You’re at a tight spot where every builder hits sooner or later. The product idea is ready, the blockchain development roadmap looks solid, but there’s one decision that keeps slowing everything down – Ethereum VS Solana.

On one side, there’s Ethereum. It’s been around longer, battle-tested, and backed by the biggest ecosystem in crypto. If you build there, you get credibility, liquidity, and developers everywhere. But you also get gas fees that can quietly drain your budget and slow things down once real users show up.

On the other side is Solana. It’s fast, cheap, and feels almost unfair when you compare transaction costs. Things just move, but then the questions creep in. Is it stable enough? What happens when serious money and real users come in? Are the tradeoffs worth it?

This choice isn’t really about which chain is better; it’s about what you’re building, how fast you need to move, and what kind of risk you’re willing to live with. So in this guide, we’ll walk through how Ethereum and Solana actually differ in practice. Let’s understand it a bit deeper!

Ethereum vs Solana: Which Blockchain Should I Build On?

This is the question that keeps founders up at night. Both networks are printing money for their ecosystems, but in different ways.

Ethereum is like a fortress. It is slow to build, expensive to maintain, but once you’re in, you’re plugged into trillions in liquidity, the deepest talent pool in crypto, and institutional infrastructure that’s been stress-tested for a decade. Ethereum vs Solana comparison shows something interesting – Ethereum didn’t win because it was fastest, it won because it solved the trust equation first.

But here’s what’s changing. Solana spent 2025 proving something – speed and cost matter more than most industry veterans admitted. When Solana validators processed 186% more revenue year-over-year, that wasn’t speculation or hype cycles. That was real transaction demand from real users who actually use their blockchains like payment networks, not just gambling platforms.

But the hard truth is, it depends on what you’re building. And we mean that genuinely.

If you’re building a DeFi app that needs maximum liquidity, Ethereum is still the only sensible choice. Your smart contracts will integrate with Uniswap, Aave, Curve – the entire financial architecture is Ethereum-native. You’ll pay more in gas, sure, but you won’t be rewriting a protocol in six months because liquidity is fragmented across a dozen L2s.

But if you’re building something that uses blockchain technology instead of something that is just blockchain theater, like a gaming experience, a payment rails application, an NFT platform where friction kills adoption, Solana’s economics start looking less like a compromise and more like the only rational choice.

Why Speed Matters When Choosing Between Ethereum and Solana in 2026?

Speed is the most misleading metric in blockchain, as everyone quotes it but nobody really understands what it means.

