Decentralized Finance, often referred to as DeFi, has emerged as one of the most influential trends in the blockchain space. This revolutionary concept leverages blockchain technology to create a decentralized financial ecosystem that operates without traditional intermediaries like banks. In this comprehensive guide, we will delve into the world of DeFi, exploring its platforms, protocols, development companies, lending platforms, trading platforms, and how it all ties into the broader blockchain landscape.

Decentralized Finance, commonly known as DeFi, is a revolutionary movement within the blockchain ecosystem protocols that seeks to recreate traditional financial systems using blockchain technology. Unlike traditional finance, which relies on centralized intermediaries like banks and financial institutions, DeFi operates on decentralized platforms and smart contracts.

It encompasses a wide range of financial services and applications, including lending, borrowing, trading, asset management, and more, all built on blockchain networks. DeFi platforms, protocols, and development companies play a pivotal role in enabling this ecosystem, while blockchain technology provides the foundation for its transparency and security.

Furthermore, DeFi is closely intertwined with blockchain trends, as it leverages blockchain’s potential to disrupt traditional finance and expand into other industries beyond the financial sector. This transformative trend is redefining the way we think about and interact with financial services, offering users greater control and accessibility to their financial assets and transactions.

DeFi applications are built on blockchain technology, which is a distributed ledger system that records transactions in a secure and transparent manner. Blockchain technology allows DeFi applications to operate without the need for a central intermediary. Top DeFi protocols use smart contracts to automate transactions and interactions between users.

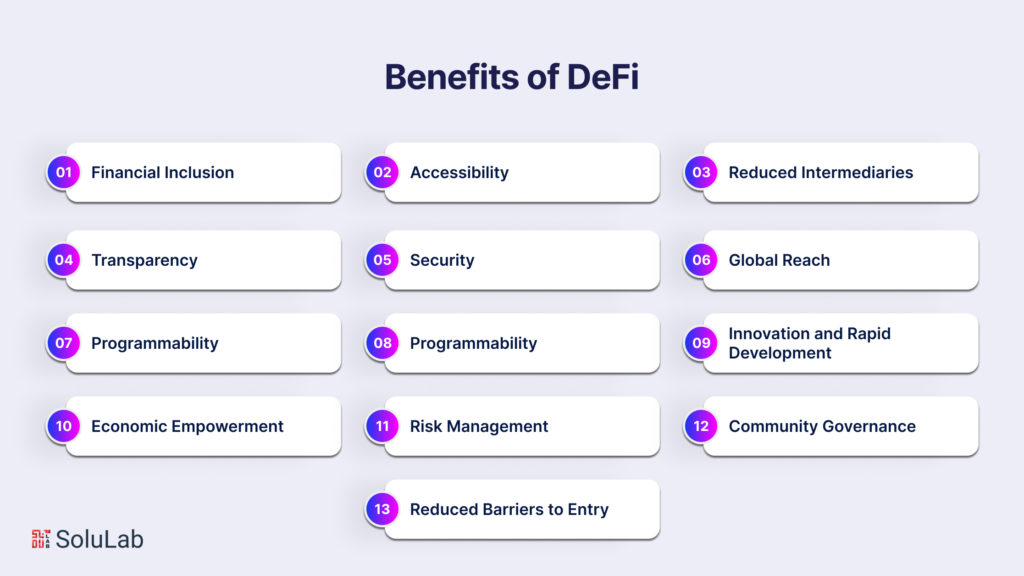

Decentralized Finance (DeFi) is transforming the financial landscape in numerous ways, offering a wide array of benefits to users, developers, and the global economy.

DeFi opens up financial services to anyone with internet access, enabling global financial inclusion. This is especially significant in regions with limited access to traditional banking. According to the World Bank, around 1.7 billion adults worldwide remain unbanked. DeFi can bridge this gap and empower individuals to access and manage their finances.

Unlike traditional financial markets with set trading hours, DeFi operates 24/7, allowing users to trade, lend, and borrow at their convenience. This accessibility provides flexibility and empowers users to make real-time financial decisions.

