Businesses can verify the authenticity of transactions and data, reducing disputes and the need for intermediaries.

Smart contracts, a feature of blockchain, automate contract execution and enforce terms without the need for intermediaries. This leads to reduced administrative costs and faster transaction processing times.

Blockchain enables end-to-end visibility in supply chains, reducing fraud, errors, and delays. Businesses can track products from origin to destination with greater accuracy.

Check Out the Blog Post: Top 10 Real World Applications of Blockchain Technology

Blockchain facilitates cross-border transactions by eliminating the need for multiple intermediaries and reducing transaction fees. This is particularly beneficial for international trade.

Blockchain is a catalyst for innovation, driving the development of new business models and revenue streams. Companies can explore blockchain applications that were previously unthinkable.

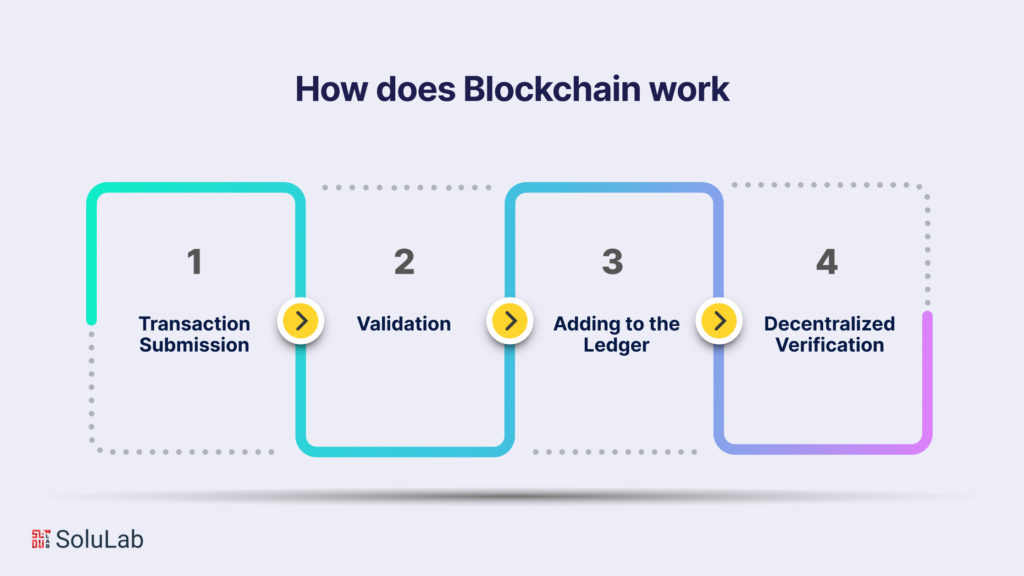

Understanding how blockchain operates is crucial for businesses looking to leverage this technology effectively:

Users initiate transactions by creating a request to add data to the blockchain. This data can represent various actions, such as transferring assets, verifying identities, or recording ownership changes.

Transactions are sent to the network’s nodes, where they undergo verification. In public blockchains, this verification is typically done through a consensus mechanism like PoW.

Once a transaction is validated, it is added to a new block. This block is then linked to the previous one, forming a continuous chain.

Multiple nodes on the network must reach a consensus before a transaction is considered valid. This decentralized verification ensures trust and security.