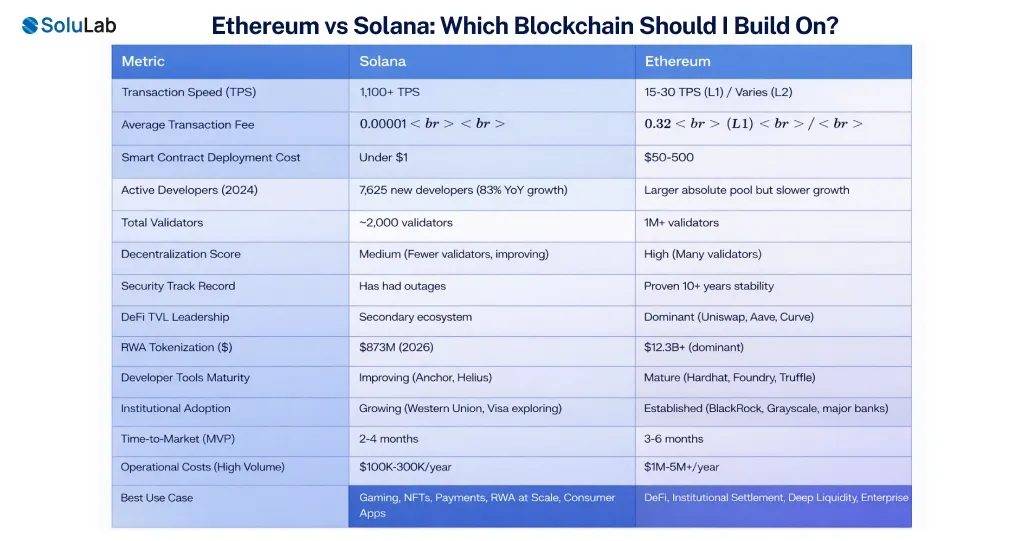

Here’s the reality: Solana processes transactions in under a second. Finality comes in about 12-13 seconds now, though the Alpenglow upgrade launching in 2026 is supposed to push that down to 1 second, making transactions nearly irreversible almost instantly. That’s physics-defying stuff.

But Ethereum, the base layer, handles about 15-30 transactions per second, though recent upgrades pushed actual throughput to around 18 TPS. That sounds pathetic compared to Solana’s 1,100+ TPS average, and it is, if you’re measuring raw throughput.

But here’s what everyone misses – Ethereum activity has already moved off mainnet. Layer 2 solutions like Arbitrum and Optimism are processing millions of transactions daily. Base is printing more transaction volume than most L1s ever will. The real Ethereum stack isn’t 18 TPS anymore; it’s however fast your layer 2 wants to be.

So, which is faster for your project?

For raw solana vs ethereum differences in latency, Solana wins decisively. A transaction settles on Solana before an Ethereum L2 batch gets posted to the base layer. If your users care about snappy interactions, think gaming, real-time derivatives, or any app where 200ms of delay breaks the UX. Solana’s not just faster, it’s categorically different.

But if you’re building something finality-critical and want the deepest security guarantees, Ethereum’s layered approach means you’re settling against the most secure blockchain in existence. There’s a reason institutions moving billions still choose Ethereum blockchain development.

Which Has Lower Transaction Fees in 2026: Ethereum vs Solana?

Let me give you the number that matters- Solana’s fees are somewhere between $0.00001 and $0.001 per transaction, seriously.

Ethereum’s average transaction fee, as of January 6, 2026, is $0.32. That’s for an average transfer. For complex smart contract interactions, you’re looking at $2-5 per interaction during moderate congestion, and $20+ during peak periods. Ethereum vs Solana investment decisions often hinge right here.

But fees don’t exist in isolation; you have to think in terms of cost per outcome.

If you’re deploying a DeFi protocol, each new contract instance costs about $50 in Ethereum gas to deploy. Do that on Solana, and you’re paying a fraction of a cent. Scale that to 100 deployments across your entire ecosystem, and you’ve just saved thousands; that’s real money. That’s engineer hours you can spend on features instead of gas optimization.

For a high-frequency trading bot or a gaming platform where every user action triggers a blockchain write, Solana’s sub-cent fees turn economics that are impossible on Ethereum into something viable. A user minting an NFT on Ethereum is $0.50-2, but the same action on Solana costs you around $0.0005. The difference isn’t rounding error; it’s whether the business model works.

But here’s the flip side – Ethereum Layer 2s have gotten ridiculously cheap too. Arbitrum and Optimism bring you down to $0.10-1.00 per transaction. Still 100-1000x more expensive than Solana development, but cheap enough that you’re not designing your entire product around fee minimization anymore.

The psychological element matters too. On Solana, users don’t think about gas. The fee is so low it doesn’t register. On Ethereum L1, they do. That changes behavior. It changes adoption and changes your unit economics.

How Solana Vs Ethereum Differences Show Up At The Architecture Level?

This is where design philosophies become technical tradeoffs, and tradeoffs are where the real conversation starts.