Traditional financial systems rely on intermediaries like banks, brokers, and clearinghouses, which charge fees for their services. DeFi minimizes or eliminates these intermediaries, reducing costs for users. Smart contracts execute transactions automatically, bypassing the need for intermediaries and their associated fees.

DeFi leverages blockchain technology to ensure transparent and immutable record-keeping. Every transaction is recorded on a public ledger, providing users with complete transparency. This transparency enhances trust, as users can independently verify all transactions.

DeFi benefits from the security features of blockchain technology. Smart contracts, once deployed, are immutable, reducing the risk of tampering or fraud. The security of blockchain has contributed to a significant decrease in successful attacks on DeFi platforms.

Cross-border payments are a significant part of the global economy. DeFi enables seamless cross-border transactions, allowing users to send and receive funds globally without the delays and high fees associated with traditional cross-border banking services.

DeFi platforms are highly programmable, allowing developers to create customized financial solutions. This programmability has led to the development of a diverse range of applications, including yield farming, decentralized exchanges, automated trading bots, and more. Users can participate in these innovative financial services.

DeFi platforms like Compound and Aave offer users the opportunity to earn interest on their assets. Users can participate in lending or liquidity provision, often earning yields that surpass traditional savings account rates by a significant margin. This opens up new avenues for passive income and wealth creation.

DeFi is characterized by its rapid pace of innovation. New projects, tokens, and protocols continually emerge, offering new financial products and services. The open-source nature of DeFi fosters competition and innovation, driving the development of cutting-edge solutions.

DeFi can empower individuals to take control of their finances. Users are not reliant on centralized institutions; they have custody of their assets and can engage in financial activities autonomously. This increased agency can lead to greater financial empowerment and self-reliance.

DeFi platforms often allow users to set their own risk parameters. For example, users can choose the level of collateral required for loans, mitigating risk to some extent. Additionally, DeFi insurance projects offer coverage against smart contract vulnerabilities and hacks, further enhancing risk management.

Many DeFi projects employ decentralized governance mechanisms. Token holders have a say in protocol upgrades and decision-making. This approach promotes a more democratic and community-driven ecosystem.

In traditional finance, launching financial products and services can be highly regulated and costly. DeFi reduces these barriers to entry for entrepreneurs and developers, making it easier to create and launch financial innovations.

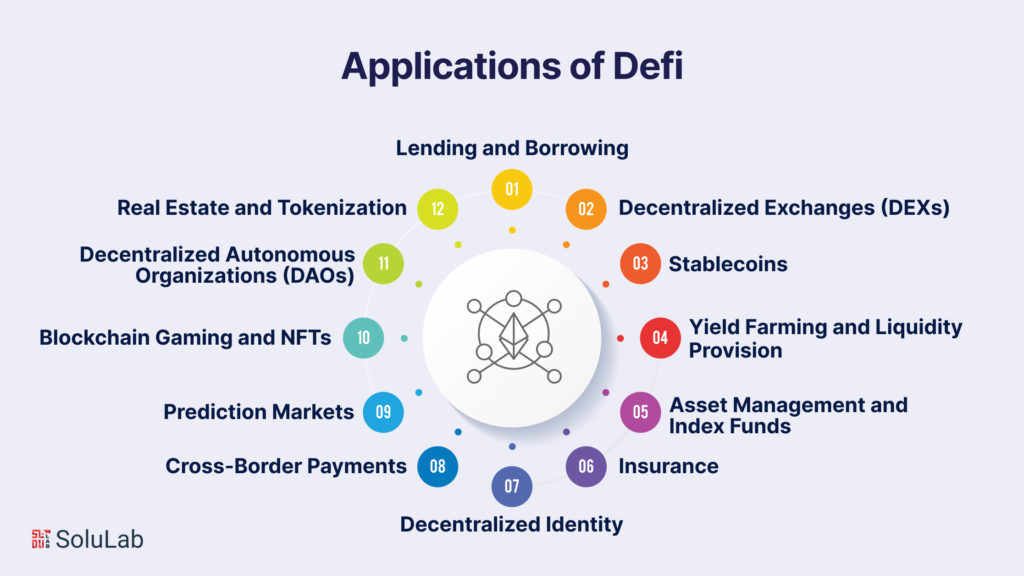

Decentralized Finance (DeFi) has a wide range of applications that are transforming the traditional financial landscape. These applications leverage blockchain technology to provide innovative and decentralized solutions to various financial services. Here are some key applications of DeFi:

DeFi lending platforms allow users to lend their crypto assets to earn interest, while borrowers can use their crypto holdings as collateral to secure loans. These platforms often offer more attractive interest rates than traditional banks.