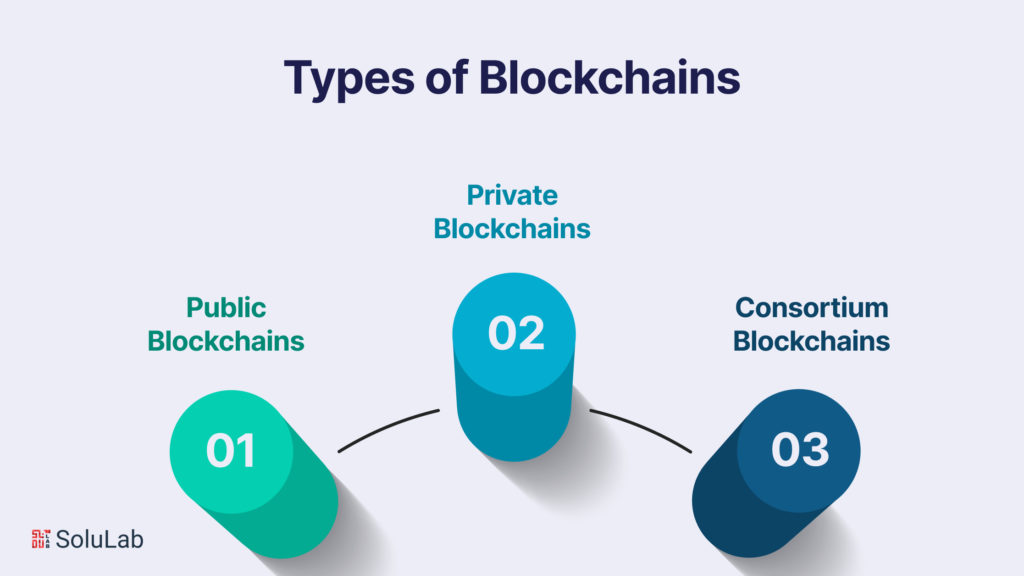

Blockchains come in various forms, each suitable for different business needs:

Public blockchains, like Bitcoin and Ethereum, are open to anyone and offer complete transparency. They are ideal for businesses looking to create blockchain-based applications with widespread accessibility.

Private blockchains are restricted to a specific group of participants, making them suitable for businesses that require control over access and data privacy. They are often used for internal processes and collaborations.

Consortium blockchains are a hybrid of public and private blockchains. They are governed by a group of organizations rather than a single entity. This type is beneficial for industries with multiple stakeholders, such as blockchain in supply chains.

In today’s fast-paced and ever-evolving business landscape, staying competitive requires constant innovation and the ability to leverage cutting-edge technologies. Blockchain technology has emerged as a transformative force, offering a wide array of applications for businesses across various industries. To embark on this journey, it’s crucial to start with the right blockchain business idea. In this guide, we’ll delve into the essential steps of blockchain business idea generation.

Identifying Business Needs

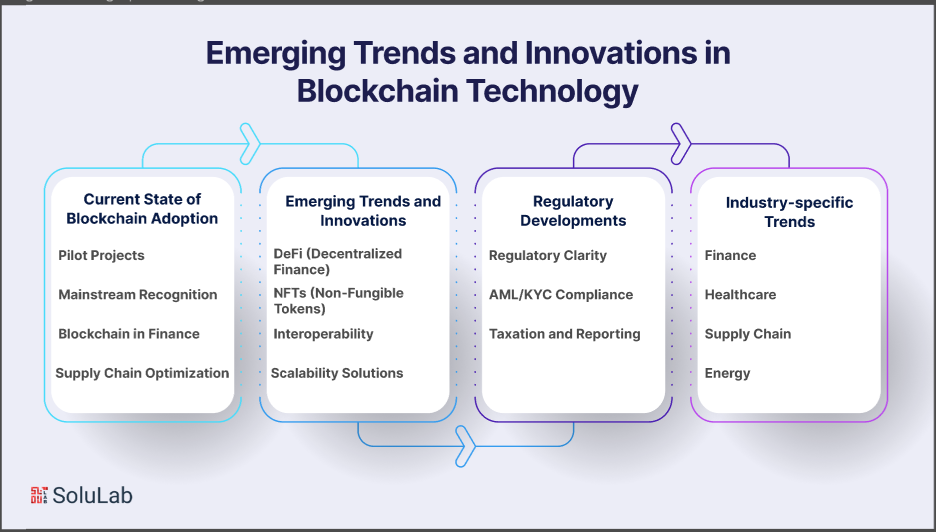

Blockchain technology has made significant strides in recent years, with a growing number of businesses recognizing its potential to revolutionize various industries. The current state of blockchain adoption reflects a dynamic landscape of innovation and transformation.

Many businesses have moved beyond the initial experimentation phase and are now actively implementing blockchain solutions. Pilot projects are being conducted across diverse sectors, from supply chain management to healthcare.

Blockchain is no longer a niche concept. It has gained recognition and support from major tech companies, financial institutions, and governments worldwide, showcasing its mainstream appeal.

In the financial sector, blockchain is being used for cross-border payments, remittances, and even central bank digital currencies (CBDCs). This adoption has the potential to disrupt traditional banking systems.

