In this era, AI is spreading its roots to numerous industries, and blockchain is not a new concept for developers and entrepreneurs. However, the concept of AI integration in asset tokenization can make you think deeper. From small chatbots to smart contracts, AI has shifted the workflows. Now, another innovation towards asset tokenization is gathering attention from several researchers.

Deloitte also mentioned in its Q4 2025 report that the tokenization market is projected to grow from $300 billion to $4 trillion in the future. This is the signal that AI-powered asset tokenization is set to make a unique entry into the market. Therefore, to stay ahead of the racing market, you must know how this adoption is going to affect your niche.

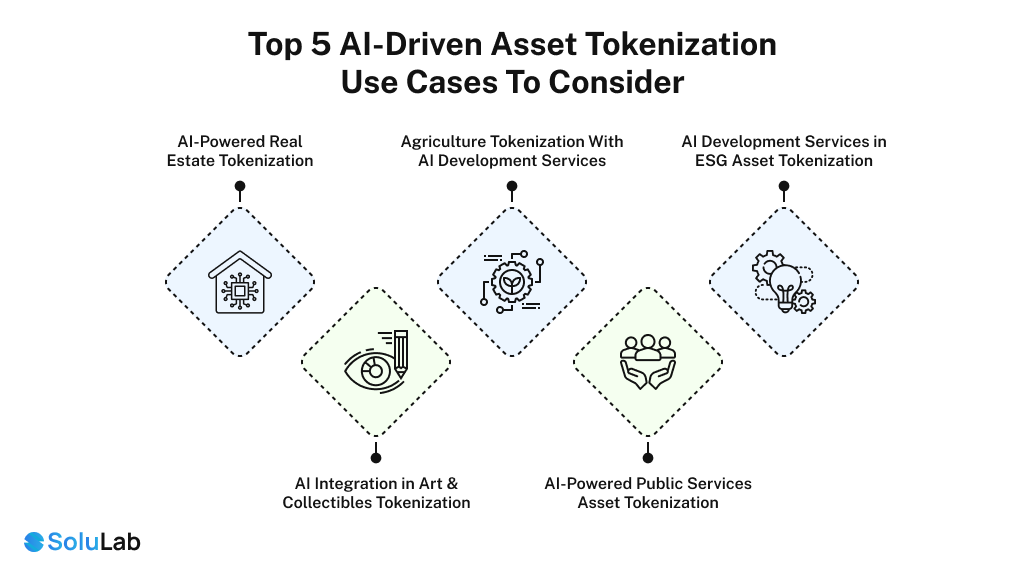

The following discussion will give you clear details on how different industries are affected by AI-driven asset tokenization use cases.

Tokenization without intelligence quickly hits operational limits. Enterprises managing thousands of assets, investors, and compliance rules cannot rely on manual processes or static smart contracts alone.

AI solutions enable enterprises to build enterprise asset tokenization platforms that scale smoothly across geographies, asset classes, and regulatory environments.

Key reasons AI is becoming foundational include:

As a result, AI-driven systems transform your asset tokenization services from a technical deployment into a long-term business capability.

It’s not just a one-day process to adopt customer-friendly AI development services into an asset tokenization platform. However, once the process starts, you can see the shift in your dynamics. Let’s see some key market shifts that showcase futuristic initiatives.

Furthermore, real estate tokenization adoption is accelerating globally. Governments in Japan, Israel, and parts of Asia are actively exploring tokenized property frameworks. These initiatives are driven by faster settlement cycles, reduced intermediaries, and programmable financing structures. AI plays a critical role here by enabling dynamic pricing, automated compliance checks, and portfolio-level risk optimization.

There are numerous industries, but the currently hyped and fast-adapting AI services in asset tokenization are given below:

Real estate remains the largest and fastest-growing tokenized asset category. AI enhances both operational efficiency and investment intelligence.

Read More: Top 10 Countries to Launch a Real Estate Tokenization Platform in 2026

a. AI-Driven Portfolio Structuring

AI models analyze asset performance, location data, tenant behavior, and macroeconomic indicators to structure optimized tokenized portfolios.

b. Automated Compliance and Investor Management

AI simplifies complex regulatory workflows across jurisdictions.

Art and collectibles represent a high-value yet illiquid market. AI enables transparency, pricing confidence, and broader participation.

a. Intelligent Asset Valuation and Authentication

AI analyzes auction histories, provenance records, and market sentiment to support pricing accuracy.

b. Liquidity and Market Access Optimization

AI improves liquidity planning for traditionally illiquid assets.

Agriculture tokenization transforms illiquid farming assets into tradeable digital instruments while supporting farmers directly.

a. AI-Enabled Financial Inclusion Model

AI creates verifiable financial identities for farmers using transaction histories and yield data.

b. Supply Chain Transparency and Yield Optimization

AI provides end-to-end visibility across agricultural supply chains.

Financial assets, including debt instruments and stablecoins, benefit significantly from AI-driven risk and liquidity management.

a. Intelligent Risk Modeling and Pricing

AI analyzes market volatility, creditworthiness, and liquidity signals continuously.

b. Stablecoin and Capital Stack Optimization

AI supports multi-layer capital structures across equity, debt, and hybrid instruments.

ESG-focused tokenization requires accurate data, transparency, and accountability, areas where AI excels.

a. ESG Data Quality and Standardization

AI resolves inconsistencies across ESG data sources.

b. Sustainable Investment Optimization

AI helps investors align returns with measurable impact.

By 2026, asset tokenization will no longer be experimental. It will be embedded into enterprise financial and operational systems.

What forward-looking enterprises are preparing for:

However, challenges remain. Not all assets generate revenue, digital literacy gaps persist, and blockchain infrastructure requires upfront investment. Enterprises that succeed will be those that treat tokenization as a long-term system, not a one-off product.

An experienced asset tokenization development company helps enterprises design compliant, scalable, and AI-driven architectures that evolve with regulation and market demand.

Every industry is gaining benefits through AI-powered asset tokenization. This is where real growth starts. Once you start integrating AI services into the tokenization platform, you can see the customer engagement. To achieve this, a potential AI development company that has strong experience and a strong team is a must. We, at SoluLab, with

If you are also ready to build an AI-integrated asset tokenization platform, contact us today. Make your future vision come true with our 24/7 support.

The cost of AI development services for healthcare asset tokenization typically starts from $10,000 and can scale higher. Pricing depends on data complexity, compliance requirements, AI-powered asset tokenization features, and enterprise-grade security integrations.

Developing an AI-powered real estate tokenization platform usually takes 3 to 4 months. Timelines depend on asset volume, regulatory scope, AI model complexity, and whether you are building a custom enterprise asset tokenization platform or upgrading an existing system.

Yes, AI can be integrated into an existing art tokenization system without rebuilding everything. AI-powered asset tokenization improves valuation accuracy, fraud detection, investor insights, and liquidity management while strengthening enterprise tokenization use cases for art assets.

You can contact SoluLab directly through their website to discuss AI-powered asset tokenization needs. Their team provides consultation, architecture planning, and end-to-end asset tokenization development services for enterprises and startups.

Yes, SoluLab actively works with clients in Dubai and the Middle East. They deliver AI development solutions, enterprise asset tokenization platforms, and compliance-ready tokenization applications tailored to UAE regulations and regional enterprise requirements.