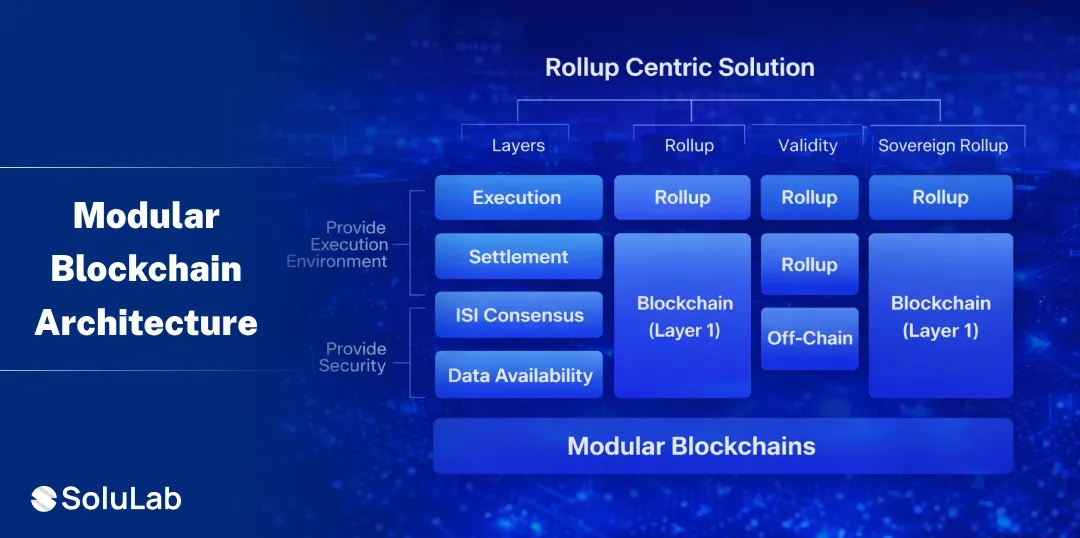

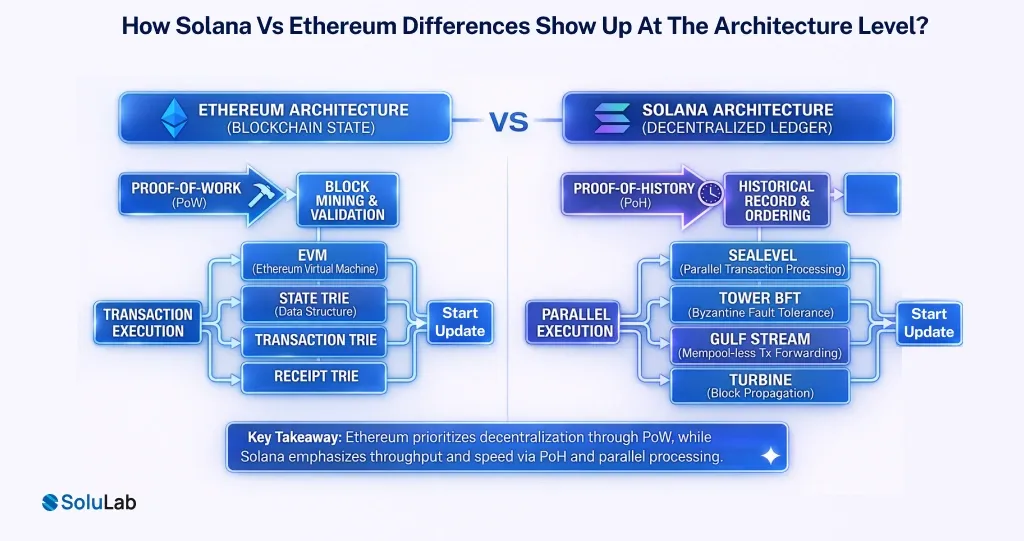

Ethereum is a modular stack. It does consensus and execution on the base layer, but it deliberately made itself expensive to run the most secure environment possible. They said to build a rollup, and Arbitrum and Optimism took that bargain and built entire ecosystems on top.

This is brilliant architecture, but it’s fractured architecture. Liquidity sits in Ethereum, Arbitrum, Optimism, and Base. Cross-chain communication works, but it’s never frictionless as users pay bridge fees. Developers build separate contracts for each chain. It’s modular in the architectural sense, which is great for scaling but fragmented for end-users.

