Tokenization of assets is increasingly seen as a transformational force in financial markets. According to a World Economic Forum report, tokenization could modernize infrastructure by enabling shared systems of record, fractional ownership, and composability across asset classes, potentially making markets more inclusive and efficient.

Major financial institutions are already experimenting with tokenized products. For example, banks like JPMorgan Chase have launched tokenized money-market funds, signaling rising institutional adoption.

Tokenization platform development isn’t just for crypto natives. It has the potential to reshape traditional capital markets by reducing inefficiencies and enabling atomic settlement, where ownership and cash settle simultaneously on a distributed ledger, a capability that could significantly reduce operational costs.

Key Takeaways

- Tokenization platforms must be designed with compliance embedded at the protocol level, not added later.

- Enterprise-grade tokenization requires lifecycle management, interoperability, and strict access controls.

- Choosing the right token standard is critical for regulated asset issuance and secondary transfers.

- With the right architecture and partner, enterprises can launch compliant platforms in 90–180 days.

How Enterprises Are Using Tokenization Development to Modernize Capital Markets?

Enterprises and financial institutions are increasingly adopting tokenization to modernize how capital markets function. At its core, tokenization turns real-world assets like bonds, equities, real estate, or funds into digital tokens on blockchain networks.

This shift aims to reduce settlement times, improve transparency, and open markets to a broader investor base.

A 2025 World Economic Forum report highlights that tokenized infrastructure can dissolve traditional silos between finance and crypto, enabling more efficient, interoperable capital systems. Major players are testing and deploying real-world asset (RWA) tokens.

For example, JPMorgan Chase recently launched its first tokenized money-market fund. It was seeded with $100 million and accessible to institutional and high-net-worth investors via its in-house tokenization platform. This reflects the broader institutional trend and AI and blockchain adoption in multiple industries.

Benefits that drive enterprise adoption include faster settlement cycles, programmable compliance tied to regulations, and fractional ownership, which can unlock liquidity in traditionally illiquid markets. By converting physical or financial assets into digital tokens, companies can also streamline cross-border investment flows and reduce administrative friction.

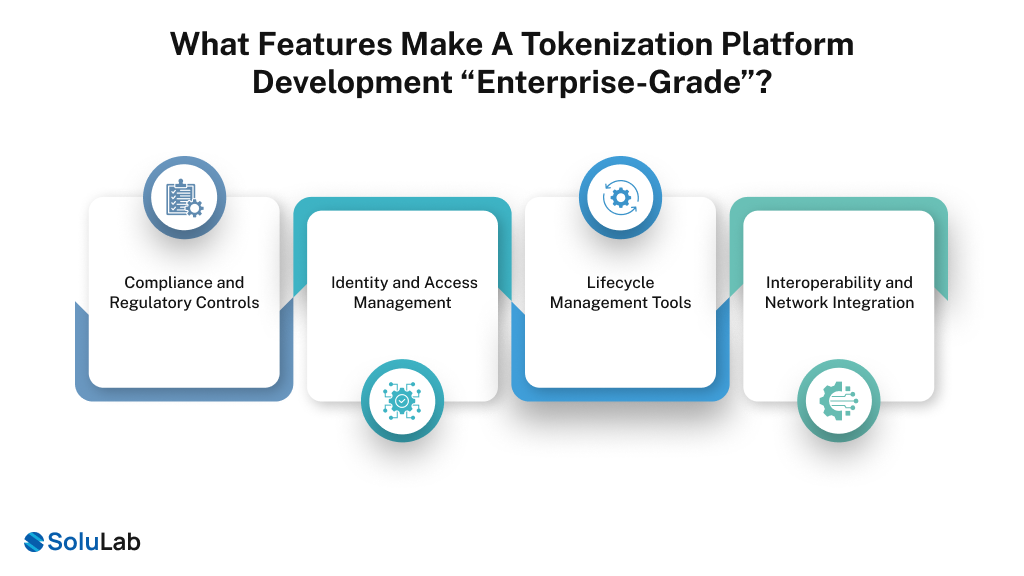

What Features Make a Tokenization Platform Development “Enterprise-Grade”?

An enterprise-grade tokenization platform goes beyond simple token issuance. It must embed compliance, security, and flexibility into its design. Core features include:

1. Compliance and Regulatory Controls

Enterprise platforms enforce jurisdictional rules and eligibility criteria through programmable logic rather than manual oversight. Tokens should reflect the legal and economic rights of the underlying asset, which often involves regulatory mapping and escrow or SPV (Special Purpose Vehicle) structures to ensure enforceability across markets.