Examples: Compound Finance, Aave, MakerDAO

DEXs enable users to trade cryptocurrencies directly without the need for a centralized intermediary. They provide liquidity and allow for trustless and transparent trading.

Examples: Uniswap, SushiSwap, Balancer

Stablecoins are digital currencies crafted with the intention of preserving a fixed value, frequently linked to a traditional currency such as the US dollar. They serve as a stable medium of exchange and a store of value within the volatile crypto market.

Examples: USDC, USDT, DAI

Yield farming encompasses the act of supplying liquidity to DeFi protocols in return for incentives. Users can earn tokens and interest by locking up their assets in liquidity pools.

Examples: Yearn.finance, Curve Finance, Balancer

DeFi allows users to create, manage, and invest in tokenized portfolios, enabling automated trading and diversification of assets.

Examples: Set Protocol, PieDAO

DeFi insurance platforms provide coverage against smart contract vulnerabilities and hacks in the DeFi ecosystem, offering protection to users.

Examples: Nexus Mutual, Cover Protocol

DeFi can be used to establish decentralized identity systems, giving users more control over their personal information.

Examples: uPort, SelfKey

DeFi facilitates cost-effective and rapid cross-border transactions, reducing the fees and delays associated with traditional international transfers.

Examples: Stablecoin-based remittance services

DeFi prediction markets enable users to create and participate in markets for predicting real-world events, offering a decentralized way to speculate on outcomes.

Examples: Augur, Gnosis

DeFi and blockchain technology are integrated into the gaming industry, allowing players to buy, sell, and trade in-game assets and NFTs.

Examples: Axie Infinity, Decentraland

DAOs are organizations governed by smart contracts and token holders, enabling decentralized decision-making and governance.

Examples: Yearn Governance, Compound Governance

DeFi can be used to tokenize real estate assets, making it easier for users to invest in properties and participate in real estate markets.

Examples: RealT, Propy

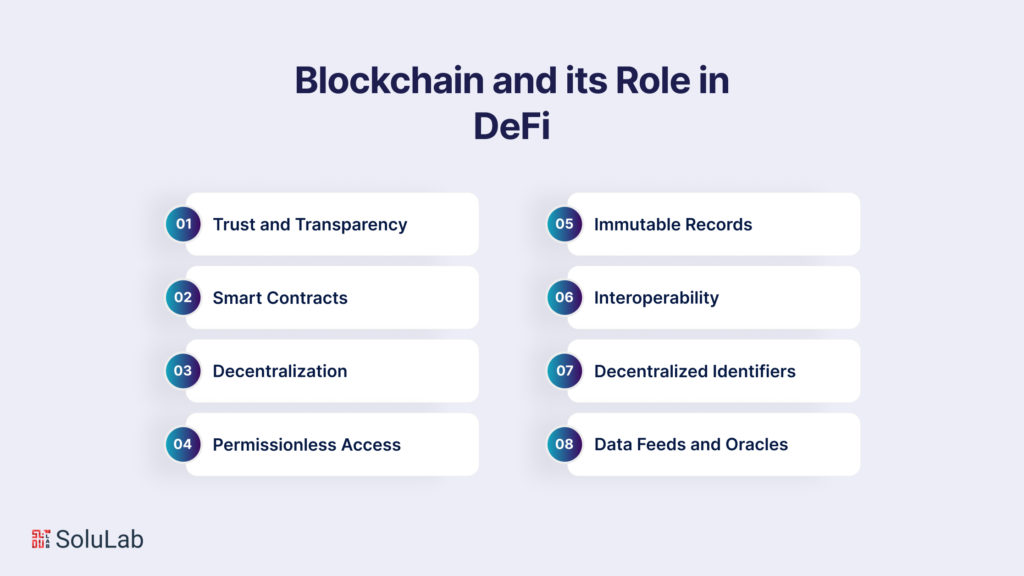

Blockchain technology plays a pivotal role in the success and functionality of Decentralized Finance (DeFi). It underpins the entire DeFi ecosystem, providing the infrastructure and key features necessary for its operation. Here’s how blockchain contributes to DeFi:

Blockchain is a decentralized and distributed ledger technology. It records transactions in a secure and transparent manner across a network of nodes. This transparency ensures that all DeFi transactions are publicly verifiable, and participants can audit the transaction history. Users can trust that the information on the blockchain is accurate and tamper-proof.