Solana did the opposite. One monolithic chain. Consensus, execution, data storage, everything on a single layer. This means building one contract works everywhere. No bridges, fragmentation, or liquidity split across rollups. It’s simpler and cleaner.

But simplicity has a cost – decentralization. Running a Solana validator is expensive, as you need serious hardware. That’s why there are roughly 2,000 Solana validators versus over 1 million Ethereum validators. Fewer validators means more concentration risk, which is why Solana has had outages, and Ethereum hasn’t in years. These are physics, not luck.

The Firedancer upgrade coming in 2026 is supposed to reduce Solana’s hardware requirements, promising decentralization improvements, but it’s not here yet.

So which architecture is better? That depends on whether you value decentralization as a customer-facing feature or a backend infrastructure property. For most builders, the answer is clear: you care about its existence, not about being able to audit every validator’s hardware.

How Developers Influence Startup Blockchain Choices: Ethereum vs Solana?

The answer is both, and neither, depending on how you measure.

Ethereum still has the larger, more mature developer ecosystem. More smart contract auditors, more DeFi infrastructure. More of everything, in absolute terms. If you search Solidity best practices, you get a Wikipedia’s worth of resources. Search Rust for blockchain, and you get less.

But Solana just stole something important – momentum.

In 2025, Solana attracted 7,625 new developers — more than Ethereum for the first time since 2016. Solana now has 2,000+ monthly active developers and is the number one developer ecosystem in India, where a massive portion of the world’s new coding talent lives. On every continent except maybe North America, Solana’s the fastest-growing option.

Because the barrier to entry is lower. Rust is harder than Solidity, but once you get it, the documentation’s gotten killer. Helius, Magic Eden’s developers, and the Foundation itself have poured resources into making Solana development accessible. Hackathons are bigger, as Colosseum’s Breakout hackathon got 1,412 submissions, a blockchain record.

For tools, Ethereum still leads. Hardhat, Foundry, Truffle, the testing and deployment frameworks are more mature. Solana’s catching up with programs like Anchor, but it’s not parity yet.

But here’s the thing that matters more: can you hire a blockchain developer? On Solana, the talent pool might be smaller, but SoluLab is a hub for hiring good talent.

Are Smart Contracts Cheaper and Faster on Solana vs Ethereum?

Let’s get concrete. You’re deploying a staking contract. How much does it cost?

| Factor | Ethereum | Solana |

| Contract deployment cost | ~$50–$500 per deploy, depending on network congestion | Under $1 |

| Testing & iteration cost | Expensive — every iteration costs gas (5–10x deploy cost adds up fast) | Essentially free |

| Audit availability | Large, mature auditor ecosystem | Limited auditor supply (Rust expertise is scarce) |

| Audit cost (simple contract) | ~$5,000–$15,000 | Often lower, but harder to source |

| Execution speed | Slower execution, higher latency | Faster execution and finality |

| Operational costs post-launch | ~$1,000–$5,000/month depending on usage and gas | Near-zero for most on-chain activity |

| Risk profile | Slower, but heavily battle-tested and audited | Faster, but relies more on your internal discipline |

| Best fit | High-TVL, long-lived protocols | MVPs, rapid iteration, cost-sensitive builds |

So Solana is cheaper upfront and cheaper to operate, which is measurable.

Faster? It depends on what you mean. Solana contracts deploy and execute faster. Ethereum contracts are more heavily audited by default. Solana gives you speed, but Ethereum gives you safety. You’re not choosing between equal speeds, as you’re choosing between different risk profiles.

Here’s the practical breakdown – if you’re shipping an MVP and iterating fast, Solana’s lower cost and faster deploy cycles win. You’ll test more versions and fail cheaper. If you’re managing $100M in protocol TVL, the audit ecosystem and battle-tested frameworks on Ethereum start mattering more than raw speed.

Why Institutions Are Choosing Ethereum and Solana for Real-World Asset Tokenization?

In 2025-2026, blockchains stop being side projects and start being infrastructure.