2. Identity and Access Management

Whitelisting and digital identity systems are essential to limit participation to verified investors and comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) mandates. This avoids the risk of unauthorized trading and aligns tokens with regulatory standards.

3. Lifecycle Management Tools

Enterprise solutions enable issuers to manage token issuance, transfers, corporate actions, and redemption processes. These governance and control mechanisms provide flexibility for issuers and compliance teams.

4. Interoperability and Network Integration

Platforms should support connections to multiple blockchain networks and traditional finance rails. This makes it easier to integrate with custodians, exchanges, and decentralized finance protocols while maintaining compliance.

Collectively, these features of the tokenization platform ensure it can operate at scale within regulated environments, meeting institutional expectations even as markets evolve.

Core Architecture of a Modern Tokenization Platform Development

A robust tokenization platform typically comprises several layered components. But these are based on your regional requirements.

1. Asset Representation and Legal Layer

Before tokens are created, the legal rights and enforceability must be defined. Many enterprises use SPVs to hold underlying assets, with tokens representing legal or economic interests.

2. Compliance and Identity Layer

Whitelisting controls, investor verification, and jurisdiction enforcement sit here. This is critical in regulated markets where investor types and regions determine eligibility.

3. Token Logic Layer

Smart contracts handle minting, transfer rules, balance tracking, and automated compliance. These contracts must be rigorously audited and structured for regulatory clarity.

4. Distribution and Marketplace Layer

Tokens need distribution channels. This can involve integrations with trading platforms, custodians, and DeFi protocols. An interoperable stack allows assets to move between private and public networks securely.

5. Data and Analytics Layer

Real-time reporting and analytics help institutions monitor holdings, transfers, and compliance events. This layer supports corporate actions and investor reporting.

By separating concerns into these layers, platforms achieve the flexibility, regulatory alignment, and scalability required for institutional use.

What are the Right Token Standards for Regulated Assets?

When enterprises evaluate tokenization, they are not asking, “Which token standard is popular?” They are asking, “Which standard lets us issue assets legally, operate across jurisdictions, and scale without rebuilding later?”

In practice, regulated tokenization platforms are built using a combination of standards, each solving a specific institutional requirement.

1. ERC-1400

Before modern compliance-native standards emerged, many early security token platforms relied on the ERC-1400 standard family.

What it solved

- Partitioned ownership (useful for tranches or classes of shares)

- Document management hooks for legal agreements

- Transfer validation logic

Who used it

- Early security token platforms in Europe and Asia between 2018–2020

- Pilot projects for tokenized equity and funds

Where it fell short

- Heavy complexity

- Fragmented adoption

- Difficult interoperability with DeFi and newer blockchain tooling

Many enterprises that started with ERC-1400 later migrated to newer, more flexible standards as tokenization matured.

2. ERC-3643

ERC-3643 emerged specifically to solve the operational reality institutions faced after early pilots.

Instead of wrapping compliance around tokens, it embeds:

- Identity verification

- Transfer eligibility

- Jurisdiction enforcement is directly into the token logic.

This matters in real business scenarios.

Example

When European asset managers began issuing tokenized bonds post-2020, regulators required continuous control over who could hold and transfer assets. Platforms built on ERC-3643 allowed issuers to enforce these rules automatically, even during secondary transfers, without relying on manual approvals.

This approach is one reason platforms like Tokeny became attractive to banks, transfer agents, and fund administrators operating across multiple jurisdictions.

3. ERC-20

Despite its limitations, ERC-20 is still used in regulated tokenization, but never in its raw form.

Top enterprises use ERC-20 only when:

- The asset is permissioned through strong access controls

- Transfers are restricted via custom smart contract logic

- Identity and compliance layers sit tightly above the token

Business reality

ERC-20 is familiar, widely supported, and easy to integrate with wallets and infrastructure. For private markets or internal settlement use cases, enterprises sometimes choose a heavily modified ERC-20 architecture for speed and ecosystem compatibility.

However, without deep customization, ERC-20 alone is insufficient for regulated issuance.