Blockchain’s traceability and transparency features are driving its adoption in supply chain management. Businesses are utilizing blockchain to track and authenticate the origin of products, improving trust and reducing fraud.

The blockchain landscape is continuously evolving, with several emerging trends and innovations shaping the future of business applications.

DeFi projects are growing rapidly, offering decentralized lending, borrowing, and trading platforms. These innovations challenge traditional financial intermediaries and offer greater financial inclusion.

NFTs have gained immense popularity, particularly in the art, entertainment, and gaming industries. These digital assets are revolutionizing ownership and provenance verification.

Cross-chain compatibility and interoperability solutions are emerging, allowing different blockchains to communicate and share data seamlessly. This will enhance the flexibility and utility of blockchain networks.

The challenge of blockchain scalability is being addressed through various solutions, such as Layer 2 solutions and sharding, enabling faster and more cost-effective transactions.

Read Our Blog: Best Companies to Hire Blockchain Developers in 2023

Blockchain technology has prompted regulatory bodies to respond with new frameworks and guidelines.

Governments are increasingly providing regulatory clarity, which is essential for businesses to navigate the blockchain space confidently. This includes defining the status of cryptocurrencies and tokens.

Regulations regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures are being strengthened to mitigate risks associated with blockchain-based financial transactions.

Tax authorities are developing guidelines for cryptocurrency taxation, ensuring that businesses and individuals are compliant with tax obligations related to blockchain assets.

Blockchain’s impact is felt differently across various industries, each with its unique trends and opportunities.

In finance, blockchain is leading to the tokenization of assets, making it easier to trade and transfer ownership of real estate, stocks, and other assets.

Read Our Blog: Blockchain Security: Best Practices Every Developer Should Know

In healthcare, blockchain is improving data security and interoperability, facilitating the secure sharing of patient records among healthcare providers.

The supply chain industry is witnessing blockchain adoption to enhance traceability and reduce fraud, addressing consumer demands for transparency.

Blockchain is being used to create decentralized energy grids, allowing peer-to-peer energy trading and optimizing resource allocation.

Blockchain development services play a pivotal role in enabling businesses to harness the power of blockchain technology for their growth and innovation. These services encompass a wide range of solutions tailored to meet the specific needs of businesses seeking to leverage blockchain’s potential. Let’s delve into the essential aspects of blockchain development services, their significance, and how to make the right choice for your business.

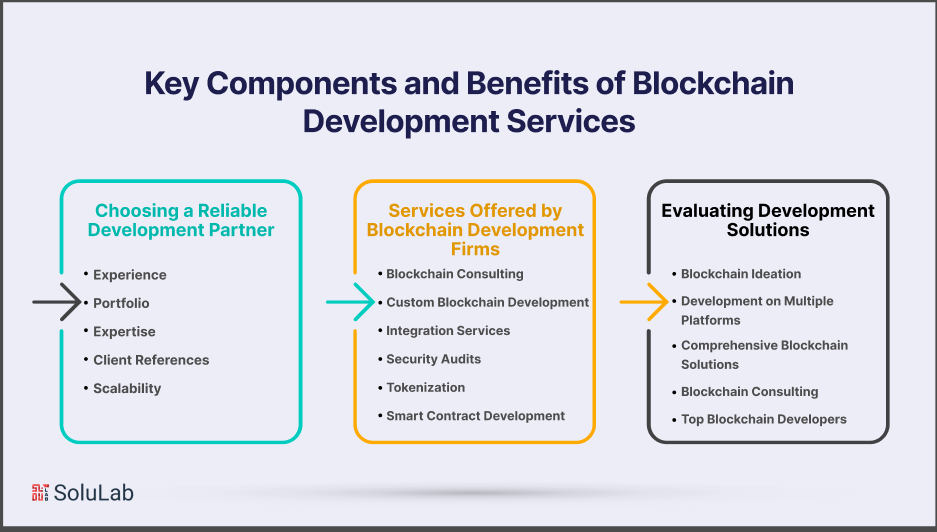

Selecting the right development partner for your blockchain project is a critical decision that can significantly impact its success. When considering blockchain development services, businesses should look for reliability, expertise, and a track record of delivering high-quality solutions. Here are key factors to consider when choosing a development partner:

Evaluate the development partner’s experience in blockchain technology. Have they worked on similar projects or blockchain use cases relevant to your business idea?