Ethereum’s got the institutional playbook locked down. It hosts 54% of all stablecoins globally. When BlackRock, Grayscale, and every major wealth manager want to tokenize assets, they build on Ethereum or Ethereum L2s. This is institutional confidence manifesting as capital concentration. Ethereum’s the institutional default.

But Solana’s making a play, and it’s working.

Solana’s RWA (real-world asset) tokenization hit $873 million in January 2026. Not the largest as Ethereum’s still around $12.3 billion, but Solana went from afterthought to serious player in a single year, because institutions realized that when you’re moving $873M across multiple transactions, Solana’s cost structure beats Ethereum’s by orders of magnitude.

Tokenizing a $100M bond portfolio on Ethereum would cost you $50,000+ in transaction costs during issuance and trading. Same on Solana, maybe $500. That’s not a rounding error, that’s a business model difference. That’s why companies like Ondo Finance and other institutional players are building on Solana.

Western Union just chose Solana to build their stablecoin settlement platform, launching in H1 2026, which is infrastructure-scale adoption.

Ethereum and Solana institutional play are diverging. Ethereum’s winning DeFi, stablecoin settlement, and the deep-liquidity stuff, where Solana’s winning RWA tokenization, payments, and high-frequency operations, where cost per transaction is a make-or-break metric.

Which Blockchain Is Better for DeFi, Gaming, NFTs, and Payments?

Let me separate these because they’re completely different things.

1. DeFi

Ethereum, without question. Uniswap, Aave, Curve, and the liquidity is on Ethereum. Building a second-tier DeFi protocol on Solana works, but you’re competing against Ethereum’s network effects, not its technical capabilities. Ethereum wins because of lock-in, not because it’s faster.

2. Gaming

Speed matters for UX. Sub-cent fees matter for player economics. Magic Eden’s NFT game ecosystem is bigger than anything on Ethereum because of Solana’s throughput. If your game requires 100 transactions per second, processing player actions, minting, and trading, Ethereum’s base layer can’t handle it. L2s can, but fragmentation hurts.

3. NFT

Solana vs Ethereum is interesting here because both win, just differently. Ethereum’s got the blue-chip collection history like Bored Apes, Pudgy Penguins, and a collector mindset. Solana’s got the volume, around 35.99M daily transactions on Solana versus 1.13M on Ethereum. If you’re minting mass-market NFTs or creating art platforms with low price points, Solana’s cost structure makes it viable. Magic Eden’s volume regularly exceeds OpenSea’s.

4. Payments

Solana, clearly, as Western Union agreed. Visa is exploring stablecoin rails for crypto exchanges on Solana. When you’re processing millions of micropayments, Ethereum’s economics don’t work. Solana’s do.

How Do Post-Launch Costs Compare for High-Volume Projects?

This is where the spreadsheet really matters. Say you’ve built a DEX and you’re processing 1M transactions per day. This is a cost comparison for you –

| Cost Area | Ethereum | Solana |

| Simple smart contract(token, escrow, basic logic) | $5,000 – $10,000 | $2,000 – $5,000 |

| Mid-complexity build(DeFi module, DAO, staking) | $20,000 – $50,000 | $15,000 – $40,000 |

| Enterprise-grade system(multi-chain, institutional, RWA) | $100,000 – $300,000+ | $75,000 – $200,000 |

| Security audits | $5,000 – $50,000, with wide auditor supply | Comparable, sometimes slightly lower but fewer reputable auditors |

| Gas / testing costs | $2,000 – $10,000 during dev & testing | Near zero |

| Total MVP to launch | $25,000 – $75,000 | $15,000 – $50,000 |

That’s a 10x operational cost difference. If you’re a startup or smaller protocol, that’s life-changing. Ethereum’s gas costs add a permanent tax to high-frequency operations, but Solana’s don’t.

But higher costs on Ethereum also mean higher MEV. More sophisticated bots andcomplex attack vectors. You’re paying for security theater, network effect strength, and liquidity depth. Whether that payment’s worth it depends entirely on your use case.

Which Blockchain Should I Choose Based on My Use Case?