Read Our Blog: https://www.solulab.com/erc-3643-vs-erc-1400-vs-erc-20/

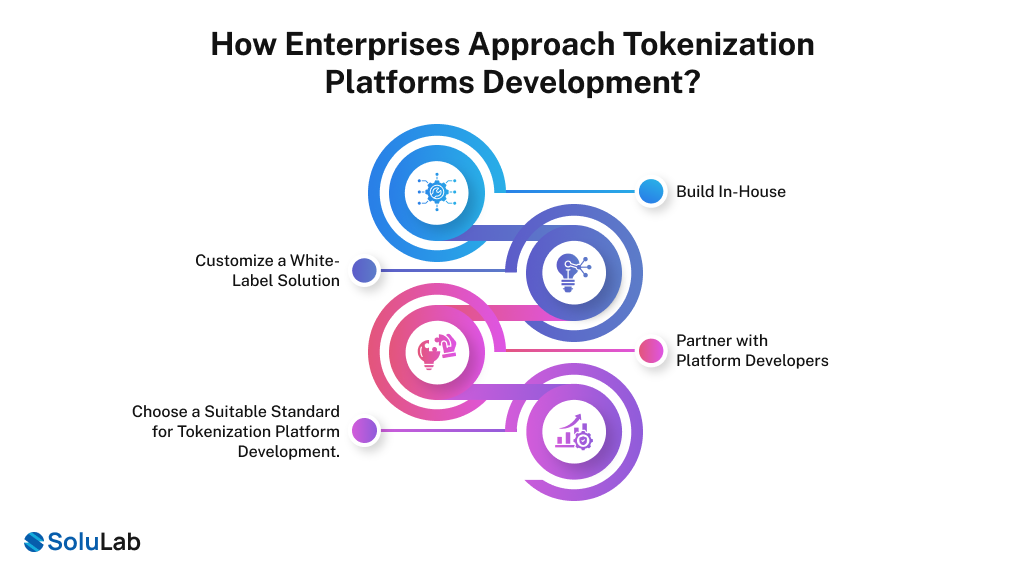

How Enterprises Approach Tokenization Platforms Development?

Enterprises generally follow three paths when building tokenization platform like Tokeny:

1. Build In-House

Large financial institutions with blockchain expertise may attempt internal development. This offers maximum control but requires significant investment in compliance, engineering, and legal expertise.

2. Customize a White-Label Solution

Many firms choose established tokenization frameworks and white-label them. This approach accelerates time-to-market while retaining branding and governance control. With the present tools and AI, adopting white label tokenization can be done in 7 to 10 days.

3. Partner with Platform Developers

Most enterprises partner with specialized tokenization platform development companies that bridge financial rigor with blockchain execution. These partners bring deep technical experience, compliance knowledge, and integration capabilities across custody, KYC providers, and trading venues.

Decision criteria for enterprises often include compliance support, integration flexibility, scalability, and ongoing support. You should also keep the tokenization platform development cost in mind. A partner that understands both legacy financial ecosystems and decentralized infrastructure reduces risk and speeds deployment.

4. Choose a Suitable Standard for Tokenization Platform Development.

There is no single “best” token standard for regulated assets. What separates successful tokenization platforms from stalled pilots is how standards are applied, not which one is named.

Enterprises building or evaluating Tokeny alternatives should focus on:

- Whether compliance survives secondary trading

- Whether regulators can audit the logic

- Whether assets can move across networks without losing legal integrity

That is the difference between a platform that scales globally and one that stays stuck in proof-of-concept mode.

How SoluLab Helps Enterprises Build Tokenization Platforms at Scale?

Enterprises looking to build an RWA tokenization platform like Tokeny need skilled teams that understand compliance, blockchain architecture, and market integration. SoluLab, a top asset tokenization platform development company, can provide you with a clear road map:

- Architecture Design and Compliance Mapping

- Smart Contract Development and Audits

- Integration with Identity, Custody, and Trading Systems

This structured approach enables institutions to launch compliant tokenization platforms with minimal disruption to legacy processes.

Many industries, from healthcare to telecom, are using tokenization platforms to provide better services to their customers. We are here to help you with the best platform development and integrations. Contact us today!

FAQs

Academic research shows that while tokenization promises liquidity, real trading volumes remain low for many tokenized real-world assets, indicating the need for deeper market infrastructure and regulatory clarity

Virtually any asset with definable ownership rights, including equities, bonds, real estate, commodities, and private credit, can be tokenized where legal frameworks permit. But there will be different methods and rules to tokenize in different industries.

Enterprises can connect with SoluLab by filling out the inquiry form on the official website or by scheduling a direct consultation with the solution team. Once the request is submitted, SoluLab typically responds within 48–72 hours, depending on region and project complexity, to discuss requirements, timelines, and next steps.

Yes. Hospitals and healthcare organizations are exploring tokenization for assets such as medical equipment, real estate, research funding, and even revenue-sharing models. Tokenization helps improve transparency, enable fractional ownership, and streamline capital access while keeping operational control with healthcare providers.

The cost of tokenization platform development varies based on asset types, customization level, integrations, and scalability requirements. For enterprises, costs typically range from a pilot or MVP build to a full-scale platform. However, the base price starts from $10k as features like multi-asset support, advanced analytics, and ecosystem integrations are added expenses increase.