Examine their portfolio to gauge the quality of their previous work. Look for successful implementations of blockchain applications with businesses.

Assess the team’s expertise in various blockchain platforms and technologies. Are they well-versed in blockchain trends and best practices?

Request client references and testimonials to gain insights into the partner’s reputation and the satisfaction of past clients.

Ensure that the development partner can accommodate your project’s scalability requirements as your blockchain application grows.

Blockchain development firms offer a comprehensive range of services to cater to diverse business needs. These services typically include:

Identifying viable blockchain use cases for your business, helping define blockchain business strategies, and assessing the feasibility of blockchain adoption.

Creating tailor-made blockchain solutions to meet specific business requirements, whether it’s developing decentralized applications (DApps), smart contracts, or private blockchains.

Integrating blockchain technology seamlessly with existing business systems and processes to ensure smooth operations.

Conducting security audits and implementing robust security measures to protect blockchain assets and data.

Developing and launching tokens for fundraising or asset management purposes, such as initial coin offerings (ICOs) or security token offerings (STOs).

Designing and coding smart contracts to automate business processes, enforce agreements, and enhance transparency.

When considering SoluLab for blockchain development services, businesses benefit from a reputable and experienced partner. SoluLab offers a wide array of blockchain services, including:

Assisting businesses in identifying blockchain use cases and crafting innovative blockchain business ideas.

Expertise in developing various blockchain platforms, such as Ethereum, Hyperledger, and Corda.

Providing end-to-end solutions, from consulting and development to deployment and maintenance.

Offering strategic guidance and insights to help businesses align their blockchain strategy with their goals.

Access to a talented team of blockchain developers who are proficient in the latest blockchain technologies and trends.

By collaborating with SoluLab, businesses can leverage their blockchain expertise and commitment to delivering reliable, scalable, and secure blockchain solutions.

Blockchain development services are indispensable for businesses looking to harness the potential of blockchain technology. Choosing a reliable development partner and assessing the services offered are crucial steps in ensuring the success of your blockchain project. SoluLab stands as a reputable option for businesses seeking blockchain development solutions that align with their objectives and aspirations.

In conclusion, SoluLab’s comprehensive Blockchain Business Strategy Guide offers invaluable insights into the dynamic world of blockchain development for businesses. As the landscape of technology evolves, it’s evident that blockchain is more than just a buzzword; it’s a transformative force with numerous blockchain use cases that can revolutionize your business. From enhancing security to streamlining operations and fostering trust among stakeholders, the potential of blockchain technology is boundless.

By investing in blockchain development services from SoluLab, you are not only staying ahead of blockchain trends but also positioning your business to thrive in an increasingly digital and decentralized world. Our expert blockchain developers can tailor blockchain solutions to match your unique needs, whether you’re exploring blockchain applications with business processes, considering new blockchain business ideas, or seeking to optimize your existing operations through blockchain technology.

With SoluLab’s blockchain consulting services, you gain a trusted partner who can guide you through the intricacies of blockchain technology, helping you make informed decisions and seize opportunities in this rapidly evolving space. Our commitment to delivering top-notch blockchain development solutions ensures that your business stays at the forefront of innovation and maintains a competitive edge. SoluLab’s blockchain consulting services provide expert guidance in the ever-evolving blockchain landscape. Trust us to lead your way to innovation and success. Contact SoluLab today for a brighter future.

Blockchain development involves creating decentralized, secure, and transparent digital ledgers. Businesses should consider it to streamline operations, enhance security, and explore innovative opportunities like blockchain applications with business.

Blockchain has numerous applications in businesses, including supply chain management, smart contracts, identity verification, and tokenization of assets. These use cases can improve efficiency and reduce costs.

Blockchain trends evolve rapidly. Stay updated on trends like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and interoperability solutions to make informed investment decisions.

Blockchain development can offer competitive advantages by increasing transparency, reducing fraud, and enhancing trust among stakeholders. It can also open up new revenue streams with blockchain platforms and innovative solutions.

When seeking blockchain development services, consider their expertise, track record, and ability to align blockchain technology with your business goals. Look for providers offering comprehensive blockchain solutions.