Let’s make this simple and honest.

| Choose Ethereum if… | Choose Solana if… |

| You need deep DeFi liquidity from day one | You’re building consumer-facing products |

| You manage institutional or regulated capital | Cost and speed are critical to UX |

| Security and decentralization matter more than fees | You need fast iteration without gas concerns |

| You’re okay paying for network effects | Payments or high-volume transactions are core |

| Your users prioritize trust over cost | You’re building gaming, NFTs, or real-time apps |

Choose both if:

- You’ve got funding to support it

- Your product benefits from bridged liquidity

- You’re hedging against regulatory uncertainty

The truth is that neither is objectively better. They’re solving different optimization functions. Ethereum chose decentralization and security at the cost of performance and Solana chose performance at some cost to decentralization. Both bets are paying off in different ways in 2026.

Where Can I Get a Custom Blockchain Strategy for My Startup?

You know what actually decides this, not the technology. It’s how you think about your customers, your go-to-market, and your risk tolerance. A blockchain consulting strategy starts by asking: where will your customers actually go?

- If your answer is institutions and DeFi protocols, build on Ethereum, as the path is proven and the ecosystem is there.

- If your answer is everyday users doing everyday things, test Solana. The friction is lower, and the cost doesn’t get in the way.

But both answers require understanding your unit economics deeply.

- How much does each transaction cost you?

- How much can you afford it to cost your users?

- What’s your customer acquisition cost, and how sensitive is it to transaction friction?

That’s the conversation that actually matters. Not which chain is faster or which chain lets you reach your customers most efficiently.

For deep-dive strategic work, you’d want to talk to teams that have built on both and can honestly assess your specific use case. The contingency here is – you need blockchain advisors or an enterprise blockchain development partner like SoluLab who can model your economics across both chains and help you make a data-backed decision.

Conclusion

January 2026 is wild because both blockchains are finally doing what they were designed to do. Ethereum’s processing record developer activity while proving itself as the institutional settlement layer, where Solana has proven that high-frequency blockchain operations aren’t theoretical; they’re a business with real users, real capital, real adoption.

The question isn’t which one will win, as both are winning. The question is which one wins for your specific product.

You’ll hear people say Ethereum is more decentralized and Solana is faster. Both true, but equally useless without context. What matters is whether decentralization is a customer-facing feature or an infrastructure property for your business. What matters is whether speed actually changes your unit economics or just feels good in demo videos.

Solana vs ethereum differences matter. Ethereum vs. Solana comparison is worth doing rigorously. But solana vs ethereum price prediction decisions should be secondary to product-market fit strategy. Build where your customers are and where your unit economics work; that’s what we suggest in SoluLab. Everything else is noise.

FAQs

Yes, significantly. Solana development averages 30-40% cheaper due to negligible gas costs during testing and deployment. However, audit availability is more constrained, which can offset some savings in Solana.

Yes, many teams do, and at SoluLab, we suggest doing so. Deploy your core logic on both chains, then use bridges for liquidity. It’s a more complex operationally but hedges regulation with ease.

Solana finality is 12-13 seconds, improving to 1 second with Alpenglow, while Ethereum L2s achieve sub-second finality with batch posting. For consumer apps, Solana’s user experience is noticeably snappier.

Ethereum’s proven track record and validator decentralization around 1M+ validators make it theoretically more censorship-resistant, whereas Solana’s smaller validator set, around 2,000, presents concentration risks, though this is improving.

Possibly, but fragmentation remains a real problem. Users and liquidity will continue splitting across L2s even with better interoperability.

Ethereum validators can run on standard cloud instances with around 32 GB RAM, whereas Solana requires more powerful hardware, though this is improving with Firedancer.

Yes, multiple bridging solutions exist, like Wormhole, Allbridge, etc., but bridges carry their own security and cost considerations.

Ethereum for now, due to regulatory clarity, audit ecosystem maturity, and institutional investor familiarity, but Solana’s catching up with RWA adoption and institutional partnerships.