DeFi relies heavily on smart contracts to automate and execute financial agreements without the need for intermediaries. These contracts are immutable and executed according to predefined rules, enhancing the security and reliability of financial transactions.

Blockchain networks, such as Ethereum, are decentralized, meaning there is no central authority or intermediary controlling the system. DeFi applications leverage this decentralization, eliminating the need for trusted third parties like banks. Users retain control of their assets and transactions, reducing counterparty risk.

DeFi platforms built on blockchain technology are generally permissionless, meaning anyone with an internet connection and the required assets can access and use these services. This inclusivity opens financial services to a global audience without regard for geographical location, background, or identity.

Once a transaction has been added to a blockchain, it becomes immutable, i.e. it cannot be altered or deleted. This immutability enhances the security of financial transactions, making it difficult for fraudulent or unauthorized changes to occur.

Blockchain networks and protocols are often designed to be interoperable, allowing DeFi platforms to communicate and interact seamlessly. This interoperability enables various DeFi applications to work together and create a more interconnected financial ecosystem.

Blockchain can provide a foundation for decentralized identity solutions, allowing users to control and manage their personal data and identity. This is particularly important in DeFi, where privacy and identity verification are essential.

To provide real-world data to smart contracts, DeFi projects often rely on oracles. These oracles are external data sources that feed information from the real world into the blockchain. They play a critical role in enabling smart contracts to respond to real-world events and conditions.

Decentralized Finance (DeFi) is reshaping the financial landscape, offering a more inclusive and transparent way of managing assets and accessing financial services. As blockchain technology continues to advance, we can expect even greater innovation and adoption in both the DeFi space and across various industries.

Bear in mind that the DeFi arena is ever-changing, and new entrants may come into play. Hence, it’s crucial to engage in comprehensive research and due diligence when deciding on a DeFi development company. With the right team and a forward-looking vision, your DeFi project has the potential to become a game-changing force in the financial realm.

If you’re still in search of the ideal DeFi development company, get in touch with Solulab without delay. Solulab boasts extensive experience in DeFi development services, a strong technical acumen, and a commitment to fostering innovation, making them an excellent option for businesses and entrepreneurs looking to embark on DeFi endeavors or enhance their existing DeFi solutions.

DeFi, short for Decentralized Finance, is a blockchain-based financial ecosystem that offers decentralized alternatives to traditional financial services like lending, borrowing, and trading. Unlike traditional finance, DeFi operates on blockchain technology, removing the need for intermediaries, providing transparency, and enabling users to have full control over their assets.

To start with DeFi, you need a crypto wallet, usually compatible with the Ethereum blockchain, as many DeFi projects are built on Ethereum. You can fund your wallet with cryptocurrencies, connect to a DeFi platform, and then explore and use various DeFi applications, such as lending, borrowing, or trading.

DeFi platforms prioritize security, but they are not immune to risks. Users should conduct thorough research, use reputable platforms, and follow best practices such as enabling two-factor authentication and using hardware wallets. Additionally, smart contract vulnerabilities and exploits have occurred, so it’s crucial to assess the risk before participating.

Yield farming is a DeFi strategy where users provide liquidity to decentralized exchanges or lending platforms in exchange for rewards or interest. It involves staking assets in liquidity pools and earning tokens or a percentage of transaction fees. Yield farming can offer attractive returns but carries risks and should be approached with caution.

Yes, DeFi offers opportunities for passive income. Staking assets in DeFi platforms, providing liquidity to DEXs, or participating in yield farming can all generate passive income. However, these strategies come with varying degrees of risk, so it’s essential to research and understand the potential rewards and risks associated with each method.